A recent trip to the Bilbao Wind conference, and meeting several leading wind turbine manufacturers, highlighted how the industry continues to evolve and fundamentals continue to improve.

One of our 20 investment themes across the Sustainable Future fund range is Increasing energy from renewable sources, which we see as a multi-decade structural shift as the world moves towards lower-carbon energy. We feel this a key trend for any fund to get right to generate attractive returns and wind turbine manufacturers are a clear beneficiary of this changing landscape.

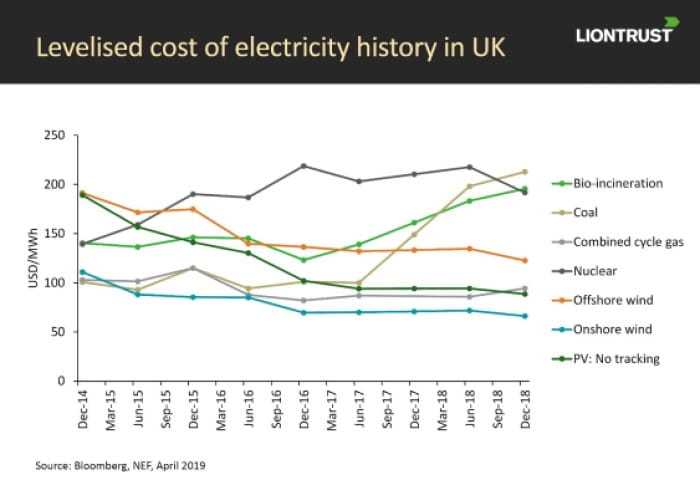

Wind and solar are now the cheapest ways to generate electricity in many countries, including the UK, and this should logically translate into even higher demand for renewables: it not only makes sense economically but is also the answer to reducing the carbon intensity of the electricity we use.

In the chart below, we show how the costs of generating electricity from different sources have evolved in the UK over the past four years. This uses the Levelised Cost of Electricity (LCOE), which estimates the costs of building and operating facilities and expresses it in US dollar cost per megawatt hour (MWh) of electricity generated. What this clearly shows is that onshore wind and solar are the cheapest ways to generate electricity while coal and nuclear are the most expensive. There is a similar picture globally although details vary by region.

There has been a seismic shift in how electricity markets are regulated in the last few years. We have seen a move away from Feed-In Tariffs (where you get paid for each unit of low-carbon renewable energy you produce, typically for the life of the project – around 20 years) towards an auction system where the cheapest bidder wins a lower payment for a shorter period of time.

One consequence of this has been wind developers see their investment returns get smaller and, in response, turbine manufacturers have had to sell their onshore wares at much lower costs to allow customers to build viable projects. The result has been a drop in turbine prices of about 25% over the past two years, which is clearly painful for manufacturers. In response, many have reacted aggressively and innovatively to ensure that, while their margins have compressed, they are still making high single-digit operating margins.

Scale remains important, both in terms of turbine size (the bigger the turbine, the more energy it produces, and this is one of the main drivers of making wind so competitive versus other ways of generating electricity), as well as the size of the manufacturer.

Wind markets are characterised by significant stages of feast or famine in end markets. Put simply, as the economic incentives to support renewables progressively fall, you get periods where developers are rushing to get new wind farms completed before incentives decline. As a result, turbine manufacturers need to cater for a number of different markets and must be a certain size to cope with this.

In light of such a demand picture, these stocks can be volatile. The way the industry works is firm orders are placed and the turbine is delivered about 18 months later: all turbines are built to order. This means manufacturers have limited visibility on orders beyond that timeframe and year-to-year sale volumes can be volatile due to regulatory changes.

To offset this to some extent, service contracts are becoming a bigger part of what these companies are paid for – it is no longer just about selling wind turbines and they make roughly twice the margin on this other part of the business.

Meanwhile, offshore wind markets are also opening up as the know-how in building these structures, and the resulting decrease in costs, becomes apparent. Looking at LCOE figures in the chart, we can see the cost of generating electricity from offshore wind has fallen from around $200/MWh to $120 /MWh, a huge and positive fall in price. While offshore is probably less than 10% of the turbine market today, it is a rapidly growing area with less pressure on pricing as the turbine is a much smaller proportion of overall development costs compared to onshore.

Ultimately, we believe a combination of lower costs of turbines, which is making them even more price competitive, and future regulations to support greater adoption of renewable energy will support turbine sales over the next decade and beyond. In the short term, however, we would like to see turbine pricing stabilise and stay around the long-run expectation of 3% to 5% price deflation a year. We also need other wind markets to accommodate the known expected fall in demand for turbines in the US after next year as a result of a lower tax incentives for wind farm investors.

Overall, we continue to highlight a number of negative implications for electricity generation technologies other than renewables. We see a headwind against them for the next decade and beyond, and it will get increasingly difficult for these to compete against wind and solar as the latter become increasingly cost competitive.

We see huge risks to coal, for example, which is effectively dead as it is the most carbon-polluting way to generate electricity. While natural gas will play a role, it will find it hard to compete with an effective marginal cost of energy from renewables of close to zero. Nuclear, while low carbon, is economically uncompetitive and (rightly, we think) out of favour.

The dream of renewables, plus smarter grid plus storage, continues to get closer and we think this will be virtually impossible to compete against economically, maybe as soon as 2025. Here’s hoping, otherwise life will get uncomfortably hot and unpleasant for all of us in the decades to come.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.