Banks and building societies are advertising the best savings rates seen for some years, reflecting the sharply tightening monetary policies of central banks around the world. These are enticing after the turmoil that impacted equities and bonds so negatively in 2022. But are cash deposits a serious option for investors seeking to make real wealth gains over the longer term? Will they beat the high levels of inflation being seen globally?

Inflation has ebbed and flowed

Historically, cash has a good track record versus inflation. Real interest rates – nominal interest rate less inflation – normally had to exceed inflation to control it. Cash also deserves a risk premium: investors are taking the risk that the institutions to which they lend go out of business and hence should be rewarded.

Then the Global Financial Crisis (GFC) hit in 2008. Central banks embarked on ultra-loose monetary policies and the biggest ever programme of quantitative easing to restore liquidity to a financial system that threatened to freeze. Interest rates declined and cash deposits became all the less attractive. But no matter how loose policy became, it seemed nigh on impossible to generate inflation.

The post-Covid fiscal looseness, combined with Russia’s invasion of Ukraine changed the dynamics once again. Shortages of key commodities, especially oil and gas, fed into an economy that was already suffering supply side issues because of the Covid pandemic. In 2022, central banks around the world embarked on monetary tightening that has involved some of the most aggressive rate hikes ever seen.

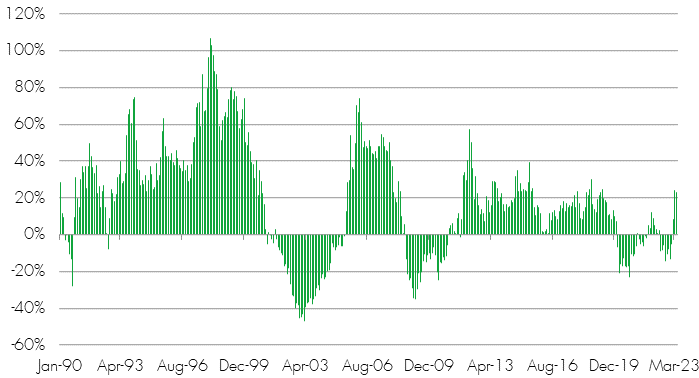

The relative performance of cash, as measured by three-month Libor, versus UK inflation since 1987 is illustrated in Fig. 1. It shows how the real interest rate was highest during the inflation-tackling era of the 1980s but declined gradually until turning negative from the GFC onwards. Apart from a short period in 2015-16 when they were slightly positive, they have remained negative ever since, reaching a nadir in 2022 when rate hikes lagged the rampant inflation.

Fig. 1: Real UK interest rates, 1987-2023

Source: Bloomberg, 13 June 2023

Alternatives to cash

Investors have many other options apart from cash, of course. The other two main asset classes are bonds and equities, both of which offer attractive long-term risk-return profiles that can be used effectively to diversify portfolios.

Equities are generally regarded as offering the strongest returns over the long term, although they are significantly more volatile than cash. Holding equities is fractional ownership of the prospects of a business generating capital growth and income from dividends. Although some companies do fall by the wayside, historically, companies have proved to be highly successful at generating returns that exceed inflation, as demonstrated by the long-term returns of stock markets. Companies are seen as having an in-built defence against inflation because they can pass increasing costs onto consumers by raising their prices, although this will depend on the market power that they wield.

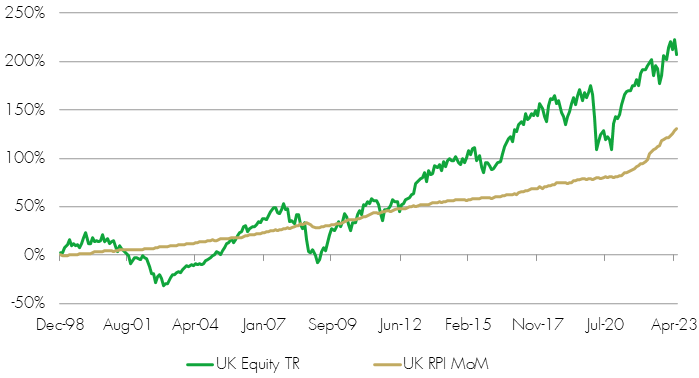

For example, Fig. 2 shows how the total returns from equities have outstripped inflation in most of the years between 1990 to present, sometimes by 100% or more.

Fig. 2: Rolling six-month total return on UK equity from 1990 to 2023

Source: Bloomberg, 13 June 2023

The value of the interest, or ‘coupons’, that bonds offer does vary according to the creditworthiness of the borrower. For example, developed market government bonds tend to be lower risk than investment grade or high yield company bonds because of their reliability. Fig. 3 shows how the yield on two-year UK government bonds, also known as gilts, has remained in positive territory since 2002 apart from 2020-21.

Fig. 3: Gilt yields versus FTSE 100 dividends

Source: Bloomberg, 13 June 2023

Gilts have become a meaningful income alternative to equities for the first time in years because of their current yields, which make them all the more useful at present from a portfolio construction perspective.

Investors should remember that there is a trade-off between risk and return in a free market in that the greater the risk involved in an asset, the greater the potential return. This trade-off tends to be more consistent over time and across asset types. Cash and government bonds are lowest risk but both generate lower long-term returns than equities, which lie at the other end of the risk-return spectrum. In between these poles are high yield bonds, which are higher risk than most fixed income but lower risk than equities.

Fig. 4: UK equity returns outstrip inflation over the long-term

Source: Bloomberg, 27 June 2023

Beyond cash assets

Past performance should not be used as a guide for future returns, but one of the biggest mistakes in investing is to think that ‘it is different this time.’ Investors may look at global financial markets now and feel concern about the volatility seen in recent years. There are certainly risks, and our own view is that the best antidote to this is diversification.

But if investors are concerned about whether their returns can exceed price rises then the current rates of inflation and interest rates mean they must look to non-cash assets if they are to have a prospect of doing so. The shortfall of cash versus inflation on current rates will only be exacerbated the longer that investments are parked in savings accounts that pay negative rates versus inflation.

Cash plays a role in balancing the risks in diversified portfolios, but the world offers a much wider choice of investment assets with the potential to enhance long-term returns. The evidence points to equities being the best way to beat inflation over the long term (See Fig. 4), which lies at the heart of our own portfolio construction. The key issue for investors is to balance the asset mix to ensure it matches their own risk profiles.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds and Model Portfolios managed by the Multi-Asset Team have exposure to foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The majority of the Funds and Model Portfolios invest in Fixed Income securities indirectly through collective investment schemes. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. Some Funds may have exposure to property via collective investment schemes. Property funds may be more difficult to value objectively so may be incorrectly priced, and may at times be harder to sell. This could lead to reduced liquidity in the Fund. Some Funds and Model Portfolios also invest in non-mainstream (alternative) assets indirectly through collective investment schemes. During periods of stressed market conditions non-mainstream (alternative) assets may be difficult to sell at a fair price, which may cause prices to fluctuate more sharply.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.