Climate change remains a hugely emotive topic around the world, with awareness and activism both surging in recent months – and today marks the start of the first London Climate Action Week.

But while many might be aware of the Paris Agreement to limit global average temperatures and the UK’s very welcome recent pledge to be carbon neutral by 2050, it remains to be seen how far these laudable goals are understood in practical terms.

Getting to zero emissions requires halving current global emissions by 2030, halving again by 2040 and then halving/offsetting the rest by 2050. The faster we do this, the better the outcome. To be clear, current regulatory demands would produce nowhere near that kind of reduction and we therefore predict much tighter global regulation to reduce emissions in the years ahead. This is likely to create opportunities for companies on the right side of this energy transition and we will be covering some of these in an article later this week.

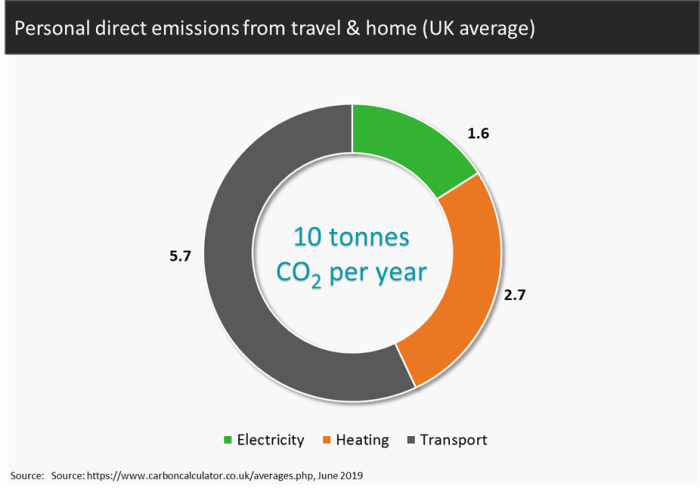

To try to make sense of this, we have looked to see what this net zero emissions target means for the average person in the UK, who directly emits 10 tonnes of carbon dioxide a year. Broken down, approximately 5.7 tonnes of this is from transport, 2.7 tonnes from heating with natural gas and a further 1.6 tonnes come from the electricity used in the home.

If people are so minded, there are a few simple steps to reduce these figures almost immediately.

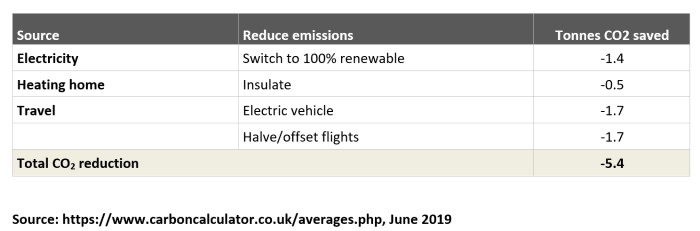

Taking electricity first, moving to a 100% renewable provider (of which there are a growing number in the UK) can be done instantaneously and, for the most part, for the same price as existing tariffs. This ensures all the electricity you need is supplied to the grid via renewable sources and moving to such a provider reduces the annual emission by 1.4 tonnes.

On the heating side, ensuring your home is properly insulated can cut another 0.5 tonnes off that annual emission level – and while this work will mean an initial outlay of a few hundred pounds, the saving on future heating bills should more than offset that in fairly short order.

Coming finally to the transport question, electric vehicles (EVs) will become significantly cheaper as all the main car manufacturers are set to bring more affordable EVs to market in the next two years. The charging infrastructure is also being expanded at pace. As these two major barriers to adoption are reduced, we believe EVs will take a meaningful share of the car market.

Moving to an EV shaves a further 1.7 tonnes off the annual level, and again, while there is a cost question at the purchase stage, there are considerable ongoing savings versus running a petrol or diesel car.

According to data from British Gas, for a small family hatchback over 10,000 miles the average price per mile is 4.1 pence for an EV versus 18p for a petrol car, while a large diesel vehicle is considerably more expensive. Figures do vary according to car model and various other factors (including charging at home versus a public point).

A final measure is cutting down airline flights where possible and, as a last resort, offsetting the impact where you have to travel, which can take another 1.7 tonnes off the total. There are two main types of offsetting projects: investing in renewable energy projects or for the more horticulturally minded out there, either stopping existing trees being cut down or planting new ones.

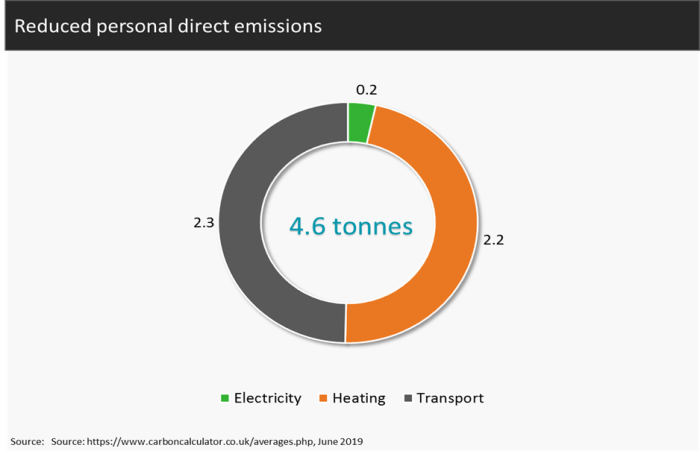

If we take all these measures together, it is remarkably easy to more than halve the average person’s direct carbon emissions in the UK. In this example, it removes a total of 5.4 tonnes off the average annual emission of 10 – and with the possible exception of changing cars, these are all steps that can be taken in a few days, without excessive cost and with very little discernible impact on our daily lives.

Overall then, the challenge to reduce emissions is huge and broadly misunderstood and underestimated. It will affect many parts of our economy, not just energy generation but also transport and how we heat and cool buildings as well as industry. But this lower carbon future can be a positive one and is a massive opportunity to rethink and better manage resources as well as consider how we can help people who need decent work to get behind the products and services enabling the transition. It could easily be much better than what we have now.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.