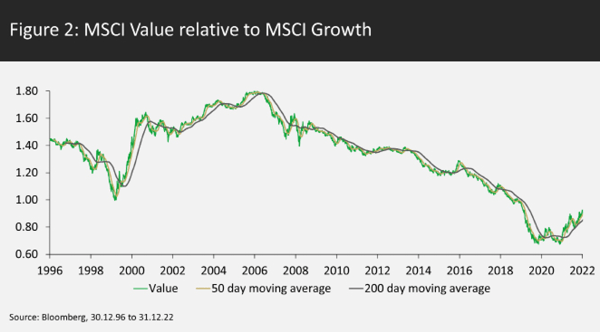

We will kick off with a chart that shows MSCI Value relative to MSCI Growth, which looks to be completing a major basing pattern (see Figure 1). This started with a large double bottom formed between November 2020 and November 2021, followed by a break-out from the base starting in March 2022, which was successfully retested in August 2022 before a further break higher. There are a few encouraging points.

First, this process has been underway for over two years and as such could signal a major change in trend. Second, despite the run up from the December 2021 lows, value has still not recovered all the underperformance relative to growth since the start of 2020, which would require another 7% move higher. Third, all these moves are small in a long-term perspective; the bounce off the lows has only recovered 20% of value’s underperformance of growth since 2006 (see Figure 2). The 200-day moving average of the value to growth ratio (the yellow line in the two charts) has only been rising for nine months, after having declined pretty steadily for 12 years. Clearly, there is scope for a short-term pull back but we would see this as the pause that refreshes.

The fundamental picture is of an economic backdrop which is much more favourable for value than over the last decade, namely higher inflation, higher nominal GDP growth and higher bond yields. At the same time, MSCI Value still trades at a 44% discount to MSCI Growth, well below its historic average of a 27% discount. Given the epic growth run which led to investors fleeing value-based strategies, it takes time to make people believe that value stocks can outperform. It still feels like we are in the foothills of the rehabilitation of value as a strategy.

Strategy notes and the press are awash with bearish prognostications so this month we thought we would take a step back and consider the much bigger picture and the potential for a very positive long-term development in the global economy: a pick-up in productivity growth.

Every cloud has a silver lining, or so it goes. There is a chance the silver lining of the current cloudy backdrop is that the red-hot labour markets in the US and other developed economies, coupled with a period of rapid technological change, will trigger a surge in productivity growth, breaking the economy out of its decade-long low productivity stupor and driving a medium-term acceleration in real GDP growth. Companies certainly have major incentives to do this, given the difficulty of hiring workers and wage inflation.

Equally, on the technology front, a number of developments seem to be maturing at just the right time, in particular robotics, AI (especially transformer models) and 5G networks (which will allow edge computing – or processing of data locally – and facilitate the Internet of Things). People have been talking about these developments for some time but it seems like we are finally at the point where they will really start to drive operating benefits for companies.

Long-term economic growth is a function of the number of people in the workforce and the amount of output per worker, or productivity. To drive real GDP growth, economies need more workers or they need to make the workers they have more productive, or preferably both.

A critical issue for the economic outlook is whether after a long period of declining and then stagnant productivity growth, we are poised to enter a productivity renaissance, in a similar vein to what happened in the mid-1980s. That was largely powered by technology. IBM launched its first PC in August 1981, which set the standards for affordable computers and literally changed the world. Out the window went typewriters and paper ledgers and in came spreadsheets and word processors. In 1991, the World Wide Web was made available for public use. The combination of PCs and the internet allowed businesses to transform their processes and drove a surge in productivity and economic growth. However, it was not a sudden Big Bang, rather it was a long-drawn-out learning process as businesses worked out how best to use the new tools. It’s a process of stop-start trial and error, which is part of the reason why productivity growth is trending.

At this point, you might be thinking that the 2010s were also a period of massive technological innovation, with Amazon launching AWS the cloud computing behemoth in 2006, Apple launching the iPhone in 2007, and Verizon launching the first US 4G network in 2010. A combination of smartphones, high-speed networks and cloud computing should theoretically be a powerful combination for productivity. However, the 2010s were accompanied by close to record low productivity growth in the US. Why? The Bureau of Labour Statistics (BLS) published a report in 2021 on the weakness of productivity growth in the US since 2015 and noted that ‘not only has the productivity slowdown been one of the most consequential economic phenomena of the last two decades, but it also represents the most profound economic mystery during this time, and though many economists have grappled with the issue for over a decade and even created some innovative research approaches to address the question, we still cannot fully explain what brought on this situation’.

The article notes that the slowdown in US productivity growth is largely due to a slowdown in Multi-Factor Productivity (MFP). MFP is a residual; it is the element of productivity that cannot be explained by either changes in labour composition (the skill level of workers) or capital intensity (for instance, investment in more automation). MFP is a residual precisely because it is caused by factors that are difficult to measure. While MFP is highly variable through time, economists struggle to explain what drives it. Technological change is likely to be a key component of MFP but it is difficult to define or measure technological change. This is a big problem as variations in MFP seem to be the biggest driver of changes in US productivity growth through time.

One of the more plausible explanations, albeit a bit circular, is that the economic recovery was weak due to the fact it was recovering from a major financial crisis and this resulted in lower investment in R&D and new technology. Perhaps firms were unwilling to devote capital and time to integrating the new technologies, particularly at a time of relatively weak labour markets when it was easy to attract workers. This may have been particularly the case when investments in new technology to drive productivity have long-term and uncertain payoffs (especially relative to the instant gratification of stock buybacks).

Another is that while technological change has driven surging productivity at a small subset of mainly Tech firms, it has also laid waste to large legacy industries which have been disrupted and account for a much larger pool of workers so the overall effect has been to slow productivity growth. For instance, while workers in Amazon warehouses are highly productive, workers in retail stores that have been disrupted by Amazon have become less productive as sales per employee have fallen. Alphabet and Meta Platforms’ staff were massively productive but the industries they disrupted took a huge productivity hit. Technological change was giving with one hand and taking away with the other.

Arguably, much of the innovation in the 2010s was aimed at consumers – e-commerce, social media and video streaming. However, this does seem to be starting to change. The pandemic led to a surge in usage of work collaboration tools, particularly Microsoft Teams, which took much of the technology developed for consumer facing apps and leveraged them for the Enterprise. Productivity growth did take a big leg up during the pandemic and there is a trend of companies starting to really leverage the prior technological developments.

We conclude by saying that maybe the people chasing AI and robotics stocks to stratospheric levels were missing the bigger picture. It is difficult to predict which businesses will win out, but the important point is that the technologies will help spur a productivity revolution which will boost economic growth and the fortunes of equities more broadly.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.Investment in funds managed by the Global Fundamental Team may involve investment in smaller companies. These stocks may be less liquid and the price swings greater than those in, for example, larger companies. Some of the funds may hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio. Investment in the funds may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.