Ongoing innovation and a transition to a greener economy are integral to a more sustainable future, and a healthy pipeline of small and medium-sized enterprises (SMEs) remains an important driver of both.

We see enabling SMEs as both a vital structural growth trend and an anchor of a sustainable economy, with these companies making up 99% of all US businesses and accounting for 44% of the country’s GDP and two-thirds of net job creation (according to US Small Business Administration).

Defining an SME is jurisdiction dependent; they are considered to have a maximum of 500 employees in the US but fewer than 250 in the European Union. Whatever the definition, however, the basis of our investment theme lies in identifying companies offering products and services that give these businesses the best chance to succeed and grow. Even many high-growth companies start from sole proprietorship and, historically, there have been major barriers to developing a business idea, with SMEs needing capital, talent and knowledge to achieve scale against entrenched incumbents.

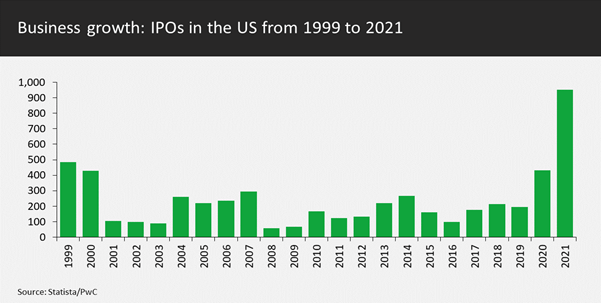

Highlighting the recent spate of business growth in the US, 2021 had the highest number of IPOs in 20 years and the figure was more than twice that seen in 2020, which had already doubled 2019’s tally.

Recent work by the OECD highlights the benefits of strong SMEs in an economy: to quote, ‘new and small firms are often the driving force behind the sort of radical innovations that are important for economic growth, since they can work outside of dominant paradigms, exploit technological or commercial opportunities that have been neglected by more established companies, or enable the commercialisation of knowledge that would otherwise remain uncommercialised in universities and research organisations’. Their strength lies in greater agility to pivot quickly towards new technology or take advantage of gaps where larger businesses cannot.

Enabling SMEs also improves the overall resilience and diversification of an economy, which is particularly important for resource-rich countries with heavy dependence on commodities, and we see these businesses contributing to the following four Sustainable Development Goals:

- Promoting inclusive and sustainable economic growth

- Providing employment and decent work for all

- Promoting sustainable industrialisation and fostering innovation

- Reducing income inequalities

Opportunities for SME enablers

Some of the traditional barriers faced by smaller businesses have disappeared over recent years with developing technology and the rise of the internet, but more focused support is needed to remove remaining hurdles. Further digitalisation and technological innovation, for example, should allow more dynamic businesses to achieve scale without mass and at lower cost. An example is using an online e-commerce marketplace, which lowers barriers to entry. SMEs will also gain from digital access to skills and talent, through better HR recruitment and knowledge sharing.

Where are we finding these SME enablers across the market? While the environment for these businesses has improved, there remain issues in areas such as high costs of tax compliance, lack of access to credit finance and training opportunities, and barriers to digitalisation. On the latter, the divide between incumbents and SMEs tends to be narrow in web presence or connectivity, but substantially larger in more niche and potentially business-enhancing areas such as cloud computing, big data or enterprise resource planning software.

Cloud computing is a good example of where innovation could potentially have large benefits for SMEs but the knowledge and costs involved are prohibitive. This tech allows delivery and use of computing infrastructure – servers, storage, databases and analytics – over the internet rather than relying on costly physical infrastructure. Access to such technology can eliminate costs of maintaining expensive hardware or software and allow SMEs to take advantage of big data without significant investment in technology or manpower. There are also major energy/carbon emission savings inherent in moving to a cloud offering.

Another area is tax compliance, which is region dependent and has a high fixed cost component. Again, lack of knowledge and resources in this area can heavily impact small firms and companies able to provide support are vital. In our funds, we own US firm Intuit, for example, which helps the self-employed and small businesses by providing financial management, compliance products and tax products.

Several holdings in our funds offer different areas of expertise to SMEs, including UK business Softcat and Learning Technologies Group (LGT). Softcat is the UK’s leading value added reseller of IT software and equipment, serving the fragmented SME market, while LTG, held under our Providing education theme, offers a collection of e-learning, compliance, training and Human Resources software and content brands.

Case study: Distribution Finance Capital (DF Capital)

On the financing side, we highlight Distribution Finance Capital or DF Capital. This is a business we know well, having invested in its parent company TruFin when it spun out of a hedge fund called Arrowgrass in early 2018. DF Capital provides short-term financing for SMEs across the UK and is exposed to our Increasing financial resilience theme. The problem the company is solving is a simple one: for big-ticket items such as motorhomes, caravans, motorsports, lodges and holiday homes, marine, transport, industrial equipment, and agricultural equipment, people often want to see and touch the items before buying.

This presents an issue for dealerships, which are required to stock a wide range of inventory to make a sale. DF Capital lends dealerships the money to pay the manufacturers so they can stock these items at their forecourt. Once the product is sold, the dealer pays back DF Capital. Most of its business comes through links to the Original Equipment Manufacturers (OEMs), which want dealerships to stock their products. It is an efficient model as once a dealer uses DF Capital to finance products from one manufacturer, they are likely to use them again to finance inventory from others.

Lending to small dealerships in the leisure and agricultural industry across the UK may sound high risk but there are safeguards in place. The first is that DF Capital does not finance the entire purchase; it will typically lend up to 85% of the wholesale value and the dealer needs to put down the remaining 15%. The second is that when it comes to the retail price, there is typically a 15-20% markup, which means DF Capital is really lending at a loan-to-value of more like 70%. If a dealer fails to pay DF Capital back, the company takes ownership of the asset, at which point it has two options: either send the product to auction, where it might theoretically take a 30% loss on the retail price, or the manufacturer itself may buy it back at the wholesale price – few want their brand damaged by a fire sale as a result of a dealer going bankrupt.

Looking to the future, enabling SMEs to overcome these hurdles should allow them to grow and provide innovative opportunities in the transition to greener goods and services. A 2013 study by the Carbon Trust, for example, shows that in the UK, SMEs already represented over 90% of clean technology businesses and, according to the OECD, small ‘green entrepreneurs’ can drive transformation by developing new business models and pioneering green practices that influence mass markets and are eventually adopted by the wider community.

With a thriving SME space so integral to general economic health and a more sustainable future, we believe companies helping to create this growth should continue to thrive and offer a range of investment opportunities for our portfolios.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future Equities team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.