Lower-than-expected US inflation data last week prompted a rally in bond markets which drove yields lower. This is the seventh such rally in the last 18 months or so as investors search for signs of an end to interest rate hikes and the proximity of interest rate cuts.

However, for high yield investors we think its important to remember that it is not necessary to call a turning point in markets in order to make good investment returns. What we view as more relevant to sustained returns in the high yield market is the good quality new issuance in recent weeks. The slightly better inflation data should catalyse further such issuance in the near term.

For example, Ineos Styrolution issued secured bonds with an 8.5% coupon. This base chemical company is of course cyclical, but the issuance helps improve its credit profile so that the majority of debt doesn’t mature until after 2026. The bond has been designed with a package of protections for its holders that allows credit rating agencies to give it a BB rating – the higher quality end of the high yield world.

Another BB issue comes from French recycling company Paprec. Some of the glow on its Tricolore halo has been dimmed by recent controversies related to its founder, but we see value in its six-year secured, BB-rated euro bonds at 7.5% which have allowed it to refinance near-term debt, with the next bond maturity not due until 2027.

Discount store owner, B&M, a highly successful retail story in a world of closing bricks and mortar shops, this week issued BB+ bonds with an 8.125% coupon. Meanwhile, Barclays recently announced a USD additional tier-1 (AT1) bond with initial price talk at 10.5%. It wasn’t long ago banks were issuing AT1 bonds with coupons below 5%.

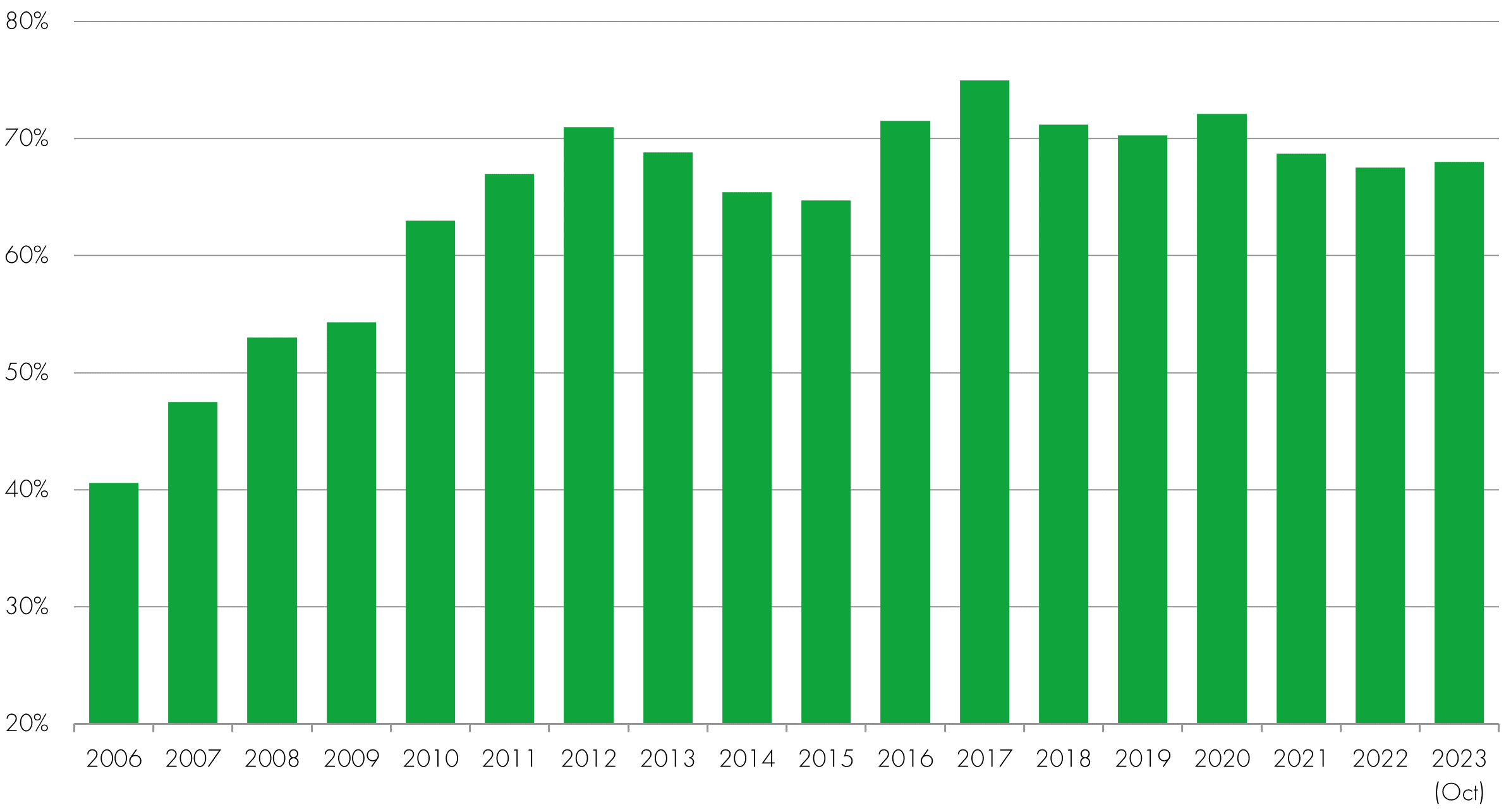

The high yield market has evolved in recent years towards higher-quality bonds, as shown by the chart below of BB issuers as a proportion of the market:

% of BB in European High Yield bond market

Source: Bloomberg, ICE BAML, Liontrust

Source: Bloomberg, ICE BAML, Liontrust

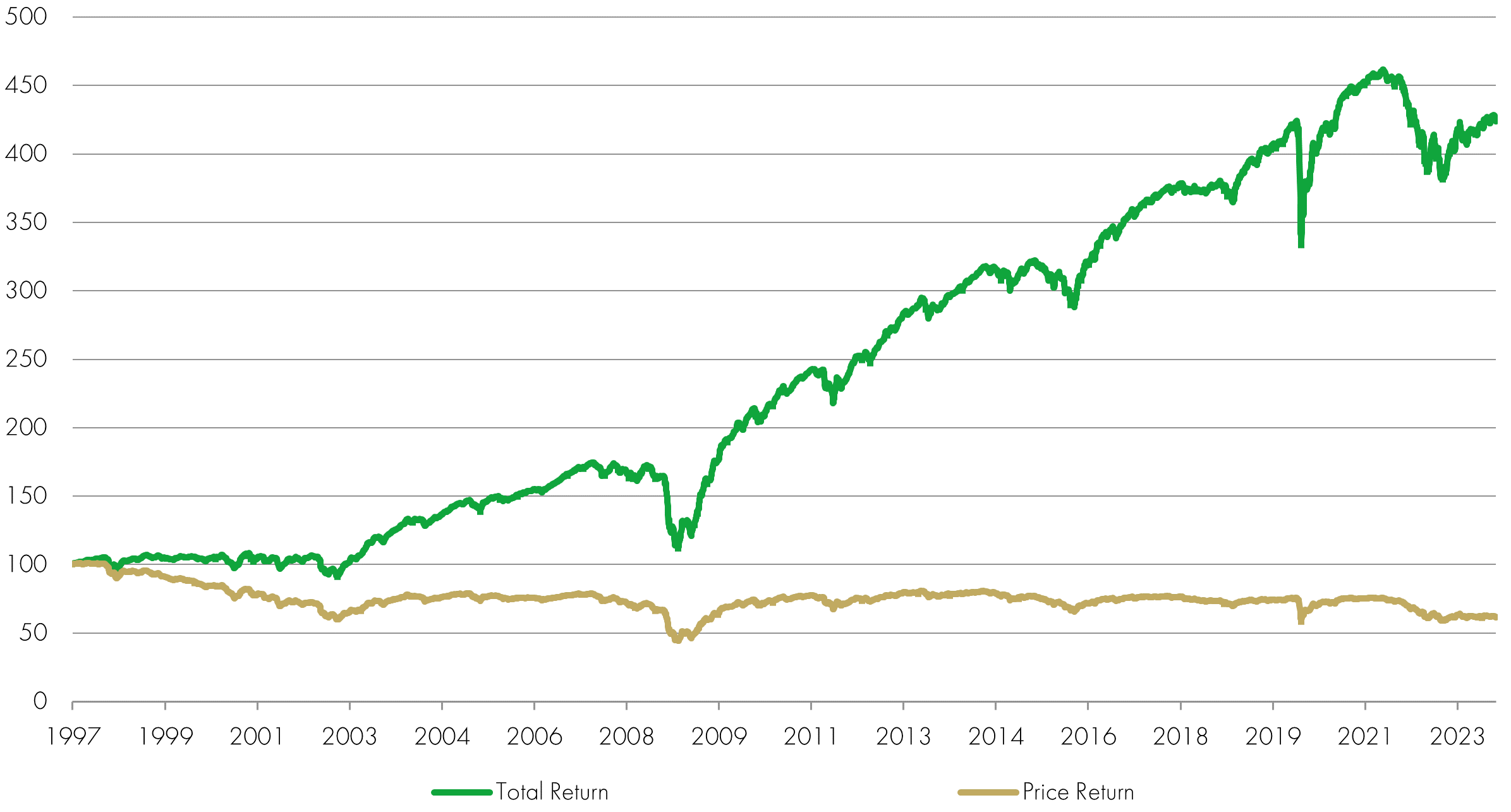

We have consistently highlighted the ‘evergreen’ nature of high yield bonds. While periods of market volatility will lead to times when bond prices trade at a in profit or loss relative to purchase price – a concept known as the ‘marked-to-market’ return – these fluctuations can be set aside if bonds are held for the medium to long term, allowing the coupons to take centre stage. It is these coupons that ultimately drive returns in the high yield market.

If held to maturity, the price return from high yield bonds as a group will be marginally negative due to the impact of a small number of issuers defaulting. Not only can this negative price impact be alleviated by selecting high-quality issuers less likely to default, it is also massively outweighed in the long term by the large positive returns from coupon income. The chart below shows the difference between the ICE BofA Global High Yield Index’s moderately negative long-term price return and its impressively positive total return - a difference which is accounted for by income.

ICE BofA Global High Yield Index Total Return versus Price Return

Source: Bloomberg, ICE BAML, Liontrust

The current average coupon in the high yield market is 4.2%, but we think it’s only going in one direction and will sustain decent, quality return from high yield bonds in the years to come.

The 9% yield on the Liontrust GF High Yield Fund, in our view, guides us very well on the future return outlook on the asset class.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Fixed Income Team:

Consider environmental, social and governance (""ESG"") characteristics of issuers when selecting investments for the Funds. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. Hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of the funds over the short term. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. May target an absolute return. There is no guarantee that an absolute return will be generated over the time period stated in the fund objective or any other time period.

The risks detailed above are reflective of the full range of Funds managed by the Global Fixed Income Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.