We firmly believe diversification works over the long term. Yet, in 2022, diversification failed.

It was a very rare year in which both equities and fixed income generally delivered negative returns. This followed more than a decade of a low cost of capital and therefore attractive real returns for equities. At the same time, cash has become more attractive over the past year because of higher returns available from saving accounts and volatility in investment markets. This has led to one of the most frequent questions we have been asked is if people should hold cash rather than be invested in equity and fixed income markets.

Cash can be a good place to park savings when you have a short time horizon so you are not subject to the volatility of investment markets. Extending the time you keep savings in cash, however, is an active decision not to invest and you might miss out on the long-term benefits of investing in markets. This includes generating real returns above the rate of inflation. Over the long term, equities have historically outperformed cash, bonds and inflation.

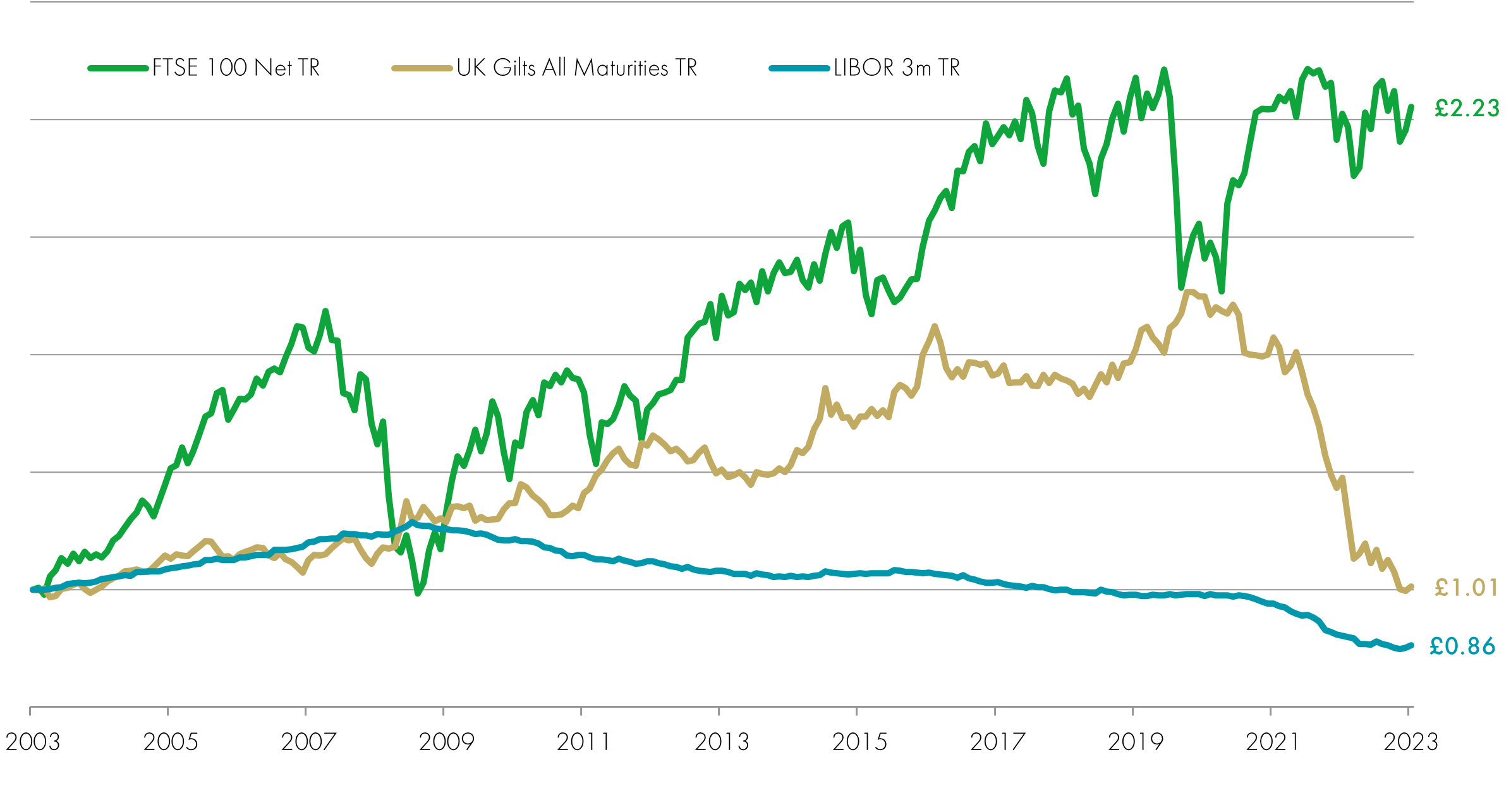

You can see this by looking back at the performance of stock markets, government bonds and cash over the last 20 years and adjust for inflation to get the real returns from all three as shown in the chart below. £1 left in cash for 20 years would have a purchasing power of 86p today. Whereas £1 invested in the UK stock market for 20 years would be worth over £2.20. You would have done fairly well in UK government bonds over the same period but the difficult 2022 means you now have about the same purchasing power that you started with.

20-year real returns: total return of £1 in real terms

Source: Morningstar, as at 31 July 2023. Past performance does not predict future returns.

Another question we are asked is why not put money in cash now and wait for a “better” investment environment before putting the money back into markets. This might sound like an attractive strategy but it is extremely difficult to do successfully.

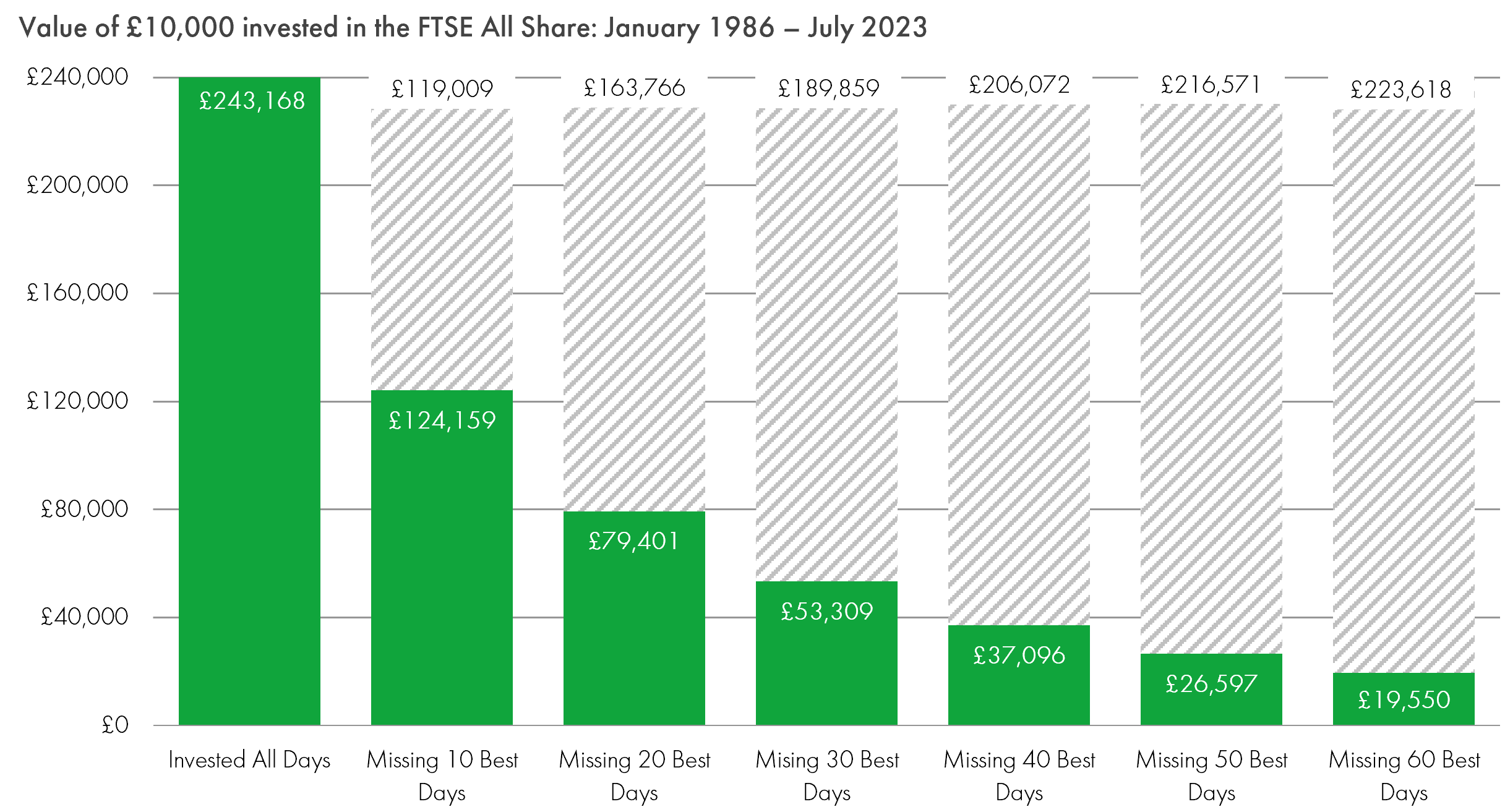

The benefit of a patient long-term disciplined approach to investing is shown by looking at the returns of the FTSE All-Share Index since 1986. If you had invested £10,000 in the market 37 years ago, the compound return would have given you £240,000 today. If you had missed the 10 best days of returns over those 37 years, your money today would be reduced from £240,000 to £124,159.

Missing out on the best days

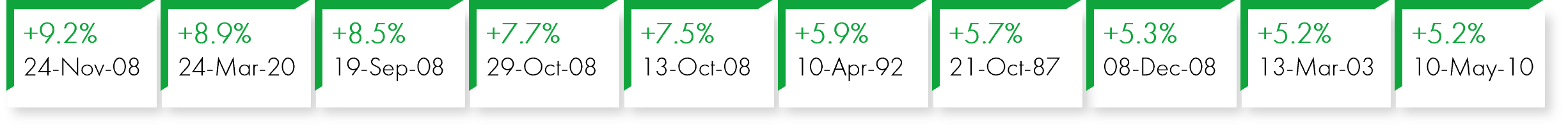

When were the 10 best days in the market?

Source: Morningstar, 1 January 1986 to 31 July 2023. Past performance does not predict future returns.

These are shown in the table above. This figure starkly illustrates the impact of missing just 10 days of returns over 37 years. The challenge is exacerbated by the fact that the best days often come during the periods of maximum pain so timing them is extremely difficult. For example, the best day of returns since 1986 was on 24 November 2008 during the Global Financial Crisis (GFC) and came just two months after Lehman Brothers went bust. The second best day was 24 March 2020, which was the day after the UK went into lockdown during Covid.

The seventh best day of performance over the past 37 years was 21 October 1987, which was two days after the Black Monday crash. Three of the other four best days of performance also followed soon after the collapse of Lehman Brothers in September 2008. What these strongest days for returns have in common is that very few investors would have had the bravery or conviction to invest at those times.

This is why the Liontrust Multi-Asset team believes in a long-term robust and repeatable investment process which remains invested during the difficult times and takes away some of the excesses through holding a diversified portfolio of different asset classes, including bonds.

Back to the old (new) normal

We have entered a period in which the investment environment will be very different from the last decade. The next few years will be a more normal period from a historical perspective that we have not seen for 15 to 20 years, in which the cost of capital is higher. We are going to return to an environment where interest rates are around 4% to 5% over the long term rather than the very low levels we have been used to; at times they have been just above 0%.

The way in which you allocated portfolios previously has to be different going forward. This will impact portfolio construction; not only the regional and country selection but also investment styles as well as making diversification more significant going forward. Alongside challenges, the next few years will offer opportunities for investors, especially those taking an actively managed approach.

There will be various winners and losers; different companies, sectors and countries competing for capital as globalisation is contracting. This follows a lengthy period in which globalisation has been expanding.

Current positioning

Returning to inflation, arguably we are through the worst with the narrative appearing to be that it is rolling back slowly. We believe inflation should continue to fall as the rolling base effects from Covid shutdowns and Russia’s invasion of Ukraine work their way through the system. This should allow central banks to tread carefully and be less aggressive on the hiking front but there also remains a risk of policy surprises or unintended consequences, neither of which are supportive for markets. But the global economy remains on a fairly solid footing despite the recession fears.

Should a recession materialise, we expect a more technical, small ‘r’ recession rather than an aggressive, protracted one.

The UK is the most unloved market in the world yet is looking good value. It has some great listed companies at attractive valuations. We are also positive on Asia Pacific and emerging markets, which have been laggard regions in 2023.

We are becoming more positive about the US. In our last asset allocation rebalancing, we slightly increased our exposure to US equities in our higher risk portfolios but we are mindful of the strong run a small number of AI-related names have experienced in recent months.

Within bonds, we think that yields should form a range around current levels but, as ever, the path they take will not be linear and we maintain exposure to this asset class for its long-term diversification to equities, some level of inflation protection and, latterly, strong income. For now, we retain a lower duration position in our fixed income allocation as central banks prevaricate over the timing and extent of rate rises and tapering.

We believe gilts now offer the prospect of delivering real yields in the medium term once the inflationary spike abates, while the spreads that investment grade corporate bonds now offer over sovereign bonds mean that quality businesses are trading at good value and offer attractive nominal yields. Our view on high yield remains neutral rather than underweight.

A final word on cash

Longer term, clients are potentially missing out on the real returns form equity markets that have historically significantly outperformed bonds and cash. Over the next 7 to 10 years, the case for holding equities is very clear.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds and Model Portfolios managed by the Multi-Asset Team may be exposed to the following risks:

Credit Risk: There is a risk that an investment will fail to make required payments and this may reduce the income paid to the fund, or its capital value. The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay; Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss; Liquidity Risk: If underlying funds suspend or defer the payment of redemption proceeds, the Fund's ability to meet redemption requests may also be affected; Interest Rate Risk: Fluctuations in interest rates may affect the value of the Fund and your investment. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; Derivatives Risk: Some of the underlying funds may invest in derivatives, which can, in some circumstances, create wider fluctuations in their prices over time; Emerging Markets: The Fund may invest in less economically developed markets (emerging markets) which can involve greater risks than well developed economies; Currency Risk: The Fund invests in overseas markets and the value of the Fund may fall or rise as a result of changes in exchange rates. Index Tracking Risk: The performance of any passive funds used may not exactly track that of their Indices. Any performance shown in respect of the Model Portfolios are periodically restructured and/or rebalanced. Actual returns may vary from the model returns.

The risks detailed above are reflective of the full range of Funds managed by the Multi-Asset Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.