The Liontrust Strategic Bond Fund returned -5.0%* in sterling terms in June. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was -3.9%.

Bond markets continue to oscillate between fears over continuing high inflation and a recession. There was plenty of evidence in June to support both of the worrying camps. May’s US consumer price inflation (CPI) data, released in early June, saw a spike to a new cycle high of 8.6%. This proved to be the final catalyst for the Federal Reserve to raise rates by 75 basis points during the following week. This is the first hike of this size since 1994. It is a close call whether the next hike in July will be 50bps or 75bps. If pushed, I’d say it will be the latter as the Fed tries to regain its hawkish credentials. It is worth remembering that the Fed has a dual mandate of price stability and maximum sustainable employment, but recent rhetoric has shifted such that regaining control over inflation takes precedence. A forecast rise in unemployment has been added to the Fed’s economic projections, thereby creating a tacit admission that higher unemployment will almost certainly be needed to bring inflation back towards target.

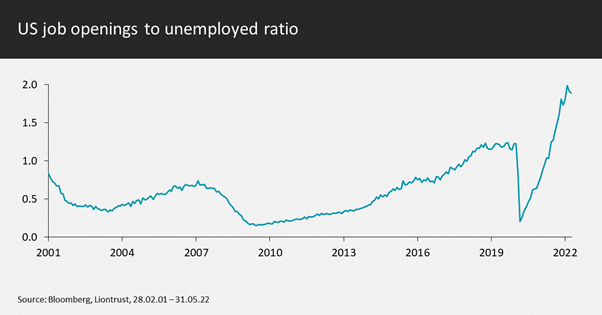

Ultimately, it is not unemployment itself that the Fed wants to target, rather it is wage inflation. Our consistent view remains that wage inflation is the key factor that creates a self-perpetuating inflationary feedback loop; without wage inflation the rises in energy and agricultural prices lead to a wallet share substitution effect. Wage inflation is presently elevated for two reasons: firstly, because people want to offset the impact of the inflation they are seeing, and secondly because labour currently has strong bargaining power. A simplistic way of viewing this is to look at the number of job openings per person in unemployment, which was just below 2 (1.89) at the at the end of May.

The Fed can ease this labour market pressure through both the numerator (job openings) and denominator (unemployment level). The hit to business confidence that rate hikes and talk of recessions creates is likely to reduce hiring intentions. Furthermore, the rise in the cost of capital will make many prior expansionary plans uneconomic – this is one of the transmission mechanisms of monetary policy. On the supply side of labour, the creative destruction that capitalism cyclically creates will lead to some businesses sadly failing and their employees needing to search for alternative work. Additionally, labour force participation rates, outside of the over 55-year-old cohort, have been picking up again.

The quantum of unemployment required does depend on myriad factors, one of the largest determinants being how embedded the inflationary mindset has become in consumers. With developed market central banks having been way behind the curve, it is imperative that they now catch up. In my opinion, the faster rates go up now the lower the peak rate – or terminal rate in market parlance – will be. And the lower the terminal rate the less long-term damage that will be done to the real economy.

The bond market has already discounted a rapid hiking cycle; US rates are currently priced to finish 2022 around 3.25%. Prime 30-year mortgage rates have soared from 3.1% to 5.9% in the first half and this is already feeding through to lower housing market activity. More broadly, the US saw weak PMIs in June with the headline coming in at 51.2. Whilst the overall manufacturing and service numbers are still above the 50 level, the forward-looking measures (new orders in manufacturing and new business activity in services) exhibited larger falls.

Evidence of a slowing in economic activity has also appeared in Europe. June’s Euro area composite PMI was 51.9 against a market consensus forecast of 54.0. Overall manufacturing was at 52.0, but manufacturing output slipped to 49.3, which is into contractionary territory. Services were stronger (52.8) but have lost momentum with May’s number having been at 56.1. This data catalysed a fall in 10-year Bund yields of over 20bps on the day, the largest daily yield decrease in over 10 years! It is a volatile time in the bond markets as the wrestling match between inflation and recessionary fears continues. This is unlikely to conclude until there are clear signs of a downward trajectory in inflation.

In July the ECB will finally start to increase interest rates. Quantitative easing will also be stopped; explicitly it is the new flow of purchases that will expire, the stock (i.e. the size of the ECB’s balance sheet) will be maintained. Regarding the PEPP (pandemic emergency purchase programme) the ECB “…intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024.” To give an idea of scale, this should be about €200bn per annum; it is the PEPP that the ECB is presently using to help avoid what it refers to as fragmentation. This means fragmentation of monetary policy, or ineffective transmission of monetary policy across the entire currency bloc. The bond market was disappointed that there was no new anti-fragmentation scheme, and this manifested itself in underperformance of the peripherals relative to Germany. The ECB promptly announced that there would be a further anti-fragmentation tool created. It is still working on this; it must be “proportionate” under European law and will have to be sterilised or it will be at odds with stopping balance sheet expansion. If the combination of the PEPP and the new tool do help to cap peripherals’ spreads, then that should empower the ECB to raise rates more rapidly to tackle inflation.

June was a brutal month for corporate bonds with global investment grade credit spreads 30 basis points wider and global high yield credit spreads over 150bps wider. Corporate bonds are now very good value when measured in yield terms and incredibly cheap if one looks at credit spreads. If credit valuations were a true reflection of the fundamental outlook, then all other risk assets are overvalued still. Of course, credit spreads should be significantly wider year-to-date, but they have overshot due to horrendous market technicals. Namely, outflows from the asset class meeting a broking community with no desire to expand their balance sheets. So, if a stock or sector gets in the cross hairs of the market then bonds can hit an air pocket. The opposite side of the equation is where there is a Street short or ongoing buying, such as >15-year maturity euro single-A credit, where insurers are actively allocating new capital as yields have reached their target for new purchases. It is a tough environment in credit, but in the long-term fundamentals do win out and there are bound to be a lot of bargains to be had over the next few months.

Rates

The volatility in bond markets afforded us the opportunity to make some incremental alpha for the Fund Obviously, the broad market moves, or beta, are the dominant force for returns at the moment, but generating some profits all helps for the long-term. The most important move was on the morning of the Fed’s policy announcement: with 75bps fully priced into markets and 10-year US yields just below 3.50%, we increased duration to our neutral level of 4.5 years†. We took profits on this duration addition towards month end and finished June with 4.0 years of exposure.

On a cross-market basis, we added 0.25 years in Australia when the spread to the US was over 80bps, subsequently locking in the gain when the spread got to the mid-50s. We were also active in allocating between the US and European duration markets, switching 0.25 years of European duration into the US at just below 180bps and reversing it just above 150bps.

This leaves the Fund’s 4 years split between 2.50 years in the US, 0.25 years in New Zealand and 1.25 years in Europe. Our preference remains for the 5-year part of the yield curve.

Allocation

The Fund’s investment grade weighting remains in the vicinity of 50%, with 53% physical holdings and a 1% risk-reducing overlay. The high yield weighting is just below 30%, containing 24% in bonds and 5% additionally from CDS index overlays – overweight compared to our 20% neutral level, but still below the 40% maximum. The majority of the negative return in June emanated from credit spreads widening. As mentioned in the commentary above, the credit market is now very cheap; within the Fund we are leaving room to buy more if the market overshoots further. Presently, we prefer to actively manage the constituents within each allocation, rotating out of bonds that have performed relatively well and increasing weightings in very cheap credits.

Selection

During June, European real estate bonds hit an air pocket of the type we’ve described above. Earlier in 2022, Viceroy, a short-selling fund, had written an aggressive note about the German property company Adler; in June it increased its attack on the Swedish company SBB too. For the avoidance of doubt, the Fund owns no exposure to either of these names, the G part of the ESG having too many red flags. However, contagion from fears around these names led to a dramatic drop in prices of bonds the Fund does own issued by Castellum, Heimstaden Bostad and CPI Property. These companies are diversified by type between office and residential, and by geography between Scandinavia and CEE/Germany; we have spoken to all 3 companies and, outside of the usual economic cycle effect which is covered by low loan-to-value ratios, have no fundamental concerns. A rebound in bond prices is anticipated as the technical overhang clears and having reviewed the positions we are extremely happy retaining all three.

On the trading activity front we sold our euro-denominated Pershing Square holding, retaining the US dollar holding. We still like the company but the bonds have been less liquid than we originally anticipated so we believed it was prudent to trim exposure. On relative value we also sold New York Life’s and Rabobank’s bonds whose spreads had held in much better than the broad market.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns.

|

Jun-22 |

Jun-21 |

Jun-20 |

Jun-19 |

|

|

Liontrust Strategic Bond B Acc |

-12.5% |

5.1% |

2.8% |

5.5% |

|

IA Sterling Strategic Bond |

-10.2% |

6.1% |

3.8% |

5.3% |

|

Quartile |

3 |

3 |

3 |

2 |

*Source: Financial Express, as at 30.06.2022, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 30.06.2022, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12-month periods due to the launch date of the portfolio (08.02.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Strategic Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.