Rapid growth in ESG-labelled bonds

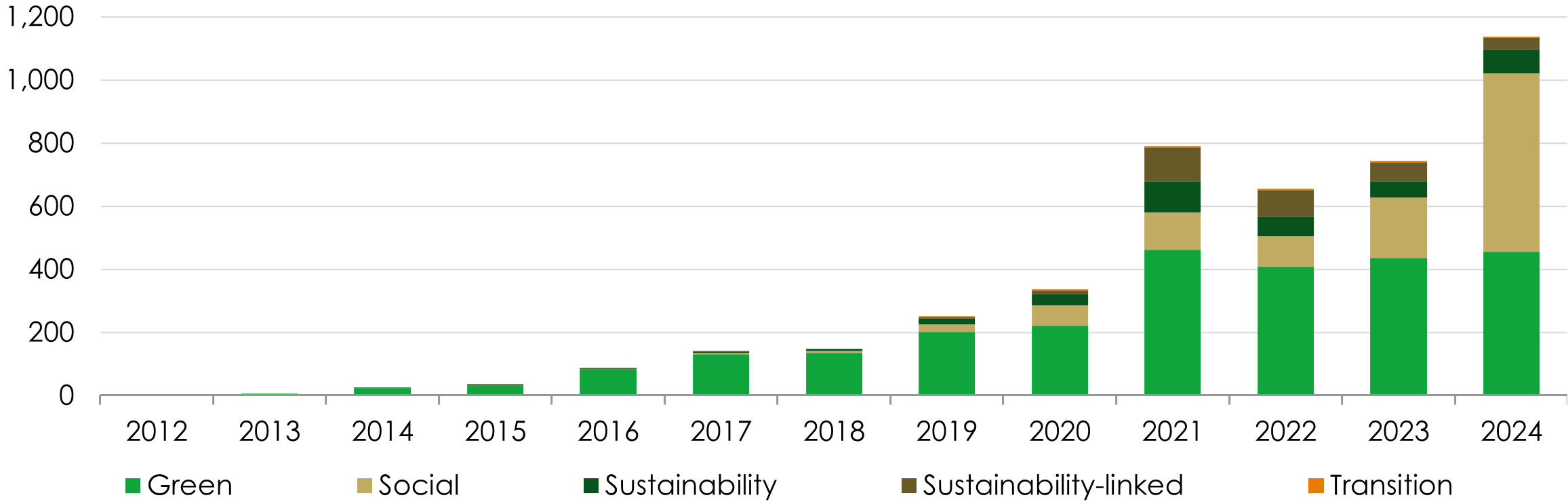

The growing recognition of climate change and environmental issues has resulted in the ‘ESG-labelled’ bond market expanding to surge through the $1 trillion issuance threshold for the first time last year.

ESG-labelled bond issuance ($bn)

This class of bond – green, social, sustainability, and sustainability-linked – was virtually non-existent as recently as 10 or 15 years ago. They provide investors a financial return as well as a positive impact on environmental or social issues.

The growth in labelled bonds means that are now a significant part of the investment grade corporate bond market: 16% of the European market and 11% of the sterling market (in the US it is more modest at 6%).

While green bonds are still the most prominent type of labelled bond, making up almost 60% of the total market, there has been a number of innovative new products developed in recent years, with social, sustainable and sustainability-linked bonds becoming increasingly popular instruments, making up over half of the issuance last year.

Sustainability bonds, like green and social bonds, are linked to specific projects although can be allocated to a combination. The water company Severn Trent, for example, reported that its sustainable bond proceeds has been allocated: 50% on its network infrastructure; 34% on the environment; 14% on water quality; 1% on social outcomes.

Alternatively, sustainability-linked bonds aren’t project-specific, with the issuer setting specific overall targets, such as reducing carbon emissions. If they fail to achieve these outcomes then the coupon steps up as a penalty, so their borrowing costs increase.

We approach labelled bonds with a degree of caution

While it’s encouraging to see sustainable projects attract this surge in capital, as investors, we think it’s sensible to approach labelled bonds with a degree of caution. The capital from green or social bonds may be earmarked for a specific project, but the cash flows are not completely ringfenced from the issuer’s other operations, so investors need to be comfortable in the organisation’s overall prospects both from a sustainability and credit quality perspective.

Green bonds ultimately give you exposure to the issuer’s wider operations. Revenues from green projects will flow up to the issuer to mix in with all its other operations, while interest payments on the bonds will also be paid by the parent issuer rather than originating solely from the green project itself.

For this reason, it is essential to evaluate both the sustainability impacts and credit fundamentals at the issuer level, rather than just focusing on the bond itself.

For example, we wouldn’t invest in green bonds at an oil & gas company as the bonds give direct exposure to the sustainability profile of the overall business. We avoid exposure to the oil & gas sector due to the need to transition away from fossil fuels, so also avoid their green bonds.

In-depth ESG and fundamental analysis at the issuer level is vital

The Sustainable Future team’s investment approach is based on the in-depth analysis of issuer-specific factors, including ESG factors and macroeconomic analysis. As with the equity team, this analysis of high-quality companies is centred on the proprietary sustainability matrix that has been core to our investment process for over 20 years.

For each company, we determine the key environmental, social and governance factors that are important indicators of future success and assess how these are managed. Of course, we are not just investing in sustainable bonds for sustainability’s sake, and bonds are also subject to fundamental analysis around credit quality, macroeconomic factors and valuations to ensure they offer attractive investment returns.

Applying a thematic approach to fixed income investments.

The Sustainable Future team aims to identify companies whose core products or services are making a positive contribution to society or the environment in some way.

While the equity team’s analysis means they often identify great small and mid-cap companies with attractive long-term earnings growth prospects, the nature of fixed income investing is different. As bondholders, we need to limit downside (default) risk while maximising the returns received in the form of bond coupon and principal payments.

Reducing the small tail risk of a large loss – a bond default or negative credit event – is a key element that drives long-term returns in our bond portfolios. In practice, this means that we have a greater emphasis on resilience and stability than equity investors. This naturally means we have less exposure to small and mid-cap companies; our investable bond universe is to larger, more established companies.

It also means that the bond portfolios’ sector exposure to the teams’ 22 sustainable investment themes might differ from the equity portfolios. For example, we have low exposure to high-growth technology stocks (the Magnificent Seven, for example) and tend to find more appropriate investments in sectors such as banks, insurance, utilities and telecoms.

Growth in labelled bonds is encouraging, but sustainable investors need to consider the bigger picture

As sustainability advocates, we welcome the wave of new capital being raised for dedicated green and social projects: every pound or dollar invested towards supporting a transition to a more sustainable economy is vital.

However, simply buying in an ESG-labelled bond doesn’t guarantee your investment is deployed sustainably. For this, investors need to conduct fundamental analysis, ensuring the bond issuer’s other operations also fit their sustainability criteria – and, of course, ensuring that credit quality and valuations also offer the potential for attractive returns.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Sustainable Investment team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- Holds Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Investment team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.