Performance summary

During November, the Liontrust Global Dividend Fund returned 2.9%in November. The MSCI World Index comparator benchmark returned 3.4% and the average return of the IA Global Equity Income sector was 4.0%. The Fund therefore underperformed the index by 0.5% and underperformed the peer group by 1.1% over the month.

Since Fund Manager inception, the Fund has returned 65.7%, which compares to the MSCI World Index return of 64.2% and the IA Global Equity Income sector average return of 39.9%. The Fund has therefore outperformed the Index by 1.5% and its peer group by 25.8%.

The Fund takes a total return approach to income investing by investing in innovative global leading businesses that can drive stock price appreciation and grow their dividends for us as shareholders.

Innovation insights

The Global Innovation team are fresh off the plane from San Francisco, where we spent a week meeting over twenty companies across our funds and watchlist. Here are four key takeaways from our trip that are currently informing our thinking as we go into 2023.

The first is that Silicon Valley is currently hunkered down, as it does every few years. These are gut-wrenching periods of plummeting valuations were the excess capital that had been available to questionable projects and companies disappears. They are also the moments of the greatest opportunity to invest in the Valley when depressed valuations lay the foundation for exceptional returns for the high-quality opportunities. In 2020, multiples expanded indiscriminately and have since contracted just as indiscriminately. But when this process is complete, we expect fundamentals not multiples to drive stock returns, so a disciplined investment approach to discerning those companies creating genuine value for customers and building strong businesses from those of more ephemeral value will have a very good chance of delivering outstanding performance.

Second, against a challenging macroeconomic backdrop, good management teams have pivoted from aggressive investment in growth to making their businesses much more profitable. For evidence of this, look no further than the 200,000 workforce layoffs in the technology sector over the past 12 months. What this means going forwards is that we should see excellent operating leverage in these companies when the economy re-accelerates. Take Netflix as an example, which laid off nearly 5% of its workforce in the first half of the year, and has quickly rolled out a lower priced ad-supported subscription tier to cater for its customers who are all feeling the squeeze of the cost of living crisis. We think the companies that took decisive actions early on in 2022 are best poised for a recovery. In other words, ‘the first in will be the first out’.

Third, although employee lay-offs are rife, the battle for the top talent is fierce. Nowhere is this more prominent than in the Silicon Valley, the beating heart of the global technology industry where data scientists and top engineers are a scarce commodity. And never is it fiercer than now, when the best are making their bets for the next cycle and taking equity at the bottom of the cycle. An innovative culture is key and the high-quality companies that have it will attract the top talent that will ensure they win over the coming years. We are closely watching the movers and shakers.

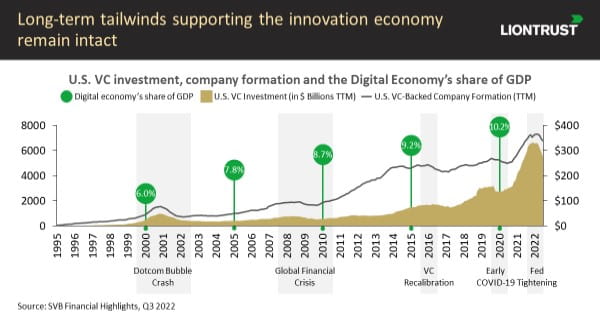

Finally, despite inflation and slowing economic growth, innovation is steaming ahead. Why? Innovation drives down prices for customers and operating costs for businesses, so it is a godsend in the face of high inflation and scarce growth. Indeed, necessity is the mother of invention and such counter-cyclicality in innovation is the historical norm. The depths of the Global Financial Crisis in 2008 spurred 126 unicorns including Uber, AirBnB, Instagram and Whatsapp, while both Microsoft and Apple were founded during the recession and inflation spike of 1975. Today’s innovation pipeline across the economy is booming. Major innovations in recent years, such as the cloud infrastructure for storing and managing data and accelerated computing to analyse and exploit it in company operations, have opened bottlenecks across almost all industries, presenting an extraordinarily large opportunity set for innovative companies over the coming years.

Portfolio news

Nvidia

Nvidia faced a perfect storm earlier this year as semiconductor demand fell following pandemic-driven gyrations while concurrently Nvidia moved into the always-tricky phase of its product cycle ahead of new launches of major products. The share price fell by two-thirds between last December and this October but has since risen around 60%, the stock having become very undervalued.

Nvidia’s new products are a significant leap forward for computing and by extension the many applications across the entire economy. Over the past decade or so Moore’s Law (the historical doubling in computing power every two years driven by reductions in transistor size) has, after many decades of consistency, flat-lined, bringing the performance gains in general purpose computing (think Intel’s CPUs) to an end. However, the rise of accelerated computing (based largely on Nvidia’s GPUs) and its scope for ongoing innovation has meant that overall computing performance is actually accelerating rather than flatlining with Moore.

For example, Nvidia’s new Hopper architecture for GPU is six times more powerful than its predecessor Ampere and 3.5 times more energy efficient. Moreover, we would expect incremental performance improvements as large as 3 times per year over time within Hopper just as Ampere historically achieved.

The pace of innovation for computing has never been faster and with broader implications. Over the past twelve months, Nvidia revenues were just shy of $30bn, but we see the long run total addressable market (TAM) at potentially $1trn. Nvidia’s leading position in accelerated computing chip design and its performance trajectory mean that it will be a critical provider of the picks and shovels for artificial intelligence revolution taking place across the economy as companies drive productivity gains through collecting data and utilizing it to make predictions, decisions and automate processes. These broad-based applications for Nvidia’s picks and shovels mean that its historical gaming market has already become less than half of Nvidia’s revenues, despite being a segment with its own impressive growth runway.

We took the opportunity of the cyclical disruption to Nvidia’s business and stock this year to invest in this first-rate company in the Global Dividend Fund.

Pool Corporation

On the other hand, Pool Corporation, if you are fortunate enough to own a swimming pool, you will be all too aware that the upfront construction cost is a misnomer. Pools require constant maintenance, frequent repairs, and renovations are always enticing. Now if your pool is in the US (where pool penetration has increased every year for the past decade), chances are that your necessary pool supplies (from filters to heaters to chemicals) have made their way through Pool Corporation’s network. As its name suggests, the company is the largest distributor of swimming pool supplies in the world, and the only player in the US operating a coast-to-coast footprint.

Since the pool industry is very fragmented, Pool uses its scale to purchase products from a vast array of manufacturers to redistribute to customers on more favourable terms than customers could obtain on their own. This pass-through of value to customers is innovation in action, underpinned by scale acting as a strong barrier to competition. The company has established relationships with 200,000 brands, owns four distribution networks and has been steadily buying up smaller competitors (completing 70 acquisitions over its history), which creates an enormous competitive advantage in the form of scale economies – it is simply very hard for any competitor to cast its net as wide.

So that is why we own the stock in the Global Dividend Fund, but what did we glean from our recent meeting with the company? Nothing all that new, which is exactly the message we hoped to receive from this resilient business. Two thirds of company revenues are non-discretionary (repair and maintenance), and 80% revenue comes from pools already in the ground, meaning that revenues are predictable and somewhat protected from an economic downturn. Pool owners will know that maintenance neglected today means a larger bill in the future. While new pool construction would be expected to contract more significantly in a protracted recessionary environment, serving this end market is a smaller component of Pool’s business and partially mitigated through a covid-induced renovation backlog bolstering demand. What’s more, the company has a two decade track record of holding onto pricing gains, which will be an important dynamic as we start to see deflation seep through supply chains.

Shares are trading on a forward price-to-earnings multiple of just 19x (a 35% discount to their five year historical average), yet the business is on track to deliver high-teens revenue growth, earnings per share growth north of 20% and a gross margin above 30% this year. To us, this looks like a classic disconnect between the long-term fundamentals of the business and its share price.

Discrete years' performance** (%), to previous quarter-end:

|

|

Sep-22 |

Sep-21 |

Sep-20 |

Sep-19 |

Sep-18 |

|

Liontrust Global Dividend |

-5.8% |

21.2% |

8.1% |

15.7% |

12.4% |

|

MSCI World |

-2.9% |

23.5% |

5.2% |

7.8% |

14.4% |

|

IA Global Equity Income |

-0.6% |

21.6% |

-3.9% |

7.0% |

7.0% |

|

Quartile |

4 |

2 |

1 |

1 |

1 |

**Source: FE Analytics as at 30.09.22. Quartile generated on 07.10.22

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.