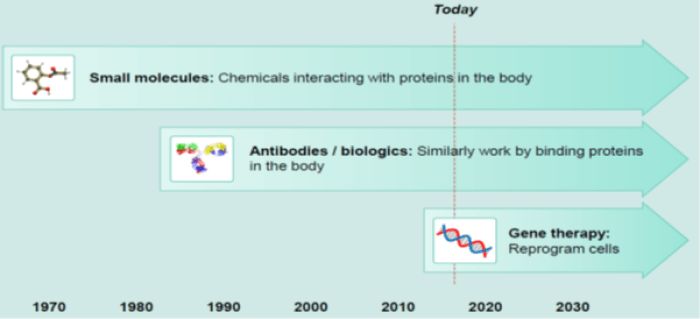

No longer the preserve of science fiction, gene therapy is set to become an increasingly important part of medical treatment and therefore of many companies we own under our Enabling innovation in healthcare theme.

In simple terms, this therapy involves the introduction of normal genes into cells in place of missing or defective ones to correct a genetic disorder. With between 4,000 and 6,000 diagnosed genetic disorders in existence, we see an approaching tipping point where gene therapy becomes commonplace, just as happened with antibody drugs in the early 1980s.

Pure-play gene therapy companies had sales of around $3bn in 2018 and consensus has this increasing to $6bn by next year. Highlighting the possible growth trajectory of this area, this would still only make up 1% of the overall prescription drugs market.

While antibody and small molecule drugs function by binding to proteins, gene therapy works further upstream in the process, either modifying or replacing a defective gene or altering the messenger RNA before it is translated into the relevant protein. The most common way to get the correct piece of DNA into the body is using viruses and there are various types, each with its own pros and cons.

Scientists have been working on these therapies since the 1980s and the ultimate objective is to produce a corrected gene, deliver it to the correct cell, express it at the correct level and not produce any side effects. The body’s immune system may see the newly introduced viruses as intruders and attack them, which can cause inflammation and, in severe cases, organ failure. The most commonly raised example is the death of Jesse Gelsinger, who died in September 1999 due to an immune response triggered by the virus used to transfer the corrected gene into his body.

As time has passed, the science has progressed and we can now achieve results with far smaller doses of virus than in the past. That said, with safety implications like these, the potential benefit of gene therapy must be significant – which is why the focus is on curing fatal and severe diseases.

It is also important to be clear on the scope of the technology, particularly given recent controversies in this area. We are specifically focused on mainstream somatic cell gene therapy, which involves modifications that affect the individual patient and will not be passed on to any offspring.

In contrast, the most contentious – and unfortunately newsworthy – side of this universe is called germline cell therapy, which modifies all of a patient’s cells and is passed on to later generations. This is currently banned in most developed countries including the US and UK.

We saw recently a case in which a Chinese scientist claimed he had genetically edited babies so they would not be able to contract HIV; this was widely condemned by the global scientific community and he is now in prison.

A range of pharma and biotechnology companies continue to make progress in the mainstream somatic space, with several trials started and products launched. In recent years, we have seen various gene therapies approved and used commercially in Europe (Glybera from UniQure and Strimvelis from GlaxoSmithKline, for example); more recently, Kymriah (a cell therapy from Novartis) and Luxturna (from Spark Therapeutics) were approved in the US towards the end of 2017.

From our perspective, the concept of a one-and-done treatment paradigm goes well with our focus on sustainable areas within healthcare, in terms of both innovation and affordability. The premise of gene therapy is that it works at the source and provides a one-time cure, with patient and payment providers both benefitting from clear and hopefully definitive results.

Payment for these treatments is expected to be done either as a one-off or on an annuity model; contrast this with the current system in which many healthcare companies get paid on volumes regardless of results and could be considered to benefit from continued illness. As long as someone remains ill, ongoing treatment is required and there is the additional kicker of price hikes for drugs year after year.

A further possible advantage lies in the nature of gene therapy, which means that when the FDA is looking at approval, it will likely spend 80% of time on the company’s manufacturing capabilities and processes and 20% on clinical data, reversing the scrutiny given to traditional biopharma products.

As gene therapies can cure diseases, they can potentially be approved on a specially designated pathway – much faster than traditional treatments. This means the company involved will potentially have to jump straight from small-scale production to large-scale manufacture, suggesting that when outsourcing, it is sensible to link up early with a partner who can be trusted working at scale. Given these dynamics, we are looking to find companies that can fill an essential part of the supply chain, on the assumption such stocks will grow with the industry regardless of which specific therapies are most successful.

One such play is Oxford BioMedica: production of viral vectors (the mechanism to introduce new genes to the body) is a key step in developing these therapies and this UK company has invested significant time and money to become the leading producer of one of these vectors (called LentiVector).

The majority of its sales are currently from oncology work for Novartis and its CAR-T drug but with a host of further relationships and licensing agreements progressing, we see the company continuing to diversify and benefit from overall growth in gene therapies.

Spark Therapeutics, meanwhile, was the first to obtain approval of a gene therapy in the US and was acquired by Roche, which we hold across our funds. Spark’s lead product Luxturna is a therapy for Inherited Retinal Disease (IRD) caused by mutations in the RPE gene.

Spark is committed to challenging the ‘inevitability’ of genetic diseases including blindness, haemophilia, lysosomal storage disorders and neurodegenerative diseases – and adds a further string to Roche, a long-term holding under our Enabling Innovation in healthcare theme.

Novartis acquired AveXis last year, bringing with it the Zolgensma gene therapy as well as the expertise and platform behind its development, and we would expect to see more companies look to access a market predicted to approach $15bn globally in the next five years.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.