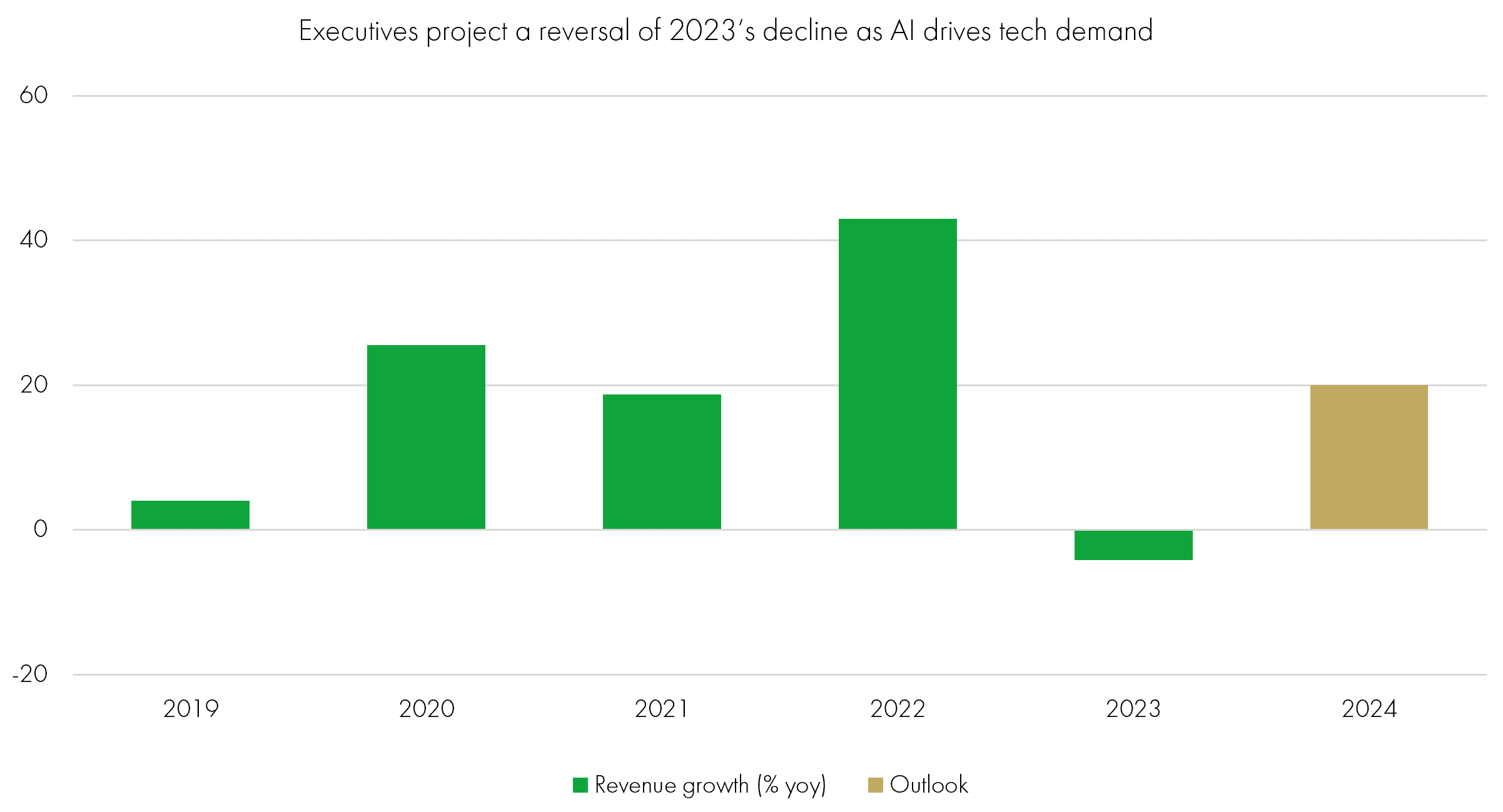

Leading chip manufacturer Taiwan Semiconductor Manufacturing Company yesterday published its Q4 earnings update and with expectations of revenue growth of 20% in 2024, has the semiconductor industry finally turned a corner?

Taiwan Semiconductor Manufacturing Company (or TSMC as it’s better known) is widely regarded as the “world’s foundry”, acting as the main chip maker for leading technology companies such as Apple and Nvidia. The largest manufacturer in the world[1], it continues to innovate and drive forward leading-edge chip technology used in mobile phones, computers, and datacentres, and which underpin recent advancements in AI.

Yet despite its formidable scale and IP, as a manufacturer TSMC is still susceptible to industry forces and cyclical swings. 2023 was a tough year for the semiconductor industry, with weakening global macroeconomic conditions and high inflation and interest rates exasperating a prolonged semiconductor inventory cycle and overall years-long “tech slump”.

However, if TSMC’s Q4 earnings update yesterday are anything to go by, it appears the industry may have turned a corner, with its CEO Che-Chia Wei announcing “our business has bottomed out on a year-over-year basis and we expect 2024 to be a healthy growth year for TSMC”.

Chipmaker TSMC expects growth to bounce back in 2024

Source: Bloomberg, TSMC, January 2024.

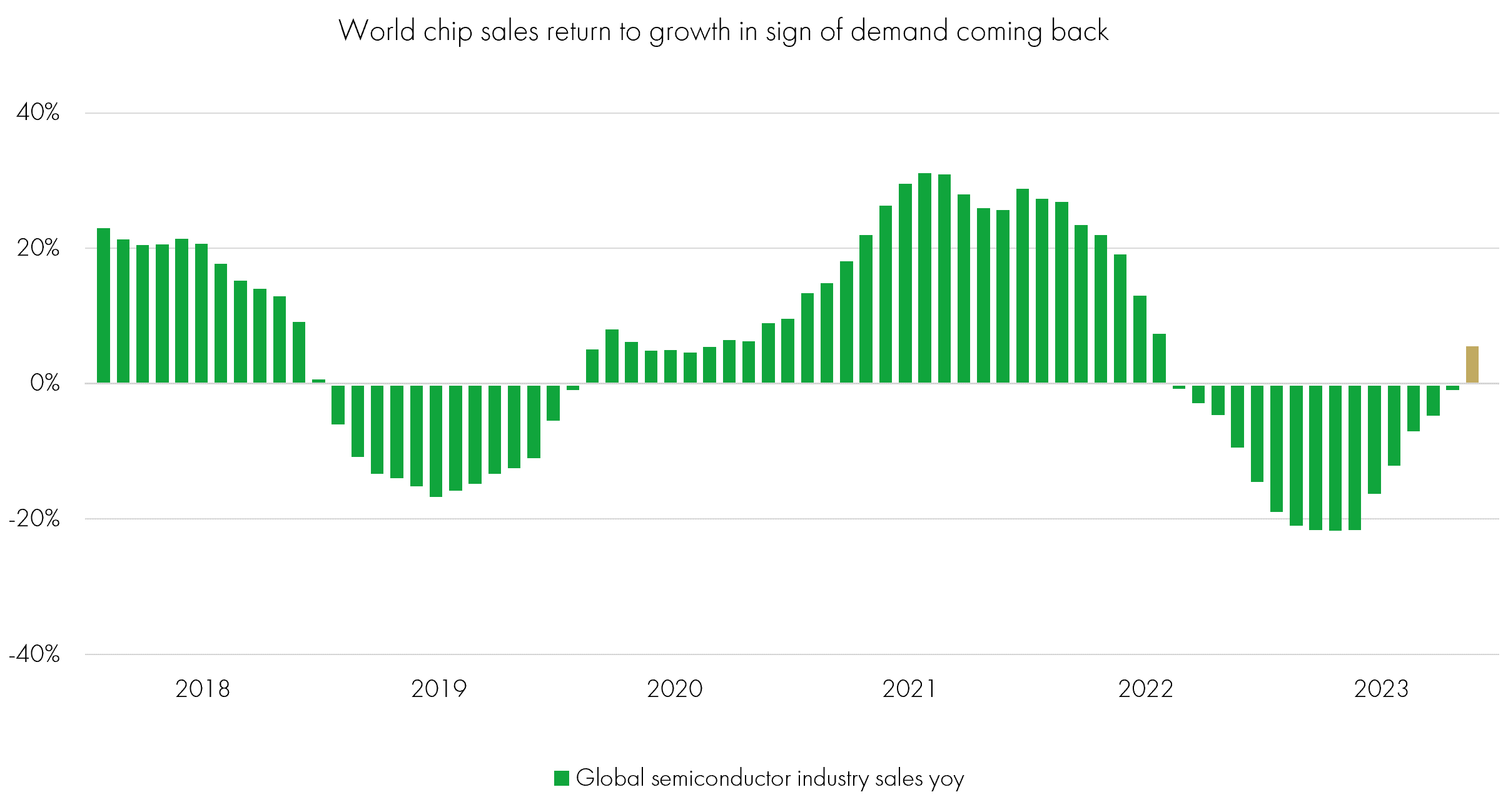

Signs of a turning cycle

TSMC is expecting revenue growth to of at least 20% for the year ahead, marking a stark contrast to the negative growth experienced in 2023 and signalling a potential turning point in the industry cycle. Accompanying this positive outlook is TSMC's readiness to increase capital spending, ensuring it is well-equipped to meet any additional demand. This strategic move underlines the company's confidence in a robust recovery and its commitment to maintaining its industry-leading position.

Recovery sprouting

Source: SIA, Bloomberg, January 2024.

AI at the forefront

Central to TSMC's growth expectations is the global AI development boom, a sector requiring the powerful chips that are TSMC's forte. CEO Che-Chia Wei emphasised the company's pivotal role, akin to its influence in the smartphone industry with Apple, in driving the AI revolution. He stated: “The surge in AI-related demand in 2023 supports our conviction that demand for energy-efficient computing will accelerate.”

TSMC is a key enabler of AI applications. With AI technology rapidly evolving towards more complex models and increased computational needs, TSMC's advanced semiconductor technologies are becoming increasingly valuable. Reflecting this, TSMC has raised its AI revenue contribution expectations to at least high-teens by 2027, up from low-teens just six months ago. This upward revision not only reflects the current momentum but also TSMC's strong positioning to try to capitalise on the burgeoning AI market.

Global Innovation funds

In Q4, we invested in TSMC across all three funds in the Global Innovation fund range. This classic innovator enabled the platform shift to accelerated computing and when combined with the cyclical weakness, we were able to build positions at a great entry price. We believe this is the start of a new technology cycle and that TSMC is in prime position to benefit from the build out of a new computing infrastructure.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.