The world of commerce is no stranger to change: from local shops to big-box retailers, business models have evolved over time, driving unit costs lower, improving convenience, and broadening selection to attract buyers and sellers alike. Such network effects have enabled winners to scale at the expense of incumbents, most notably since the advent of the internet where e-commerce has driven the meteoric rise of familiar giants such as Amazon and Alibaba. This represents the current status-quo, with shoppers increasingly shifting online – Amazon’s US online sales grew at a 14% compound annual growth rate (CAGR) from 2018 to 2023, far outpacing Walmart stores at 6%. However, as our lives become increasingly digital, the recent rise of artificial intelligence (AI) has seen a new disruptive threat emerge to further reshape our shopping habits: social commerce.

You may be familiar with the concept – shopping via social media platforms such as TikTok or Meta’s apps such as Instagram and Facebook. These platforms have boomed in popularity, with TikTok and Meta’s apps surpassing 1.5 billion and three billion global daily active users respectively in 2023. Audiences are growing rapidly, particularly among ‘Gen Z’ users who are attracted to intuitive user interfaces and short-form video formats. At the same time, we have seen these platforms evolve from social connection tools to hubs for content creation, more recently, shopping destinations.

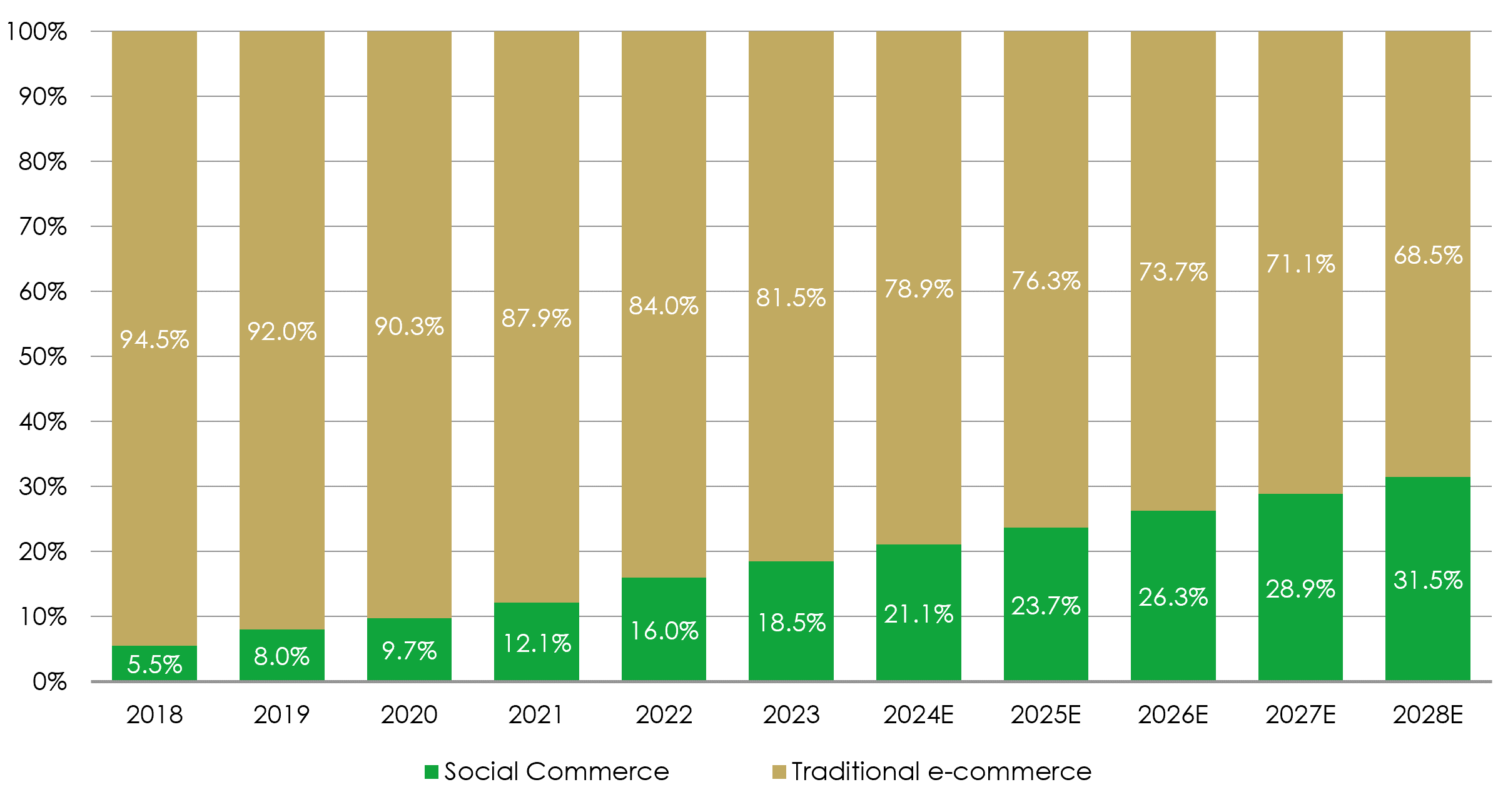

This new shopping format – social commerce – is different to traditional e-commerce as it integrates the entire online shopping experience into a single platform: from inspiration (what to buy) to research (is the product right for you?) to final purchase. This represents a paradigm shift in how consumers interact with brands: when, where and how they shop. Social commerce is growing rapidly, outpacing the growth of traditional e-commerce and accounting for 18.5% of worldwide online sales in 2023. Social commerce sales are on track to reach over $700 billion in 2024 and surpass $1 trillion by 2026 – a 23% CAGR (source: Statista, Liontrust).

Social commerce taking share of e-commerce and to surpass $1 trillion worldwide by 2026

Source: Statista, Liontrust

Social commerce’s user appeal is clear. Products are discovered in content shared by peers, strangers, influencers, or companies. Users can explore these products further via intuitive search functions, a research format that is particularly appealing to young users – TikTok is the new Google for Gen Z. Key to this appeal is authenticity: 81% of consumers trust recommendations of influencers more than brands themselves (source: Matter Communications, Feb 23), and users engage more with content shared by more “real” counterparts (micro-influencers and average joes).

The mix of image and video formats means users can see products in dynamic real-world settings and benefit from experiences such as instructional videos and before-and-after comparisons. Purchase decisions can be solidified through interactions, with customers able to ask questions, check stock and make requests in real-time. Finally, these platforms enable customers to purchase goods easily and directly, either on-platform or through quick links to seller sites, foregoing the need to shift to other platforms such as Amazon.

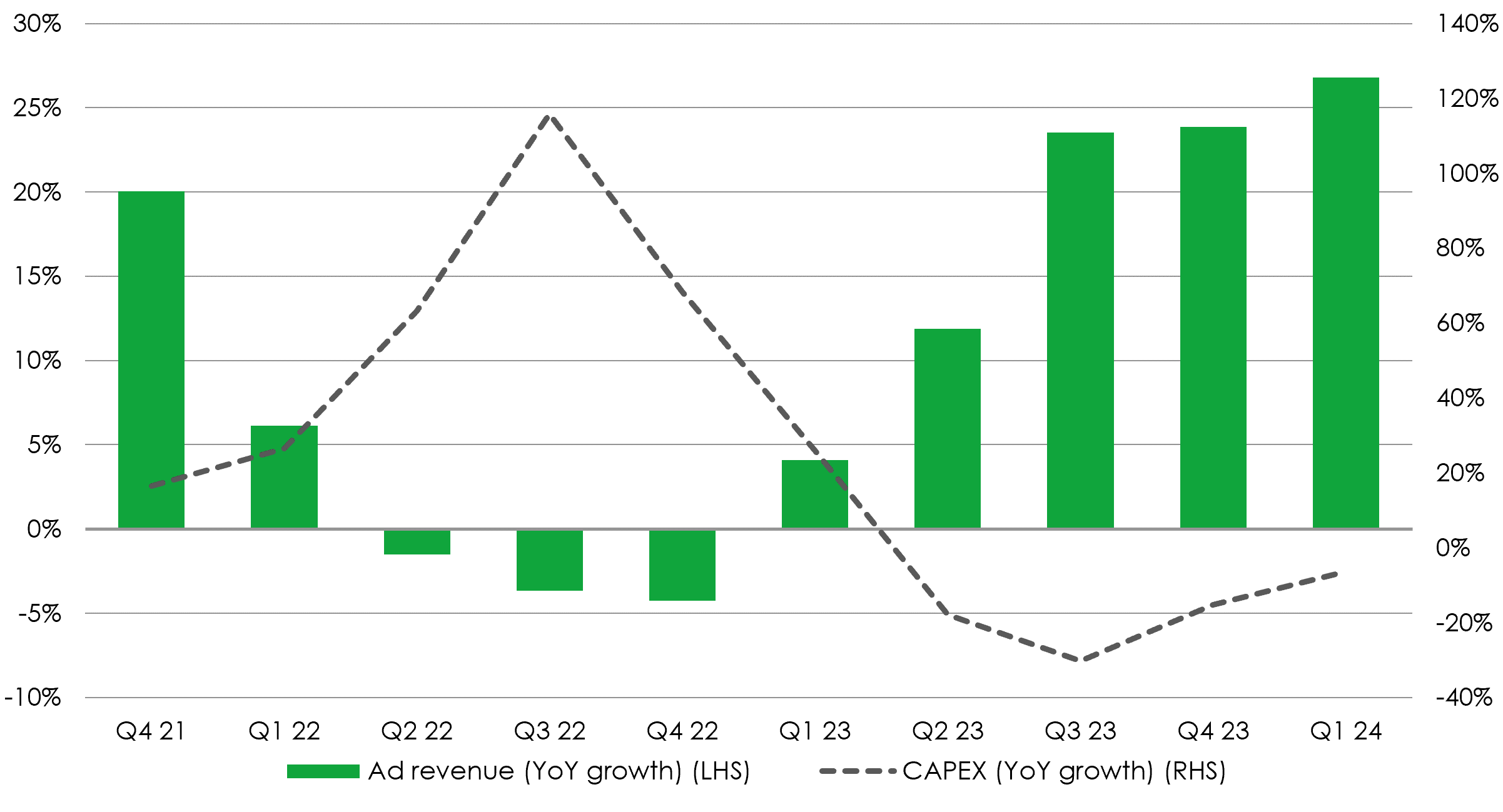

Investment in artificial intelligence will drive the rise of social commerce

The key to the success of these social platforms lies in its AI-powered recommender systems. Social media platforms ingest and generate enormous amounts of unstructured data such as biometrics, engagement, videos and images, interactions, and increasingly purchasing decisions. Companies like Meta have invested heavily in computing infrastructure over the past few years to enable it to use this unstructured data to train and run powerful AI systems that recommend image and video content based on what users like, not just who they follow. This AI is driving engagement and is increasingly pervasive within these platforms: Meta recently reported that 50% of recommended reels content on Instagram – the next video a user sees when they scroll – is recommended by AI.

These AI recommender systems improve targeting as products are more likely to be seen by relevant and interested customers, driving higher returns on advertising spend for brands and retailers who are increasingly turning to social media − either directly or via influencers − as a marketing channel. These companies can also highlight content from real-world users engaging with their products, bolstering authenticity and marketing reach at near zero cost. Further, AI-powered features such as content creation tools and automated chatbots help improve customer experiences and lower costs, driving customer conversion whilst supporting bottom-line expansion.

Meta ad revenue growth driven by CAPEX investment for recommender AI

Source: Company reports

The rise of social commerce exemplifies Clayton Christensen’s concept of disruptive innovation: social platforms, initially serving different markets, have gradually improved their offerings and leveraged AI to attract mainstream customers in the e-commerce space. This presents an innovator's dilemma for incumbents: they must choose between focusing on their current, profitable customers or addressing the emerging, potentially less profitable social commerce market. To fend off this threat, incumbents may need to make economic sacrifices such as lowering platform fees or investing in new features that may not immediately benefit their core business. However, replicating a social platform is challenging − even Google failed here with Google Plus. For incumbents like Amazon, allocating capital towards building a social network could yield low returns and divert resources from high-priority projects, such as expanding its cloud division or developing its low-cost marketplace to fend off emerging threats like Shein and Temu.

How will this space evolve going forward?

Social commerce is likely to continue exhibit strong growth, particularly in western markets which lag China. Live-streamed shopping on these platforms is growing particularly fast, already accounting for roughly $50 billion in US sales in 2023 and forecast to reach $80 billion by 2025 (source: McKinsey). By comparison, China’s livestream selling market grew from $3 billion to $171 billion in just three years from 2017-2020, and accounted for 20% of e-commerce sales in 2023 according to Shopify.

Nonetheless, incumbents like Amazon still command an envious lead in e-commerce, with large marketplaces, strong fulfilment networks, substantial compute infrastructure, and significant resources driving continued strong sales growth. Sellers and buyers alike tend to commit to multiple channels for commerce, meaning there is unlikely to be a winner-takes-all scenario in this arena.

As we move towards a future where augmented and virtual reality platforms are likely to shift the shopping landscape again, there is further opportunity for all large selling platforms to innovate and benefit at the expense of bricks-and-mortar stores. As AI continues to blur the lines between social media and e-commerce, it would seem that social platforms are very well positioned for this future.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income. The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.