Many of us will have spent Sunday 22 June listening to coverage of the US’ surprise attack on Iran’s nuclear facilities. President Trump described the mission as "…a spectacular military success. Iran's key nuclear enrichment facilities have been completely and totally obliterated.” A passage that was repeated countless times around the word. Hanging on the words of a world leader has been a global preoccupation since the invention of radio in the early years of the last century. Since then, all flavours of political recordings have been broadcast; the good, the bad and the downright ugly. The most noteworthy of these lodge themselves in the public consciousness like a bookmark in the annals of history. In the passing decades, the method of communication, went through evolution and then revolution and we find ourselves today with 24-hour access to any one of countless news outlets.

The way we digest information has certain people and events inexorably linked with it: Churchill, World War II and the wireless, Eisenhower and the Coronation with black and white TV, Nixon JFK and the Vietnam War with the advent of colour television, the Gulf War with 24 hour news, George W Bush, Blair and 9/11 with the rise of the internet and, finally, while Johnson, Farage and the Brexit Bus may lay claim to the ignominious title, surely Donald Trump is the poster child when it comes to the era of "the socials"

Investors would be forgiven for thinking there is more "news" today. Patently there is more information being thrust at us and the tone of reportage has, perhaps, become less constrained. In an era where we carry a portal to the world around in our pockets, it is difficult to switch off from the relentless noise that can prove a source of short-term gyrations in our sentiment. The challenge is that sentiment can often be an enemy of sensible long-term planning. Emotions can cloud good judgment and even the most resolute investors can find their pursuit of fundamentals tainted by the unstoppable tide of "content".

Recent years have brought with them a string of major global events, such as the Global Financial Crisis (GFC), the pandemic or the large number of elections and incumbents being shown the door last year, and some significant shifts from long-term orthodoxy. Major central banks have experimented with zero and even negative interest rates, we have had global lockdowns and past decades of globalisation, political consensus and interdependence are being slowly unpicked, whether it be through trade barriers and protectionism or through more hawkish political doctrine and conflict on the European continent with a G20 member as the aggressor. Domestically, the political response to these challenges has been a gradual drift away from the centre ground and, over the course of 2024, we had a large proportion of the global population participating in general elections, many of which saw a shift from one side of the political divide to another.

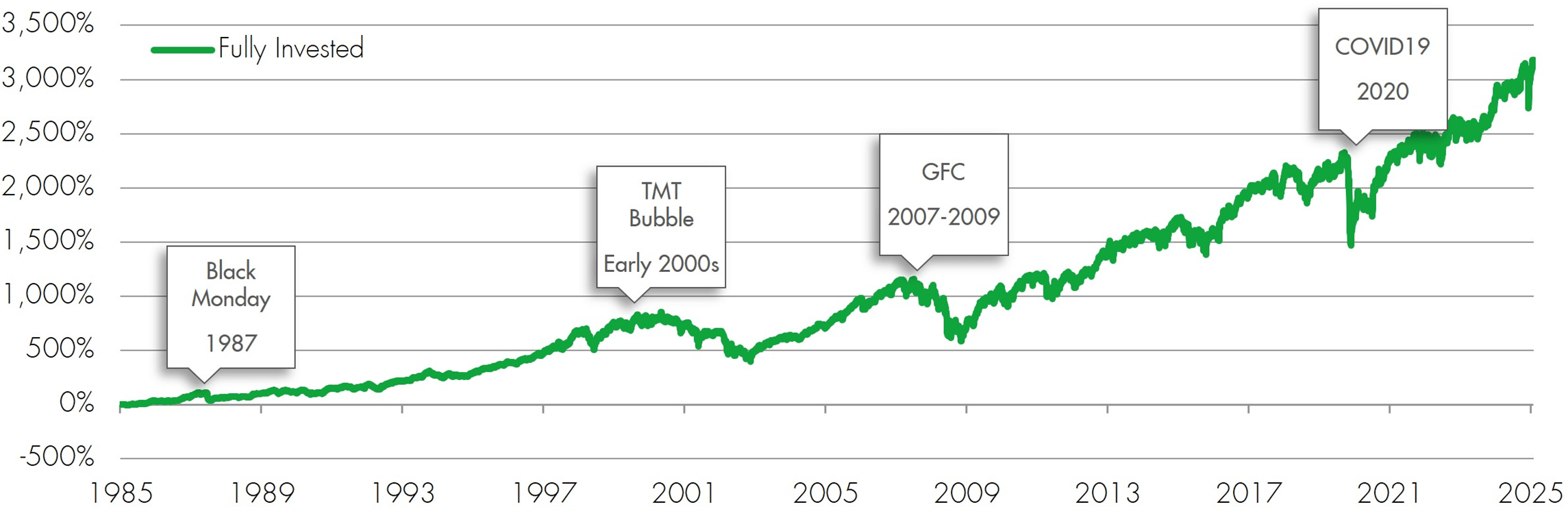

FTSE All Share TR

Source: Bloomberg, Liontrust 30 May 2025. Data between 30 April 1985 and 30 December 1985 is the All Share Price Return. Data between 30 December 1985 and 30 April 2025 is FTSE All Share Total Return index.

At times of uncertainty, it is reassuring to reflect on what we know and what is tangible. Against these wildly divergent backdrops, a few things have tended to ring true for investors. For a start, entrepreneurial spirit and a desire for success has, on average, led to significant returns for long-term investors. Even in the past 40 years, markets have had to contend with the dying days of the Cold War, conflicts around the globe, seismic political shifts, and natural disasters which all posed challenges in their own way. Yet through all this tumult, markets have progressed rather well. Of course, there have been setbacks, some very significant ones such as Black Monday in 1987, the TMT bubble (Technology, Media, and Telecoms) in 2001, the GFC in 2008 and Covid in 2020, but, despite these events, had you bought the market on 30 April 1985, your return would have been 3,180% over the following 40 years.

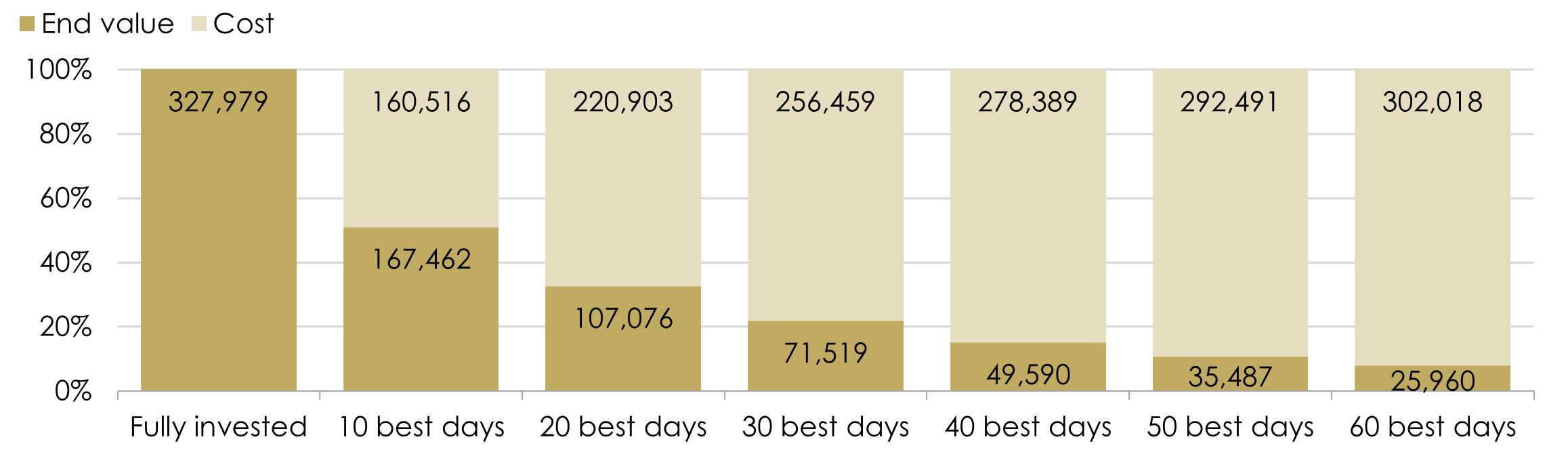

Indeed, there is plenty of data that suggest being patient and resolute can provide access to the power of long-term compounding of investments. There is some sound logic to that: for example, going back to our 40-year FTSE All-Share investment, a return of 3,180%1 tells us that had you invested £10,000 on 30 April 1985, kept it invested and reinvested your dividends, the value of your investment would be £327,979. Had you missed the 10 best days, however your ending value would “only” have been £167,462, meaning that you’ve roughly halved your gain. The challenge is that these 10 days come during periods of market volatility and often are experienced very soon after significant market falls. Markets tend to turn before the news does and so hoping to be able to sell and buy back in at the right time is very difficult indeed.

Missing best days: value of £10,000 invested in the FTSE All Share

Source: Bloomberg, Liontrust 30 May 2025. Data between 30 April 1985 and 30 December 1985 is the All Share Price Return. Data between 30 December 1985 and 30 April 2025 is FTSE All Share Total Return index.

If we allow ourselves to accept the power of sentiment on markets in the short term and we accept that sentiment tends to overshoot both on the positive and the negative, the desire to act rather than wait can be reduced. We may have timed our exit from the markets perfectly ahead of the bear market in 2020 but few of us would have chosen 24 March 2020 – the day after the UK urged us to stay at home to prevent the spread of the pandemic – to be the day to jump back in with both feet. The news was unrelentingly bad at that time but 24 March 2020 is the second best daily return of the FTSE All-Share over the past 40 years. Once you miss the market turn, your compound returns are hurt significantly and, even worse, you can fall into the trap of waiting for the next pullback to re-enter markets, but over the long run these pullbacks are few and far between. As markets grind up, the decision to re-enter becomes ever more difficult but long-term data suggests the sooner you re-enter the better.

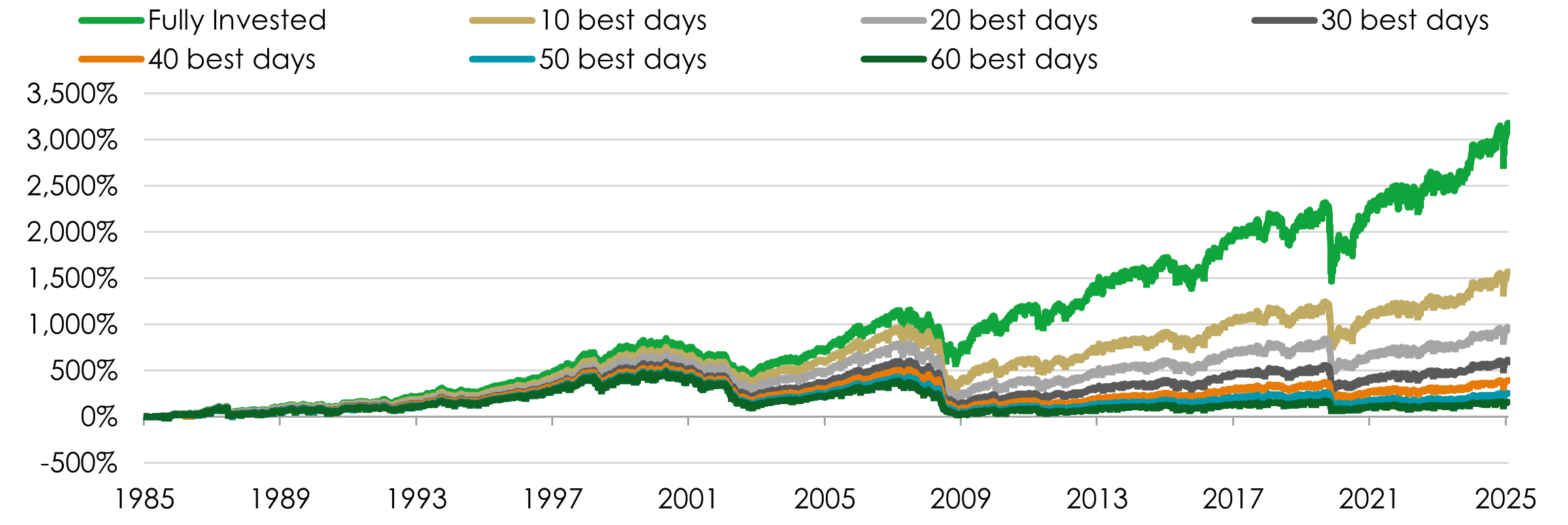

All share: missing n best days

Source: Bloomberg, Liontrust 30 May 2025. Data between 30 April 1985 and 30 December 1985 is the All Share Price Return. Data between 30 December 1985 and 30 April 2025 is FTSE All Share Total Return index.

2025 has been a microcosm of this emotional journey – we’ve gyrated from a big sell-off to a big rally in global equity markets and the only real variable has been political announcements. The impact of these political factors over the short term has been sufficient to overwhelm any fundamentals such as corporate earnings or even macro economics.

On the subject of economics, Wall Street has clearly moved on from tariffs but the key unknown today is whether Main Street has. While not inconceivable, it is a big stretch to think that consumers and businesses will be as primed to overlook the tariff uncertainty as the investment community has been.

Even if we reset all tariffs back to their level at the start of this year, the spectre of uncertainty that has come from “Liberation Day” and indeed other political events in the past couple of months must surely prove more pervading?

So, while the market impact was severe but perhaps short lived, the true impact of these three months of topsy turvy politics on the economy will only become clear in the months to come.

In the meantime, even if these impacts do have an effect on economies (which is not guaranteed, by the way) what we can say is, as with much of recent history, politics will create noise but the role of company management is to generate profits for shareholders regardless of the political winds.

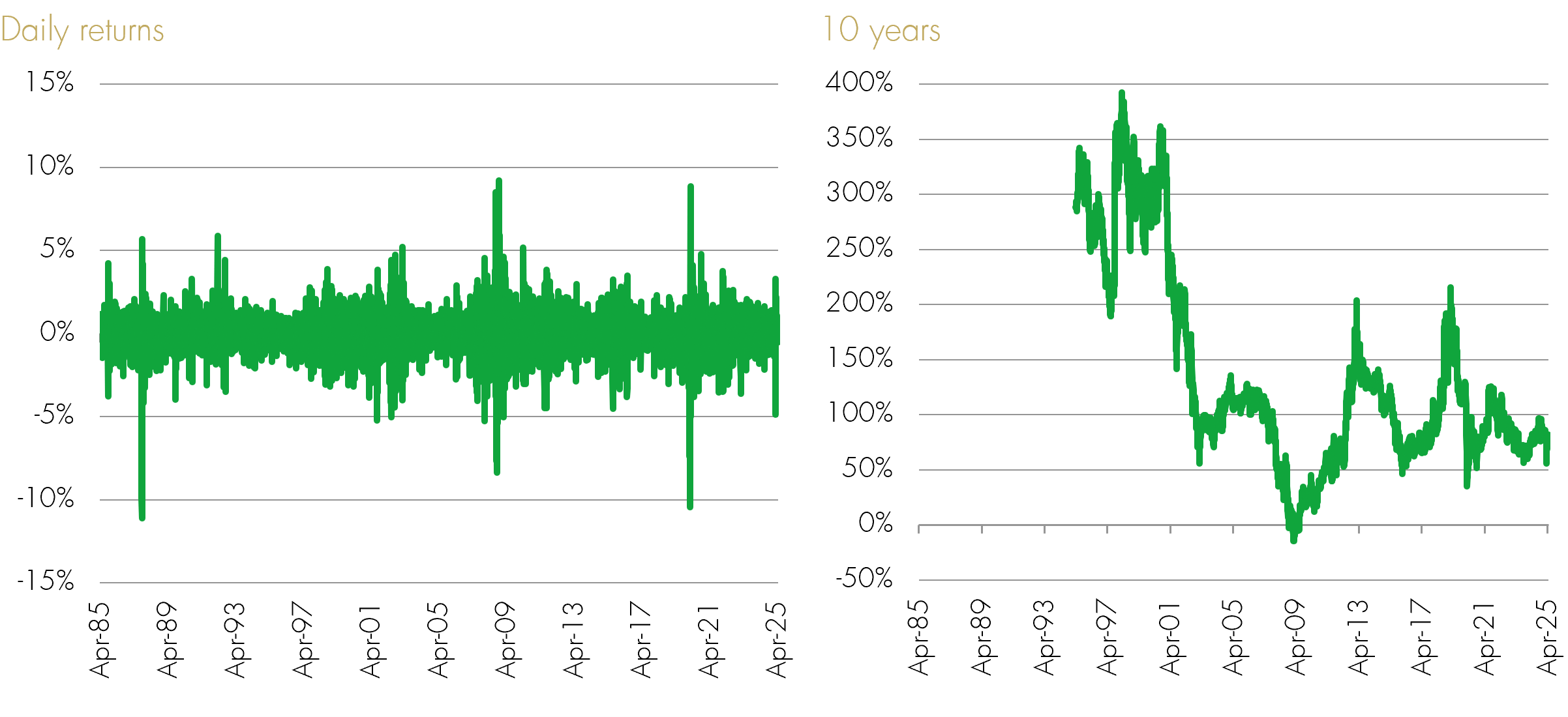

There will always be winners and losers – indeed part of the quid pro quo of entrepreneurial spirit and desire for success is greed, overambition and obstinacy which may mean a company is poorly managed through times of change. Nevertheless, stock markets as a whole – representing something of an average of the whole cohort of companies – have done extremely well through thick and thin. Month by month and year by year they have been challenged but a long-term, disciplined approach to investing has, historically, ridden it out. For example, any FTSE All-Share’s daily return chosen at random going back 40 years to May 1985 had a 52%1 chance of being positive. While the daily odds are essentially a toss of a coin, the market has returned 3,180%1, demonstrating the daily gains are on average larger than the daily losses. Even more importantly, the impact of holding periods on returns should not be understated. If the 10,000 daily returns over the past 40 years are essentially 50:50, a rolling three-month return chosen on any random day over the same period had a 69%1 chance of a positive return. An annual holding period over the same 40 years had a success rate of 76%1 and a 10-year holding period, chosen on any random day, had a 99%1 chance of a positive return. The next time you see a politician creating headlines, remember this is quintessential market noise and that noise provides opportunities for resolute, long-term, diversified investments.

Source: Bloomberg, Liontrust 30 May 2025. Data between 30 April 1985 and 30 December 1985 is the All Share Price Return. Data between 30 December 1985 and 30 April 2025 is FTSE All Share Total Return index.

The bigger challenge today stems from fundamentals and deciding whether, for example, the valuations in the US, which are elevated by historical standards, are sensible today. If you believe that the valuations in the US are in a bubble then it would be difficult to justify an overweight position to US equities today. It is possible that, rather than valuation, profitability is the real area of overheating. The billions of dollars invested in AI and related technology will likely look essential once the technology is ubiquitous. There could be air pockets on the way – remember in this area one company’s revenues generally are being sourced from another’s expenses – huge investments in technology laying the foundations for the future but if some of that is curtailed or if trade policy spooks corporate planners then the revenues could fall as precipitously as they have grown in this sphere.

To that end, the trade policies of President Trump will likely have an oblique but potentially significant impact on markets. Economies continue to perform reasonably but it is difficult to meaningfully measure the dent on confidence amongst the global business and consumer community this uncertainty has caused.

We believe in the long-term power of stock markets as a means to return capital to shareholders but we appreciate the experience of investors is not a linear path. As a result, genuine diversification, which makes use of all the colours on the multi-asset palette, should provide some moderation from markets’ excesses. Diversification across regions, asset classes, investment styles, actives and passives, for example, should reduce your portfolio’s sensitivity to any particular source of risk. Diversification is the closest we get to a free lunch in investment management – we should embrace the risks that look reasonably priced and reduce our sensitivity through diversification to those that do not.

1 Source: Bloomberg, Liontrust 30 May 2025. Data between 30 April 1985 and 30 December 1985 is the All Share Price Return. Data after 30 December 1985 is FTSE All Share Total Return index.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds and Model Portfolios managed by the Multi-Asset team may be exposed to the following risks:

- Credit Risk: There is a risk that an investment will fail to make required payments and this may reduce the income paid to the fund, or its capital value;

- Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss;

- Liquidity Risk: If underlying funds suspend or defer the payment of redemption proceeds, the Fund's ability to meet redemption requests may also be affected;

- Interest Rate Risk: Fluctuations in interest rates may affect the value of the Fund and your investment. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result;

- Derivatives Risk: Some of the underlying funds may invest in derivatives, which can, in some circumstances, create wider fluctuations in their prices over time;

- Emerging Markets: The Fund may invest in less economically developed markets (emerging markets) which can involve greater risks than well developed economies;

- Currency Risk: The Fund invests in overseas markets and the value of the Fund may fall or rise as a result of changes in exchange rates;

- Index Tracking Risk: The performance of any passive funds used may not exactly track that of their Indices.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The risks detailed above are reflective of the full range of Funds managed by the Multi-Asset team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.