In this new series, 'AI - tried & tested by the Global Innovation team’, the fund managers focus on the key industries and products where AI is democratising technologies and capabilities, opening up new markets and growth opportunities for certain companies. In this article, fund manager James Dowey uses a large language model to build a simple model to use to forecast US economic growth.

You can read the other articles here:

The rise of AI co-pilots: harnessing your personal assistant for innovation

Firefly - a small step for AI, a giant leap for Global Innovation

“Not everything that counts can be counted. And not everything that can be counted really counts”, Albert Einstein is believed to have said. Indeed, in this industry of investing in which we ply our trade, numbers rule. And no more so than in the immensely difficult, usually hated but often unavoidable task of making forecasts.

Managements’ formal quantitative guidance on future revenues and earnings weighs heavily in analysts and investors’ expectations for companies. When it comes to the overall economy, investors and economists obsess over the US Federal Reserve Federal Open Market Committee (FOMC) members’ dot plots (the committee’s expectations on interest rates over time) and other such metrics from the Fed and other major central banks.

The tyranny of numbers is well illustrated by a story the late, great Nobel Prize winning economist Kenneth Arrow used to tell about his first ever job, which was as a weather forecaster in the US Air Force during World War II. After a while, Arrow determined that his forecasts were not much better than pulling predictions out of a hat and wrote to his superiors, asking to be relieved of the duty. He received the following reply: “The Commanding General is well aware that the forecasts are no good. However, they are required for planning purposes.”

Indeed, numbers are usually at their best when they are supported and enriched by qualitative detail and colour. How well are the newest products being received by early adopting customers? How is the order book shaping up? Where are the snags in supply chains, are they improving or getting worse? Are customers feeling the pinch? Are they trading up or trading down?

But as Mervyn King and John Kay argued in their 2020 book Radical Uncertainty: Decision-making for an unknowable future, because qualitative data is tricky to handle it usually gets underweighted compared with the hard numbers, or even ignored altogether. And that is a shame.

Enter large language models (LLMs), a popular new tool in the artificial intelligence toolkit developed during the past few years that has rocketed to prominence since the release of the blockbuster app ChatGPT last November.

LLMs are not just about processing vast amounts of data. They excel in understanding and interpreting language. This means they can analyse qualitative information with a degree of nuance and insight previously unattainable and hold the promise of finally putting due weight on the detail and the colour within forecasts.

Furthermore, the beauty of LLMs is that they are simple to use. Certainly, we found that building a basic version of a forecasting model that incorporates qualitative information is achievable within less than an hour’s work.

We the Global Innovation team at Liontrust are bottom-up investors and spend most of our time researching individual companies. Nevertheless, an accurate and balanced view on the economy is very helpful. To illustrate our point, we took the US Federal Reserve’s FOMC minutes (which contain the committee’s detailed discussion and debate on economic conditions and the outlook), fed them into an LLM (Open AI’s ChatGPT-4) to build a simple model to use to forecast US economic growth.

In terms of the specifications, we simply took each set of December meeting minutes (the committee meets eight times a year) from the past 30 years and asked ChatGPT to score the FMOC’s outlook for economic growth over the year ahead on a scale of 0 to 10 based on their broad qualitative discussion of macroeconomic conditions.

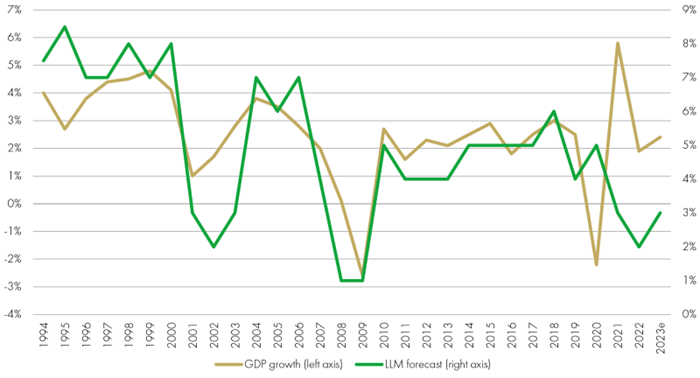

The chart below shows US real GDP since 1994 (and currently expected GDP for 2023 based on Bloomberg consensus) and our LLM outlook score taken at the end of the prior year. While of course far from perfect – the model, for example, failed miserably to navigate the volatility of the Covid period – the forecast is surprisingly good given the simplicity of the approach.

The two series have a correlation of 0.58, which is quite a good correlation with GDP growth for a forward looking variable. Indeed, the same correlation for the prior year-end Bloomberg consensus US GDP forecast is 0.63. So, it appears that using an LLM one can build a pretty respectable economic forecasting tool within the hour.

US GDP and LLM Forecast 1994-2023e

Source: Liontrust research and Bloomberg, December 2023

The obvious next step, and beyond our ambitions in this note, would be to add the LLM forecast into a broader forecast framework, for example adding it as an explanatory variable alongside others in a regression model to combine the quantitative analysis and qualitative debate in harmony..

But one could also go much further than we have here to incorporate qualitative information into the forecast using LLMs. In particular, the potential to measure and weigh sentiment from online text in the news, financial analysis and social media etc using LLMs is interesting. Existing approaches using natural language processing are well known, but LLMs are likely to prove significantly better due to their far superior handling of language and context. They may finally provide a suitable way to incorporate the economic impact of Keynes’s famous though long-elusive “animal spirits” into forecasts.

Moreover, the example of such a simple application within a domain of expertise with a non-trivial payoff serves as a small indication of the power of LLMs to drive productivity in the coming years. LLM’s accessibility plus their efficacy plus their extremely wide applicability is a powerful economic formula.

Forecasting will no doubt remain a difficult and perilous job, but LLMs may help drive the frontier forward as they are beginning to do for many challenging tasks across the economy.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.