Our latest Stocktake looks at American-Swiss medical device company Alcon, a core holding in the ‘Enabling healthier lifestyles’ sustainable investment theme.

This is the fourth article in the series, you can read the other articles here:

Vestas: a renewable investment opportunity

One billion people live with a preventable vision impairment, costing the global economy $411 billion annually according to the World Health Organization (WHO). This figure is likely to grow as many preventative conditions are strongly linked to ageing populations – a trend seen around the world. There are therefore huge opportunities for companies able to prevent sight conditions and improve standard of living.

Vision impairment is rising globally due to an ageing population

The WHO estimates that by 2050, the world’s population of people aged 60 years and older will double to 2.1 billion. The number of people aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million.

This will directly lead to growth in vision problems. Most people over the age of 70 will develop cataracts, so this is set to grow significantly, while the WHO also projects glaucoma to increase 25% between 2020 (76 million individuals) and 2030 (95 million) and age-related macular degeneration to rise 24% over the same decade (from 196 million to 243 million).

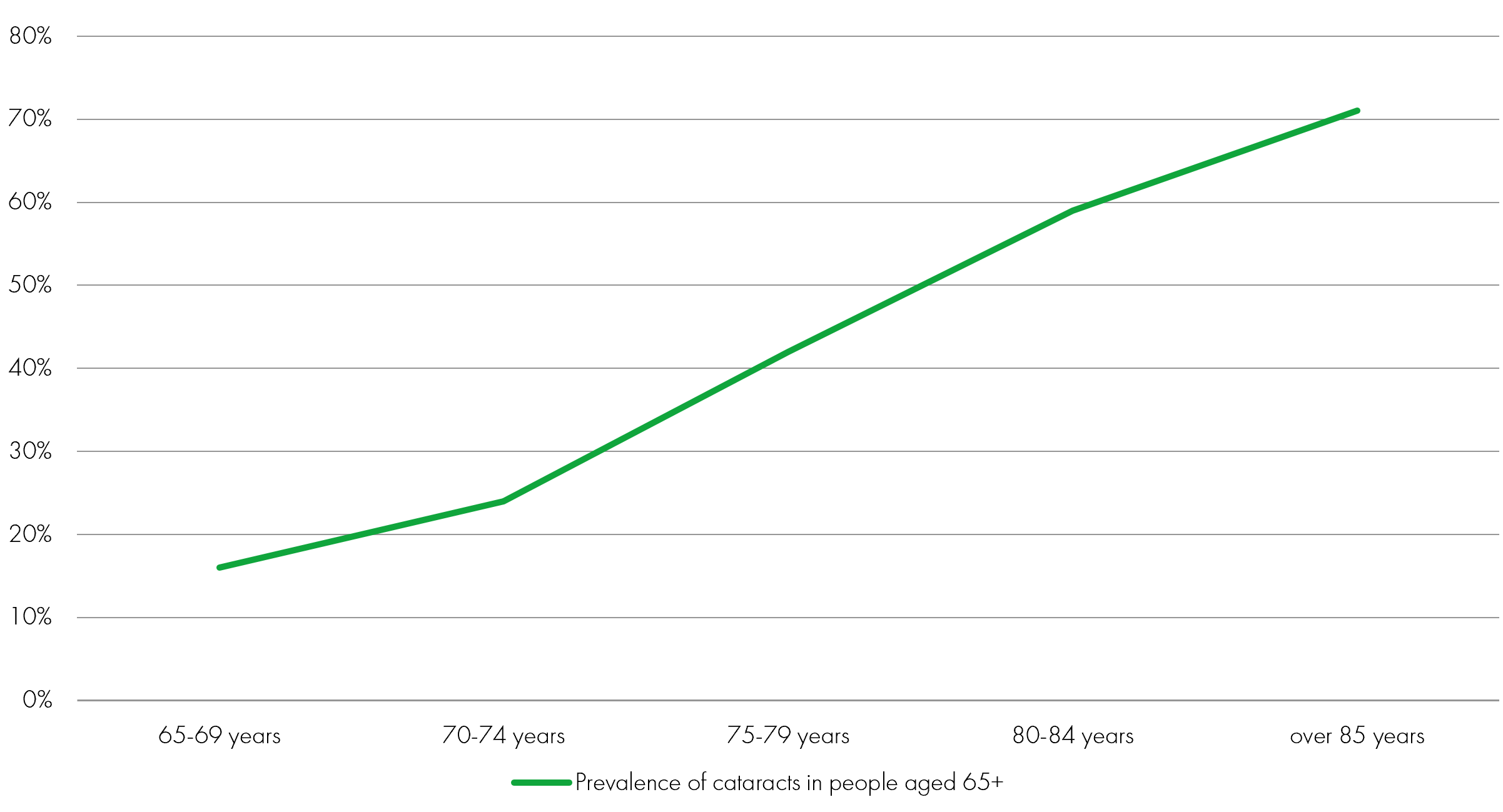

Reduced eyesight can be caused by several factors, including disease such as diabetes and trachoma, trauma to the eyes, age-related macular degeneration and cataracts. Age-related eye disease is often progressive – without treatment, many with cataracts will eventually go blind. Prevalence of cataracts increases as people age – rising from 16% at age 65 to 71% at 85. We expect tailwinds from this trend to grow the ophthalmology market 4% to 5% annually to 2028[1].

Prevalence of cataracts in people aged 65+

Source: National Institute of Health and Care Excellence (NICE), Reidy A, et al. 1998

Vision problems are more acutely felt in low and middle-income countries

Blindness and vision loss are felt more acutely by people in low- and middle-income countries where accessibility to treatment may be lacking. The prevalence of unaddressed distance vision impairment in low- and middle-income regions is estimated by the WHO to be four times higher than in high-income regions. Rates of near unaddressed vision impairment are estimated to be greater than 80% in western, eastern and central sub-Saharan Africa, while comparative rates in high-income regions of North America, Australasia, Western Europe, and Asia-Pacific are lower than 10%.

Alcon – the world’s largest ophthalmology company

Under the Enabling healthier lifestyles theme, the Sustainable Future investment team invests in a broad range of companies that promote healthier lifestyles; to enable, improve, or maintain people’s quality of life and standards of living. The theme supports a variety of exposures, from positive leisure activities such as gym operators, to healthcare companies helping prevent disease or enabling people to manage health conditions.

Within this theme, we believe that vision correction is a strong structural growth market for the coming decades. As illustrated above, there is a high degree of certainty that ageing populations will require a growing volume of corrective equipment and procedures.

We believe that American-Swiss company Alcon is well set to tackle this growing health issue and generate strong returns. This medical device company specialises in the design and manufacture of interocular lenses, consumables and equipment used in ophthalmic surgery and consumer contact lenses. It is the largest company in this space, with a dominant position in the United States and around 40% market share around the world. In the contact lens market, it is the second-largest company, with market share of around 20%.

This dominant position enables a scale advantage in its research and development spend – keeping it well ahead of smaller competition – as well as a significantly larger sales force distributing products widely across the world.

Additionally, many ophthalmology surgeons learn with Alcon equipment during their training and even have their consumable surgery kit customised to their preferences. Taking the time out of surgery to change equipment to a different provider and adopt a new way of working risks surgical mistakes and lost revenue, switching costs which are difficult to overcome for competitors.

Stripping out equipment sales, around 90% of Alcon’s revenues are from ophthalmology consumables and are recurring in nature, either through daily contact lens use or predictable corrective eye surgeries which are a function of age. For example, at 100 years old, it is more than likely that both eyes will have been treated for cataracts. Phacoemulsification machines used to complete the cataract surgery cost c.$50,000 – $100,000 and are often sold at reduced cost to the surgery but with a consumables contract purchase agreement locking customers in.

Another key division for Alcon is intraocular lenses (IOLs), a tiny artificial lens for the eye which was developed in the 2000s. These replace the eye's natural lens during cataract surgery. The lens refracts light rays that enter the eye, helping to provide clear vision. There are a range of IOLs to treat different types of vision impairment with varying levels of sophistication from more basic mono-focal to multi-focal and accommodative, which mimic the eye more closely.

Alcon has taken a sizeable share in the advanced technology intraocular lenses (AT-IOL) market since 2019 with a rejuvenated product suite including PanOptix, Trifocal and Vivity – it is estimated that Alcon has accounts for over 70% market share in the US[2]. This innovative portfolio has been driven by strong research and development (R&D) investment at around 7-9%.

Applying the sustainability matrix to Alcon

While a company might have significant exposure to a theme, the next part of our investment process is to apply our proprietary Sustainability Matrix. For each business, we determine the key ESG factors that are important indicators of future success and assess how well these are managed.

Every company held across the Sustainable Future fund range is given a matrix rating. First, we assess the extent to which a company’s core business helps or harms society and the environment. An A rating indicates a company whose products or services strongly contribute to sustainable development via our investment themes; an E rating indicates a company whose core business is in a conflict with sustainable development (such as tobacco or very polluting activities such as coal fired electricity generation).

Overall, we have rated Alcon an A as it is 100% dedicated to treating vision impairment – a strong net positive impact with minimal negatives. By preventing patients going blind, Alcon extends their quality of life, particularly in older age. It does this through its exposure to ophthalmic surgery – considered necessary to reverse the progression of vision loss.

We also award a 1 (best) to 5 (worst) score for management quality, assessing whether a company has appropriate structures, policies and practices in place for managing its material ESG risks and impacts. Companies must score C3 or higher to be considered for inclusion in our funds.

We have rated the company a 2. Alcon has published its first sustainability report in 2022, which includes key material factors such as environmental emissions, waste, and water, as well as social considerations (employee turnover, diversity and, importantly, health and safety). On these key metrics, the company appears to be on an upward trajectory but it misses absolute targets around the 1.5 degree alignment, disclosure on employee engagement and diversity targets at senior levels. Overall, however, we think Alcon is performing well and managing key impacts, but with some engagement required.

Alcon is set for robust structural growth by helping address a key economic and social issue

Uncorrected vision is a costly health and social issue that can impact quality of life and economic productivity. When combined with an ageing population, we believe that the opportunity to improve vision represents a strong structural growth market for the coming decades. Alcon has a strong installed base of ophthalmic equipment which drives recurring revenues from its innovative consumables portfolio, reinforced through R&D investment. We believe Alcon, with its deeply embedded competitive advantages, is set to further cement its market leading position whilst improving patient lives and extending quality of life for years to come.

Martyn Jones, Fund Manager, Sustainable Future Investment team

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.