The Liontrust Sustainable Investment team manages a broad range of funds across equities, bonds, and managed funds.

Latest insights

View all insights Mike Appleby

Mike Appleby

Evolution of our sustainable investment themes

As the world changes, so too our sustainable investment themes are evolving as we discuss here

Deepesh Marwaha

Deepesh Marwaha

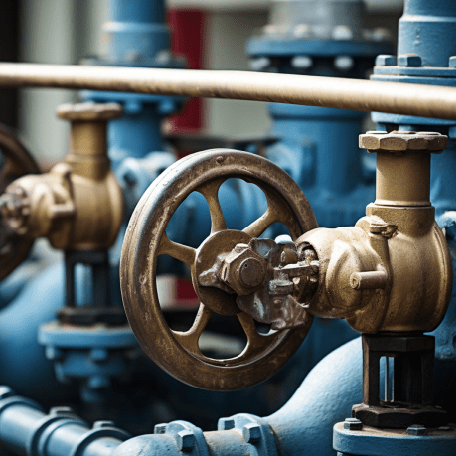

In deep water – engaging with UK water companies

Investing in UK water utilities has hit rough waters in recent times with chronic underinvestment. But there is a route to better outcomes

Martyn Jones

Martyn Jones

Alcon – Enabling healthier lifestyles

One billion people live with a preventable vision impairment, a figure set to grow as the global population ages. This Stocktake from the Sustainable Investment team looks at Alcon, a market leader in ophthalmic surgery

The impact of climate change on cocoa prices

Climate change and, specifically, severe weather events have seen global cocoa prices soar to almost $10,000 a tonne this month – setting the scene for an expensive Easter for confectionary fans.

Simon Clements

Simon Clements

Why World Water Day matters

On World Water Day fund manager Simon Clements discusses why improving the management of water is a key theme for the Sustainable Future team