Despite the market turmoil in 2022, the businesses we are invested in were largely resilient and continue to exploit their significant competitive advantages, grow their market share and deliver compelling financial returns. The business models of our companies remain robust, relevant to their clients, and we regard them as niche champions in their various sectors.

In this note, we provide an update on the Liontrust Special Situations Fund, expanding on these key points:

- 2022 performance: size and style headwinds

- Trading resilience of our companies – including the small caps

- Valuation opportunities

- Keeping the shape of the portfolio - topping up seven of our 10 worst performers in 2022

- Takeovers – four in 2022, affirming that our companies are tough to replicate

- New additions – three exciting businesses added

- Outlook – recession, uncertainty, and the importance of owning great businesses

2022 performance: size and style headwinds

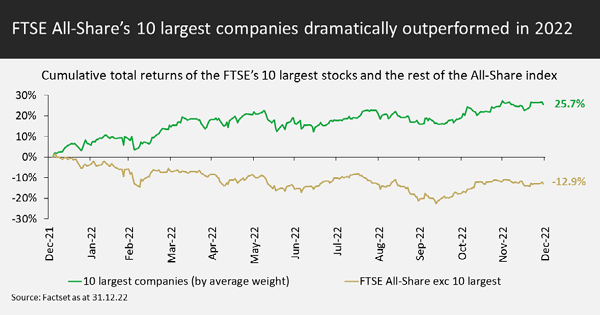

Size mattered in 2022. The 10 largest companies in the FTSE All Share dramatically outperformed, returning 25.7% compared to the -12.9% performance for the rest of the index. The FTSE AIM All Share returned -31%, the FTSE 250 -17.4%, and the Liontrust Special Situations Fund, with its deliberate overweight to mid and small caps, returned -11.2%.

While equity market weakness in the early part of 2022 stemmed predominantly from ratings contracting – i.e. the ‘p’ in price/equity ratios falling – as investors priced in higher interest rates (and discount rates) on future expected growth, earnings estimates also came under pressure later in the year as recessionary forces built.

Much of this weakness was concentrated in the mid and small-cap sections of the market. The Fund’s exposure to mid and small-caps is around 50%, significantly greater than the FTSE All-Share weight of 17%. The size return profile of the market was therefore another substantial performance headwind.

The macroeconomic backdrop at the start of 2022 combined to create an environment in which ‘value’ style equities outperformed their ‘growth’ and ‘quality’ counterparts – particularly in Q1. When interest rate expectations rise, growth stocks – those with high expected earnings growth rates – suffer from higher discount rates applied to their future forecast earnings. Value stocks, by contrast, are viewed as short-duration assets and are less affected by discount rates.

Last year, the Fund had some exposure to companies with at least one foot in the value camp, including large-cap energy stocks BP and Shell. AstraZeneca was also among the portfolio’s risers as investors rotated towards defensive areas. But, overall, the strength in value was a strong headwind to the Fund, contributing to its underperformance of the FTSE All Share Index. Because the investment process seeks out dependable, consistent businesses with barriers to competition, high financial returns and strong balance sheets, there is an observable style tilt towards quality and away from value.

Trading resilience of our companies – including the small caps

Our companies reporting in Q4 2022 and January 2023 have, on the whole, impressed us with a strong haul of results, notwithstanding some isolated pockets of trading weakness in stocks which are either more exposed to specific challenging end-markets or have flagged a note of caution on cyclical exposure.

It is understandable that investors might be concerned that smaller companies would be disproportionately affected by the problems faced by the UK’s domestic economy. However, while we by no means claim that any of the Fund’s companies will be immune from a contraction in the UK economy, we have so far been reassured by the trading resilience shown by many of them. Of the 17 small caps that have reported on trading so far in 2023, we have seen two downgrades, eight ‘in line’ statements and seven companies which have delivered upgrades to expectations.

The portfolio continues to have low overall exposure to traditional domestic consumer cyclicality in areas such as travel and leisure, retail and housebuilding; half of our ‘consumer discretionary’ exposure is actually to media businesses, which are increasingly transitioning towards subscription/recurring income business models, are underpinned by harnessing the power of data, and are generally well diversified by end-market and geography.

Valuation opportunities

While we make no claim that our businesses, with their hallmarks of quality, are cheap compared with the wider market, we nevertheless feel optimistic that the current environment provides fertile hunting ground for stock opportunities.

Valuations have come a very long way off the highs of the post-Covid bounce, particularly in our ‘sweet spot’ of mid and small-cap.

Comparing the average 12-month forward price/earnings ratio of the Fund’s stocks in each size band at the end of 2022 to one year earlier:

- The average large-cap p/e ratio reduced by 15%

- The average mid-cap p/e ratio reduced by 23%

- The average small-cap/AIM p/e ratio reduced 34%*

Notwithstanding the obvious short-term possibility of further downgrades to earnings and cash flows if macro data surprises on the downside, share price levels following the de-rating feel like a much more attractive level from which to compound returns over the long run.

Refreshing the portfolio and maintaining its shape

One of the features of the Economic Advantage investment process is the frequency with which its holdings have proven attractive to acquirers. Four of the Fund’s positions – Clipper Logistics, Ideagen, CareTech and EMIS Group – were subject to corporate activity in 2022, all at healthy premiums.

We have been using the proceeds of these takeovers to top up our mid and small-cap names at attractive valuations. Of the bottom 10 contributors to performance in 2022, we have actively added to seven of these names.

We have lost none of our high conviction in the power of these entrepreneurial, dynamic businesses to deliver superior returns over the medium to long term and, when considering company size, we made a conscious effort to keep the overall shape of the portfolio consistent with prior years.

We have also added three brand new small-caps:

- Team17 is a developer and publisher of video games, acting as a games label and creative partner for third-party independent developers as well as creating and developing own-IP games. It is held under the investment process on the strength of its intellectual property (IP). The group prides itself on a tried-and-tested process for ‘funnelling’ high calibre third-party games to work on, while in its own-IP stable it has a keen focus on the importance of the longevity and durability of games titles. Its most famous games are from the “Worms” franchise, which was first released over 25 years ago.

- Midwich Group is a specialist on-trade audio-visual equipment distributor. It has diverse end markets, with around 30% sold into education and a further 5% apiece into healthcare and public sector. The stock is held due to the strength of its distribution network. Midwich operates in a very fragmented market, and its scale and domain expertise provide it with a significant advantage when it comes to distributing a wide range of specialist branded products into a broad network of customers. The company employs over 900 people across 26 offices around the world.

- Focusrite is an audio products group that develops hardware and software for the high-quality production of recorded and live sound. Its products – including audio interfaces, synthesizers and loudspeakers – target a wide range of customers from the amateur hobbyist through to the professional musician. We believe Focusrite has key intangible asset strengths in the form of its intellectual property and distribution network. The core of its IP strength is know-how and many years of accumulated technological and product expertise. The company typically spends 6-7% of revenue on research and development and has a strong focus on innovation, with multiple new product launches each year. It has steadily built out a truly global distribution network, with offices in four continents and a distribution network covering 240 territories.

Outlook – recession, uncertainty, and the importance of owning great businesses

Clearly, most companies will be vulnerable to share price falls if economic conditions worsen considerably, but we would expect the pain to be more acutely felt among more cyclical businesses with low barriers to competition, poor pricing power and weaker balance sheets.

Inevitably, markets use a broad brush when reacting to economic developments and do not differentiate between companies until later in the cycle when the successful ones are able to show, by their delivered results, their superiority. We believe that the Fund is invested in companies which are dependable, consistent businesses in possession of barriers to competition which give them pricing power.

In particular, balance sheet strength is notable – two thirds of the overall portfolio has conservative gearing of less than one times net debt:EBITDA (earnings before interest, tax, depreciation and amortisation). Furthermore, over 80% of its small caps are in a position of net cash*.

We note that if investors are concerned about a weakening outlook for the UK economy in particular, the portfolio’s overseas sales exposure, at 70%, is slightly higher than the FTSE All Share benchmark at 67%**, despite its much greater weighting towards mid and small caps. Many of our mid and small caps can already be considered genuinely global businesses, with all the benefits of geographic diversification and growth runway which that entails.

*Source: Canaccord Genuity Quest.

** Source: Style Analytics

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

A proportion of the portfolio is invested in smaller companies and companies traded on the Alternative Investment Market. These stocks may be less liquid and the price swings greater than those in, for example, larger companies.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.