The Federal Open Market Committee (FOMC), the US Federal Reserve’s monetary policy setting committee, raised rates to a range of 1.50 - 1.75% yesterday evening, a 75 basis points (bps) increase.

This 75bps hike was 100% priced into the very short end of the market. After the upside surprise to US consumer price inflation (CPI) data last Friday, the Fed clearly needed to act to regain some hawkish credentials. A very well-placed article appeared in the Wall Street Journal on Monday 13 June stating that Fed officials would consider “surprising markets with a larger-than-expected 0.75-percentage-point interest-rate increase at their meeting this week.” This is ironic, as the clear aim of the article was to ensure that a 75bps hike was not a surprise!

The FOMC members’ core PCE (personal consumption expenditures) projections were nudged upwards by 0.2% this year to 4.3% and by 0.1% in 2023 to 2.7%. Forecasts for headline PCE – the Fed’s preferred inflation measure – jumped from 4.3% to 5.2% for 2022 but converge to similar levels to the core PCE figures thereafter. The minutes clearly state that the “…Committee is strongly committed to returning inflation to its 2 percent objective.”

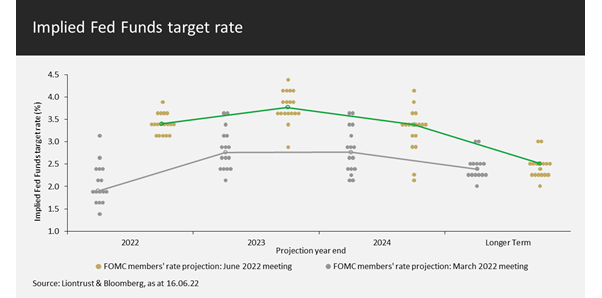

In terms of how they are going to achieve this, they are heading rapidly towards a restrictive monetary policy setting. There was a well-anticipated large jump in the dot plots of FOMC members’ projections – illustrated below – with more clustering around the median (green line); the grey dots are from the prior projections in March 2022, while the yellow dots show the new June 2022 projections.

Source: Bloomberg

A further 175bps of hikes are predicted for this year, with rates expected to finish 2022 in the 3.25% to 3.50% range. An additional 50bps of hikes are then expected in 2023, before being reversed in 2024.

Both equity and bond markets rallied on the announcement yesterday, suggesting investors like this approach; raising rates sooner and more rapidly should lead to a lower peak in rates and less long-term damage to the economy.

The FOMC’s longer-term projection is for rates to come down from restrictive monetary policy towards a neutral rate of 2.50%. Furthermore, the Fed has now started shrinking its balance sheet with every $1 trillion estimated to produce the equivalent of another 25bps hike.

Although the Fed is late to the table in tackling inflation, it is now showing it is taking the matter seriously. Our long-held opinion has been that the US economy can cope with higher-for-longer rates in the neutral range of around 2.50%. But a peak in rates of 4.0% will slow the economy significantly. It would create the rise in unemployment that then dampens down wage inflation and puts a halt to the feedback loop that is currently driving inflation expectations.

A hawkish central bank looking to tame inflation is what many bond managers have been clamouring for. With US 10-year yields close to 3.50% ahead of the meeting as they priced in the likelihood of a 75bps hike, we believed sovereign bond markets were starting to offer decent value. Yesterday morning, ahead of the policy announcement, we increased the duration on our strategic bond strategies to neutral – the first time in over a decade that we have not been underweight duration risk.

On this side of the Atlantic, the Bank Of England continues to be behind the curve, moving today with another incremental 25bps hike, albeit only with a 6-3 vote – the dissenters preferring a 50bps increase. Maybe, to give it some credit, it did not want to opt for 50bps straight after the fiscal stimulus. A large hike is definitely a live option for the upcoming meetings with the Bank of England stating that it “…would be particularly alert to indications of more persistent inflationary pressures, and would if necessary act forcefully in response.” CPI now looks like it will peak, according to its forecasts, at 11% in October when the next energy price cap increase comes through; if double digit inflation does not require forceful action, then it is hard to envisage what does!

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies which may have the effect of increasing volatility. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.