The Intergovernmental Panel on Climate Change (IPCC) released its AR6 report this week [1] and it made for a sobering read. According to the report, the world is very likely to surpass the target of keeping global temperature rises at 1.5C, as early as the 2030s. Furthermore, a widespread lack of progress on implementing greenhouse gas (GHG) reduction policies means even meeting a 2C limit looks much harder now. The IPCC also highlights the risk of tipping points and warns that every increment of additional warming will intensify hazards and lead to ‘compounding cascading risks’.

What happens this decade is critical. Indeed, the actions that humans take over the coming years will be felt for thousands of years. As the report emphasised, the existing fossil fuel infrastructure alone will, over its planned lifetime, use the carbon budget for a 2C world. The implication is that to undershoot 2C, this infrastructure has to be retired or fundamentally altered.

The report, which is aimed at policymakers, concludes that rapid, deep and immediate reduction in GHG emissions is required across all sectors; and emphasises the need to invest in adaptation to counter the impacts of climate change. There is a rapidly narrowing window of opportunity to enable climate resilient development and the report makes it clear that finance, technology and cooperation are critical enablers for accelerated climate action.

The message could not be starker, nor more urgent in its call for action.

Sustainable Future funds

From the perspective of the Sustainable Future funds, it reinforces our themes around decarbonisation:

For over 20 years we have been investing in companies that are aligned with reducing GHG emissions. We believe there is a huge investment opportunity from the growth of businesses which are providing the solutions. In our SF Global Growth fund 31% is invested in Better Resource Efficiency themes.

In 2022 we have seen major changes in policy, finance and technology which lead us to be optimistic about the prospect of these businesses and humanity’s ability to meet the challenge laid down by the IPCC.

We would highlight:

-

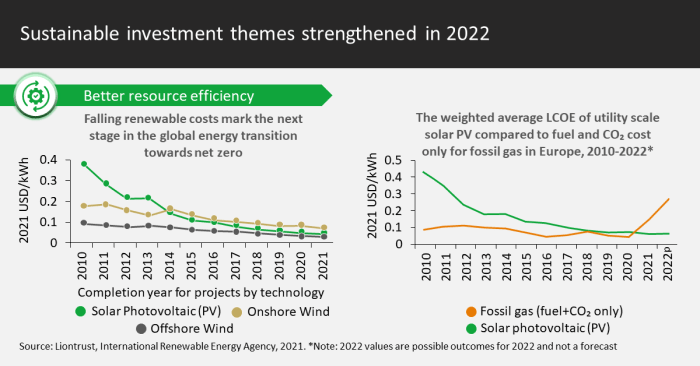

The dramatic fall in the cost of renewable energy making it cheaper and less volatile than fossil fuel alternatives.

-

The policy action in the US with the IRA – $370bn earmarked for renewables and environmental technology investment, and the EU ‘Fit for 55’ – 55% reduction in GHG emissions by 2030 (on 1990).

-

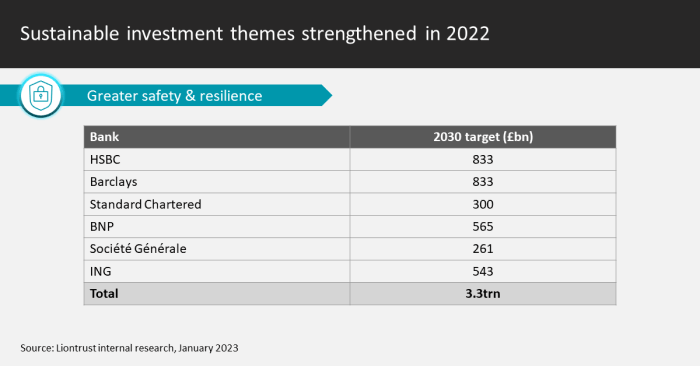

The commitment from leading banks to finance climate reduction.

These developments provide solid underpinning for stocks such as:

Vestas is a Danish wind turbine manufacturer and service provider which is one of the three main players outside of China. Wind power is a renewable and low carbon source of energy and the company contributes to reducing emissions from the electricity grid by providing cost-competitive wind-derived electricity.

Smart Metering Systems (SMS) installs and manages smart meters as well as investing in battery storage projects to improve the resilience of the electricity grid so it can take on more renewables.

Advance Drainage Systems (ADS) is focused on developing solutions for water management, while keeping plastic out of landfills. Its products keep waterways safe from pollution and prevent excessive stormwater runoff.

Atrato Onsite Energy is a renewable energy infrastructure fund that installs solar modules on industrial use roofs in the UK. It contracts the sale of electricity from this to the willing occupier. The result is more lower carbon electricity generated and lower power price costs for customers.

For more insights and views from Liontrust visit: https://www.liontrust.co.uk/insights/ourinsights

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.