The Cashflow Solution investment process identifies companies generating high free cash flows from their operating assets whose share prices undervalue these cash flows.

A secondary scoring system further refines the cash flow attributes and style factors of each company. The benefit of these secondary scores is that they allow us to dynamically adjust the portfolio’s style profile to reflect the prevailing market regime, tilting towards growth or value, for example, as conditions evolve. In analysing the market regime, our toolkit includes proprietary indicators such as investor anxiety, corporate aggression, market momentum and valuations.

Prior to the emergence of Covid-19, cash generative companies with growth characteristics had been the mainstay in the Liontrust European Dynamic Fund for several years. However, the sharp market reaction to the pandemic at the start of 2020 led to a very clear message developing as we applied the Cashflow Solution process: all our indicators were signalling the need to steel ourselves to fundamentally re-shape our portfolios with a heavy emphasis on cash flow valuation rather than growth.

The backdrop: more than a decade of value underperformance

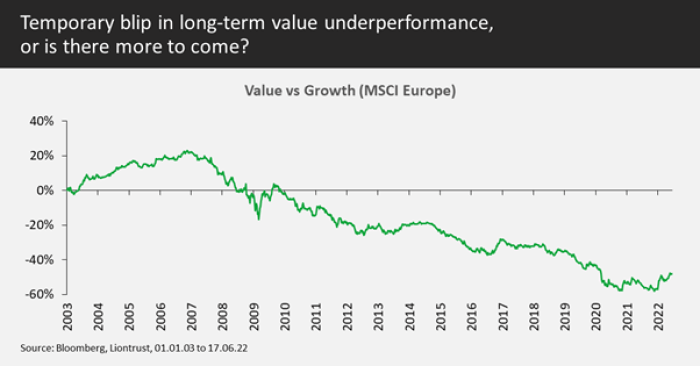

While its long-term track record is excellent, value as an investment style had underperformed massively over the decade from 2010 to 2020. The extent of this poor performance is illustrated in the chart above, which runs through to March 2020, when the impact of Covid-19 began to be felt by stockmarkets. The chart, based on Kenneth French’s dataset at Tuck School of Business at Dartmouth, illustrates the remarkable fact that value had suffered its worst decade of returns in 70 years.

Strategies that endure this kind of return typically suffer from significant capital flight and fund closures – certainly, it’s the case that returns to value had been so bad that people were starting to question its ongoing relevance as an investment approach.

Traditional measures of value include a broad range of balance sheet asset ratios such as price-to-book and income statement measures such as the price/earnings ratios. Our assessment of value is instead tethered to cash flows – a more relevant and accurate yardstick we believe of the value opportunity.

However, for several years our investment process had been leading us to prefer companies with strong cash flow growth prospects rather than those with value credentials. As a result, our portfolios had a long-standing negative exposure to value as an investment style when viewed through the prism of fundamental factor risk models.

Like many practitioners, the speed and scale of the Covid-19 sell-off last year took us by surprise and was not anticipated by our investment process. Immediately prior to the Covid-19 crisis, we held a constructive view of equity markets: although markets had become more expensive after strong returns in Q4 2019, valuations didn’t look worrying and companies in Europe were not showing any signs of over-aggressive levels of investment, which tends to be a positive indication for equity markets.

Whilst we owned some cyclical value stocks in our portfolios, we also had a number of stocks we would characterise as quality growth stocks that looked expensive on conventional value measures but were attractive owing to their tremendous cash generation – good examples were Novo Nordisk and Simcorp.

Covid-19: value capitulation presents investment opportunity

Value investors may have felt like they had endured a rough time prior to the pandemic, but the sell-off in markets in March 2020 dramatically increased their pain. Value stocks were hit extremely hard while many growth stocks – particularly those seen as immune to the economic impact of Covid-19 – fared relatively well.

The graph below – showing the performance of the MSCI Europe Growth Index relative to the MSCI Europe Value Index – makes this painfully clear. With lockdown measures enforced globally, many businesses were severely restricted in their ability to trade, with traditional value stocks – often reliant on a physical presence or face-to-face interaction – among the most obvious victims.

However, whilst shocked at the speed and severity of the sell-off, we noticed that our investment process was beginning to highlight a significant opportunity. Specifically, there were two indicators that we monitor closely that were signalling the need to steel ourselves to fundamentally re-shape our portfolios with a heavy emphasis on cash flow valuation rather than growth – the mainstay of our stock selection for the last several years.

Our investment process was telling us loud and clear that, rather than fleeing the value space, investors should actually be embracing the risk found in these much-maligned stocks.

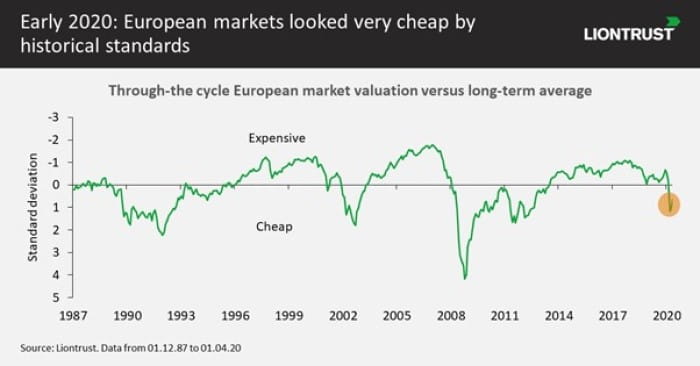

The first, and simplest, of our investment process signals pointing to an upbeat outlook was market valuation. Here, we were looking at our own measure of share price valuation based on ‘through-the-cycle’ measures that use average cash flows over a multi-year period. On this purely quantitative, backward-looking measure (that made no predictions about Covid-19’s impact) stockmarkets had slipped to very cheap levels.

When markets rapidly downtrend into such anomalously cheap territory, our historic analysis suggests that they tend to rebound swiftly to generate excellent one-year returns, albeit often with a lot of volatility along the way. We also knew from our analysis of historic recoveries – going back to the 1920s – that these sharp rebounds have almost always been led by value.

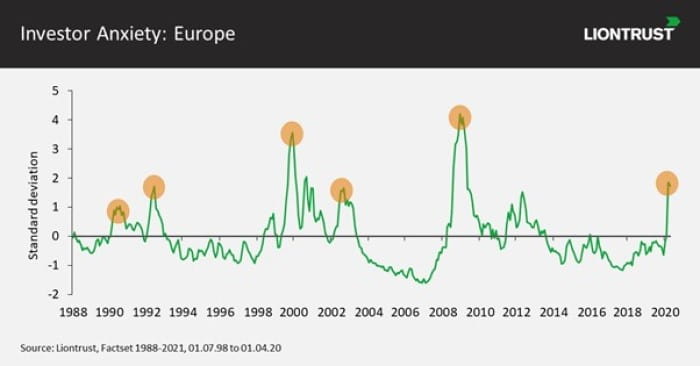

We have been aware for many years that value recoveries are often extremely difficult for investors to capture, mainly due to the psychological pressures an investor feels at the depths of a sharp sell-off. As a result, several years ago, we developed a measure of investor anxiety or stress. We reasoned that very high investor stress levels were likely to be the starting point for value recoveries and developed an indicator of this stress not only to highlight these opportunities but also to force us to act against our natural instincts to seek safety at moments of high stress.

We spent a significant amount of time developing this investor anxiety indicator having been chastened by our failure to participate in the resurgence of value styles in the aftermath of the 2011 plunge in markets. Back-testing of this measure did indeed show that the time to embrace value and be contrarian was always at times of high investor stress. We noted from the historic record that the returns to value strategies at this point were spectacular and very painful for investors who failed to participate.

As shown in the chart below, this investor anxiety indicator in 2020 surged to very high levels that had only been surpassed during the global financial crisis and technology bubble, episodes which set the stage for powerful value rallies.

When investor anxiety is high, it’s natural for investors to gravitate towards perceived safer bets: defensive growth stocks such as the UK’s consumer staples conglomerates Unilever and Reckitt Benckiser, or pharma giants AstraZeneca and GlaxoSmithKline. This results in widening valuation gaps between the popular, expensive stocks and the out-of-favour cheaper value shares.

The best approach to deploy in these environments is therefore to buy the very cheap stocks that have been shunned by investors, even though at the time this feels fraught with risk and danger. Specifically – and as classified by our proprietary stock designations – it pays to identify ‘Contrarian Value’ or ‘Recovering Value’ opportunities. These groups include companies that are responding to tough trading conditions with measures such as the imposition of capital controls, asset disposals and other restructuring measures.

In effect, the Covid-19 market sell-off had delivered a perfect storm for value investors: an extended multi-year period of underperformance, followed by a market rout in which value stocks plunged the most, and a severely uncertain outlook for the ability of many of these companies to operate.

Investors were being offered a hefty premium to take on risk and uncertainty in the form of very depressed value shares. When the level of premium on offer is of the type we saw in Q2 2020, it is almost always the right thing to do to take on the risk and uncertainty of a more valuation-based approach. By contrast, growth and momentum strategies – and in particular companies seen as immune from, or even beneficiaries of, the pandemic – looked very expensive consensus positions that we were concerned about.

Having the confidence to be contrarian

The problem is, doing the ‘right thing’ isn’t always straightforward. Reflecting in hindsight on the environment in April 2020, it was clear many investors were avoiding value stocks for a reason: no-one knew what the short, medium or long-term impact of the pandemic would be. In such circumstances, most investors find it rational to pay a large premium to hold stocks that seem most resilient to extremely challenging circumstances.

As we considered how to reposition portfolios for this environment, we found that a lot of people we spoke to were very apprehensive about taking on significant value exposures at this time. When faced with this kind of emotional pressure, it can be tempting to find safety in numbers and follow the herd. In such situations, we take great reassurance from the long-term empirical work we have done, testing and re-testing our investment strategies against historical data sets.

Our investment process was telling us that sheltering in expensive stocks that had been resilient to the sell-off was exactly the wrong thing to do – the outlook for crowded trades and momentum strategies was very concerning and it was in fact this strategy that was the high-risk dangerous trade, not value. Periods of very high investor anxiety almost always set the stage for feared ‘momentum crashes’ – periods during which the stocks that have delivered strong relative performance do badly, whilst stocks that have delivered very weak relative returns perform extremely well.

We know that the Cashflow Solution investment process can deliver its strongest returns during bouts of market inflection and it is essential not to miss these turning points. Luckily, both Liontrust and our funds’ investors share the conviction we place in our investment process, allowing us to take a bold contrarian position.

Selecting the most attractive contrarian positions

To help us identify the most attractive contrarian value stocks, we deployed a proprietary crowding score. This measure combines a variety of factors including price performance, valuation and analyst sentiment. We were looking for true contrarian stocks – those with low crowding scores, that were hated by analysts and not widely held by investors, resulting in depressed share prices.

Unsurprisingly, in the midst of global lockdowns, downtrodden value sectors such as autos, travel, financial and media loomed large in this category. These value stocks had excellent backward-looking cash flow yields as a result of strong historic cash generation combined with share prices that had been among the worst affected by the pandemic. It was not uncommon to find stocks that had fallen into this category down by 80% or even 90% in the sell off. Investors were reasoning that these stocks faced severe operational challenges and were likely to see their earnings collapse as the economic downturn took hold. However, we reasoned that, yes, such companies were likely to suffer in the short term but were just as likely to see their cash flows revert to more normal levels as economies recovered in time from the pandemic.

November 2020: The vaccine rally

We had prepared ourselves to be patient for these contrarian value investments to pay off as the world got to grips with the pandemic, but November 2020 revealed a step-change in this process. As news of potential Covid-19 vaccines broke, there was optimism that the recovery might now be in sight and we witnessed a significant factor rotation in value’s favour. At the same time, we saw the biggest one-day momentum crash in history after the positive vaccine announcements by BioNTech/Pfizer and Moderna.

2021 – 2022: Value rally matures and evolves

The value rally has evolved significantly over the last two years and its path has been volatile. Even after the initial large rotation towards value in November 2020, we then fairly immediately observed a period of trend reversal as a new wave of coronavirus infections at the end of the year threatened economic reopening.

This volatility has required us to both maintain our conviction and reappraise the nature of the rally.

To understand how different types of value investment appeal in different circumstances, its useful to look at the types of stocks we have invested in over the last two years. As the pandemic hit, and we initially repositioned portfolios towards value, it was contrarian deep value stocks that we were interested in – those that were experiencing particularly tough trading conditions and whose share price valuations reflected very high scepticism. This investment style had suffered many years of chronic underperformance, while – at the other end of the valuation spectrum, quality growth had enjoyed a buoyant decade-long run of outperformance and looked very expensive. Deep value stocks we invested in included container shipping company AP Moller-Maersk, which had to withdraw financial guidance as Covid-19 impacted global growth, and Danish jewellery company Pandora, which was unable to operate out of most of its physical store estate due to various lockdowns.

During 2021, we then recognised that leadership of the rally was transitioning from deep value stocks to those value stocks showing some evidence of recovery and momentum.

In 2020, making a value bet in a portfolio meant taking a negative position on momentum as the strong momentum cohort was dominated by growth stocks. This was no longer the case by 2021. The strength in value had persisted long enough for it to begin overlapping the momentum cohort. This was a development in the world of factor investing that has not occurred for a number of years.

We ran our quantitative analysis on the European companies with the best cash flow characteristics -creating our ‘Cashflow Champions’ watchlist – and then we used a scoring system to target companies showing positive business momentum, generating significant cash flows as the damaging economic impacts of Covid waned, and which were returning that cash to shareholders.

Stocks we were investing in at this time included banks Bank of Ireland and BNP Paribas and auto companies Daimler (owner of Mercedes Benz) and Stellantis (Peugeot and Fiat Chrysler).

By the end of 2021 and start of 2022, interest rate expectations were on the rise due to rampant inflationary pressures which accompanied the global economy’s bounce back from the restrictions imposed during the early stages of the pandemic, as well as the supply-side shock from Russia’s war with Ukraine.

This served to further strengthen the sense that the value rally was accelerating. With discount rates heading higher, long-duration growth stocks looked likely to suffer relative to shorter-duration, and often more inflation-resilient, value stocks.

As 2022 has progressed, we’ve dynamically adjusted our exposure again. As the chart illustrates, the value rally over the last year or two has recovered only a small amount of the prior decade’s losses relative to growth styles. While we think this suggests there is plenty of scope for relative strength in value, our proprietary market indicators are guiding us towards stocks with strong recovery and cash return characteristics, as well as those with some defensive, or cheap quality, attributes.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Cashflow Solution team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. Some of the funds may hold a concentrated portfolio of stocks. If the price of one of these stocks should move significantly, this may have a notable effect on the value of the respective portfolio.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.