Banks have a key role to play in the shift towards a low-carbon economy, with their lending policies, influence with corporates and scope to provide sustainable financing all vital to reducing greenhouse gas (GHG) emissions.

From our analysis, it is clear different regions and countries are moving at radically different rates, however. Specifically, the majority of EU and UK banks are embracing scientific-based approaches that are broadly consistent with the Paris Agreement, whereas countries such as the US and China are not there yet. UK/EU banks are running ahead of regulators in actively seeking to address climate risk, with most committed to mitigating their own risks resulting from climate change and future tightening of capital requirements.

As we have written over recent months, many people were disappointed with an apparent lack of progress from Glasgow’s COP26 event last year but we continue to believe more stringent regulations to reduce GHG emissions are inevitable and the world will see huge disruption as the energy transition develops. Across our Sustainable Future bond portfolios, we aim to invest in banks that are targeting net-zero by 2050 or before (including indirect Scope 3 emissions) and most are looking to achieve this through a combination of the following factors.

Reducing lending to high-carbon sectors

As part of our analysis of banks, we are looking to assess the standard of policies that control lending to controversial sectors; consistent with our screening criteria, we will not invest in those where lending to these areas exceeds 5% of the total. This can involve targets to exit financing to coal-fired power stations and thermal coal mining, for example, with dates typically dependent on where a business is based. For those in developed regions (EU/OECD), most banks are aiming to stop this lending by 2030, whereas the end point is more like 2040 (due to humanitarian concerns) in the developing world. Examples of banks employing such measures include HSBC, Credit Agricole and ING, and this exit program appears to be consistent with the Paris target (to keep average temperature rises to 2 degrees, and ideally 1.5) and the Paris Agreement Capital Transition Assessment (PACTA), a 2 degree Investing Initiative.

Similarly, we also look for Paris alignment for banks’ lending to oil & gas companies. As standard, we want banks to be signed up to PACTA (or equivalent) and have set targets and displayed commitment to reporting on progress towards this, with names such as BNP, ING, Barclays leading the way. As a further factor, we look for banks to be signed up to relevant sustainability initiatives, such as TCFD, Responsible Banking and EU Taxonomy.

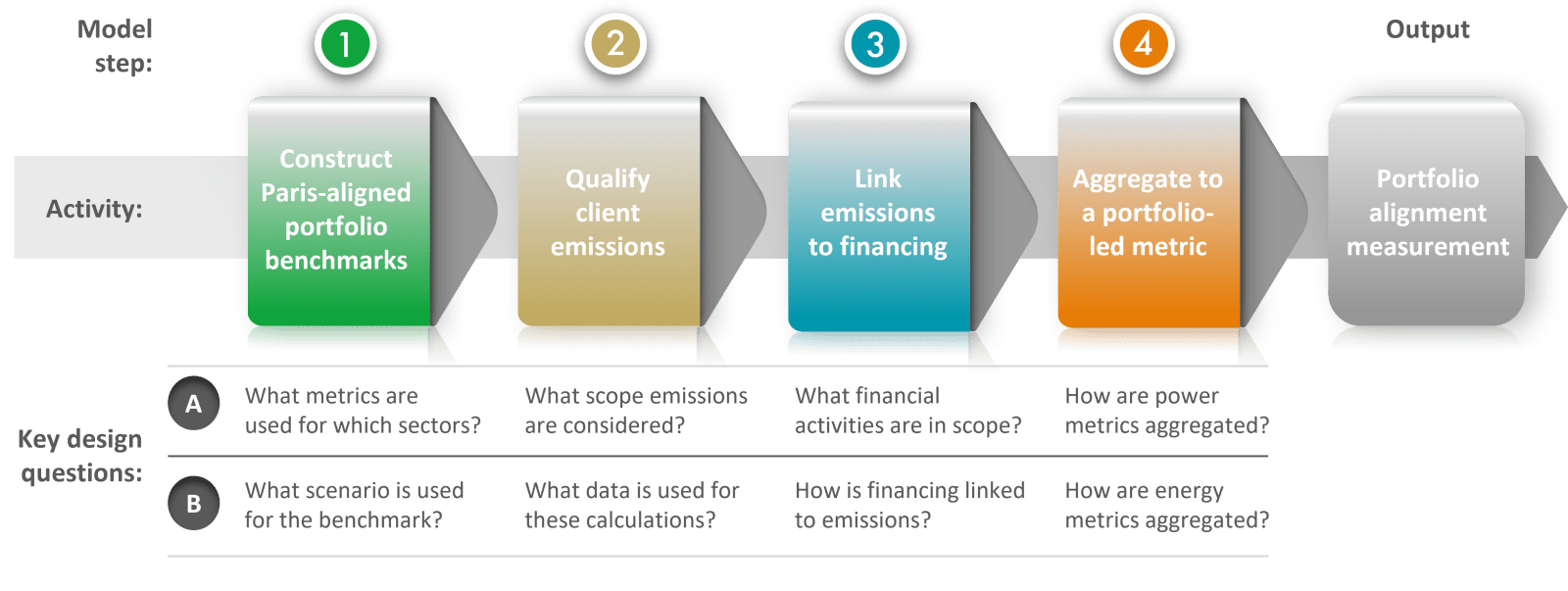

Overall, banks are generally committed to delivering on net zero by 2050 and some have gone beyond PACTA by adopting in-house methodologies to include sectors currently outside its scope, such as Barclays’ BlueTrack for example, which we show below.

Barclays BlueTrack system

Provision of green/sustainable finance

On top of avoiding controversial sectors, many banks are also setting out detailed targets to provide lending to sustainable and green companies and projects. HSBC is a strong example here: having met its initial target of $100 billion between 2017-2020, it is now aiming to provide aggregated lending of between $750 billion and $1 trillion to support decarbonisation of corporate clients by 2030. This equates to between 25%-30% of its total loan book.

While not in the same league, Barclays has a target of £100 billion of green financing by 2030 and is also committed to alignment with Paris across its entire business, including investment banking operations. ING, meanwhile, has lent a total of €188 billion to companies linked to the Sustainable Development Goals and has an ongoing target of further lending of €10 billion or more per annum.

Working with corporates to reduce their emissions

As a further measure, banks including NatWest and Lloyds are seeking to cut the emissions within their corporate loan book by at least 50% by 2030. There is limited low-hanging fruit here, as exposure to high-carbon sectors is already small, so these banks are working with corporate clients to identify areas where they can reduce emissions. Key measures are elements such as specialist account managers and web-based offerings to model the cost/benefits of a smaller carbon footprint, and, ultimately, discounted loans. This is particularly interesting as it ensures the transition is taking place across a broad range of sectors, including SMEs and micro-cap companies.

As a minimum, we look for banks that fully incorporate ESG into the decision to lend and for these considerations to be represented at a high level within the management structure.

Improving the energy efficiency of their mortgage book

While still at an early stage in the UK and Europe, we are starting to see this become more of a focus, with several banks setting targets to improve the average energy average rating of their mortgage book. Best in class at present appears to be Rabobank, whose current mortgage book has an average energy rating of C, with a stated target to improve this to B by 2024 and A by 2030. The company is seeking to do this through a combination of focusing on new lending to highly efficient homes and working with existing customers to implement energy efficiency improvements. Like the Lloyds example above, they are offering assistance, cost/benefit analysis and discounted loans to encourage necessary changes.

Green mortgages are still early in their development but starting to gain traction; over time, we expect the banking industry to come together to share ideas and experiences in a way that will accelerate improvements in the green mortgage market.

Ensuring ESG is incorporated across divisions

Several banks in which we invest also have asset management, wealth management and insurance operations; given these subsidiaries are key providers of capital to the economy, we also analyse the level to which ESG is incorporated within these divisions. Lloyds Scottish Widows, for example, has introduced formal exclusionary criteria, resulting in significant divestments from its investment portfolio. Moreover, the company has set targets for other sectors/companies that, if not achieved, will result in further divestments.

Banking remains among our favoured parts of the credit market, alongside telecoms and insurers, and was the largest sector position across the Liontrust SF Corporate Bond and Monthly Income Bond Funds at the end of 2021, accounting for 18.1% and 25.3% respectively. We continue to see value in banks, particularly as spreads widened in Q4, and used that opportunity to add risk within the sector.

From an environmental, social and governance (ESG) perspective, our analysis of individual banks for the funds has traditionally focused on the third element but as these businesses play an increasingly pivotal role in facilitating the energy transition, environmental analysis is becoming essential. MSCI, for example, has now upgraded many of the banks that previously scored relatively poorly from an ESG standpoint from BBB/A to AA, which reflects the company changing its methodology on the sector to focus on climate related issues. They are catching up on our rationale for why we rated a number of banks significantly above MSCI in 2019 & 2020, including Lloyds, NatWest and HSBC, and as these businesses help to change the energy landscape, this part of their profile will continue to grow.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.