The Liontrust GF Strategic Bond Fund returned -3.4%* in US dollar terms in April. The average return from the EAA Fund Global Flexible Bond (Morningstar) sector, the Fund’s reference sector, was -2.1%.

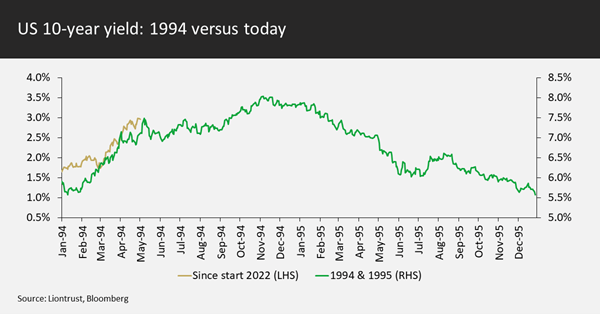

April was a torrid month for the bond markets as the repricing of rate expectations accelerated and credit spreads widened. With US Treasury yields rising by 60 basis points in April, this has led the cumulative total return for the first third of the year to be the worst since 1788 (hat tip to Deutsche Bank research for this historical gem). Bringing us more into the modern era, I thought it instructive to compare the movement in yields now to that of the 1994 bond bear market:

The green line shows the progression of US 10-year yields in 1994 and 1995, plotted on the right-hand axis. The gold line, scaled to the left-hand axis, shows how yields have changed since the start of this year. The move is comparable in both scale and speed.

The trillion-dollar question is: how much higher yields will go? The US is already discounting a peak in Fed funds rates of approximately 3.5%, a level that would undoubtably be restrictive. If the Fed gets to its neutral area (2.25% - 2.50% band for its 2.4% dot plot median neutral rate) and pauses to observe the lagged impact of cumulative policy tightening, then bond markets have already discounted too many interest rate rises. If the Fed is forced to engineer a recession in order to bring inflation back under control, then sovereign bonds could face further pain. A good way of seeing how much further yields could rise is to examine real yields:

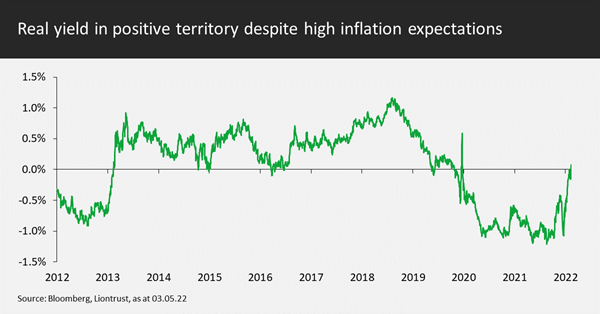

The chart shows the nominal yield on the 10-year US Treasury minus the inflation breakeven (this is equivalent to the real yield on the treasury inflation protected security). The real yield is back in positive territory, with the majority of the move being driven by the upward shift in conventional bond yields; 10-year inflation breakevens are just below 3%. A real yield of between 0.5 and 1.0% would represent a decent entry point into sovereign bonds. There are two ways of getting there: either a further selloff in conventional debt or, if the Fed regains inflation fighting credibility, then longer-term inflation expectations should start to fall and breakevens fade back towards 2-2.5%.

Clearly there are many moving parts, for a more in depth look at our current macroeconomic thinking, please see our latest quarterly strategy document.

Rates

The Fund finished April with a duration of 3.75 years, still below our neutral level of 4.5 years and way below the index duration of approximately 7.25 years. If yields continue to rise, we will keep reducing the underweight. We have gone from hating sovereign bonds to just having a mild dislike.

The only significant rates trade during April was to switch some European duration into the US when the spread between Germany and the US reached 200 basis points. This leaves the Fund with 2.75 years’ duration in the US, mostly in the 5 to 10-year maturity bucket, and 1-year in Europe. We retain the cross-market position of being long New Zealand government debt relative to Australian bond futures.

Allocation

April was a tough month for credit spreads as well as sovereign bonds. Most investment grade indices exhibited widening of 15-20 basis points with some individual bonds clearly seeing significantly larger moves. Two factors conspired to cause the widening: fear and flows. The fear refers to justified concerns that central banks will cause a recession. Flows out of the fixed income market have been large and, particularly in Europe, the dealing community finds itself longer than it wants to be. As new buyers emerge, this technical overhang should start to clear. We are optimistic on the appearance of new buyers longer-term as yields are becoming more compelling for those looking at total and real return potential as well as parts of the insurance and assurance markets which can now reach their target yields.

The Fund remains neutrally allocated to investment grade corporate bonds with a 50% weighting (55% physical holdings minus a 5% risk-reducing overlay). We prefer to spend the risk budget on high-quality high yield. The Fund has a 30% weighting (mainly physical holdings plus a 1.5% long risk overlay), above our 20% neutral but still below the 40% maximum allocation. Our strong structural and cyclical preference is for quality issuers; the Fund has no CCC-rated exposure and very low exposure to cyclical sectors.

Selection

Stock trading activity was low during April as the bid/offer in the market was too wide to be able to find many relative value switches that would work. This was a case of Easter illiquidity compounding the impact of “the Street” being long and wrong.

A holding in CAF was trimmed as it had been a relative outperformer. We added to Netflix exposure; its struggles with subscriber numbers quite rightly led to an equity de-rating. From a bondholder perspective the business is generating good cashflows, has low balance sheet leverage and the bonds are a cheap crossover credit.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns.

|

|

Mar-22 |

Mar-21 |

Mar-20 |

|

Liontrust GF Strategic Bond B5 Acc |

-3.96 |

13.15 |

-0.40 |

|

EAA Fund Global Flexible Bond - USD Hedged |

-2.98 |

13.23 |

-1.88 |

*Source Financial Express, as at 31.03.22, total return, B5 share class.

**Source Financial Express, as at 31.03.22, total return, B5 share class. Discrete data is not available for ten full 12-month periods due to the launch date of the portfolio (13.04.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality, the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Key Features of the Liontrust GF Strategic Bond Fund

|

Investment objective & policy1 |

The investment objective of the Fund is to maximise total returns over the long term through a combination of income and capital. The Fund will seek to achieve its objective by investing in bond and credit markets worldwide. The Fund invests in a wide range of bonds issued by corporates and governments, from investment grade through to high yield. The Fund invests in developed and emerging markets, with a maximum of 40% of its net assets invested in emerging markets. Investments may be made in "hard" currencies, such as US Dollar, Euro and Sterling, and up to 25% of the net assets of the Fund may be invested in soft currencies, such as those of emerging markets. Where the Fund invests in non-US Dollar assets, the currency exposure of these investments will generally be hedged back to US Dollar. Up to 10% of the Fund's currency exposure may not be hedged, i.e. the Fund may be exposed to the risks of investing in another currency for up to 10% of its assets. The Fund may invest both directly, and through the use of derivatives. The use of derivatives may generate market leverage (i.e. where the Fund takes market exposure in excess of the value of its assets). In addition, the Fund may invest in cash or cash equivalents, such as deposits and Money Market Instruments, for cash management purposes. Within the limits stated above, there are no geographical or economic sector restrictions on the Fund's investments. The Fund has both Hedged and Unhedged share classes available. The Hedged share classes use forward foreign exchange contracts to protect returns in the base currency of the Fund. The fund manager considers environmental, social and governance ("ESG") characteristics of issuers when selecting investments for the Fund. |

|

Recommended investment horizon |

5 years or more |

|

Risk profile (SRRI)2 |

4 |

|

Active/passive investment style |

Active |

|

Benchmark |

The Fund is actively managed without reference to any benchmark meaning that the Investment Adviser has full discretion over the composition of the Fund’s portfolio, subject to the stated investment objectives and policies. |

|

Sustainability profile |

The Fund is a financial product subject to Article 8 of the Sustainable Finance Disclosure Regulation (SFDR). |

Notes: 1. As specified in the KIID of the fund; 2. SRRI = Synthetic Risk and Reward Indicator. Please refer to the KIID for further detail on how this is calculated.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF Strategic Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances. This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.