Home ownership is high on the agenda for many people but soaring mortgage rates and historically high property prices in much of the country mean that getting a foot on the ladder has rarely been as tough.

Yet for investors, an alternative potentially worth considering as part of a diversified portfolio is to invest in property through a real estate investment trust (REIT).

A REIT is a property investment company that effectively acts as a property rental business. Investors who put money into a REIT are therefore indirectly investing in property, albeit in a more liquid way than investing directly in property.

The benefits of investing in property through a REIT typically include long-term rental income streams which can often be inflation-linked to some degree.

The stability of the cash flow profile can be seen as a defensive source of income and returns and can provide diversification versus other traditional investments such as equities and bonds in the long run.

Furthermore, there is no corporation tax charged on either rental income or any gains made on sales of properties held within a REIT.

What has been the performance of REITs?

However, the last 12 months or so have shown that total returns from property, in particular listed property, can be volatile in share price terms – despite strong fundamental performance and in many cases growing dividends.

Higher yields on risk-free assets have led to investors requiring a higher return or income hurdle for holding ‘risky’ assets such as property. The re-setting of yields subsequently caused the prices to fall due to the long-term nature of income streams. While rental growth helped to offset some of the yield increases, we have still seen double digit declines in the valuation of property portfolios as represented by the Net Asset Valuations (NAVs).

As measured by the MSCI UK Property Index, which measures the total returns from directly held property, we saw returns of -10.1% (-14.2% from capital, 4.7% from income) in the sector, while in the year to date (2023), there has been some stabilisation in property yields, with total returns just above 1%, and a small decline in capital values (-1.1%) being offset by income at 2.4% (source: NUMIS, MSCI).

Despite the stabilisation in yields, the listed markets have continued to drive discounts wider to their NAVs and post meaningful negative returns as a result. The market is currently pricing in further yield widening due to higher interest rates – however we believe the magnitude of the discounts may be overdone, especially for certain REITs and sectors that have demonstrated strong rental growth with lowly levered balance sheets. An investor with a long-term mindset that can withstand short term noise stands to benefit from attractive returns.

Somewhat counterintuitively, it is the more secure and defensive income REITs (e.g healthcare REITs) that have seen the biggest downgrades. This is because the starting yield levels were much lower than more risky REIT sectors such as retail, which have already seen yields widen during the Covid pandemic. Meanwhile the UK listed property sector trades at a discount of -38.8% (source: NUMIS, 11 July 23).

What is the future for returns?

Falling interest rate expectations are the obvious catalyst for a strong re-rating in the sector, but we believe even if interest rates were to stabilise at current levels, the discounts will encourage buyers back into the market, especially in REITs with strong balance sheets and long-term structural growth. We have seen this through the lens of mergers and acquisitions (M&A) activity, where deep discounts have enticed M&A activity led by private market participants – for example, Blackstone’s cash offer for Industrial REITs (14th April) and CK Holdings cash offer for Civitas (9th May). We may see more from well capitalised players if discounts persist at these levels, which will be positive for the REITs sector as a whole.

Using history as our guide we also note, periods of high persistent discounts are often followed by very attractive prospective returns from the higher starting yields and the unwinding of the discounts.

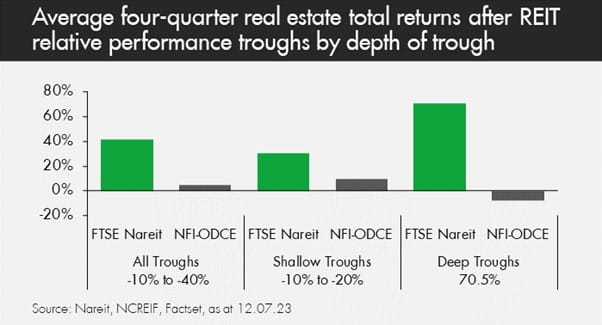

The chart below shows the average total 12 month returns from REITs relative to the performance of unlisted property funds which typically trade close to their NAVs. Consequently, times when REITs underperform unlisted funds – or in other words are trading at large discounts to NAVs – are typically followed by strong returns.

Debt

A key fundamental concern is leverage in the sector as represented via Loan to Value (LTVs) and the risk of re-financing in a higher interest rate environment. REITs in general have seen a reduction in their LTVs from c40% in 2012 to c30% for UK REITs in 2022; and from close to 50% in 2012 to c40% in 2022 for European REITs.

Furthermore, many REITs have also taken advantage of the low interest rate environment prior to 2022 to lengthen the maturity of their debt and fix interest at low levels. Average interest rates were c3% in UK and 1.4% in EU as of the end of 2022, compared to 4.9% in UK and 3.8% in the EU ten years earlier. (source Stifel, Bloomberg). The average maturity of debt remains fairly long on average, at around six years for UK REITs and about five years for EU REITs.

Risks and opportunity

Owning property via listed vehicles implies a trade-off of a preference for liquidity over short-term volatility and higher correlations, especially in extreme market environments. In the long-term private and listed markets for real estate deliver similar returns. However, in the current market context, we believe the forward- looking return opportunity is much greater in listed than private markets due to the deep discounts available in REITs. Within listed property, our focus remains on specialist areas with structural growth and defensive characteristics such as healthcare, logistics and digital. Stock selection remains key in this environment as emphasising companies with low LTVs, visibility of dividend cover and growth along with an astute management team will generate the highest returns.

Furthermore, we believe investors should consider a broader remit of real assets beyond property. ‘Real’ in this context can include tangible assets such as land, buildings, toll roads and energy generators (solar and wind farms), which derive value from their availability and usability. Combining disparate sources of returns from a broader range of real assets can help cushion the volatility of standalone property exposure, as well as potentially offering enhanced returns.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The nature of the Fund's holdings mean they may be more difficult to value objectively so may be incorrectly priced, and may at times be harder to sell. This could lead to reduced liquidity in the Fund. The fund invests in non-mainstream (alternative) assets indirectly through other collective investment schemes. During periods of stressed market conditions non-mainstream (alternative) assets may be difficult to sell at a fair price, which may cause prices to fluctuate more sharply.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.