In the latest of our ongoing Stocktake series, we cover a key sustainable investment theme – ‘Building better cities’ – and take a closer look at construction chemicals manufacturer Sika.

This is the third article in the series, you can read the other articles here:

Vestas: a renewable investment opportunity

More than two-thirds of the world's population are likely to be living in cities by 2050 due to rapid urbanisation. This will increase demand for new infrastructure and, as a result, concrete to build with, as well as the need to maintain the structural integrity of buildings through repairs. This has clear environmental impacts. How can we look to ensure the creation of ‘better cities’ with more desirable outcomes?

Building better cities

Today, 55% of the global population live in cities, but this is projected to reach 68% by 2050 – equating to urban growth of 2.5 billion people. Of this expansion, 90% is expected to be in Asia and Africa, of which 35% will take place in just three countries: China, India, and Nigeria. Urbanisation offers people a route to higher standard of living in emerging economies, but it is these cities that are often those most susceptible to climate change.

From a sustainability perspective, urbanisation is not an altogether undesirable trend. The benefits of higher urban density include greater productivity and innovation for service industries, better access to and utilisation of goods and services, and more energy efficient construction and transportation. It is, however, a trend that brings substantial sustainability challenges. For example, unless good planning is in place, one negative consequence of urbanisation is urban sprawl, which greatly increases the environmental impact of cities.

Urban sprawl is the low-density physical expansion of cities that occurs when land-use growth exceeds population growth and urban planning. It can lead to greater environmental impacts from increased land use and forms of transport, as well as social issues such as income inequality between localities.

Unfortunately, sprawl is a global phenomenon that appears to be getting worse. There are a number of examples in the US such as Chicago or more recently Houston, which takes up the same space as Singapore with just 40% of the people.[1]

Even when sprawl is avoided, cities face significant challenges such as minimising construction and operating emissions, providing affordable housing for those on low incomes, avoiding poor air quality, and climate change adaption to cope with heat island effects and surface water flooding.

It is clear from the sustainability challenges surrounding the huge projected growth in urban areas that Building better cities deserves its place as one of our 20 key sustainable themes.

There are a number of solutions emerging to deal with the challenges around cities, such as modern methods of construction, digitisation of buildings (to create efficiencies in both construction and maintenance), HVAC (Heating, Ventilation and Cooling) and BACS (Building Automation and Control Systems).

Sika – improving the performance of construction materials

The Liontrust Sustainable funds invest in a range of companies exposed to the Building better cities themes, including specialists in insulation, HVAC, BACS and building information modelling, as well as the best in class within the housebuilders and real estate sector.

In this Stocktake, we focus on Swiss group Sika, which produces specialist construction chemicals for the building industry. Sika has five core technology competencies which underpin its product range: thermoplastic systems; adhesives; mortars; coatings; and concrete systems. Construction accounts for around 80% of Sika’s revenue. The business’s positive impact in this emissions-intensive industry comes through its ability to reduce the environmental impact of products.

Firstly, 45% of group sales and 70% of sales in developed markets are in renovation, which is commonly increasing the efficiency of buildings through measures such as better insulation or sealing. Secondly, its products improve durability and longevity – for example, by making a structure more resilient through water-proofing.

Currently cement production is estimated to account for up to 8% of global carbon emissions[2]. Yet with increasing urbanisation leading to rising demand for infrastructure – and ultimately, cement – the environmental impact of this key material also looks set to rise sharply.

Unfortunately, cement emissions are difficult to reduce because there are no other materials available at the required scale to build the homes, hospitals, schools, and transport infrastructure needed for a clean, healthy and safe environment. This is a key area where Sika’s products can help reduce the embodied emissions in construction.

Sika has a range of innovative chemical admixtures that enhance the properties of concrete, such as its ViscoCrete and Sikament products. Its cement additive Sikagrind reduces the attraction of fine particles during grinding in the production process of cement, reducing the carbon-intensive clinker content of concrete and the environmental emissions that come with it. Sika estimates that ViscoCrete, Sikament and Sikagrind alone save 100 million tonnes of cement annually and prevent 65 million tonnes of carbon dioxide emissions.

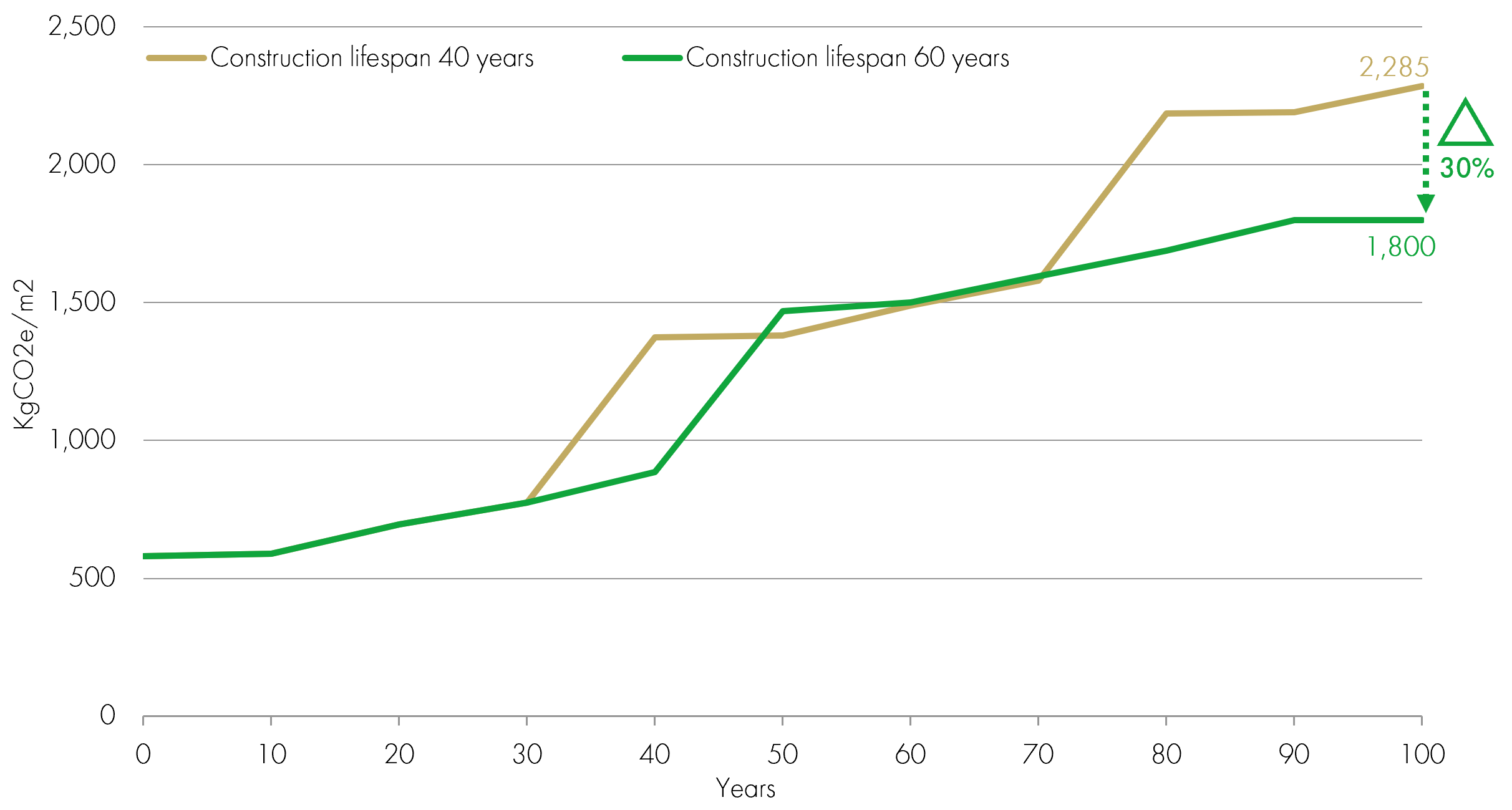

Many of Sika’s products improve the performance of materials and so either reduce the amount used or prolong the lifespan of a building. As the graph below shows, extending the useful life of a building reduces the frequency of demolition and reconstruction, thereby reducing resource demand and emissions.

Durability increases construction resource efficiency

Source: Sika Company Presentation, WBCSD; Sika modelling.

Sika has also developed a novel process that can recycle concrete waste from demolition and reuse it as building material again, rather than downcycling it to be used as road tarmac, which is the standard today.

Applying the Sustainability Matrix to Sika

Construction is a large part of the global economy, typically contributing 5% to 10% of economic output. With cement production accounting for between 6% and 8% of global carbon dioxide emissions, even a quarter reduction could move us noticeable closer to net zero. Because Sika generates 80% of its sales from construction, it has a significant ability to contribute to sustainable development. An estimated 25% of sales comes from concrete admixtures, which we award an A for product sustainability, the highest rating in our proprietary Sustainability Matrix. Overall, the company scores a B when its full product range is considered.

The other component of our matrix ratings is a 1 (best) to 5 (worst) score for management quality, which assesses whether a company has appropriate structures, policies and practices in place for managing its ESG risks and impacts. Companies must score C3 or higher to be considered for inclusion in our funds.

We have scored Sika as 2, reflecting its good ESG disclosure, strong culture and human capital management. It has also committed to near and long-term carbon emission reduction targets, which are currently being validated by the Science Based Targets initiative. Aiming to reduce emissions in absolute terms is very positive in the context of the high-growth strategy for the business. However, we think Sika has room to improve with its remuneration policy – particularly around performance targets for annual bonuses – and its health and safety record.

Overall, Sika scores B2 and is a core holding in a number of our Funds.

Interestingly, Sika is rated as an A by MSCI, the top-tier of its ‘average’ band of ESG performers, but only the third of seven rating levels overall – below the AA and AAA designations of ESG ‘leaders’.

We’ve previously discussed the perils of attaching too much importance to the convenient sustainability numbers provided by ratings agencies, and this seems to be another case in point. Sika has been marked down by MSCI partly because it operates in high-emission sectors with stringent regulations on carbon and chemical safety, but this assessment seems to overlook that decarbonisation is a key part of Sika’s product offering, while operating within such a highly regulated market gives more assurance on standards.

Additionally, the highly regulated nature of Sika’s markets drives demand for more innovative products – which Sika can provide due to its Research & Development (R&D) focus and scale – and creates competitive advantage for Sika in the form of switching costs for clients moving away from its approved products to those of a competitor (which may need reapproval).

Sustainable credentials should support growth in excess of wider construction industry

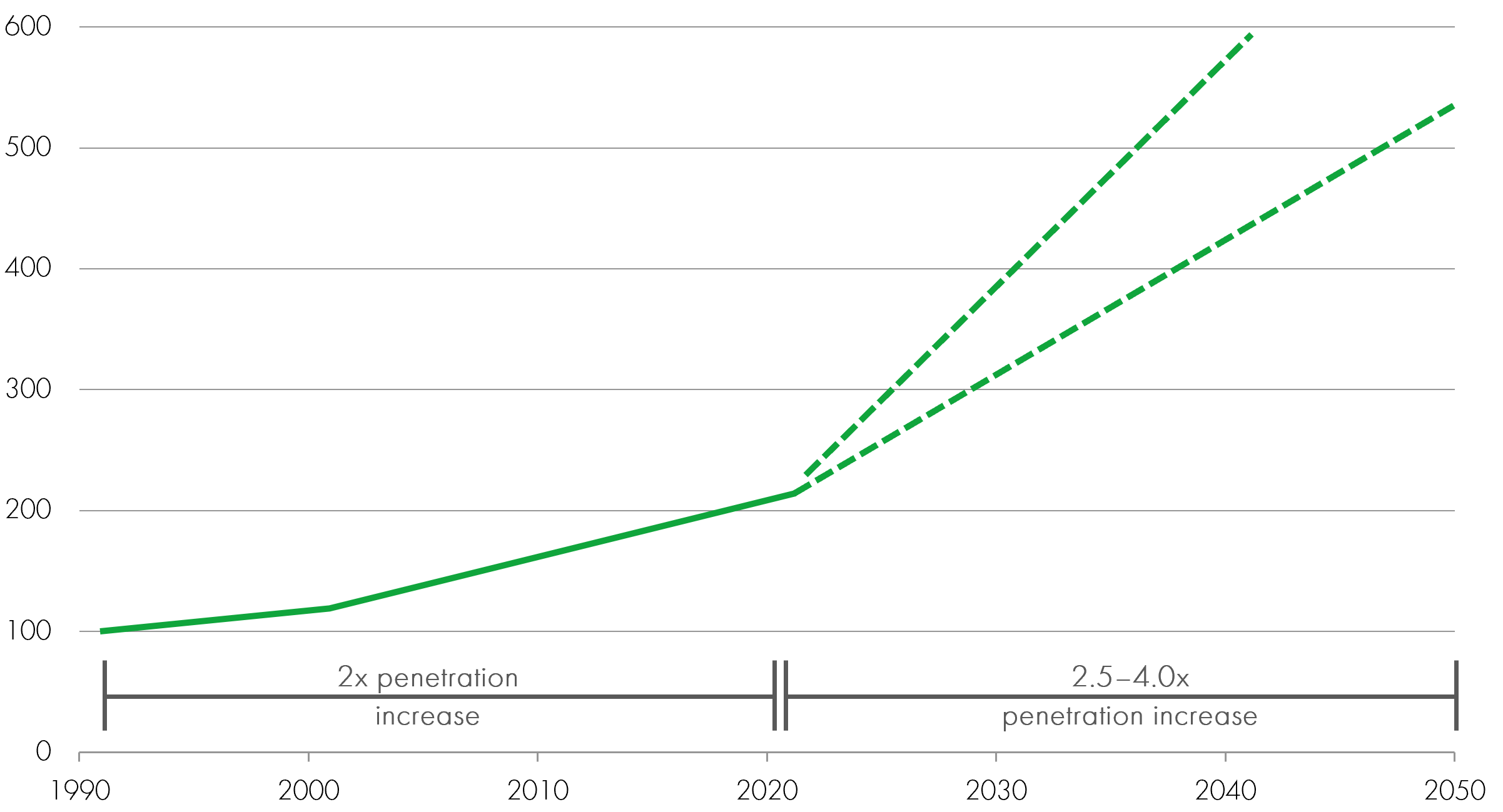

Demand for Sika’s chemicals should grow at a faster rate than the overall construction market as its products achieve greater penetration within an industry seeking to reduce embodied carbon emissions.

Construction chemicals penetration (1991 = 100)

Source: Liontrust, Sika 2028 Strategy presentation, United Nations Report.

Sika targets average annual revenue growth of between 6% and 9%; we think this is very achievable through a combination of organic and acquisitive growth.

Organic growth should be supported by Sika’s significant R&D investment, with market share gains accruing as it creates or enters new product spaces. In 2021, Sika filed 90 patents and increased its R&D workforce by over 10% to 1,240.

In addition, considerable organic growth has also come from expansion to under-penetrated regions. Sika’s exposure to emerging markets is ahead of its competitors. It gained a significant first-mover advantage in terms of brand and customer relationships ahead of some peers in markets such as Asia and, more recently, Africa and Latin America.

Turning to inorganic growth prospects, Sika has the opportunity to further consolidate a very fragmented construction chemicals market. Sika is one of the larger players with 11% market share, with the top 30 in the industry only representing 45%. Sika’s scale and relatively low cost of capital allows acquisitive growth to form a key part of its strategy – by acquiring smaller companies on lower valuation multiples, earnings enhancing growth can be readily achieved.

[1] https://www.thrillist.com/travel/nation/urban-sprawl-worst-cities

[2] Olivier, J., Janssens-Maenhout, G., Muntean, M. and Peters, J. (2016), Trends in global CO2 emissions: 2016 Report, The Hague: PBL Netherlands Environmental Assessment Agency, http://edgar.jrc.ec.europa.eu/news_docs/jrc-2016-trends-inglobal-co2-emissions-2016-report-103425.pdf (accessed 27 Nov. 2017).

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.