The Liontrust Strategic Bond Fund returned 4.8%* in sterling terms in July. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was 2.6%.

July was one of those times in markets when bad news was viewed as good news, with plenty of negative economic data releases, both relative to expectations and outright. The reasons markets rallied are that slowing economies should help tame inflation and lead to lower terminal interest rates in this cycle. On the latter point, the frontloading of rate hikes by central banks has also been taken positively in that they should also lead to lower peaks and less of a risk of central banks creating deep recessions. Thus, after one of the worst markets for fixed income in the first half of 2022, July was able to see a strong rebound in returns.

This was accentuated both by the oversold nature of the credit markets where the demand/supply imbalance had led to a great valuation opportunity, and the sentiment boost to markets from the Nord Stream 1 pipeline restarting gas flows (albeit at a reduced pace) after its routine maintenance shutdown. On this latter point the risk of gas rationing in winter this Europe is a key fundamental overhang for economies and markets over the coming quarters. We expand upon this and other key issues in our strategy document.

On the economic data front, the Eurozone PMIs were dreadful, thus catalysing a further rally in sovereign bonds. As a reminder, above 50 is expansionary and below 50 contractionary.

Eurozone July PMIs:

|

|

Prior |

Forecast |

Actual |

|

Manufacturing |

52.1 |

51.0 |

49.6 |

|

Services |

53.0 |

52.0 |

50.6 |

|

Composite |

52.0 |

51.0 |

49.4 |

Source: Liontrust, Bloomberg.

The declines are broad based by both industry and geography; they point towards a 0.5-1.0% fall in GDP run rate at the start of this quarter. There is no way of sugar coating them, the only positive is that price pressures are weakening from their very high starting level.

Regarding last quarter’s GDP figure in the Eurozone, the first estimate has come in at 0.7% quarter-on-quarter with Q1 revised down slightly to 0.5%. The geographic mix is interesting here. The German economy was flat in Q2 whereas Spain and Italy both saw a pickup in growth. Spain and Italy both benefitted from a rise in consumption and boosts from an increase in tourism. Looking forwards, the surge in the costs of living has dented consumer confidence and spending power so expect a slowdown in consumption. Q3 is likely to see a loss in momentum but it is Q4 that will be key, so much of Q4 (and Q1 2023) will depend on the weather – if it is a cold winter then energy rationing is inevitable, if it is a mild winter then energy needs should be covered. We need to convert our armchair expertise from epidemiology to meteorology!

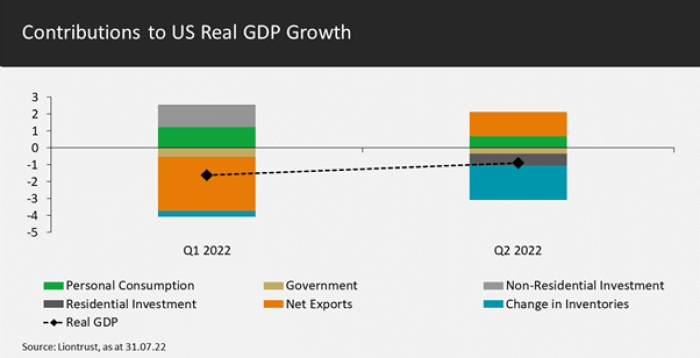

Across the Atlantic, the first release of US Q2 GDP figures came out showing a contraction of -0.9% quarter-on-quarter. With Q1 real growth having been -1.6% (see black triangles on charts below), this meets the technical definition of a recession of two negative quarters in a row. However, the National Bureau of Economic Research (NBER) in the US, which makes the decision about whether it is a recession or not, is unlikely to call it one given the strong labour market and decent consumption growth. We do think a mild recession is coming and I agree that Q1 & Q2 only constitute a technical recession; let me elaborate why:

The weakness in Q1 was driven by the very volatile net exports (in orange above) figure, this was mainly due to a restocking of supply chains and a mismatch in timings between various economies – hence the positive contribution in Q2. The restocking may well have proven to be an overstocking as inventories (dark blue) caused a big drag in Q2. Residential investment turned negative in Q2; expect this to continue to be a drag on real GDP as housing market activity dramatically falls in the wake of the leap in US mortgage rates. Lastly, and mostly, consumption (green) is the key driver. Consumption represents about two thirds of the US economy. What can be seen above is that its contribution is slowing from 1.24% in Q1 to only 0.70% in Q2. If consumption growth turns negative then, even if we do not see a technical recession, it will look and feel like a real recession. The inter-relationship between consumption, wages and employment is paramount here. The Fed will keep raising rates until they all weaken.

In July, the Federal Reserve raised rates by 75bps for the second month in a row., The size of the hike was in line with both the consensus forecast and market pricing. This now has the Fed in their neutral range for the Fed Funds rates of 2.25% to 2.50%. The Fed acknowledged that economic activity is slowing; but whilst the labour market remains very strong, they will keep tightening.

The Fed clearly wants to curb any domestic excess demand and sees, correctly in my opinion, inflation as being endogenously generated as well as being driven by exogenous factors such as commodity prices. Forward guidance has effectively been dropped and the Fed will be making decisions on a meeting-by-meeting basis. Unemployment and wage inflation data will be the key variables that will determine which path the Fed chooses, followed by data on inflation itself. The market now has Fed Funds peaking at about 3.3%, below the ~3.8% level in the Fed’s June economic projections.

The European Central Bank (ECB) raised rate for first time in over a decade. After some murmurings ahead of the meeting about a 50bps hike (the market had 38bps priced in) the ECB duly delivered, taking rates to zero. I view the 50bps hike as a compromise agreement reached with the more frugal nations’ central banking representatives to get the anti-fragmentation tool over the line. They want to get rates to neutral territory. Progress toward this has been eased due to the removal of forward guidance; by shifting to a meeting-by-meeting basis this no longer effectively constrains them to the quarterly staff forecasts rounds.

The launch of the anti-fragmentation tool, the Transmission Protection Instrument (TPI), was announced. Subject to the countries meeting criteria, the ECB will be able to purchase the respective jurisdiction’s securities. The question marks are over what the ECB will do if countries stop obeying the criteria, or how much wiggle room there will be. I would expect markets to test the resolve of the ECB at some stage if any member state starts to disregard the fiscal rules.

Rates

The Fund finished the month with a duration of 4 years, split between 2.5 years’ duration contribution in the US, New Zealand at 0.25 years and 1.25 years in Europe. A new cross-market position was established near the start of July, going long 0.5 years’ duration from Canada versus the US at the 10-year tenor. Within two weeks the spread between Canadian 10-year bonds and those in the US had contracted by almost 20bps; having rapidly made just under 10bps of alpha from this cross-market rates trade we decided to lock in the gains. We continue to monitor the differential between the two for opportunities for generating incremental alpha.

Regarding yield curve exposure, we have been favouring the 5-10-year maturity bucket this year. We took >15-year duration exposure to zero when the 5s30s curve inverted in April. During July, the differential touched +30bps so we switched 0.5 years of 5-year into 30-year maturity duration exposure. This should be viewed as reducing the size of the underweight in the long end; we strategically still think the yield curve will steepen but it has moved far enough already for us to reduce the size of the position. If 5s30s flattened back to +10bps we would go back to zero >15-year exposure; if 5s30s keeps steepening we will gradually add curve exposure back to the long end.

Allocation

Near the start of the month, the Fund’s investment grade weighting was increased from 50% to 55%. Credit spreads are offering fantastic long-term value, economies will get worse but spreads peak before the recession starts. We are not willing to go to our maximum overweight yet because of deteriorating macroeconomic fundamentals and challenging technicals (demand and supply); but with these valuations, a strategic overweight in investment grade credit is warranted.

We would actually own more investment grade credit if it were not for the risk budget already being deployed in the Fund’s overweight in high yield. The current high yield weighting is 27% down from 30% at the start of the month – note the Fund’s neutral level is 20% and there is a maximum of 40%. Toward the end of July, we took advantage of market strength to trim a couple of percent of European high yield exposure. On any market setback we would look to reinvest the proceeds with a bias towards the US high yield market. As a reminder, we are avoiding the most cyclical parts of the credit market and own no CCCs in the Fund.

Selection

During June, there was an extreme oversold position in some high-quality real estate companies’ bonds. During July, a new buyer arose for some of these bonds as some of the companies have started buying back their debt. The best example was Heimstaden Bostad, a Swedish residential real estate operator which launched a tender for almost €700m nominal of their hybrid bonds, entirely funded by an equity contribution from existing shareholders. We often talk about the importance of the alignment of interests of all stakeholders in a company (the M in our PRISM research framework stands for Motivations, or what some would call Governance) and you do not get much more bondholder friendly than an equity funded debt tender. This led to a jump in some other real estate companies’ bonds too, such as Castellum. The two Scandinavian companies’ bonds were the highlights for the month. Other strong performers emanated from both the healthcare and telecommunications sectors; examples include Becton Dickinson, Eli Lilly, Telefonica, and Altice.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns.

|

Jun-22 |

Jun-21 |

Jun-20 |

Jun-19 |

|

|

Liontrust Strategic Bond B Acc |

-12.5% |

5.1% |

2.8% |

5.5% |

|

IA Sterling Strategic Bond |

-10.2% |

6.1% |

3.8% |

5.3% |

|

Quartile |

3 |

3 |

3 |

2 |

*Source: Financial Express, as at 31.07.2022, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 30.06.2022, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12-month periods due to the launch date of the portfolio (08.02.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies which may have the effect of increasing volatility. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.