As we approach the midway point of 2022, we review what has been an extremely challenging few months and assess the current state of markets.

Unprecedented became a hackneyed phrase in the early part of the Covid-19 pandemic, eventually dropping out of market commentaries as we got used to lockdowns and frozen supply chains. But with war in mainland Europe and Covid far from gone, as recent events in China make clear, it may be time to bring it back again. Worryingly for investors, another term from the lexicon we might need to dust off over the coming months is stagflation, with inflation higher and growth slowing quicker than expected.

Inflation has been rising for more than two years, with Covid simultaneously damaging global demand and driving a supply-side shock via shrinking workforces and clogged up production in many parts of the world. Huge bouts of quantitative easing and ultra-low interest rates, alongside other policies, were designed to boost demand, and where this ran into limited supply, the inevitable result was inflation. Russia’s invasion of Ukraine, sparking energy price volatility, has clearly intensified this. We still believe inflation will fall away as Covid base effects work through the system but this is little comfort to those people and businesses struggling to cope.

A growing cost of living crisis has left many central banks battling to maintain a delicate balance between tighter policy to curb inflation and not tipping economies into recession, and the key questions, beyond geopolitics, are when we might see peak hawkishness and what kind of landing policymakers are able to contrive. Our core view remains that the best antidote to short-term volatility is a resolute focus on long-term outcomes and we see little to be gained by aggressive trading in the current environment.

But investors are clearly concerned about the immediate future, particularly as talk of potential recession ramps up, and the following are a few core messages to keep in mind.

What is driving performance for our multi-asset funds and portfolios this year?

Rising inflation is proving toxic for markets, with equities, bonds and currencies all taking their cue from a price spike that is clearly looking anything but transitory at present. While we have seen a pronounced value rotation over the last six months, favouring markets such as the UK (which is skewed towards the energy and financial sectors), equities broadly have continued to struggle, with anything in the long duration or growth camp hit by the prospect of higher interest rates.

Fixed income would usually be expected to provide defensive ballast during equity sell-offs but we are in a rare period of extreme market stress in which asset classes have correlated. Rising rates also provide a challenging backdrop for fixed income, with government bonds in particular suffering as yields continue to climb.

For our multi-asset funds, in particular, the current strategic asset allocation (SAA) has a large weighting to UK gilts, which have struggled as the Bank of England was first to hike rates and yields spiked as a result. Over the first quarter of 2022, UK gilts underperformed global bonds by around 3%, which has had a considerable impact on our performance relative to peers, especially for the lower and mid-risk funds.

After also proving a major detractor in the first quarter of 2021, this gilt position is having an outsized impact on overall performance, and we are working to make sure our SAA delivers more consistent returns on the path to meeting the same risk targets.

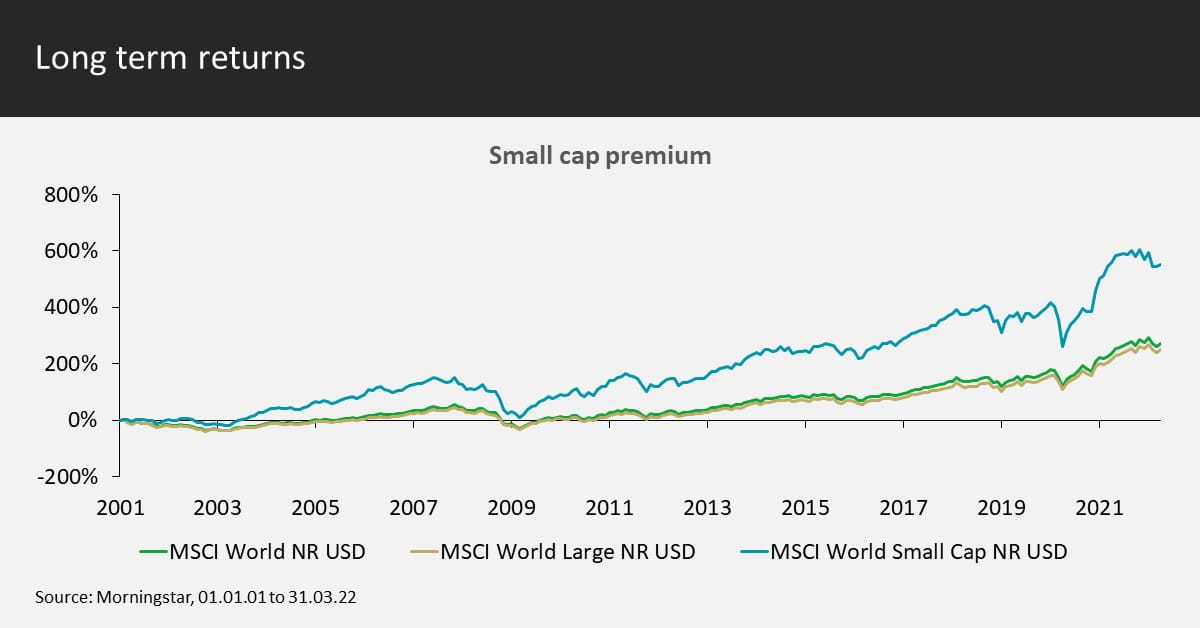

In a reflationary environment, we expect the rest of the world to outperform the US, value stocks to outperform growth and small caps to outperform large – and apart from the latter, markets have recently moved in our favour. So far this year, we have been right to be underweight government bonds and the US and overweight UK equities, and to prefer value over growth. The main drags on performance, however, beyond gilts, have been allocations to ‘quality’ managers, whose stocks have been sold alongside growth names, as well as our allocation to mid and small caps, which have come under pressure amid recent selling.

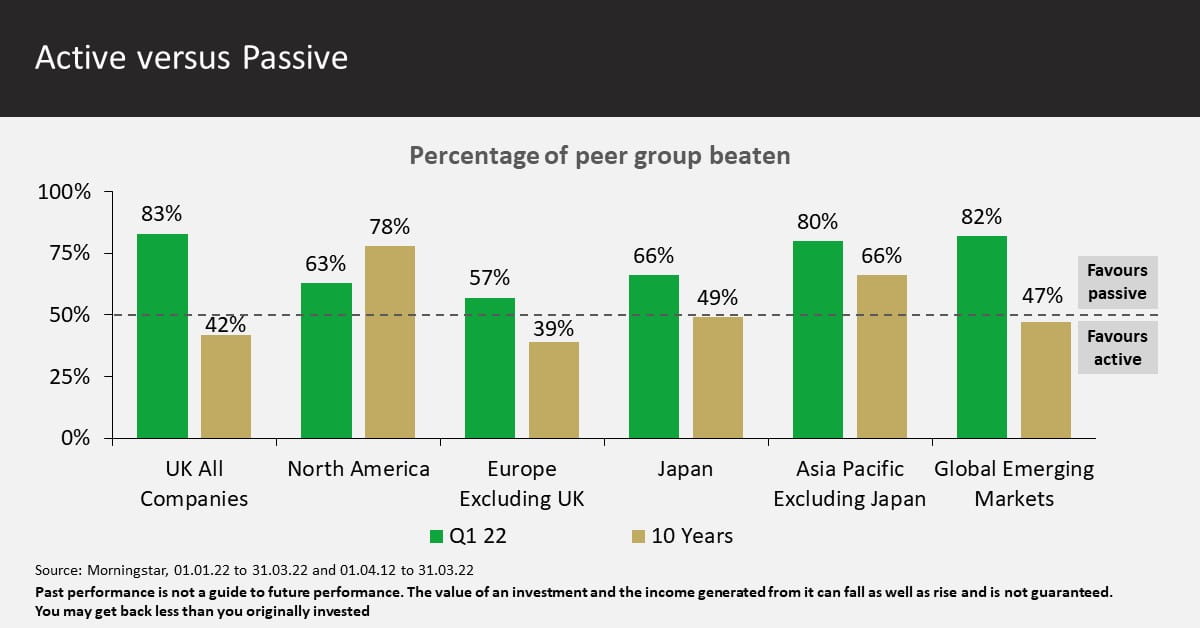

This backdrop has favoured passive funds (as the chart above highlights), which are usually heavily exposed to blue-chip (and more value-oriented) businesses. As the majority of small and mid-cap companies have been indiscriminately punished and actively managed funds are naturally more weighted towards this end of the market, they have lagged passive offerings – which would be expected in falling markets. We see our allocation to mid and small caps as a key differentiator versus passive peers, which tend to take a market-cap weighted approach to equities, but while we are confident it will add value longer term (as the chart below shows it has), this has clearly been a recent detractor.

What to expect for the rest of 2022?

We have long stressed that equities, ex-US, are attractively valued, and post-corrections, they may look even more so. We feel there will ultimately be opportunities for patient investors from this volatility but continue to resist any temptation to fall into the busy fool trap.

After a decade-plus of growth ascendancy, the value rotation is an early sign the backdrop may be changing and ongoing uncertainty around inflation and interest rate rises support our view that returns from stock markets, particularly the US, will be lower this year. Higher interest rates typically present a more difficult backdrop for long-duration growth companies and if we are set to be in a hiking cycle for a couple of years or longer, we would suggest the environment for value could be favourable. That said, recent selling has left many growth companies on more attractive valuations and we would expect to top up our weighting over the coming months. We maintain that multi-asset portfolios able to tilt between growth and value, while keeping a foot in both camps, offer the optimal risk/reward balance.

While there may not be much obvious activity in our funds and portfolios at present, there is plenty going on behind the scenes. Times such as these lead to introspection and this compels us to check the fine detail of our process and beliefs, and to reassess the relative merits of our tactical, stylistic and manager views.

Across our Multi-Asset funds, we are looking to focus on where we feel we can add the most value through selecting active managers. In UK and European equities, for example, we are moving to an overall 70%/30% split between active and passive funds in our Blended range, compared to 40% active/60% passive in the US. We expect this rebalancing to enhance performance over the long term but it will take time to finish this work. Given the fact so many growth companies have sold off over recent months, we can take the opportunity to increase quality and growth exposure across the funds at attractive valuations.

We always build our portfolios from the perspective of preparation rather than reaction and while we maintain the view that inflation will fall, we added index-linked bonds in 2020, remain underweight duration on our bond allocation (as central banks continue to debate rate hikes and tightening), and recently added the Liontrust Diversified Real Assets Fund (DRAF) across several portfolios. We believe real assets should provide a differentiated return and income profile and, importantly given the backdrop, an element of inflation hedging.

To reiterate, we have positioned our funds for three long-term calls: global ex-US equities are more attractive than the US, small caps should outperform large, and value should outstrip growth – all running contrary to what happened for most of the 2010s. While we remain confident in these allocations, outperformance will not come all at once, so it is sensible to retain prudent diversification rather than making a significant gamble that one particular thesis pays off. We continue to hold a blend of asset classes and styles rather than relying on any one portfolio element and believe this will help us deliver on suitability over the long term.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds and Model Portfolios managed by the Multi-Asset Team have exposure to foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The majority of the Funds and Model Portfolios invest in Fixed Income securities indirectly through collective investment schemes. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. Some Funds may have exposure to property via collective investment schemes. Property funds may be more difficult to value objectively so may be incorrectly priced, and may at times be harder to sell. This could lead to reduced liquidity in the Fund. Some Funds and Model Portfolios also invest in non-mainstream (alternative) assets indirectly through collective investment schemes. During periods of stressed market conditions non-mainstream (alternative) assets may be difficult to sell at a fair price, which may cause prices to fluctuate more sharply.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.