Following forensic analysis of companies' historic cash flows and balance sheet developments, as well as examination of our market regime indicators, the Liontrust European Dynamic Fund has been repositioned to best reflect the signals from the Cashflow Solution investment process in 2022.

The Fund’s portfolio of holdings is actively managed throughout the year, with the portfolio repositioned as companies release new financial reports and as the signals from our market regime indicators shift. However, because many European companies issue their annual reports in March and April, the opportunity for the Liontrust European Dynamic Fund to restructure its portfolio tends to be greatest in the second calendar quarter, after these reports have been analysed.

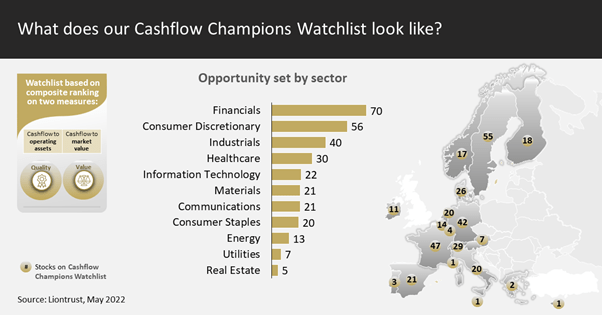

The first step in our investment process is to apply two equally-weighted cash flow ratios to the European (ex-UK) investment universe, creating a composite ranking that narrows the universe down to the stocks with the best free cash flow generation and the most attractive valuations. The first screen is a quality measure (cash flow relative to operating assets) and the second is a value screen (cash flow relative to market value).

Only the top 20% of this ranked universe qualifies for further, qualitative, analysis. We call this list the Cashflow Champions Watchlist. As is typical, this year the list includes constituents from a wide range of countries. As you would expect, there is good depth in the region’s largest stockmarkets of France and Germany, while the Nordics, Netherlands, Spain, Switzerland and Italy also have a strong selection of stocks scoring well on our screens.

From a sector perspective the Cashflow Champion’s watchlist also achieves good coverage, with all 11 GICS (Global Industry Classification Standard) sectors represented. It shows a large opportunity set in financials and consumer discretionary in particular, with these sectors including a number of stocks showing attractive recovering value characteristics. Financials also now ranks as one of the most represented sectors in the Watchlist.

While healthcare is the largest sector in the MSCI Europe ex-UK by market capitalisation, it ranks fourth in our Watchlist by number of stocks scoring highly on the cash flow screens. Nevertheless, the healthcare opportunity for our process is higher than in previous years. This sector has had low representation in the Watchlist in recent years due to expensive valuations, but this year we found that some stocks are now trading at levels offering inexpensive entry points for businesses with quality characteristics. The same can be said of the consumer staples sector.

The investment opportunity in IT is low relative to its index weightings, to some extent reflecting the fairly high constitution of the type of high forecast growth stock that our investment process is shunning.

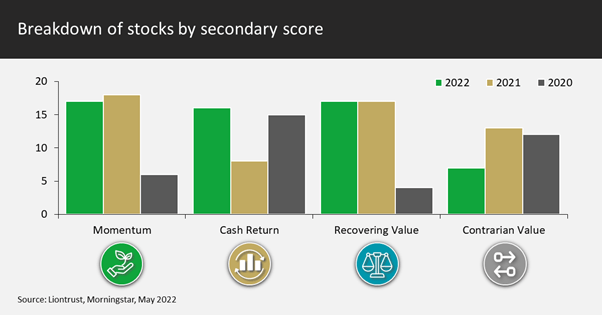

We pick the very best investments from within the Watchlist by categorising stocks according to our four secondary scores: Momentum, Cash Return, Recovering Value and Contrarian. We also apply a set of key proprietary indicators – valuations, investor anxiety, corporate aggression and market momentum. These allow us to designate the prevailing market regime and, in turn, optimise portfolio construction by emphasising different secondary scores within stock selection in order to target growth or value exposure.

In 2020, the portfolio was restructured with an emphasis on the more value-orientated of the secondary scores as soaring investor anxiety during the pandemic had created a substantial opportunity in these stocks. The value tilt to the portfolio has been maintained since then, although it has evolved over time. We have moved away from contrarian value picks and instead emphasised recovering value and momentum secondary scores.

So far in 2022, market turmoil in combination with an expensive valuation indicator and rising corporate aggression has presented an opportunity to add some stocks with inexpensive defensive and quality characteristics. The quality cohort is still expensive overall, meaning that we have to be very selective, but there are some good value opportunities available.

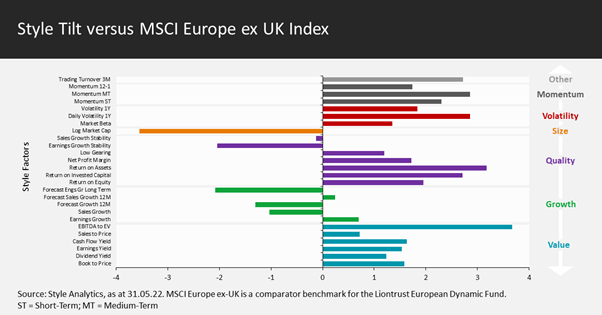

The style tilt chart below shows that the Fund currently has a continuing positive tilt to value and momentum, while the exposure to quality has increased in reflection of the better valuations on offer in this cohort.

The Fund continues to have a negative tilt to growth; despite their recent poor share price performance, stocks with high forecast growth still trade on very expensive valuations according to our analysis.

Recent new purchases for the Fund include:

Swedish Match is a tobacco company specialising in smoke-free products such as snus, nicotine pouches and chewing tobacco. It scored strongly on our cash flow screens this year. Secondary score analysis showed that its cash return characteristics were good while it also rated highly on momentum. Shortly after addition to the Fund, the company accepted a takeover offer from US tobacco sector per Philip Morris.

Jeronimo Martins is a food distribution specialist operating in Portugal, Poland and Colombia. It has good momentum and recovering value cash flow characteristics. Operating cash flow has been growing strongly and the stock traded on a free cash flow yield of over 10% at the time of purchase. It also has good momentum and recovering value cash flow characteristics. This reflects stronger growth in its Eastern European businesses, including good like-for-like sales growth and operating margin improvements, and much stronger growth at Ara, the Columbian retailer. The group balance sheet is strong and this was reflected in the dividend payment to shareholders for 2021 - an exceptional 100% payout of net income.

Roche is a good example of an inexpensive and defensive quality stock. The Swiss pharma giant trades on a free cash flow yield of over 6%.

Dassault Aviation is a French manufacturer of military aircraft and business jets. The company has a very high free cash flow yield. It offers quality characteristics on an attractive valuation while also showing good business momentum including a large order backlog due to strong demand in the defence segment and a recovery in business jets.

Arcelor Mittal scored very well on our initial combined screen owing largely to its very attractive cash flow relative to market value. The Dutch-listed steel manufacturer has excellent cash return characteristics. Historically, this has included healthy growth in the annual dividend (27% in 2021) and share buyback programmes. The company expects continuing strong cash generation in 2022 and recently announced a new $1.0bn share buyback programme.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Cashflow Solution team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. Some of the funds may hold a concentrated portfolio of stocks. If the price of one of these stocks should move significantly, this may have a notable effect on the value of the respective portfolio.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.