Alzheimer’s disease is often referred to as one of the final frontiers in drug discovery. It represents one of the most complex, elusive and high stakes areas in medical research. It is one of the most formidable challenges in neuroscience and drug development due to the complexity of the brain, the long pre-clinical phase of the disease and the difficulty in measuring outcomes.

The stakes are high

Alzheimer’s disease and other forms of dementia are unfortunately common; many readers will likely know someone affected by these conditions. Alzheimer’s disease is a progressive neurological disorder that unfolds gradually, impacting memory, cognitive functions and daily activities.

The preclinical stage involves brain changes occurring years before any symptoms emerge. This is followed by mild cognitive impairment, characterized by subtle memory issues while maintaining independence. In the early stage of mild dementia, noticeable memory lapses may occur, such as difficulty in word-finding or becoming disoriented. The middle stage, or moderate dementia, sees increased confusion, mood fluctuations, challenges with daily tasks and behavioural changes. The late stage, or severe dementia, results in individuals losing the ability to communicate, recognize loved ones or control movements, necessitating full-time care.

Beyond the significant emotional and personal toll, the economic cost of Alzheimer’s disease and other dementias is substantial. Annually, unpaid care, social care and healthcare costs amount to an estimated $1.3 trillion, with this figure projected to more than double by 2030.

The amyloid hypothesis

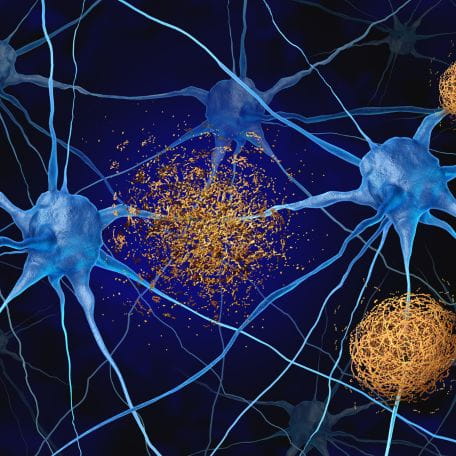

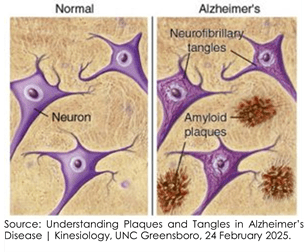

Until recent advancements, most treatments focused on managing the disease’s symptoms rather than addressing its root cause. The amyloid hypothesis proposes that Alzheim

er’s disease is caused by an accumulation of amyloid beta protein fragments in the brain. These fragments clump together, disrupting communication between brain cells and eventually causing cell death. This hypothesis has guided research since the early 1990s, following the pioneering work of Professor John Hardy and his team at University College London (UCL). They first identified genetic mutations associated with certain types of Alzheimer’s and then observed the build-up of amyloid beta plaques in patients. The key question is whether eliminating this build-up of amyloid will stop the disease’s progress?

Major breakthroughs?

There have been several advancements in anti-amyloid treatments, with new medications such as Eisai’s Lecanemab and Eli Lilly’s Donanemab demonstrating effectiveness in clearing amyloid from the brain and decelerating the progression of the disease by up to 35% in clinical trials. However, the real-world results have been less impressive. In the US, physicians have been reluctant to prescribe these medications, and many health systems globally have refused to cover the costs.

The recent decision by National Institute for Health and Care Excellence (NICE), one of the primary decision-making bodies for the NHS in the UK, not to cover the estimated $30,000 annual cost highlights the issues, concluding that these drugs offer only modest benefits and require significant resources to administer via intravenous infusion and the necessary scans for diagnosis and monitoring.

Does this disprove the amyloid hypothesis? A significant challenge is that by the time patients typically exhibit symptoms and become eligible for these treatments, the brain damage incurred during the long, multi-decade pre-clinical stage is irreversible. By focusing trials on symptomatic patients or those already at an advanced stage of the disease, the best achievable outcome is a deceleration of decline. However, if we can diagnose the disease earlier in its course, when patients are still cognitively normal, the outcomes could be substantially different.

A new hope

There are several imminent developments poised to significantly alter the landscape. Blood-based diagnostics developed by companies such as Sysmex are on the verge of receiving regulatory approval. These diagnostics can detect specific proteins in the blood many years before symptoms manifest, offering a simpler and more cost-effective alternative to brain scans and lumbar punctures.

The next generation of treatments, such as Eli Lilly’s Remternetug, currently in phase 3 trials, will be administered subcutaneously, like insulin pens.

Looking further ahead, primary prevention trials are exploring the administration of anti-amyloid drugs to individuals genetically at risk, up to 25 years before the expected onset of symptoms. Additionally, combination treatments that address both amyloid beta accumulation and associated Tau tangles are under investigation. These have the potential to transform Alzheimer’s disease into a manageable chronic condition, akin to the advancements in HIV treatments during the 1990s.

What about the cost?

The recent decision by NICE primarily focused on quantifiable costs to the NHS and observable benefits, but it did not consider the quality of life and financial implications for patients and their families. A more holistic analysis could potentially lead to different conclusions. The cost of housing a dementia patient in a care home with specialist nursing care exceeds $100,000 a year and is increasing. Additionally, the benefits of having patients and their caregivers remain in the workforce for longer are likely to be substantial.

Tackling Alzheimer’s disease is a significant challenge, but recent advancements in diagnostics and treatments offer hope. Early diagnosis and innovative therapies are paving the way for better management of the condition, potentially improving patients’ quality of life to a degree where the benefits will far exceed the costs. While obstacles remain, the progress made signifies a crucial step forward.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Equities team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term. Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.