Stablecoins – digital assets pegged to stable fiat currencies such as the US dollar – have evolved dramatically since their early use in crypto trading. Originally designed to simplify the exchange of cryptocurrencies, they have rapidly found product-market fit in the infrastructure layer for global payments, remittances and cross-border business to business (B2B) transactions.

To the average consumer, payments seem simple – just a tap to pay. But behind this seamless experience lies a complex web of intermediaries: point-of-sale systems, acquiring banks, issuing banks, payment processors, FX conversion layers and card networks, with each adding cost, latency and complexity. Stablecoins, a tokenised currency on public blockchains, can cut through this friction. We can now send dollars across the globe in under one second and for less than one cent. This is not just an incremental improvement – it is a leap forward, especially when including instant settlement and transparency. Stablecoins are no longer just a crypto trading tool; they are solving deep inefficiencies embedded in the architecture of global finance.

To the average consumer, payments seem simple – just a tap to pay. But behind this seamless experience lies a complex web of intermediaries: point-of-sale systems, acquiring banks, issuing banks, payment processors, FX conversion layers and card networks, with each adding cost, latency and complexity. Stablecoins, a tokenised currency on public blockchains, can cut through this friction. We can now send dollars across the globe in under one second and for less than one cent. This is not just an incremental improvement – it is a leap forward, especially when including instant settlement and transparency. Stablecoins are no longer just a crypto trading tool; they are solving deep inefficiencies embedded in the architecture of global finance.

While volatility has long defined crypto trading and decentralised exchange volumes, stablecoins tell a different story. Their activity has shown consistent, upward momentum, steadily growing through periods of market turbulence. As the chart below illustrates, this resilience highlights their expanding role far beyond crypto trading, binding their place in real-world payment applications.

DEX trading volume ($bn) versus monthly active Stablecoin addresses (mn)

Source: Artemis Terminal, The Block, Bernstein analysis, June 2025

Even more remarkable is the sheer volume processed via stablecoins. Today, they handle nearly 20 times PayPal’s transaction volume, with last year’s annual transfer volume surpassing the combined volume of Visa and Mastercard by 7.7% – and rapidly closing in on the scale of the Automated Clearing House (ACH) network.

In only a decade, stablecoins have become the 19th largest holders of US Treasuries, rivalling sovereign nations. Citi recently projected that by 2030, total stablecoin assets could hit $3.7 trillion, placing them at the very top of the international leaderboard for US Treasury holdings.

Top international holdings of US treasuries (billions)

Note: US Department of the Treasury, as of March 2025; Source: FRED, DefiLlama, Visa on-chain analytics, Company filings, Bloomberg, Bernstein analysis, June 2025.

Use cases

With increased efficiency, improved transparency and enhanced resilience, stablecoins are solving problems now, with use cases multiplying across industries. On the retail front, margin sensitive businesses are the biggest beneficiaries. Think coffee shops, newsagents and locally run restaurants who can add 2% directly to the bottom line – potentially doubling profits. But the deepest disruption currently is hitting global remittance and B2B cross border settlements, where stablecoins are available 24/7, 365 days a year with near instant settlement.

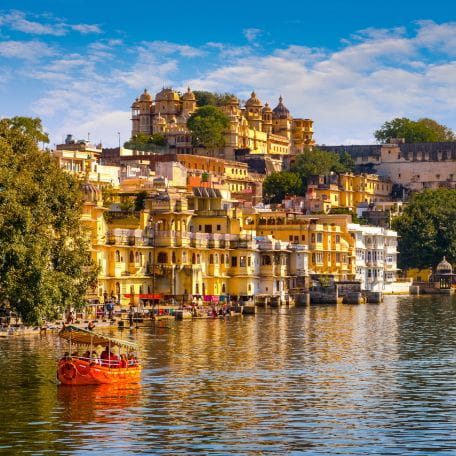

Stripe, the financial infrastructure platform for businesses, completed its acquisition of Bridge earlier in the year. Bridge’s most obvious use case is cross-border money flows, in particular to countries that have unstable currencies or are underbanked. For example, one firm which hires around the world pays contractors in stablecoins, allowing them to receive payment immediately in US dollars in countries with unstable currencies.

Shopify recently partnered with Coinbase and Stripe to bring frictionless, secure stablecoin payments to merchants globally using their existing payment and order fulfilment flows with no integrations or new gateways required. Onchain stablecoin payments also go beyond transferring value – they are programmable, allowing automated triggering steps in complex financial flows like multi-stage payment commitments.

Visa and Mastercard, the backbone of the payments world, have also embraced stablecoins. Visa is actively integrating stablecoins directly into its settlement infrastructure, with Mastercard also enabling global acceptance and payments with stablecoins, allowing consumers and merchants to use stablecoins like cash at over 150 million merchant locations worldwide.

‘Stablecoin Summer’ also saw the much anticipated Circle IPO, which soared over 450% last month. As the second-largest issuer of US dollar stablecoins (with around a 24% market share compared to around 60% for Tether), Circle’s rise reignited interest in Coinbase, which enjoys a 54% reserve income split thanks to a preferential USDC distribution agreement.

USDC: Circle’s revenue sharing model (Q1 2025)

USDC supply distribution (average, %)

Source: Bernstein Research, 31 March 2025.

Reserve income distribution (%)

Source: Bernstein Research, 31 March 2025.

Regulation

Regulation is beginning to catch up with the stablecoin boom. On 17 June, the US Senate passed the GENIUS Act with a vote of 68–30, marking the first comprehensive regulatory framework for the issuance and supervision of payment stablecoins. By mandating full reserve backing, third-party audits and strict compliance with anti-money laundering laws, the legislation aims to protect consumers and rebuild trust in the crypto and blockchain space – especially after several high-profile failures in recent years.

A key provision within the GENIUS Act* prohibits non-financial public companies from issuing stablecoins, therefore setting the stage for tech platforms, e-commerce firms and digital marketplaces to partner with regulated US financial institutions instead. *(On 18 July, President Trump signed the GENIUS Act into Law).

While, the CLARITY Act is beginning to draw clearer definitions and jurisdictional boundaries for the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Together, these legislative moves mark a decisive pivot from regulatory ambiguity to structured oversight – signalling the wider crypto economy entering a new era of legitimacy and to re-shore crypto companies back to the US.

What’s next?

Blockchain and tokenisation – once viewed as a direct threat to the US dollar, are now emerging as its most powerful enabler. With over 99% of stablecoin supply denominated in US dollars, the technology is reinforcing this currency’s dominance in today’s digital economy. In fact, stablecoin supply is at an all-time high, with roughly 1.1% of the total US dollar supply now tokenised.

Excitingly, Coinbase recently launched a new standard for internet-native payments – where sending stablecoins becomes as effortless as loading a webpage. By enabling instant payments over HTTP, this will unlock seamless transaction capabilities for APIs, apps and even AI agents, paving the way for an automated internet economy.

Meanwhile, tokenised real-world assets (RWAs) are gathering momentum. With over $20 billion already onchain and projections of a $2 trillion market base case by 2030, tokenisation is reimagining traditional finance. Tokenisations of RWAs transforms physical assets into programmable digital tokens that retain economic utility – offering benefits such as lending, fractional ownership, faster settlement and lower transaction costs. With adoption accelerating across major institutions like Visa, Mastercard and Stripe, stablecoins are poised to revolutionise cross-border money movement – breaking apart an industry long plagued by cost, inefficiency and fragmentation.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Equities team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term. Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.