Listening to a recent All-In podcast gave a fascinating insight into the views of the new Trump administration (via the AI and Crypto czar, David Sachs) against those of the more traditional (Democratic) mindset of Larry Summers, former Treasury Secretary under the Clinton administration.

Summers likened the Trump administration to that of Peron in Argentina, citing policies as reckless and creating self-inflicted harm. Sachs stood up for the essential need for change and that America had to stop allowing itself to be ‘used’ by the rest of the world. The intense emotion of the exchanges highlights what world markets are dealing with – extremes of views imbued with intense emotion and the leader of the Western World driving new and therefore uncertain policy decisions. The impact is clear in this chart from the Financial Times reproduced in the attached tweet.

It is easy to see how an outsider could be forgiven for thinking that US economic policy is being created on the fly. The method of calculation for the significant tariff increases has been ridiculed and, at the same time, in just a week saw significant policy pull back and change, culminating in a 90-day suspension of all tariffs above 10% while terms are negotiated with specific countries.

The market voted very clearly on this uncertainty. In times of trouble, it would be normal for money flows to seek out the US dollar and treasuries as a safe haven. In this case, that has not happened. In fact, the US 10 year yield increased 60bps in the week following the tariff announcements, marking its sharpest increase since 1982. Gold, the Swiss Franc and Yen looked like the safer haven assets with gold rising to consecutive highs throughout the reactionary period post 2 April.

The move to suspend the new tariff levels on Wednesday 9 April, just a week after their introduction, resulted in a 12.5% up-move in the Nasdaq Index and +9.5% in the S&P 500 – the third largest single day up-move in equity market history, surpassed only by days in 2008 and 2001 during the Global Financial Crisis and the dotcom boom-bust. Incidentally, neither of these two bigger moves marked the bottom in markets during those two periods. Based on data showing significant short covering on this move higher, we have to believe it is likely the bottom is not in place here either.

Investment strategy from here…

As laid out in our January outlook article for 2025, we remain convinced the concentration in a narrow selection of US companies is set to change. Passive investment flows, American exceptionalism and the AI revolution have all contributed to a very narrow group of winners. This set up was already of concern but it was not clear what the catalyst would be for it to change – it seems quite likely that the new Trumpian economics might well be that catalyst.

Following a sharp rally after the US elections in November, 2025 has seen the beginning of a rapid unwind evident most clearly perhaps in the share price of Tesla. It rallied 40% from the election to the end of 2024; in 2025, the shares have fallen 37%. Another reversal of fortunes has occurred in semiconductors where the SOX index had a two-day drawdown of 17% in the week beginning 7 April – the worst such move since the 1970s. There is not a single SOX constituent that rates positively on the Global Equity Team’s T-Score relative indicator. We strongly believe that risk reward now favours more diversification away from passive core index strategies, M7 and American exceptionalism. There is much to play for as the following charts from Goldman Sachs show.

The concentration of money flows into such a narrow portion of the market also leaves a level of vulnerability from the upcoming earnings season. We cannot see many companies brushing aside the tariffs and related earnings issues. At best, we may see guidance removed; at worst, it is likely that guides are lower. Investment levels are also likely to be cut as no one has any idea what the tax (tariff) implications will end up being. Again turning to work from Goldman Sachs, it is clear that most scenarios see the US market struggling to move sustainably higher.

Central forecasts around valuation estimates are highly sensitive

Source: FactSet, Goldman Sachs Global Investment Research, based on 2025 EPS and forward P/E multiples starting from 4 April 2025 close

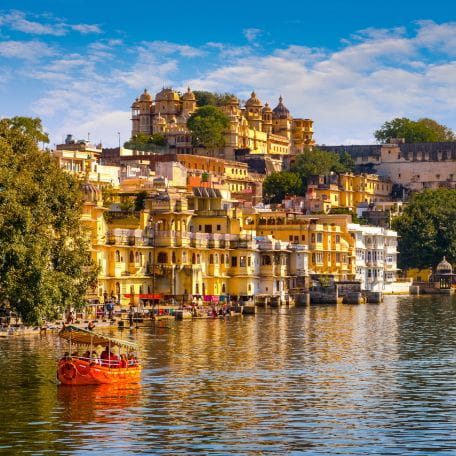

All this concern and likely relative derating of the US leads us to continue to favour diversification into other geographies. Europe remains very cheap historically; India looks like a relatively tariff unaffected growth story and we still believe that China holds value based on the significant de-rating of names there. In fact, one feature of the protectionist policy on IT and AI that America has been pursuing is that of reduced innovation in the US market itself. DeepSeek was a great case in point. Faced with losing access to the most powerful chipsets in AI, the Chinese have had to be far more innovative and they have been just that. Could the reluctance of the US to make their hardware available to China end up leaving them lagging in certain areas of innovation?

Within the US equity market itself, we believe diversification is also important. On a top level, the S&P Equal Weight is expected to outperform the S&P. We look towards similar types of diversification in US equity portfolios.

Finally, it seems clear that volatility and uncertainty are here to stay for the time being and so safe haven assets should form a bigger part of a diversified portfolio. Gold has been a stellar performer and that is likely to remain so; gold miners have also done well but still sit well below their all-time highs. Safe haven currencies like the Swiss Franc and the Japanese Yen have done well since the tariff announcement and this is also likely to continue making assets in these markets interesting.

In conclusion, risk levels have increased; Trumpian policy is unclear and subject to change on a coin toss. Equity risk premia increase on that basis and diversification both within the US equity market and more broadly on a geographic basis makes sense. The Q1 earnings season is likely to be very cautious and can only result in raised concerns for those companies that are in the eye of the tariff storm. We still see many opportunities in equities and the initial phase of volatility has resulted in most companies moving lower. This presents a clear opportunity where those moves are unjustified and we are looking to exploit these anomalies.

Key Risks

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Disclaimer

Non-UK individuals: This document is issued by Liontrust Europe S.A., a Luxembourg public limited company (société anonyme) incorporated on 14 October 2019 and authorised by and regulated as an investment firm in Luxembourg by the Commission de Surveillance du Secteur Financier (“CSSF”) having its registered office at 18, Val Sainte Croix, L-1370 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg trade and companies register under number B.238295.

UK individuals: This document is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.