The Liontrust GF Absolute Return Bond Fund (C5 share class) returned 1.8% in sterling terms in Q4 2022 and the IA Targeted Absolute Return, the Fund’s reference sector, returned 2.1%. The Fund’s primary US dollar share class (B5) returned 2.0%.

The year reached its conclusion with myriad central banks hiking rates by 50 basis points in December. Central bankers started 2022 way behind the curve with inflation clearly not having been “transitory”. The late starting to the rate-hiking cycle has meant that terminal rates will have to be higher and recessions deeper in order to conquer inflation. I found it interesting contrasting the statements from December 2021 with those of December 2022.

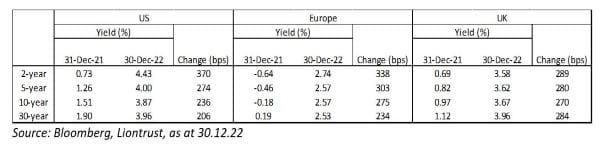

The US Federal Reserve ended 2021 with fed funds rates in the 0% - 0.25% range, stating “..the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment”. By the end of 2022, fed funds rates were at 4.25 - 4.50% with further policy tightening a foregone conclusion. The statement is now decidedly hawkish, saying “…no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy”. The increase in sovereign bond yields in 2022 across differing tenors can be seen below:

The European Central Bank was even more dovish a year ago: “…in support of its symmetric 2% inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon … this may also imply a transitory period in which inflation is moderately above target.”

Move the calendar on a year and the tone has completely shifted. Accompanying the ECB’s policy decision in December 2022, inflation forecasts were revised upwards: it is expected to be 8.4% in 2022, 6.3% in 2023, 3.4% in 2024 and 2.3% in 2025. Excluding energy and food, the numbers are much lower than headline inflation in the first two years (3.9% in 2022, 4.2% in 2023), slightly lower in 2024 (2.8%), and a smidge higher in 2025 (2.4%). With those inflation forecasts it is no surprise that the ECB’s Governing Council “…judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations”. At the press conference Lagarde was asked for further colour on the “steady pace” and her reply was that it implies 50bps hikes “for some time”, taken to mean at least one more meeting and possibly two. She then went on to say that market expectations for the terminal rate (which had been about 3% for the deposit rate) were too low. It was by far the most hawkish press conference Lagarde has ever hosted. The ECB states that the monetary policy path is data dependent, but it sounds like there will need to be a significant change in the economic data to alter the current hawkish mindset. However, as the eurozone slips into recession this year, the ECB’s view is likely to be challenged.

I believe that one of the over-riding themes for bond markets in 2023 will be this tension between hawkish central banking rhetoric and financial markets attempting to price in rate cuts toward the end of the year. In my opinion, the key determinant of when central banks will be able to cut rates is the labour market.

Using the US as an example, whilst the level of inflation is obviously too high, the direction is very encouraging. Core goods prices have been falling over the last few months, with the biggest driver being used car prices. Shelter inflation, one of the stickiest components in the consumer price inflation baskets, will start falling rapidly in late Q2/early Q3 as a natural lagged impact from a weakening housing market feeds through. The lag is mainly due to the measurement methodology that the BLS uses to calculate rents and owners’ equivalent rents (OERs). This just leaves core services inflation, which (excluding shelter) was rising at 6.6% according to the inflation data released for November. Core services inflation exhibits a high degree of correlation to nominal wage inflation, itself a function of a very strong labour market. There remains a big imbalance between demand and supply of labour; until this imbalance has corrected the Fed will continue to be hawkish.

It is our opinion that by the end of 2023 the US economy will have weakened enough to significantly reduce the pressure on wage inflation; after all, unemployment has historically been a late cycle indicator. So, the Fed will be able to cut rates. Whether it chooses to cut is another matter. Just as delays to raising rates have contributed to a higher terminal rate for this cycle, delays to cuts when the time comes would only lead to more loosening being eventually required.

Carry Component

We split the Fund into the Carry Component and three Alpha Sources for clarity in reporting, but it is worth emphasising we manage the Fund’s positioning and risk in its entirety. As a reminder the Carry Component invests in investment grade bonds with <5 years to maturity, within this there is a strong preference for investing in the more defensive sectors of the economy.

At the aggregate level, the Fund’s positive return was driven by the yield carry, followed by just under 1% contribution from credit spread tightening.

Alpha Sources

Rates

The Fund spent most of the quarter with a duration of 2 years, above the neutral level of 1.5 years (as a reminder, the permitted range is 0-3 years). Duration was reduced by 0.25 years at the start of December as we believed that sovereign bonds yields had rallied a little too far and fast. After a retracement of 30bps in US Treasury yields and 60bps in Bunds, we added the duration back on the 28th of December. The split is 1.2 years in the US, just above 0.7 years in Europe and just under 0.1 years in the UK.

Allocation

The weighting in the Carry Component remained at approximately 80% during October and November. It was increased during December at the expense of Selection as we reduced the spread duration of the Fund after a strong rally in credit. This marginal reduction in the credit beta of the Fund should be viewed within its permanent lower beta status relative to the broad credit market. The increase in the Carry Component to 87% was both actively due to a couple of switches, covered below, and passively through some bonds now naturally moving from Selection to carry as their maturity drops below five years (or three years for financials).

Selection

Profits were taken in Eli Lilly’s long dated-bonds in euros. The profits were on the duration hedged position, i.e., the bonds fell in price, but due to credit spread tightening the government bond future used to hedge out the duration fell in price by more. Small profits were also taken in Belden. As part of the reduction in the Fund’s spread duration, Techem’s bonds were also sold, as was a subordinated bond in The Southern Company. Proceeds were reinvested in 2023 maturity bonds, topping up Deutsche Telekom and Kellogg’s, and buying new positions in Royal Bank of Canada senior debt, Bristol-Myers Squibb and Thermo Fisher Scientific.

The top positive contributions within Selection during the quarter were from Eli Lilly, The Southern Company, Grifols and Zurich Insurance. The one negative was Credit Suisse’s senior debt. Within the Carry Component, most bonds contributed a small positive performance. The best two were Pershing Square Holdings and Smurfit Kappa; the laggards were in the real estate sector, namely CPI Property and Aroundtown.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns

|

Dec-22 |

Dec-21 |

Dec-20 |

Dec-19 |

|

|

Liontrust GF Absolute Return Bond |

-4.6% |

-0.4% |

2.9% |

2.5% |

|

IA Targeted Absolute Return |

-0.4% |

3.5% |

2.6% |

4.4% |

Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

*Source: Financial Express, as at 30.09.22, total return (net of fees and interest reinvested), C5 class.

**Source Financial Express, as at 30.09.22, total return, C5 class. Discrete data is not available for ten full 12-month periods due to the launch date of the portfolio

Key Features of the Liontrust GF Absolute Return Bond Fund

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF Absolute Return Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.