Year two for the Liontrust GF International Equity Fund may not have had the same performance potency as year one, in large part due to the impact of the regulatory crackdown in China. Nevertheless, it was another exceptional year for capitalising on short-term shifts in sentiment and general market anxiety, where we were able to double down on some existing positions and add new ones to enhance the long-term potential for investors in the Fund.

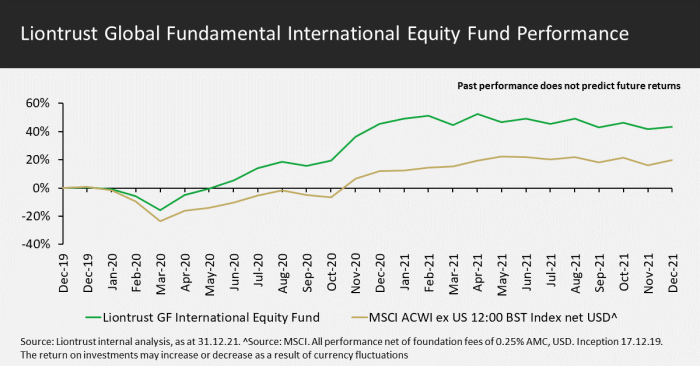

My long investment horizon of five or more years means that periods of change and uncertainty can be the best times to take advantage of short-term anomalies. Uncertainty associated with the economic reopening, shortages and bottlenecks, the monetary policy response to the spike in inflation and, indeed, China enabled us to pursue opportunities across a range of themes and geographies. The Fund returned -1.4%, Class F USD, compared to 7.2% for the MSCI ACWI ex US 12:00 BST Index Net USD, during the year. Since its inception, the Fund has returned 43.4% net of fees, compared to 20.0% for the benchmark, and an annual return of 18.1% p.a. compared to the benchmark return of 8.3% p.a. See the end of the note for GBP performance figures.

In the midpoint of the year, we decided to strengthen the management structure of the Fund and appointed Tom Hosking as co-manager. Tom has worked closely with me since he joined Majedie in 2014 as an analyst in the Global team and brings his analytical rigour, growth mindset and detailed approach to valuation to the management of the Fund.

Figure 1: International Equity Fund Performance

China regulation hurt performance, but opportunities remain for patient investors

The impact of China’s regulatory crackdown on tech giants and the private education industry was the main thorn in the side of Fund performance this year. Well-publicised problems at Evergrande, China’s largest property group, were a clear symptom of wider government intervention in a number of sectors aimed at promoting common prosperity rather than the historic model of some get rich first, the rest later. This concept included the introduction of a range of measures designed to decrease costs in areas like health and education, which impacted the holding in New Oriental Education, where the majority of its business in profit-seeking after-school education was banned. Although I had felt the creation of a new regulator for the sector meant a worst-case scenario would be avoided, the government intervention was harsher than expected and I sold the shares. Similarly, Alibaba, Tencent and Meituan were weak on regulatory concerns over the end of exclusivity in some of their business lines, which dragged down the value of holdings in Softbank and Prosus. As a team, we still regard these companies highly – they are genuinely innovative and now, given their growth prospects, we believe are very cheap. We have retained these positions believing they continue to offer extraordinary potential for patient, thoughtful capital.

At this point, it is worth reflecting more on why we haven’t rushed for the exit in a way that some other investors have. First, we think that the shape of Chinese economic growth is likely to continue to evolve, and the role of technology will expand from fulfilling consumers’ needs to enabling industrial and business efficiency. Second, investing in China comes with episodes of unique regulatory and economic risk, which we believe investors must consider against the potential level of excess return on offer. Indeed, Chinese technology has been one of the greatest stock market success stories of our time. Moreover, the companies we invest in have strong, self-reinforcing competitive advantages. Importantly, they have a sense of what Xi and the Chinese government wants, and have the resources and willingness to deliver on that.

I believe that we are well through the worst of the regulatory cycle and that the Fund’s investments in China are well-positioned to outperform against a backdrop of relatively modest expectations over the coming years. In one of our Team Macro Chats we noted that the regulatory impetus that is underway has many similarities to the sorts of social and economic reforms the West would like to accomplish – clear examples include healthcare reforms (Obamacare) and the constant battles between social media and US Congress. China’s government is using its broad power to decrease inequality, improve social security, and lower costs for education, healthcare and housing in a way that might not be palatable in Western societies and has added to the nervousness from overseas investors. We believe that in the long run these changes should make for a more resilient environment for companies to operate in and believe we have passed the regulatory nadir. Certainly, comments from the China Securities Regulatory Commission (CSRC) suggest that what happened in after school tuition should be seen as a one-off not a new modus operandi. We are watching events closely for potential opportunities for the Fund.

Idiosyncratic winners show breadth of portfolio

One of our aims when constructing the portfolio is to invest in a range of idiosyncratic opportunities that offer long-term asymmetric returns. This is another way of saying holdings that have the potential to deliver significant upside in relation to downside risk. We have deliberately positioned the portfolio to ensure it is not too reliant on one theme or geography for returns, and where it has a concentration of exposures that they are deliberate and proportionate. It also implies that many holdings will have some form of thematic structural tailwind.

It is therefore pleasing to see the breadth of positions on the leader board in terms of positive performance. Zooplus, the leading European online retailer of pet food and supplies, had a particularly strong year due to competing bids from private equity firms attracted to the long-term value potential of this business. We took up their final cash offer as part of this bidding process and sold out of the Fund’s position in November. Elsewhere, the designer of silicon chips for graphics, AI and blockchain NVIDIA and diabetes and biotech companies Novo Nordisk and Sartorius Stedim performed strongly. Swiss dental equipment specialist Straumann was a notably strong contributor. This business has an excellent long-term growth profile supported by trends in aesthetic dentistry (a boost in implants and aligners, for example). We added the stock to the Fund in January 2021 believing it also offered exposure to the Covid recovery, as dental practices reopened. The shares have since doubled in value and we have subsequently halved the position size to reflect the changed risk-reward profile, while retaining exposure to the longer-term structural growth story.

Some of the more value orientated names also performed strongly, including container shipping and logistics operator Maersk which is a leader in an industry that has changed dramatically. Maersk is showing signs that it is now driven by profits rather than market share after a considerable bout of consolidation. I have been reducing this position, as the shares have tripled from a level where the market cap was similar to the expected operating cash flow from the business this year. Anglo American, another value-oriented name, also performed well. This is an innovative mining company which is focusing its portfolio of assets on a handful of attractive areas, lowering costs and improving best practice at its different operations, and looking at how it can extract value across the whole chain for its commodities rather than being a commoditised miner. This is starting to gain market recognition, yet, in our opinion, the shares remain cheap on a single digit price to earnings ratio.

Opportunity to deploy patient capital

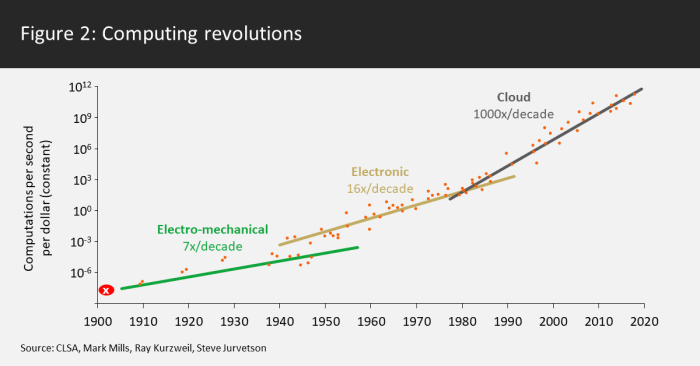

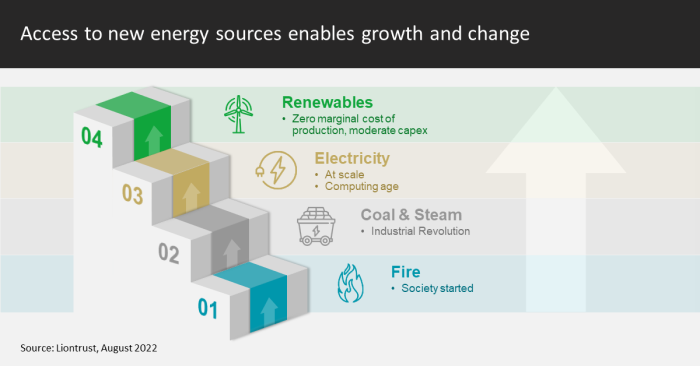

Our long-term approach requires a deep understanding of the businesses in which we invest and the role they play as vanguards of innovation and change, whether that be in biotechnology and healthcare or in the revolutions that are occurring in computing and energy [Figures 2 and 3]. We combine this with broader macro analysis of major social, economic, political and technological trends. This mosaic of information informs our assessment of the potential risk and reward on offer for each potential holdings, and enables us to invest early in exciting innovators and to take contrarian positions against the tide of short-term sentiment.

New holdings this year included innovative Singaporean consumer internet company Sea ltd, which has an exciting platform that integrates e-commerce, fintech and gaming, through its subsidiary operations Shopee, SeaMoney and Garena, respectively. The growth prospects of its fintech and e-commerce operations across the Asia Pacific region, which are funded by its successful Garena gaming business, have great potential to drive long-term returns for investors, in our view.

In the UK, we participated in the IPO of Oxford Nanopore, which is one of the few companies to offer effective next generation DNA and RNA sequencing. The recent increase in accuracy of its technology and breadth of potential applications give it the skew of potential returns to the upside that we look for in all our holdings. Over the coming years we should see validation of its technology by the scientific community and are already seeing some large-scale projects signed, such as population sequencing in the UAE. We also invested in Fever-Tree, the premium drinks and mixers business, which is expanding globally and has significant potential to replicate its UK success in the US and Europe. Its margins are currently depressed and offer us an attractive entry point.

NVIDIA, which we added to the Fund in March following a year of fundamental improvement without gains in its share price, is a company the wider Global team have analysed for a number of years. It designs graphics processor silicon chips and enables a range of applications with exciting long-term potential. It sets the industry standard for AI and machine learning technology, and its easy-to-use Cuda software has created a high barrier to entry here. It also provides essential technology for the auto industry and is expanding rapidly in datacentre processing. NVIDIA is a dominant player in the consolidation of the chip designer realm, and is well-placed to retain a leading position as designs become more complicated, take longer to design and cost more.

The Fund’s addition to its position in Ambu is an instructive example of our long-term, patient and, at times, contrarian approach. Established over 80 years ago, Ambu is a Danish medical devices company with a long track record for innovation. In the 1950s, it created the first self-inflating resuscitator, aptly called the Ambu bag, and has a long track record as a leading provider of technology in the areas of anaesthesia (including the Ambu bag) and patient monitoring and diagnostics. In recent years it has harnessed its R&D talent to develop disposable endoscopes, which are used across urology, gastroenterology, pulmonology and otorhinolaryngology (e.g. ears and throat). In doing so, it has disrupted the reusable endoscope market, and has cemented its position as a leader in this field, selling more scopes than its competition combined. We bought more shares in the business in March and June and have seen the stock price languish with the market taking a negative short-term view on a slowdown in the growth rate of its legacy business due to Covid-related delays to elective procedures. This was despite accelerated sales figures for its endoscopes. In our experience, growth is rarely linear, which is why we take great care to fully understand the businesses in which we invest, so we have a clear understanding of short-term risks and the drivers of longer-term returns. In the case of Ambu, the relative decline in Covid hospitalisations, which has been feature of the Omicron variant, should lead the market to better appraise the growth trajectory of this innovative business.

Within the biotechnology space, we also bought a new holding in Wuxi Biologics. The company has demonstrated a particular skill in researching, developing and producing new drug candidates for pharmaceutical and biotech companies. Its strategy of helping to design drugs, using its own pool of scientists and then following that drug through clinical trials to production should ensure many years of growth as revenues grow with the drug’s progress. The pooling of their customers’ R&D within Wuxi gives it the potential to develop its IP and scale rapidly.

Another exciting new addition to the portfolio was fuel cell manufacturer Doosan Fuel Cell. Its stationary hydrogen fuel cell business has tremendous support in South Korea. Nowhere in the world can you find as much regulatory support for hydrogen infrastructure as you can in South Korea. This is particularly important for an industry as nascent as that of stationary fuel cells. The short term is very uncertain for this business but we believe that its immaturity, technology and knowhow gives it the skew of long-term potential returns that we look for.

Overall portfolio turnover remained low at under 15% during the year, implying an average holding period of over six years.

Figure 2: Computing Revolutions

Figure 3: Energy Revolutions

The road ahead

Before concluding, it is worth touching on the impact of a small handful of US mega-cap stocks on the returns of both US and broader Global indices, namely Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla and NVIDIA. These seven stocks account for roughly 26% of the MSCI US Index by combined weight and over 17% of the MSCI World index. As a group, they have had an outsized impact on the performance of both indices, which have returned 27% and 22% reflectively, compared to an MSCI ACWI ex-US index return of 2.7%. Each has its own fundamental strengths and weakness (as mentioned earlier, NVIDIA as well as Amazon are held in the portfolio, for example). However, we are mindful that periods when markets have been led by a narrow group of stocks do not persist indefinitely, with regime change happening for many reasons, including capitalism’s propensity for innovation and creative destruction. No one can predict how the current regime will end. However, a truism of a narrow market is that other high-calibre idiosyncratic opportunities and investment themes are often neglected. We are pursuing many of these for investors in the International Equity Fund in markets and sectors with highly differentiated return profiles to that on offer from US and mainstream global indices.

In summary, two years ago in 2020, the impact of the macro environment on stock markets was extreme and I had positioned the Fund (at the margin) to benefit from those extremes, while remaining focused on my core long-term approach. Over the last 12 months, I have been deliberately populating the portfolio with individual stock opportunity and risk. The Fund’s positioning can be summed up as balanced and broad. It has exposure to a wide range of structural growth drivers, with an element of cyclical recovery, and is exposed to opportunity in both developed and emerging markets. For each holding the team’s fundamental analysis gives confidence that the skew of long-term potential returns is to the upside.

*The Fund returned -0.1%, Class F GBP, compared to 8.6% for the MSCI ACWI ex US 12:00 BST Index Net GBP, during the year. Since its inception, the Fund has returned 40.5% in GBP, net of fees, compared to 17.6% GBP for the benchmark, and an annual return of 19.3% p.a. GBP compared to the benchmark return of 9.4% p.a. GBP.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

Investment in funds managed by the Global Fundamental Team may involve investment in smaller companies. These stocks may be less liquid and the price swings greater than those in, for example, larger companies. Some of the funds may hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio. Investment in the funds may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates.

Some of the funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances. It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of securities are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).