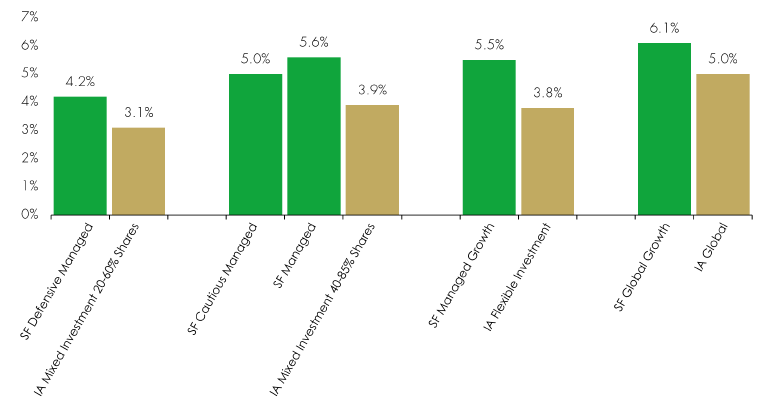

- All five Sustainable Future (SF) Managed funds outperformed the average return of their respective IA sectors over Q2.

- Markets experienced notable volatility in Q2 2025, driven by uncertainty around tariff policy and conflict in the Middle East.

- We remain positive on risk assets overall as we move into the latter half of 2025. While overall economic growth remains subdued, falling costs and the operating leverage opportunities for companies could spur accelerating earnings.

- We believe corporate bonds continue to offer attractive value, providing solid compensation relative to their underlying fundamentals.

- Top equity performers for Q2 included Advantest, Spotify and TransMedics. Becton Dickinson and Thermo Fisher were among the detractors.

- Over the quarter, we added Ingersoll Rand under our Improving the resource efficiency of industrial and agricultural processes theme, while selling our position in TechnoPro.

- We made the strategic decision to close the infrastructure asset class across our Managed Funds.

Sustainable Future Managed Range – Q2 performance

Source: FE Analytics as at 30.06.25. Liontrust SF Managed fund range versus relevant comparator benchmark, primary share class, total return (net of fees, interest/income reinvested). Figures subject to rounding.

Market review

Markets experienced notable volatility in Q2 2025, driven by uncertainty around tariff policy and conflict in the Middle East. Despite these headwinds, most major asset classes ended the quarter with gains as worst-case scenarios were avoided and underlying economic data remained solid.

The announcement of tariffs on 2nd April, known as “Liberation Day”, triggered a sharp market selloff, with both equities and bonds reacting strongly. However, the US administration quickly moved to ease tensions by pausing tariffs for 90 days and outlining a trade agreement with China. This policy shift helped restore investor confidence, leading to a broad recovery in risk assets.

Mega-cap technology stocks rebounded strongly, supported by renewed optimism and robust earnings. Following a weak first quarter, the ‘Magnificent 7’ significantly outperformed, signalling a return to the momentum-driven leadership seen in 2023 and 2024, with technology and AI-related stocks once again leading the market.

As anticipated, this leadership has become more broad-based. Mid- and small-cap stocks have been performing well alongside the mega-cap names. Encouragingly, areas such as software have also kept pace with the larger names, which has been pleasing to see.

The key area of weakness within markets remains the healthcare sector. The Trump administration had immediately sought to remove federal government support for the National Institute for Health (NIH), as well as any other federal government spending on healthcare research. President Trump then suggested he’d seek to regulate pricing to ensure the US consumer received the lowest price for treatments globally, a policy known as Most Favoured Nation status. This led to widespread weakness across the healthcare sector, despite signs of recovery in growth in the sector as it recovers from the post pandemic growth slowdown.

Overall equity markets delivered a strong quarter, recovering all of the losses from the previous period.

Market outlook

We remain positive on risk assets overall as we move into the latter half of 2025. While overall economic growth remains subdued, falling costs and the operating leverage opportunities for companies could spur accelerating earnings. While interest rates remain elevated, so does inflation, so the potential for support from loosening monetary policy is debatable over 2025. The chances of support for risk assets from rate cuts does remain a distinct possibility.

The risk of a policy error from the Trump administration has receded, as it has quickly dialled back policy decisions which equity and bond markets have deemed damaging. This was a feature of Trump’s presidency, and the fact the administration is likely to be kept in check by markets is somewhat reassuring, despite the chaos at times from the new administration.

The key risk facing markets as we move towards 2026 is the fiscal challenges facing governments in both the US and the UK. Until economic growth can start to accelerate, spending is likely to be constrained by bond markets, which are concerned about the long term trajectory of government debt. This is likely to be a challenge for bond investors in the short term, but could become a bigger problem longer term for all risk assets.

Equity performance

Global equity portfolio

The top performer in Q2 was Advantest (+61%), the Japanese manufacturer of semiconductor testing equipment and electronic measuring instruments, whose shares surged on the back of strong financial results and surging demand for AI and high-performance computing (HPC) chips. The company posted a 60.3% increase in revenue to ¥779.7 billion and a 159% rise in net income to ¥161.2 billion, fuelled by a favourable product mix, a weaker yen, and an 80.4% jump in sales from its semiconductor test systems segment as chipmakers accelerated investments in advanced testing solutions. Market sentiment was further boosted by a brokerage target price upgrade, reinforcing investor confidence, even as traders largely shrugged off escalating geopolitical tensions between Israel and Iran.

We were particularly encouraged by Advantest’s strong performance this quarter following our recent decision to add the company to the portfolio as part of our strategy to increase exposure to the AI theme. We believe the company is well-positioned for continued growth into 2026 and beyond, with its market-leading role in semiconductor testing becoming increasingly valuable as chips grow more complex.

Spotify (+31%) continued its strong performance with Q1 2025 results reflecting robust user and subscriber growth, with monthly active users (MAUs) rising 10% year-over-year to 678 million and premium subscribers increasing 12% to 268 million. Revenue climbed 15% year-over-year to €4.2 billion. However, both earnings per share (EPS) and total revenue came in slightly below analyst expectations. Despite the shortfall, CEO Daniel Ek reiterated the platform’s resilience amid economic uncertainty and highlighted strong user engagement and retention as key strengths supporting long-term momentum.

Medical technology company TransMedics (+88%) rose sharply during the period. Held under our Enabling innovation in healthcare theme, TransMedics had a very poor second half of 2024 and there was a large amount of scepticism as to whether the company could reaccelerate revenue growth. In this light, its most recent results were extremely impressive: revenues grew 48% year-over-year and net income more than doubled to $26 million in the quarter.

Among the detractors was Becton Dickinson (-29%). c.$60 billion market capitalisation business in the healthcare sector, listed in the United States. The company’s products enhance medication management, patient safety, infection prevention, surgical procedures, drug delivery, anaesthesiology care, disease diagnosis, and cellular research

Becton Dickinson’s share price fall was confounding to us. Revenues missed consensus by 1.5% in the quarter but better-than-expected operating margins led to a 2% beat to earnings per share. Organic revenue growth for the full year 2025 was lowered from 4-4.5% to 3-3.5%. There are lots of headwinds facing the business at present, from weakness in China, to National Institutes of Health funding cuts in the US, to tariff headwinds, so we think a 1% cut to organic topline growth isn’t too bad in this context. The fall leaves the shares on less than 12x forward earnings, which for the quality and resilience of the business, is far too low in our opinion. A recent investment in the Fund, we are frustrated that we were a few months too early on our entry, but remain confident for the shares to perform well in the coming years from this low base.

Thermo Fisher (-23%) was also among the detractors as the life-science industry continues to be in recovery mode following the post-pandemic issues with inventory, as well as ongoing weakness from China. While many of these issues are beginning to pass, the incremental headwind for its core pharmaceutical and biotechnology customer base from the Most Favoured Nation (MFN) legislation led to a multiple derating over the quarter. Thermo is a high quality business, and we remain confident it can again grow its revenue and earnings, but the market has lost patience with it and the wider Life Science group.

UK equity portfolio

It was encouraging to see such positive performance over what was a highly volatile quarter, during which tariff concerns overshadowed the broader macroeconomic picture in April. The subsequent recovery was driven by robust financial results and optimistic outlook statements from many of our portfolio companies.

We believe the UK domestic economy is poised for greater stability and modest growth. Companies exposed to this environment are well positioned to benefit from any return to more typical economic conditions.

Our portfolio remains focused on high-quality, mid-cap growth companies aligned with our sustainable investment themes. Our analysis indicates that these businesses continue to offer compelling long-term growth prospects, yet they are trading at a meaningful discount to their historical valuations. As such, while we are encouraged by the recent period of strong performance, we believe there is considerable further upside.

The top contributor to performance in Q2 was long-term holding 3i Group (+15%), which saw its shares rise, primarily driven by the continued strong performance of its flagship investment, Action, which delivered 6.9% like-for-like sales growth and opened 111 new stores by late June.

In addition, the private equity company – which invests predominantly in retail, infrastructure, healthcare, technology and industrials – successfully exited its investment in MPM, a premium pet food company, generating a 3.2x return and a 29% internal rate of return – further validating its disciplined investment approach. The combination of high-quality realisations and the consistently strong showing from Action led analysts to upgrade forecasts, reflecting growing market optimism around 3i’s strategy and execution.

Specialist lender Paragon Baking Group (+28%) delivered a stronger-than-expected first-half performance, with new lending up 11% to £1.38 billion. Mortgage advances rose 25% to £812 million, driven primarily by buy-to- let lending and supported by the accelerated rollout of its digital origination system. While redemptions increased, they remain historically low, and customer retention remains strong.

Net interest margin came in at 313bps, just 1bp lower than the second half of 2024 and above the full-year guidance of ~300bps. Although some margin compression is expected in the remainder of the year, it is likely to be more modest than previously anticipated. As a result, full-year margin guidance has been upgraded to “over 300bps.”

AJ Bell (+28%) shares surged following interim results that exceeded expectations. The investment platform operator reported a profit boost, driven by elevated customer activity amid heightened market volatility in March and April.

The volatility – triggered by US tariff announcements and subsequent market swings – spurred trading, benefiting AJ Bell's transaction-driven revenue. The firm now expects full-year revenue and pre-tax profit to exceed earlier guidance.

Ferguson Enterprises (+30%), the provider of sanitation equipment and infrastructure, water infrastructure equipment, raised its full-year guidance after reporting stronger-than-expected sales in its fiscal third quarter.

The company, which is held under our Building better cities theme, now expects low- to mid-single-digit revenue growth, up from its previous low-single-digit forecast. It also increased its adjusted operating margin guidance to 8.5% - 9%, compared to the prior range of 8.3% - 8.8%. Meanwhile, capital expenditure expectations were lowered to $300 - $350 million, down from $325 - $375 million.

Mobico Group (-52%) – a small holding within the portfolio – was among the detractors, as its shares dropped sharply following the announcement of the sale of its US School Bus division to I Squared Capital for £457 million. The disposal, part of the company’s strategic realignment, was poorly received by investors.

Formerly known as National Express, the transport group also warned of a “significant statutory loss” tied to goodwill impairments, the derecognition of deferred tax assets, and additional onerous contract provisions related to its German operations. The combination of asset disposal and fresh loss guidance weighed heavily on market sentiment. We believe there is now a risk that it lacks sufficient capital, and have therefore taken the decision to exit the position.

Fixed income performance

We believe corporate bonds continue to offer attractive value, providing solid compensation relative to their underlying fundamentals. Credit spreads, which had previously widened due to volatility stemming from US tariff policy, have since tightened and now trade close to fair value. As such, further compression appears limited. Despite this, healthy fundamentals across the asset class – especially within the high-quality bonds held in the portfolio – mean that credit still provides a meaningful yield premium over gilts. We continue to identify selective opportunities within the market and are using these to move up in credit quality across the portfolio.

The financials sector was the strongest contributor, driven by our overweight in insurance and effective stock selection. Our allocation to the banking sector contributed positively to performance. We have reduced our exposure to banks and continued to move up the capital structure within financials. We still like the sector but as spreads have compressed close to fair value, the compensation from having a larger allocation to higher beta sectors has declined and therefore so has our position.

Against this backdrop, we believe gilts remain attractively valued, supported by growing evidence of economic softening in the UK. Recent data highlight continued weakness in GDP growth, a loosening labour market, and subdued consumption trends. These developments have reinforced expectations for a more aggressive monetary easing cycle, leading to outperformance in UK government bonds during the quarter – 10-year gilt yields fell 19bps to 4.49%. At the start of the quarter, the Fund held a long duration position versus the benchmark, entirely expressed through UK exposure. Following a rally in 10-year gilts to around 4.40%, we trimmed this position, ending the quarter 0.5-years overweight. Despite this adjustment, we continue to hold a strategic long duration stance, reflecting our expectation of declining yields amid weakening economic data and anticipated rate cuts from the Bank of England. While the near-term focus remains on fiscal policy and debt sustainability ahead of the Autumn budget, which could introduce volatility, our longer-term outlook anticipates more rate cuts than currently priced, justifying our overweight duration position.

Elsewhere, US Treasuries underperformed, with 10-year yields rising 2bps to 4.23% over the quarter. Although core economic indicators remain resilient and inflation concerns have eased, uncertainty around trade policies and the fiscal trajectory – particularly in light of the “One Big Beautiful Bill Act” and the suspended tariff deadline – has reignited concerns around debt sustainability. These opposing forces are contributing to market unease and muted bond performance.

In Europe, yields also declined as inflation trends moderated, allowing the European Central Bank to deliver two consecutive rate cuts. Ten-year Bund yields dropped 13bps to 2.61%, reflecting a more benign economic and inflationary outlook relative to the US and UK. While fiscal policy continues to support growth through elevated defence and infrastructure spending, risks remain – especially given the unresolved trade disputes with the US. Unlike the UK and US, however, inflation in the Eurozone is expected to remain near target, with the ECB likely nearing the end of its easing cycle.

Infrastructure performance

We have made the strategic decision to close the infrastructure asset class across our Managed funds. Currently, our exposure to this asset class stands at just 1%, and we intend to reduce this further.

In the context of a higher interest rate environment, infrastructure assets offer limited relative value. At the same time, we are identifying more compelling opportunities in both government and corporate bonds, where we continue to diversify beyond the UK market.

Given its small size within the overall portfolio and diminishing strategic relevance, infrastructure no longer warrants a dedicated asset class designation.

In the final period before the asset class is closed, and the underlying investments are reallocated back to their respective equity pots, the portfolio performed well. Across the asset class we are seeing bid activity, as higher quality assets trade at sizable discounts to their NAV.

The standout performer was Downing Renewables. It reached an agreement to sell its assets in full to Bagnell energy, at a 23% premium to the closing price on June 19th. The stock was up more than 30% on the quarter on the back of this newsflow. This follows Atrato Energy in the first quarter, where large shareholder bought the assets at a significant premium to the share price.

M&A activity within the infrastructure sector has supported a recovery in these assets, which has been pleasing as we recycle the capital back into the equity portfolios.

Asset allocation changes

Developed market (DM) credit spreads have tightened, surpassing pre-'Liberation Day' levels. As such, this feels a sensible time to reduce exposure here in funds which have retained a modest overweight. While we see no major issues in sterling or euro credit, the relative upside appears limited versus other asset classes – prompting a shift to a neutral stance.

We remain cautious about the fiscal outlook in DM economies, especially regarding long-duration bonds. We have reduced our allocation to government bonds, and within this skewed our holdings towards the shorter duration gilts we hold, to reduce exposure to the long end. In the UK, we’re comfortable with our duration overweight based on economic trends and interest rate expectations, but remain mindful of fiscal risks, particularly given developments in Germany and the US.

We are more positive on equity markets over the second half of 2025. While growth remains somewhat subdued, the risk of an economic shock from a policy error from the Trump administration on tariffs is now minimal. We see earnings support from falling costs and operating leverage, and feel equities are the most attractive asset class.

Proceeds from reducing cash, government bonds, and credit overweights will be reallocated to global and UK equities.

Trade activity

Over the quarter, we added Ingersoll Rand under our Improving the resource efficiency of industrial and agricultural processes theme. The company sells energy-efficient industrial equipment that are crucial for a wide range of end markets. Compressors are ubiquitous to manufacturing, and uptime of equipment is crucial for efficient industrial processes. Compressors also account for 10% or more of electricity expense in the manufacturing sector, with the opportunity to reduce over 40% of that by identifying inefficiencies in equipment and wider air systems.

With regards to exits, TechnoPro has been a lower-conviction holding over the past 12 months, following an underwhelming meeting with management in Tokyo last June. The core business has faced challenges retaining staff at the margins, as wage increases among Japan’s blue-chip companies have begun luring employees back. Additionally, its acquisition of Robosoft, a fully outsourced IT consulting firm in India, has underperformed amid a broader slowdown in demand for IT consulting services.

We remained patient in identifying an appropriate exit point, and shares surged by 20% last month on rumours that the management team may take the business private. This provided an opportunity to exit the position closer to our long-term valuation target.

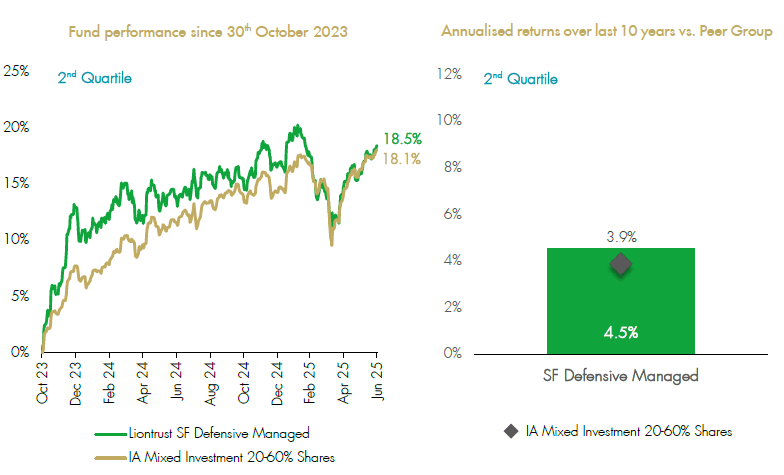

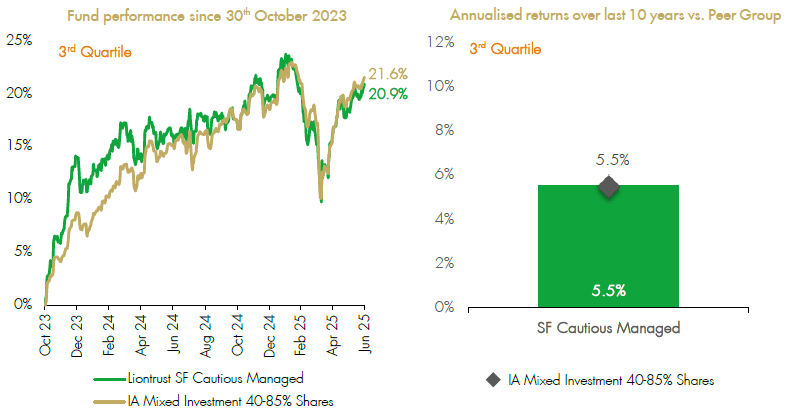

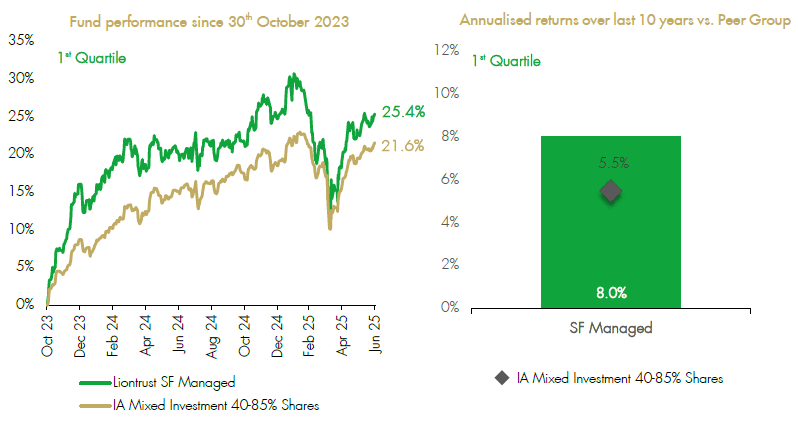

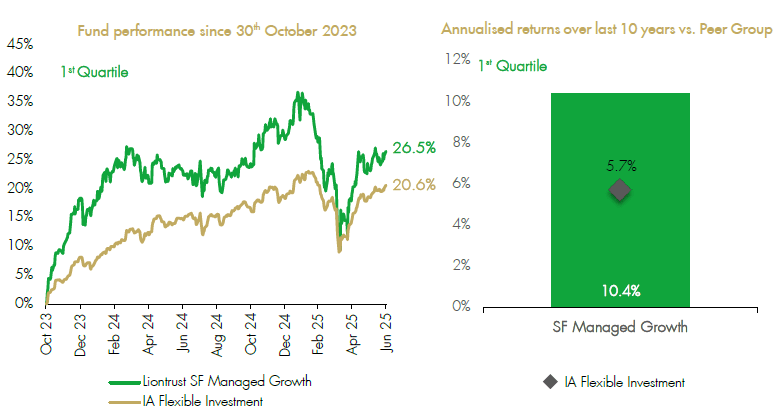

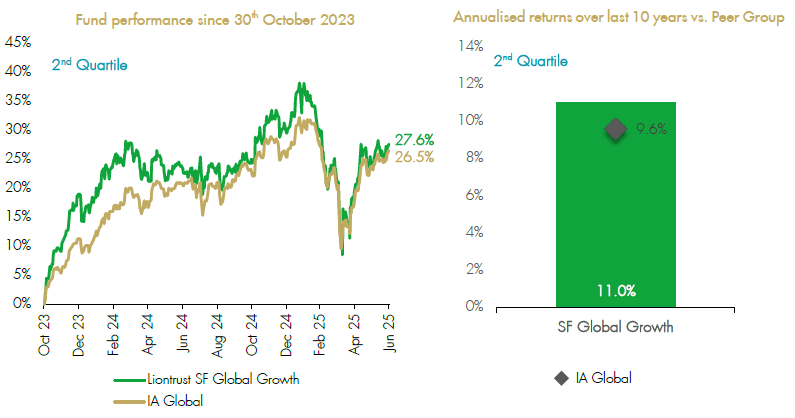

Performance from the market low – 30th October 2023

Since the market low on 30th October 2023, the Funds have delivered positive performance within their respective IA sectors. We are encouraged by this momentum and remain focused on building upon these gains in the coming periods.

Liontrust Sustainable Future Defensive Managed Fund

Source: FE Analytics as at 30.06.25. Liontrust SF Defensive Managed Fund versus a comparator benchmark, IA Mixed Investment 20-60% Shares, primary share class, total return (net of fee s, interest/income reinvested)

Liontrust Sustainable Future Cautious Managed Fund

Source: FE Analytics as at 30.06.25. Liontrust SF Cautious Managed Fund versus a comparator benchmark, IA Mixed Investment 40-85% Shares, primary share class, total return (net of fees, interest/income reinvested). Figures subject to rounding

Liontrust Sustainable Future Managed Fund

Source: FE Analytics as at 30.06.25. Liontrust SF Managed Fund versus a comparator benchmark, IA Mixed Investment 40-85% Shares, primary share class, total return (net of fees, interest/income reinvested). Figures subject to rounding

Liontrust Sustainable Future Managed Growth Fund

Source: FE Analytics as at 30.06.25. Liontrust SF Managed Growth Fund versus a comparator benchmark, IA Flexible Investment, primary share class, total return (net of fees, interest/income reinvested). Figures subject to rounding

Liontrust Sustainable Future Global Growth Fund

Source: FE Analytics as at 30.06.25. Liontrust SF Global Growth Fund versus comparator benchmark IA Global, primary share class, total return (net of fees, interest/income reinvested). Figures subject to rounding

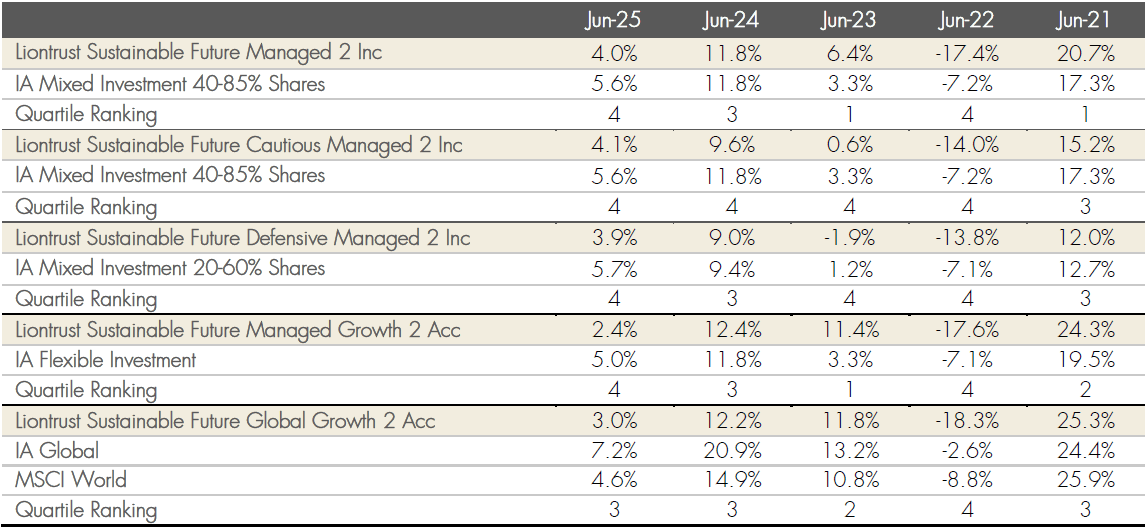

Discrete years' performance (%) to previous quarter-end:

Source: FE Analytics, as at 30.06.25, primary share class, total return, net of fees and income & interest reinvested.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Sustainable Investment team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Investment team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.