If the quarter started with concerns that the economy has already seen its best days this cycle, this was soon compounded by the frightening aggression of the Russian President stunning the world by sending his troops into Ukraine. The horrific sight of tanks rolling westward sent markets, rightly, into a panic, and risk assets got dumped in favour of havens. And any havens at that. The price of oil surged upwards and, in hitting triple digits, exposed the chronic long-term failings of energy policy across many European countries left overly reliant on Russian gas. Economic sanctions followed; although gas continued to flow. Against this gaudy backdrop, there have been some dramatic intra-market rotations at different ends of the spectrum.

The initially frantic flight to safety saw a long queue for the bond proxy buffet, with sectors such as Utilities, Pharma and Staples all generally catching a firm bid. At the same time, those areas that were generally viewed as ‘beneficiaries’ of the upending of the geopolitical order such as Defence, Energy and commodities (metals and Ag Chem) all ran hard (Source: Bloomberg), as well as other sectors deemed to be price makers on inflation such as Railroads and Waste. On the other side, flows quickly reversed (Source: Bloomberg) in interest rate sensitives like banks, consumer discretionary, commodity price takers and perceived higher risk stocks.

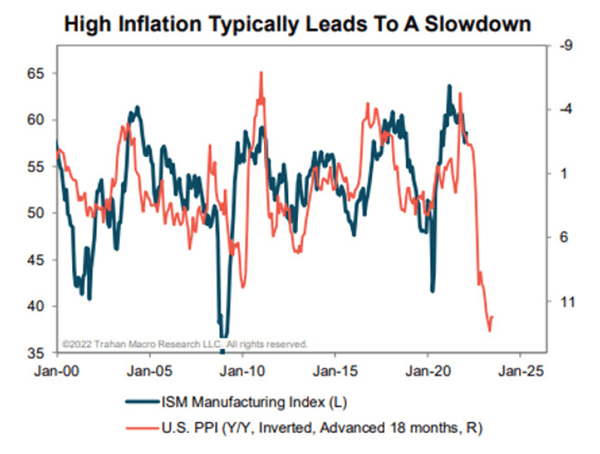

There are many very big picture issues to chew on with regard to the potential for continued spikes in energy prices and the impact that could have on the economy, consumer spending and Fed policy. These issues are likely to dominate investors’ minds for the coming year. Furthermore, the fact that supply chains are likely to see continued dislocation in certain key commodities from agricultural fertilisers (very inflationary for food) through to some specific minerals or gases (argon used in semis) only adds to the sticky scene. The war in Ukraine is going to have far reaching implications, second and third order implications which are going to take years to iron out. With inflation raging [Figure 3], and central banks scrambling to get with the curve, economic leading indicators continue to soften, and consumer sentiment seems to be falling off a cliff. These be challenging times.

Figure 1: Slowdown could be coming

Source: Trahan Macro Research, March 10

Performance

In terms of quarterly performance, the Fund lagged the S&P 500 Index by 3% (Z share class, net of fees, USD). This was due to both our sector positioning and individual stocks. On the sector front, our underweight in Energy was costly (around 1%) with the sector up more than 40% against the backdrop of an overall market decline. We had bought into shale oil producer EOG Resources early in the quarter which participated in the rally, but this still left us underweight the sector. Moving onto stocks, starting with the positive, we saw solid contributions from Crown Holdings, Anthem and Aon on results. This was more than offset by weakness in a range of holdings spread across various sectors. The largest detractors from Fund performance were Vertiv, Interactive Brokers, Hasbro, Frontdoor, Netflix and Installed Building Products. There was no underlying theme underpinning these stock moments, apart from Vertiv and Frontdoor which both experienced a negative margin impact from cost inflation. It should be noted that we don’t see any of these to be permanent impairments to the value of these businesses. Following a retesting of the thesis, we believe the current share price weakness to offer opportunities and hence are holding or adding to positions.

Vertiv, the thermal management engineering company, released a significant profit warning, leading to a halving in their share price. On the one hand, their sales and order book growth continues to impress, as they benefit from a strong end market (data centres) and market share strength. On the other hand, they have guided that they won’t make any profit this quarter. This is due to raw material price rises and supply chain issues on components and freight inflation, which they warned will not be recouped in product pricing in the short-term. We, and the market, were aware of these issues which were raised last year, and we spent much time talking to the company about them. They had expected to raise prices to recoup the inflation pressure. The problem is that the company introduced a new ERP (enterprise resource planning) system at the end of last year. ERP systems allow management to see the real-time fundamentals facing their businesses. Unfortunately, ERPs are notoriously disruptive for a few months at the time of implementation, and what an unfortunate timing this was for Vertiv with the backdrop of escalating inflation. They are an order book driven business, so it normally takes a few quarters for sales prices to reflect cost inflation, but this time lag was exacerbated by their ERP system disruption which meant they didn’t push product prices up enough.

So what are we doing with our holding? The good news is that whilst we are highly disappointed with the management execution in the short-term, we are encouraged by the sales and growth performance, and are willing to share some of the management’s hope that by the second half of 2022, the product pricing will adequately reflect cost inflation and take the company back to its margin target. In fact, we wouldn’t rule out the prospect of the company delivering a higher profit in 2023 than had been originally expected, when the benefit of premium price increases is fully evident. If the company meets its targets then the stock could then be trading on around 7x P/E, compared to a potential 16-22x when looking at peers. It is clearly very much in a show me phase; however, we have an experienced Chairman (who has now assumed a more executive role as a result of this ‘crisis’) and a company which is delivering on the top line, with a path to recover back to normalised margins. We see this as deep value with clear positive catalysts, and therefore have taken the opportunity to add (moderately) to our position. Short-term pain may ultimately offer substantial long-term gain.

Frontdoor, the home warranty company, likewise suffered from a combination of internal process weaknesses and inflation. Their technicians fix faulty heating and aircon systems for clients, the parts for which have been going up in cost. The problem is that their technicians often take a few months to file cost claims, which meant that Frontdoor didn’t realise the extent of the inflation at the end of last year until a few months too late. They are putting through premium price rises to offset this but there is a time lag in recouping the higher parts prices. The impact of this is to shave a few percent off Frontdoor’s margin (EBITDA margin expected to be 16% in 2022 according to consensus). Due to the way their business works, with customers having annual plans, with high renewal, it means that the price increases they are putting through will likely take a while to benefit margin. That being said, we have high conviction that this is just a matter of timing. In fact, we originally bought our position in Frontdoor several years ago, after what turned out to be a temporary margin squeeze, and we believe this time will be no different. We are disappointed that management weren’t more dynamic in forcing their contractors to make cost claims in a more timely way; however, we believe the current pressures are already reflected in the valuation (11x 2024 P/E) and a recovery, which we expect, could offer significant upside. We are therefore holding our position.

Netflix, the subscription video content (SVOD) provider, has been in a difficult spot over the past year. Their subscriber growth spiked during the Covid work-from-home period for obvious reasons and like many other beneficiaries of that time have seen a substantial deceleration in growth in the recent period. This reflects the ‘bringing forward’ of a significant amount of subscriber demand, which they are now digesting as consumer life normalises. In fact, we initiated our position in the stock late last year thinking that the fears of a slowdown offered a valuation opportunity for a highly attractive long-duration growth business. After we bought, the success of Squid Game lifted investor interest, which was only to be punctured in the company’s earning release when it warned once again of slowing subscriber growth, and a range of pressures to its short-term margin. Netflix’s valuation and consensus growth expectations (26x 2023 PE) have never been lower; however, we believe that the company’s long-term prospects remain highly attractive. They dominate the SVOD market, have just over 220m subscribers, compared to 700m pay-tv households worldwide and more than 1,000m global broadband households. Their value offering remains highly attractive (c$15 per month for hours of prime and new content) and they have a substantial competitive advantage versus nearly all peers in being able to leverage their content worldwide. We believe the shares are now valued as a steady but low growth subscription business, and yet there is a good chance that the business is still a steady high growth business, and hence we have added to our position.

Lastly on performance, Interactive Broker, Hasbro and Installed Building moved on macro sentiment rather than in response to their earnings updates which were all solid by our analysis.

Transactions

Over the quarter, we sold our holdings in Grand Canyon Education, Altice, American Eagle Outfitters, Meta Platforms and NXP Semiconductors. We initiated new positions in EOG Resources, Performance Foods Group, Booz Allen Hamilton, L3Harris Technologies and Adobe. The sells were all businesses in which we had reduced the position sizes significantly in recent quarters based on falling conviction in the fundamentals and a consequently less attractive estimated risk-reward in the shares. These were switched into our new holdings in which we have significantly higher conviction in the long-term fundamental outlook and valuation opportunity.

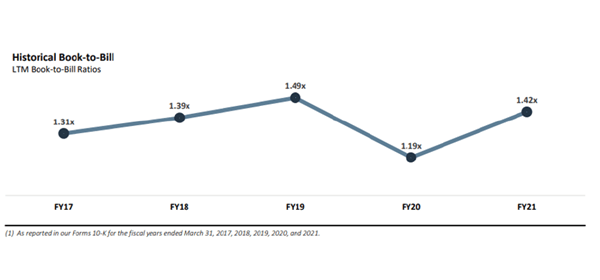

Booz Allen Hamilton is a market leading defence IT contractor. We have owned this company in the past and know it well. Since selling out, the stock had derated substantially as US defence budget growth moderated. This de-rating had piqued our interest before the war in Ukraine as we had noticed the company reported an inflection in orderbook and headcount growth [Figure 1], which management believed would soon translate to revenue growth acceleration. The subsequent fracturing of the post-World War II geopolitical order only serves to put the heat on Congress to further ramp up intelligence spending, of which Booz is a world leading outsourcing play.

Figure 2: An inflection in orders

Source: Company presentation, February 22

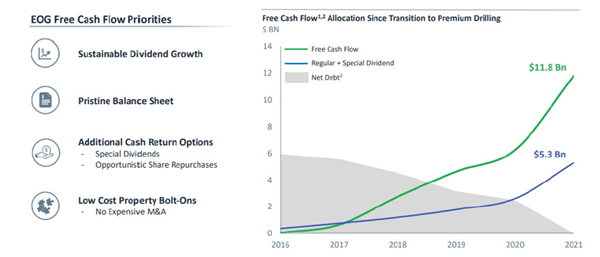

EOG Resources is a US shale E&P with a low-cost profile versus peers, and in our view is a standout in terms of having a disciplined strategy to support moderate production growth at the same time as handing back free cash flow to shareholders [Figure 2]. They have also made impressive moves to give high disclosure on their ESG footprint and have ambitious management incentive-linked targets to achieve improvements in areas from water and chemical consumption through to having a Net Zero 2040 target (Scope one and two). The stock is attractive by our analysis due to a low valuation on anything above $70 oil, leaving material optionality to a sustained higher oil price. At the current $100+ level, EOG, like its peers, is highly cash generative.

Figure 3: Cash Machine

Source: EOG Resources, Q4 results presentation

Adobe is a leading design software company with high repeat revenue characteristics. The stock has de-rated substantially in recent months with the growth sell-off and on fears that it might have benefited from an unsustainable growth boost during the Covid period. The opportunity to buy a stock with a very strong market position, and potential to continue growing the top line at 15% for many years, with high margins, at a low 20s 2024 PE, was very attractive to us.

Performance Foods is a food distributor to restaurants and convenience stores delivering both prepared and fresh packaged foods. It is a similar business to our long-time holdings US Foods. The company has historically been the fastest grower of its quoted peers, and consequently traded at a premium. After the valuation took a bath in the recent market sell-off, we took the opportunity to expand our exposure to this sector which, we believe, offers substantial post-Covid recovery, through a company that has an excellent management team with a differentiated strategy to cross sell fresh-food into their convenience store customers. We firmly believe this business can continue to grow earnings at teen rates for many years to come, and yet we were able to pick up the shares at around a 10x 2024 PE. Too cheap, in our minds.

Summary

Overall, whilst the current environment has unfortunately dented the recovery in our Fund performance, we believe we have a portfolio of many very well-placed secular growth businesses at highly attractive valuations. Thematically, the Fund has a broad range of exposures to Covid recovery names in healthcare and leisure, steady growth compounders in financial exchanges, insurance brokerage and data services through to the more recent additions in defence and de-rated software growth franchises.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested. The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term. Investment in funds managed by the Global Fundamental Team may involve investment in smaller companies. These stocks may be less liquid and the price swings greater than those in, for example, larger companies. Some of the funds may hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio. Investment in the funds may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.