Director ownership [1] and related changes has long formed part of the Liontrust Economic Advantage process for smaller companies. This aspect of the process dates back to 1998 when Anthony Cross launched the Liontrust UK Smaller Companies Fund. The team may have grown from one to six over the last twenty-five years, but today Anthony continues to co-manage the fund alongside the Liontrust Special Situations Fund, Liontrust UK Growth Fund and Liontrust UK Micro Cap Fund and this attribute remains as important as ever (for the smaller companies held).

The “management ownership” element of the process requires any smaller company held in the Economic Advantage fund range to have at least 3% of the direct company equity owned by directors and senior management. In practice, the average holding by management teams within the funds is much higher – the Liontrust UK Smaller Companies Fund, for example, has an average of c.20% ownership. This equates to an average of over £100m of director and senior management capital invested alongside us, since the average market cap in this fund is over £500m.

Ownership by management teams is a prerequisite for us to invest in smaller companies for several reasons. Firstly, the alignment of our financial interests with those running the company. Secondly, owner-managers tend to be more risk averse, exhibiting caution on both balance sheets and in undertaking big “transformational” acquisitions. This is further illustrated by the fact that within the Liontrust Special Situations Fund c.80% of the smaller companies are in a position of net cash.

We are strong believers in the entrepreneurial spirit of our owner-managers, which we consider to be a powerful driving force behind the delivery of long-term company returns, but we also welcome the conservatism that comes with having a large personal equity stake in a single company.

SmartInsider

For the past few years, we have used a company called SmartInsider to track the overall ownership levels of our smaller companies, and the trading activity of these ‘insiders’ within our companies. In addition to this, SmartInsider also provides market signals and ratios on director buying and selling. Although these ratios and signals are not formally part of the Economic Advantage process, they do inform our thoughts on management ownership.

One such ratio is the “buys per sell”. This counts the number of ‘insiders’ who either buy or sell in a particular period, rather than each individual trade. For example, if one director bought shares three times in one week this would be counted as one buy. The ratio would then compare the number of buyers against the number of sellers – for example, if four directors bought shares and one sold, this would create a ratio of four. Therefore, the higher the ratio, the more positive the market signal is, and vice versa.

It is important to note that SmartInsider does not include non-discretionary buys or sells – such as share option trades. It only captures discretionary buying or selling signals which it believes is a more meaningful measure of ‘insider’ sentiment.

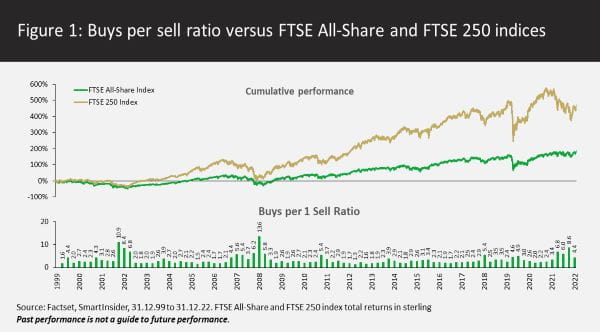

The below graph (Figure 1) shows the “buys per sell” ratio for the UK market across all companies with a market cap more than $1m since 2000. Historically, the ratio has shown notable spikes on market falls, and in some cases has timed market lows particularly well. ‘Insiders’ are typically confident in times of market uncertainty.

If you take the three big spikes in the ratio in 2002, 2008 and 2022, the buy volumes picked up and the sell volumes decreased meaningfully in the time periods immediately before them. ‘Insiders’ have shown themselves very able to call the bottom. 2020 activity was also notable. Looking at the quarterly ratio data shown on the chart, we can see a pronounced uptick in Q1 and Q2 2020, but not to the same absolute levels as the three periods mentioned before. Delving further into the data to examine monthly ratios, we note that in March 2020 the ratio over one month was 14.8, which is extremely strong. An outlier in terms of market falls may be the 2016 Brexit vote, when there was a spike in the ratio to 7.1 in June.

Putting money where your mouth is

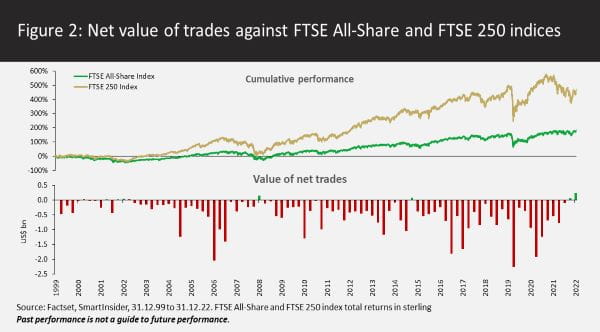

The above data and analysis are purely focused on the volume of ‘insider’ trading, rather than the total value of the trades. Interestingly, while the ratio on volume is always a positive number, this is much rarer when looking at the value traded. In fact, since 2000 there have only been eight individual quarters with a positive net value traded, i.e., where the value of shares bought by directors exceeded the value of shares sold. Furthermore, there have only been two occasions when consecutive quarters have been positive – the first being Q3 & Q4 2002, and – interestingly – the second being right at the end of last year.

It can feel difficult to be optimistic in the current environment, but it is reassuring to see UK ‘insiders’ are putting their money where their mouth is. Judging by history, we may be wise to follow them.

For more insights and views from Liontrust visit: https://www.liontrust.co.uk/insights

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Economic Advantage team invest primarily in smaller companies and companies traded on the Alternative Investment Market. These stocks may be less liquid and the price swings greater than those in, for example, larger companies.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.