Evolution of themes

The world is changing and evolving and, as investment specialists, we look to make sure that we evolve alongside, in order to ensure the best outcomes for investors and from the themes we focus on.

As a result, we regularly review our sustainable investment themes; typically every two years. We use input from experts at Cambridge Institute for Sustainable Leadership which the investment team attended in September 2022 as well as input from our Advisory Committee. This is to ensure we are not missing any new investment themes as well as retiring any investment themes that have run their course. The following changes will take effect from Q2 2024.

Financial Resilience

Financial resilience is retired – This theme recognised the importance of a well-capitalised and well-governed financial system in developing a sustainable economy. It was born in the aftermath of the global financial crisis, where the severe negative social impacts of weak governance in financial institutions were laid bare. It is pleasing to see that many financial institutions now meet the criteria for financial resilience. Without neglecting the dimension of financial resilience, we want to extend this to also incorporate the nature of the business these companies carry out and to focus on those with the largest positive sustainability impact:

Enabling SMEs

This theme seeks to find companies enabling the foundation, scaling, and improved efficiency of innovative new businesses. Small to medium sized enterprises (SMEs) are the anchor of a resilient and sustainable economy, accounting for 44% of US GDP and creating two thirds of jobs in the US. According to the Organisation for Economic Co-operation and Development (OECD), SMEs facilitate innovation, reduce inequality in society, and increase economic resilience within society. Yet there are key barriers to SMEs achieving success as they struggle to overcome complexity and reach scale. Within this theme, we look for companies enabling this journey from idea formation to value creation, helping increase SME productivity and efficiency, and ideally growing with the SMEs they support.

Financing Housing

Housing is a basic human requirement that is central to human wellbeing. A lack of housing also has detrimental effects on the wider economy; for instance, rental and mortgage costs in many developed countries have outpaced wage growth, leading to declining disposable income for households and increasing inequality.

In this theme we are looking to find companies that are allocating capital towards residential housing or making the market more efficient.

Transparency in Financial Markets

We believe that companies working to improve the transparency of financial markets are set to benefit from increasing regulatory compliance measures and the growing availability of data that can provide valuable insights for financial market participants to manage risk. In effect, if there is equal information on both sides of a market then markets are likely to function better, risk is likely to be more accurately assessed, and the financial system will be more resilient.

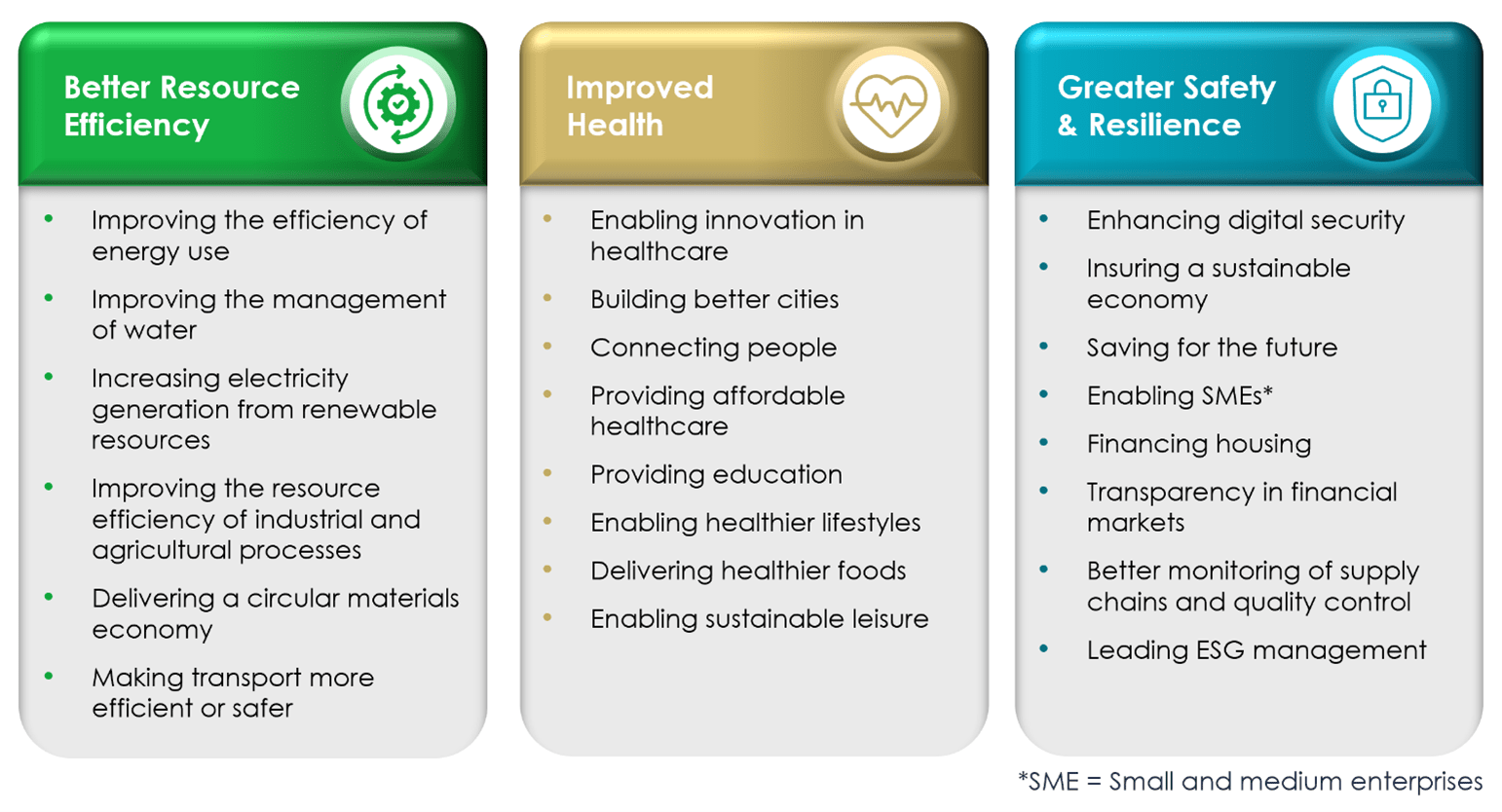

We have identified 22 sustainable investment themes which make our economy cleaner, healthier or safer. Understanding these sustainable investment themes helps us find structural long-term growth trends which we believe will be a key driver of investment returns over the medium term.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.