The path of economic and stockmarket recovery following the initial outbreak of Covid-19 has been eventful and unpredictable, and has provided good conditions for the Liontrust European Strategic Equity Fund's long/short strategy.

From the contrarian value long-book opportunity that opened up in the immediate aftermath of lockdown measures through to the over-aggressive corporate spending that is now providing good returns to our shorts, it has been a very rewarding period for the strategy.

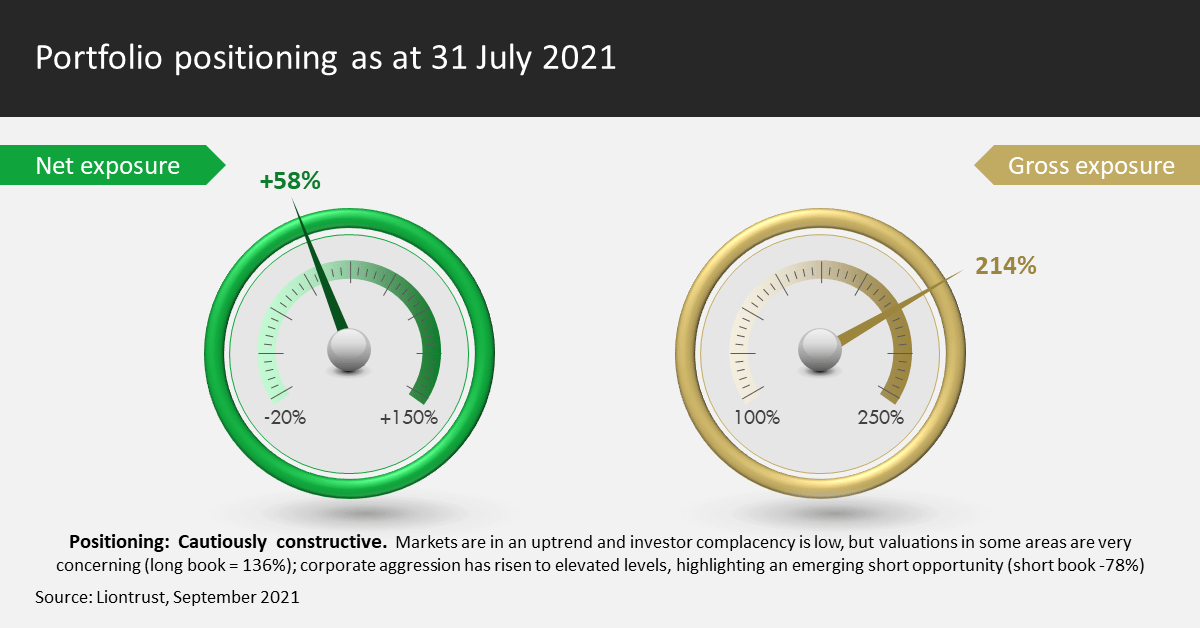

This compelling set of circumstances culminated in us pushing the Fund’s gross exposure out to its highest level on record in the second half of last year, at over 200%. We were observing unprecedented levels of valuation dislocation in the market, meaning that there were lots of cheap companies we could invest in and lots of over-valued companies we could take short positions in.

The most significant development for our net and gross market exposure in 2021 occurred in the late summer when we observed a concerning climb in our measure of corporate aggression.

We use our corporate aggression signal as a means to gauge both the outlook for the overall market and the attractiveness of shorts. The clear message in the second half of 2021 was that the market outlook threatened to become more volatile and at the same time we could expect a good return from our short book. For this reason, we increased our short book significantly in the second half of the year, reducing our net exposure to the market materially.

The extent of the value dislocations in the market during 2021 and the climb in our measure of corporate aggression meant that we were confident about the prospects for the long/short strategy, and these expectations have since been handsomely met: the Fund has returned 25.5% in euro terms in the last 12 months, compared to the MSCI Europe Index’s 1.5% rise (source: Financial Express, as at 16.05.22, total return, A4 class, income reinvested and net of fees. Past performance does not predict future returns).

Despite a modest rise in the European market over this period, the majority of the Fund’s return has come from its short book. This is a pleasing development as it has been a good illustration how our measure of corporate aggression can help us optimise our short exposure. There were pockets of the market where aggressive corporate investment was particularly high and share valuations still exorbitant; some of these pockets have since collapsed, generating very good returns for the Fund’s short positions.

Long book prospects now look more modest

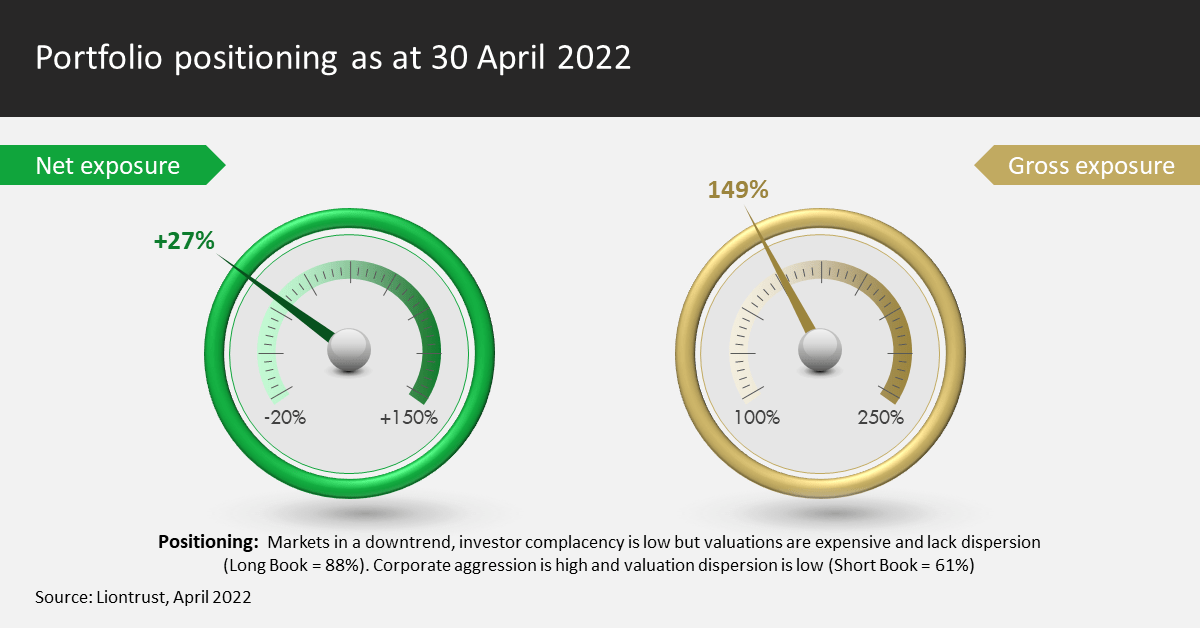

Assessing the market now, we are less ambivalent regarding its overall valuation and direction; this is because stocks are now more uniformly expensive, while the technical picture has also deteriorated.

The European stockmarket is now in a downtrend. Whereas expensive valuations are no impediment to us taking a constructive view on markets whilst an uptrend is in place, we need to be a lot more circumspect in our long exposure once this momentum breaks down.

Investor anxiety is another consideration when we rate the environment for long investing. We have a key proprietary measure which we use to indicate market investment style preference. For the first time since we developed the measure ten years ago, our reading of investor anxiety spiked to very high levels at the start of the Covid-19 pandemic. Having then abated, it has risen again somewhat in the aftermath of Russia’s invasion of Ukraine.

In early 2020, the spike in investor anxiety acted as a leading indicator of contrarian value opportunities – emphasising the need in portfolios to shift away from growth and towards a more value style. Valuation dispersion within the market was high, meaning that there were lots of deeply discounted stocks we could invest in. However, the recent bout of anxiety has come at a time when valuation dispersion has contracted somewhat. The cash generative contrarian value and recovering value stocks that performed so well for the Fund over the last year are no longer as cheap.

Instead, we have seen good opportunities for long investments in value stocks that are more defensive by nature. Of late, we have made good returns in some of the investments we made early this year in stocks like Roche, GlaxoSmithKline, Indivior, Kongsberg Gruppen and Swedish Match. Guiding us towards this more defensive value strategy has been the surge in corporate aggression. We know the best returns to value defensives with good cashflows occur when our measure of corporate aggression is elevated.

But short book opportunity remains compelling

The prospects for the short book remain appealing. For stocks with poor cash flow characteristics, we are still seeing expensive valuations – albeit less expensive than the readings we saw late last year, which were the most expensive we had come across in the 30-year history of the data we use.

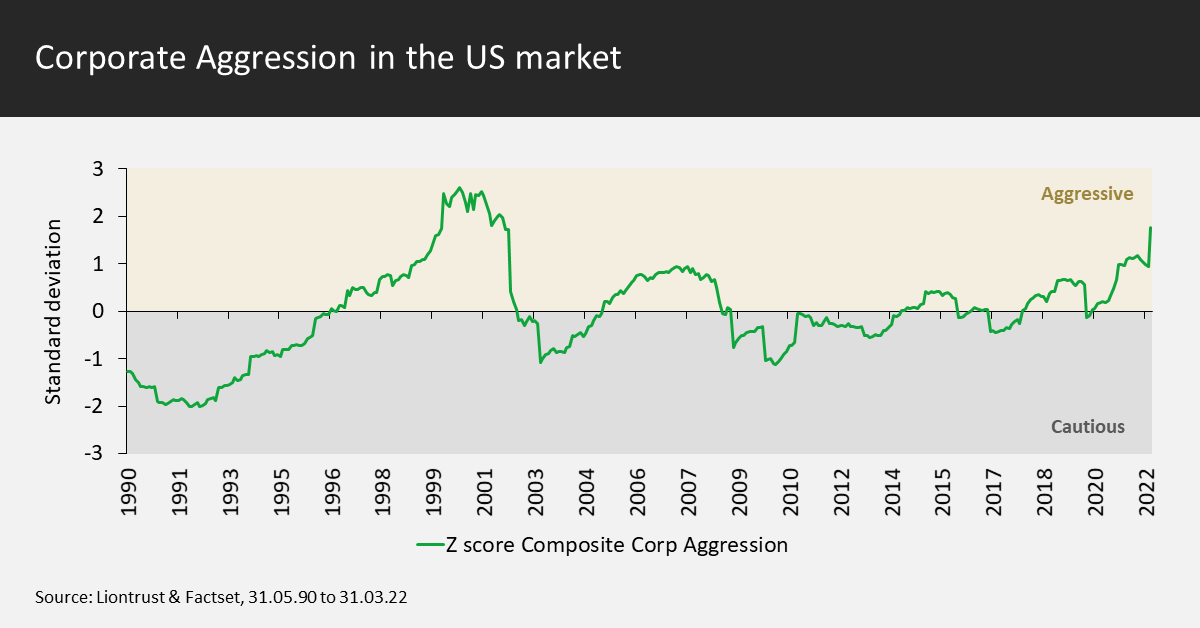

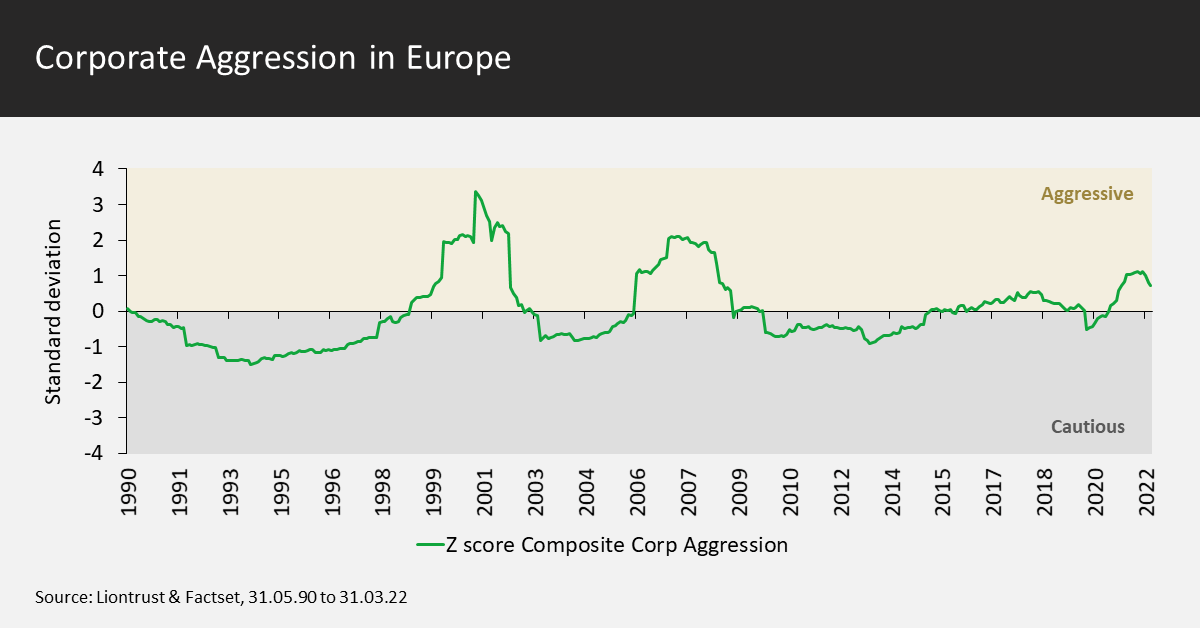

Furthermore, corporate aggression is high – moderately so in Europe but at extremes in the US. In fact, corporate aggression in the US has recently surged to levels not seen since the peak of the tech bubble in 2000.

Corporate aggression, our proxy for company manager optimism, is one of our main indicators of market regime. We see corporate optimism as a contrarian market indicator: when company managers become more aggressive in their expenditure, we are more wary about the outlook for equities. This is because aggressive corporate expenditure often signals that company managers are increasingly making optimistic forecasts which they are prepared to back with significant investment in operating assets such as property, equipment and stock to capture the growth opportunity they foresee.

When in due course the over-optimism is revealed and growth disappoints, the situation is exacerbated by the misplaced investment that has occurred. We’ve therefore designed our corporate aggression measure to highlight when managers are becoming particularly aggressive with their investment.

As the pandemic took hold, the level of corporate aggression understandably dropped given the significant pressure on corporate earnings. However, it has since risen rapidly to very high levels.

Our proprietary measure of corporate aggression now sits at around one standard deviation above average in Europe, while the US is above two. From a statistical standpoint, when this measure breaches one standard deviation above average, it sits in the top 15% of historical measurements; when it exceeds two standard deviations, it is in the top 2% .

We know that a corporate aggression level two standard deviations above average is often a harbinger of market crisis. The journey between one and two standard deviations on the indicator can also be rapid, so we will be watching the European levels with interest, ready to expand the Fund’s short book further if aggression spikes.

Shorting expensive high-forecast growth stocks with poor momentum and investing in attractively valued defensive stocks with appealing cash return characteristics

When expensive valuations are combined with a poor technical picture and high corporate aggression, this clearly paints a weak foundation for a bull market to endure. However, the major benefit of applying a variable long/short approach to the management of the Fund is that we can target positive returns in all environments, including those where we have a cautious market outlook.

As a consequence of our indicators the next exposure of the fund remains quite low at c.23%.

Due to the reduction in valuation dispersion, the long book focus has shifted away from the contrarian value stocks it sought out last year and towards attractively valued defensive stocks and those with appealing cash return characteristics. Our short book remains focused on expensive high-forecast growth stocks with poor momentum.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The Fund may invest in emerging markets/soft currencies which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.