An energy transition pioneer

As the world’s largest developer of offshore wind projects, Danish energy company Ørsted has cemented itself as an energy transition pioneer and leader.

In 2009, 85% of its energy was produced from coal, oil and gas with only 15% from renewables, but Ørsted set out to reverse this ratio by 2040. Impressively, the company achieved this target in 2019 – 21 years ahead of plan.

While this stark transformation has naturally led it to become a favourite with sustainable investors, a confluence of macroeconomic and operational challenges more recently has seen its valuation suffer. However, we have recently reviewed its credit fundamentals and think Ørsted remains attractive for bond investors – while it faces short-term challenges, the tailwinds of renewable energy transition remain potent.

Headwinds in the US have been mitigated

US cost pressures led to asset impairments in 2023 and 2024 as high interest rates, supply chain delays and falling offshore wind seabed values all had a negative impact. The new US administration has shown little signs of helping the sector face these challenges, freezing funding for the Inflation Reduction Act and temporarily halting Equinor’s fully permissioned and under construction wind project.

While there is no pretending rising costs and supply chain disruptions won’t continue to be a concern for its US operations, Ørsted has been able to take action to mitigate the impact.

A new, bond-friendly approach to capital discipline

Under a new CEO since the start of the year, Ørsted is stressing financial resilience by prioritising capex discipline and cost efficiencies over growth – a mantra that appeals to debt investors.

Its new capital discipline was highlighted by its decision to halt development on the Hornsea 4 offshore wind farm in the UK due to mounting costs – a move which crystallises sunk costs and protects its balance sheet from further cost overruns. This demonstrates its new approach to focus on project quality over quantity.

It has also undertaken a successful asset disposal plan. These asset sales and improvement in internally generated cash flows should boost key FFO (funds from operations)/net debt metrics.

All-in-all, we think any short-term bond price volatility should be viewed as an attractive entry point as the company successfully executes a strategic shift and restores its balance sheet.

Falling wind energy costs support the long-term investment case

Ørsted still maintains a deep project pipeline, positioning it well to benefit from structural tailwinds behind the shift to lower carbon energy generation. Legislation helps facilitate demand for renewables and, crucially, the European policy backdrop remains supportive. While the USA IRA is being scaled back, the Green Deal in Europe continues to progress.

Investors are often wary to rely on policy-driven change, especially in light of the recent western trend of political incumbents who were positive on the environment losing power. However, the costs speak for themselves:

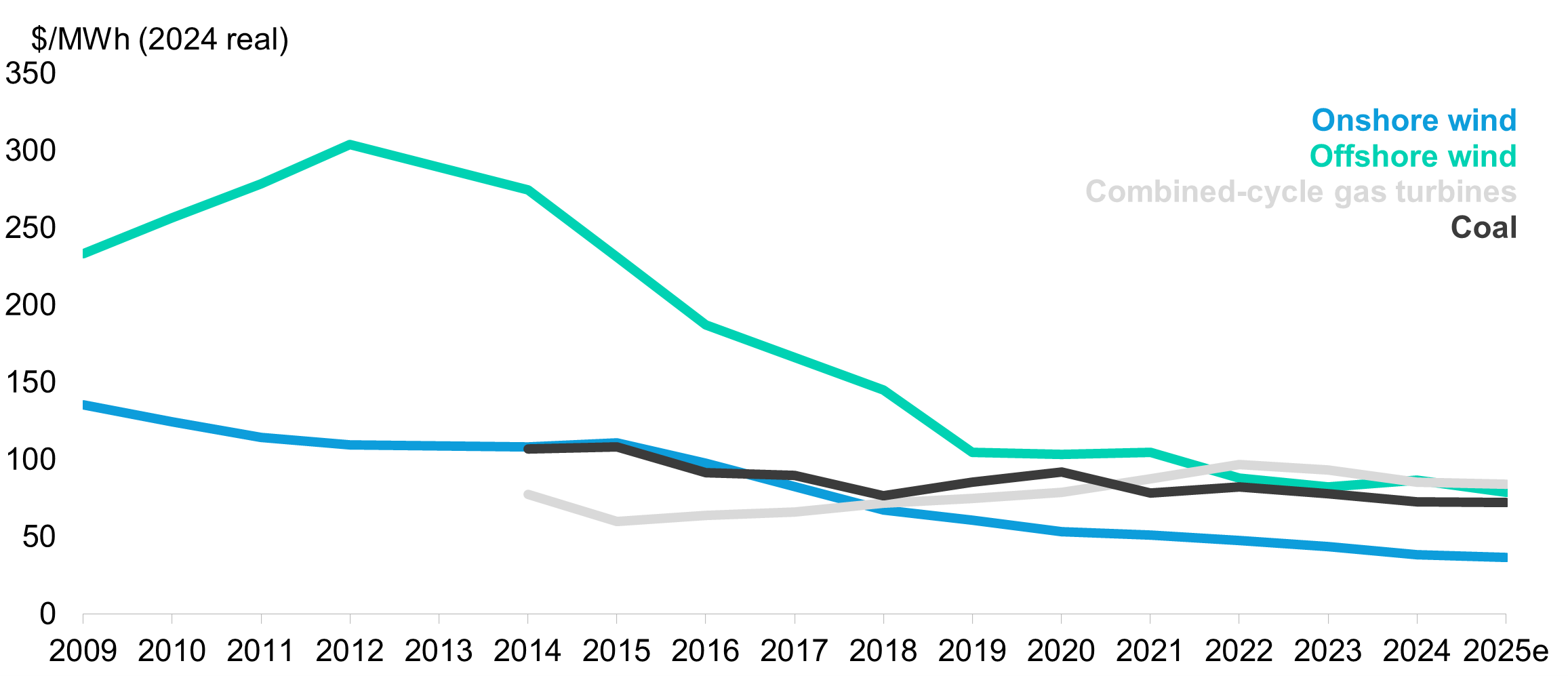

Global levelised cost of electricity

Source: Bloomberg, as at 30.06.25. All LCOE calculations are unsubsidized. Global benchmarks are country-weighted averages using annual capacity additions, except for Wind offshore where the cumulative capacity is used.

The declining global levelised cost of electricity (LCOE) from wind proves that it can compete with traditional forms of energy. Costs will only continue to come down as the technology improves and economies of scale kick in.

Orsted’s share of renewable generation has reached 99% this year, and it is on track to reduce the emissions intensity of its generation and operations by 98% this year from 2006. Its targets are well ahead those of its peers. Not only was it the first energy company to set a validated science-based net zero target, but it has since set additional interim targets to better give visibility into its progress.

Orsted champions a number of other areas as well. New renewable energy projects commissioned from 2030 will all have a net-positive biodiversity impact. It also exclusively uses green and sustainable long-term financing, with all projects being taxonomy-aligned. As regulation tightens – biodiversity through the Taskforce on Nature-related Financial Disclosures and financing through the EU taxonomy classification for example – Orsted will continue to be ahead of the curve as others struggle to catch up to eventually inevitable changes.

Conclusion

The decision to completely revamp its business model away from fossil fuels is perhaps the most pivotal in Ørsted’s history (second only to renaming from the awkwardly designated ‘DONG energy’).

While the image of a wind turbine across a green field is often the default for any sustainable investment slide pack, which risks overshadowing other diverse sustainable investment themes, Ørsted’s future prospects are emblematic of a broader energy transition: complex, capital-intensive, and beholden to the global backdrop of rates and an ever-volatile supply chain.

Ørsted’s strategic shift, more conservative credit profile, and continued commitment to being a renewable leader place it as a key beneficiary of a change in our energy mix. Political hurdles such as those we’ve seen this year can only delay the economics of renewables for so long. From a bond investor’s perspective, we believe Ørsted’s current valuation offers an attractive entry point.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Sustainable Investment team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- Holds Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Investment team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.