On 1st February, India's finance minister Nirmala Sitharaman presented the interim budget in Parliament − a statement by the outgoing government ahead of an upcoming general election in April/May, and an opportunity to lay out the shape of what would be an historic third consecutive term for prime minister Modi and his Bharatiya Janata Party (BJP). Budget statements ahead of elections are typically an opportunity for governments seeking re-election to offer last-minute sops to key electoral constituencies that need to be won over, usually at the expense of fiscal probity. Last-ditch fireworks and giveaways to secure a return to power – the very definition of short-term necessity trumping long-term planning. It was, therefore, especially encouraging that Sitharaman offered nothing of the sort, but rather a clear statement of intent − business as usual − issued from a position of strength and confidence.

The not-so Fragile 5

This strength and confidence could not be more of a contrast with a decade ago, when India was labelled as one of the ‘Fragile 5’. A Morgan Stanley report coined the term in 2013, referring to a group of emerging market economies that were heavily reliant on external financing and therefore vulnerable to a sharp increase in interest rates during the so-called Taper Tantum (the bond market's response to the US Federal Reserve's plans to taper its quantitative easing programme). At this time, India was running a current account deficit of 5% of GDP and the concern was that as the era of cheap cash ran out, it could no longer rely on money flowing in to support investment and growth. Over the subsequent decade, huge steps have been taken to restore the macro-economic stability of India − indeed the current account deficit today sits at around 1% of GDP, a perfectly healthy level for a rapidly growing emerging economy.

With Modi and the BJP at the helm since the emphatic electoral victory in 2014, a huge repair job has been underway. The leadership has addressed imbalances in the domestic economy such as bad debts in the banking system and overcapacity in the industrial sector (financed by cheap loans flowing into emerging markets during the quantitative easing) as well as external stability by shrinking the current account deficit. With this period of austerity and rebuilding largely complete prior to the arrival of the Covid pandemic, India's finances were in a robust position to cope with the economic disruptions of lockdowns. The budget of February 2021 marked a key turning point, with a major upshift in spending including a large increase in capital expenditure, offering a clear reversal of the years of fiscal contraction, and set the stage for a re-ignition of the long-awaited domestic investment cycle. In short, years of patient spadework in Modi's first term laid the foundations for a sustained investment cycle in the second term. And indeed, India has seen a notable pick up in government spending in recent years, with a clear focus on infrastructure, especially roads and railways. While the rest of the world has seen economic growth rates struggle, India has delivered the fastest real GDP growth of any major economy, at well over 7%.

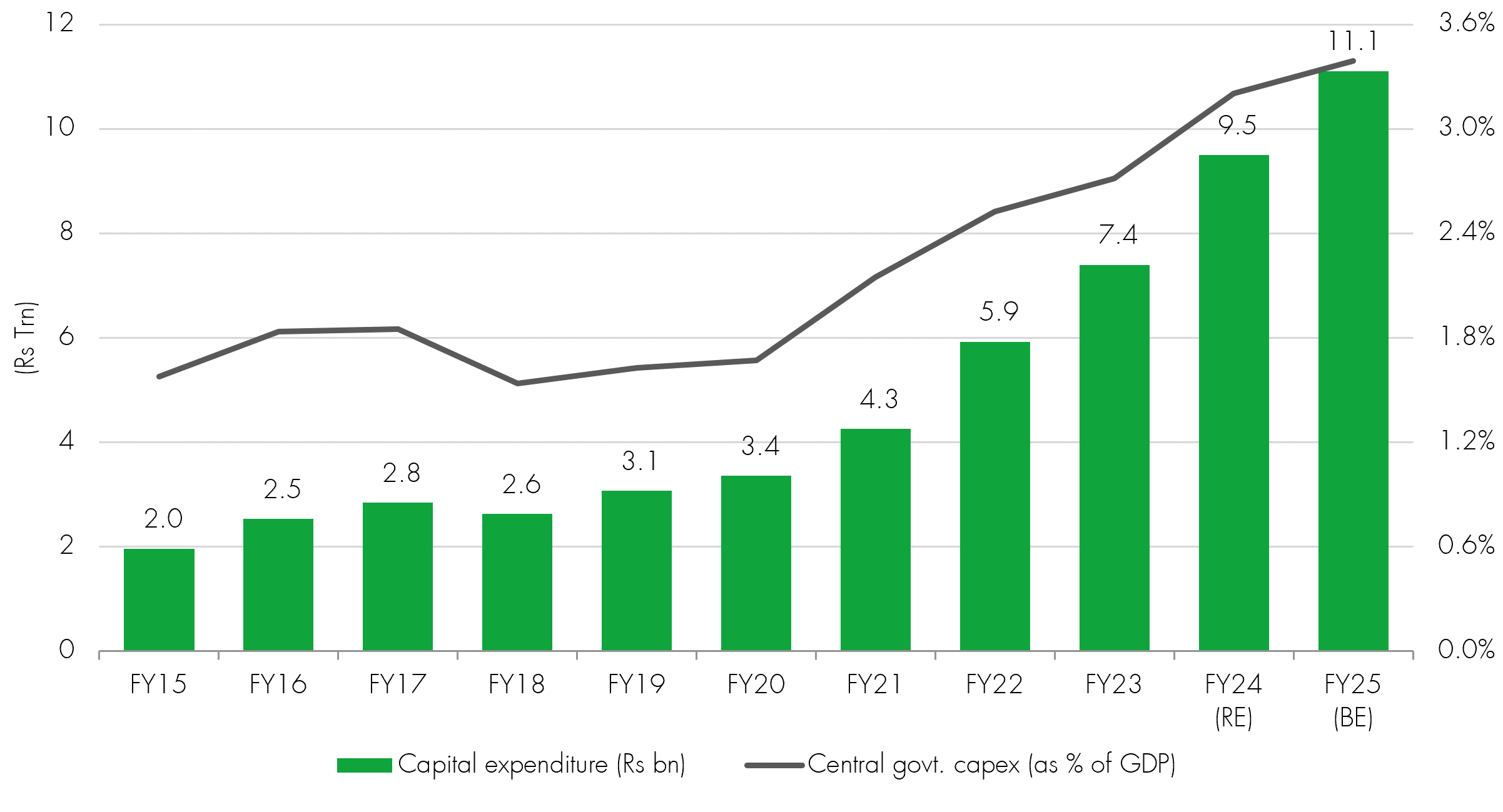

Central government capital expenditure

With this context in mind, we can see this month's interim budget as very much a continuation of recent trends. Government capital expenditure deployment continues, with an expansion of 17% over the previous year. Capex has grown at an impressive compound annual growth rate of 24% over the past five years and, from a much a higher base, the 17% rate of growth indicates a firm commitment to ongoing investment plans, while also recognising that the heavy lifting in the post-Covid phase is largely complete. Importantly, the moderation in the (previously elevated) investment rate sets the stage for the private sector to take up the slack. With capacity utilisation now running at high levels, the next phase of the recovery is expected to see corporates raising their investment plans and an easing in government investment creates space for this. The focus of the ongoing government expenditure remains energy, transport infrastructure and affordable housing – supply side reforms that promise to further unlock India's huge growth potential. A clear and consistent push for a greener economy was also underscored, for example, by the Rs100 billion (£1billion) allocation for solar roof installations.

A fiscally disciplined approach

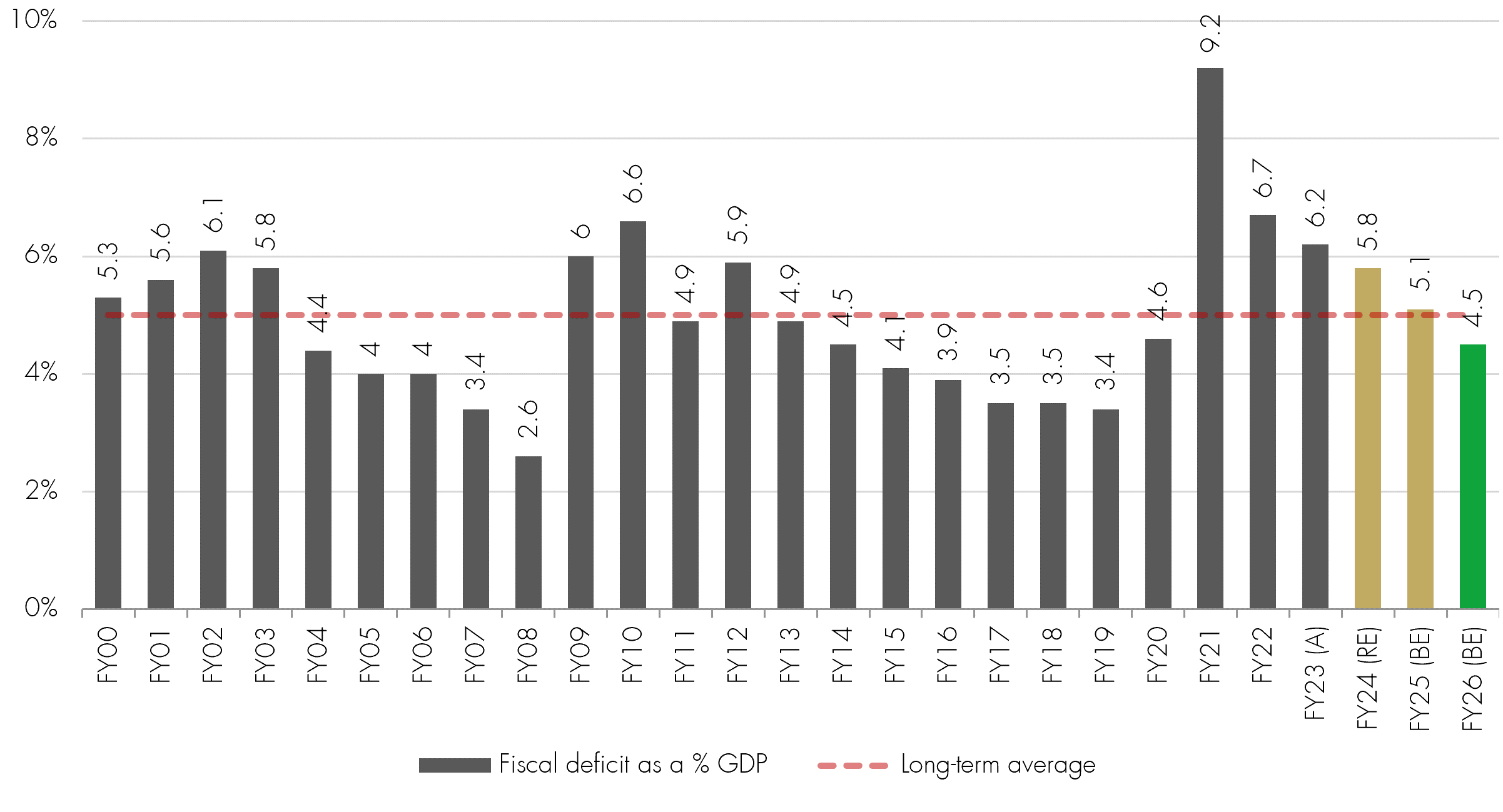

While an ongoing commitment to investment was welcome, perhaps the biggest positive surprise was the emphasis on fiscal discipline. Having spent aggressively in the post-Covid recovery, the government has now set a clear course of budgetary restraint. With the fiscal deficit coming in at 5.8% for the current financial year against an expectation of 5.9% (and compared with a recent peak of 9.2% in 2021), the finance minister proceeded to outline a fiscal deficit of 5.1% for next year. This was a notable improvement on market expectations, and furthermore the minister set a target of below 4.5% for the year after that, bringing the deficit below the long-term average. This counter-cyclical fiscal policy serves to strengthen macroeconomic stability and create a robust foundation for strong medium-term growth. At a time of uncertain global outlook, consistently raising capital expenditure while maintaining fiscal discipline only serves to underline India's long-term appeal.

India’s improving fiscal deficit

Source: Ministry of Finance, CLSA, February 2024. Note: BE stands for budgeted estimate, RE stands for revised estimate, A stands for actual (vs. estimate)

The interim budget refrained from populism, with no new social scheme announced or expanded. With the BJP significantly outperforming expectations in recent state elections and polls indicating a solid majority in the upcoming general election, the statement reflected the government's confidence in re-election. Indeed, prime minister Modi has said that this budget should be seen as blueprint of intent for another term. Moreover, it showed a BJP party confident of a return to power and in continuing to push its reformist agenda without being derailed by populism.

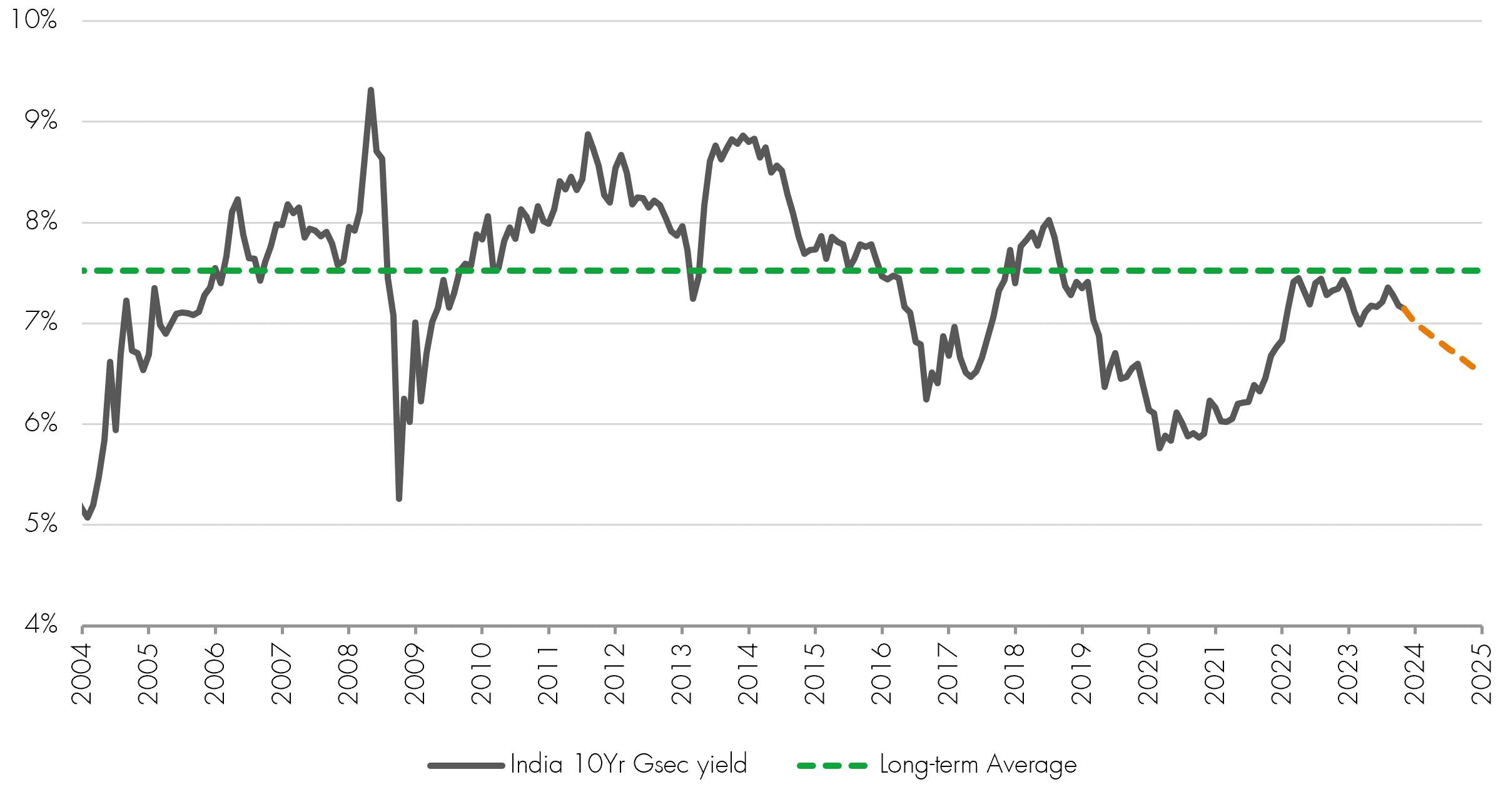

The fiscal restraint also has a further salutary effect − namely the reduction in borrowing should support lower bond yields (which, in turn, supports higher equity valuations). With the US Federal Reserve expected to cut interest rates in the coming months, lower yields in India give even more headroom for the Reserve Bank of India (RBI) to cut rates and further support economic growth. This downward pressure on borrowing costs is further supported by the important news from last year that, as of June 2024, Indian government bonds will be included in the JP Morgan GBI EM index, which is expected to bring in upwards of $20 billion of index-related flows. Indeed, we have seen already half that sum arrive in bond inflows in the past twelve months, with fixed-income inflows outstripping equity flows by a considerable margin year-to-date. This surge in inflows reflects both optimism around upcoming index inclusion, but also the lower than expected borrowing totals in the interim budget. As a rapidly growing economy, India runs a structural current-account deficit, and these large passive inflows work to offset this and provide welcome stability in the external accounts.

Indian sovereign bond yields likely to ease further

Source: Bloomberg, CLSA, February 2024. Note: Data is period-end values

Source: Bloomberg, CLSA, February 2024. Note: Data is period-end values

Sound financial management and long-term growth

The impressive handling of the nation’s finances mirrors the exceptional management of the financial sector by the prudent central bank. The RBI raised rates aggressively and early in the current cycle, getting fully ahead of the curve and maintaining control over inflation (while several developed nations struggled much more significantly with this issue). Given the huge increase in global interest rates – the US 10-year Treasury rate has moved from 0.5% in April 2020 to as high as 5% late last year – it is of huge note that countries such as India, Indonesia and Brazil (Fragile 5 alumni) have managed this cycle so well and emerged in such a strong position. The years of prudent macro repair over the past decade have truly delivered their rewards. A recent intervention by the RBI to increase banks’ risk-weightings to unsecured loans, far in advance of any cracks appearing in credit quality, further underscored how active and engaged the central bank is in assessing risk within the system and the degree to which lessons have been learned from prior periods of stress.

All in all, the interim budget revealed a confident and assured government, focused on long-term growth and intent on resisting short-term temptations towards vote-winning populism. It also serves as a reminder of the years of sound financial management from the BJP's two terms in government, backed up by the impressive RBI. India's growth pathway is currently unparalleled − world-beating economic growth rates on a large base, providing a platform to become the world's third largest economy by 2027. The long-term thinking demonstrated by an investment push married to fiscal conservatism suggests that were Modi to win a third term in government in the coming months, then we should expect more of the same for the next five years.KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in funds managed by the Global Fundamental Team may involve investment in smaller companies. These stocks may be less liquid and the price swings greater than those in, for example, larger companies.

Some of the funds may hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio.

Investment in the funds may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.