Performance summary

During November, the Liontrust Global Innovation Fund returned -3.2% in November. The MSCI World Index All-World comparator benchmark returned 4.2% and the average return of the IA Global Equity sector was 3.1%.

Since Fund Manager inception, the Fund has returned 15.8%, which compares to the MSCI All-Share World Index return of 34.6% and the IA Global Equity sector average return of 28.0%.

Innovation insights

The Global Innovation team are fresh off the plane from San Francisco, where we spent a week meeting over twenty companies across our funds and watchlist. Here are four key takeaways from our trip that are currently informing our thinking as we go into 2023.

The first is that Silicon Valley is currently hunkered down, as it does every few years. These are gut-wrenching periods of plummeting valuations were the excess capital that had been available to questionable projects and companies disappears. They are also the moments of the greatest opportunity to invest in the Valley when depressed valuations lay the foundation for exceptional returns for the high-quality opportunities. In 2020, multiples expanded indiscriminately and have since contracted just as indiscriminately. But when this process is complete, we expect fundamentals not multiples to drive stock returns, so a disciplined investment approach to discerning those companies creating genuine value for customers and building strong businesses from those of more ephemeral value will have a very good chance of delivering outstanding performance.

Second, against a challenging macroeconomic backdrop, good management teams have pivoted from aggressive investment in growth to making their businesses much more profitable. For evidence of this, look no further than the 200,000 workforce layoffs in the technology sector over the past 12 months. What this means going forwards is that we should see excellent operating leverage in these companies when the economy re-accelerates. Take Netflix as an example, which laid off nearly 5% of its workforce in the first half of the year, and has quickly rolled out a lower priced ad-supported subscription tier to cater for its customers who are all feeling the squeeze of the cost of living crisis. We think the companies that took decisive actions early on in 2022 are best poised for a recovery. In other words, ‘the first in will be the first out’.

Third, although employee lay-offs are rife, the battle for the top talent is fierce. Nowhere is this more prominent than in the Silicon Valley, the beating heart of the global technology industry where data scientists and top engineers are a scarce commodity. And never is it fiercer than now, when the best are making their bets for the next cycle and taking equity at the bottom of the cycle. An innovative culture is key and the high-quality companies that have it will attract the top talent that will ensure they win over the coming years. We are closely watching the movers and shakers.

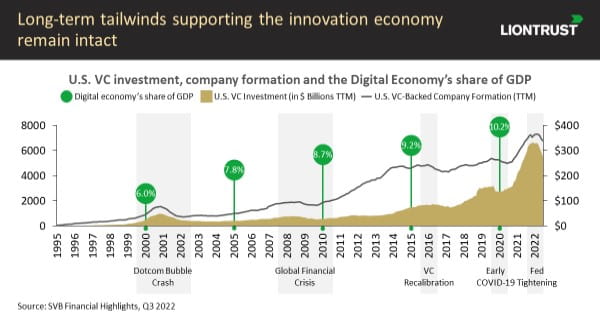

Finally, despite inflation and slowing economic growth, innovation is steaming ahead. Why? Innovation drives down prices for customers and operating costs for businesses, so it is a godsend in the face of high inflation and scarce growth. Indeed, necessity is the mother of invention and such counter-cyclicality in innovation is the historical norm. The depths of the Global Financial Crisis in 2008 spurred 126 unicorns including Uber, AirBnB, Instagram and Whatsapp, while both Microsoft and Apple were founded during the recession and inflation spike of 1975. Today’s innovation pipeline across the economy is booming. Major innovations in recent years, such as the cloud infrastructure for storing and managing data and accelerated computing to analyse and exploit it in company operations, have opened bottlenecks across almost all industries, presenting an extraordinarily large opportunity set for innovative companies over the coming years.

Portfolio news

Moderna

New holding Moderna has performed well for the Fund in November, despite the vast amounts of R&D investment inherently poured into the healthcare sector, finding genuine innovation driven value in healthcare is surprisingly hard. This is owing to the huge inefficiencies in the sector: some 90% of all drug development fails, and new trials require fresh investment, manufacturing and expertise. Developing a traditional vaccine, for example, necessitates a new manufacturing process tailored to each specific disease (since the process includes the production of the pathogen itself). This is where mRNA technology has the potential to revolutionise the industry, and new holding of ours, Moderna, is at the forefront of this revolution.

We will all be familiar with the term mRNA by now, but the key to understanding its potential is best described by Moderna itself as ‘the operating system of life’. Our DNA stores the instructions to make proteins, which is analogous to a hardware memory drive. Our mRNA transfers these instructions to the make proteins, which can be thought of as software coding. And our proteins perform the cell functions as instructed by the mRNA, similar to the apps we use every day on our digital devices. mRNA is effectively the software of our cells and can be used to encode for proteins that are either missing of faulty. Today, we are telling our cells to run Covid RNA code, but the same technology that can be used to instruct your cells to identify flu or cancer. Indeed, viewing genetic code in the same light as digital code, it really becomes a computational math problem to code for every protein known to man. Moderna, as the leading pureplay mRNA company, is best thought of as the platform powering this ability.

The potential this brings to unlock efficiency gains is significant. Since the platform’s technology is flexible, this provides accelerated R&D timelines for the company to enjoy and consumers to benefit from. For evidence, look no further than Moderna’s flu and RSV vaccine candidates, which have gone from phase one to phase three in less than a year (traditionally this would have taken around four years). The process is also more capital efficient: since mRNA vaccines or therapeutics can be produced from the same factory lines, the manufacturing footprint required is reduced. Developing new drugs more quickly and with a higher potential rate of success (using proven technology) is what we believe will drive the cash flow generation of the company over the coming years.

So what is preventing other companies from rivalling Moderna’s leadership status in an embryonic industry? The company has a moat of IP built around each and every one of its compounds, built on ten years of expertise and, crucially data. When Covid struck, the company already had a pre-existing platform with nine vaccines in clinical trials, so creating the Covid vaccine (accomplished in 2 days) was basically a copy and paste job – inserting the new genetic code into their pre-existing platform. The company simply has a ten year lead in their proprietary data set versus competitors, which they continue to invest behind in order to maintain.

For now, the stock is a Covid story, but this underestimates the longer term market opportunity. Covid vaccines comprise 100% mRNA revenues industry-wide today, but by 2035 they are estimated to only be around one quarter. Indeed, before the pandemic struck, Moderna focused much of the past decade on using mRNA to try to develop personalized cancer treatments (a vaccine for which has just cleared a pivotal trial and shows early promise.). What Covid did was accelerate the company’s trajectory by about three years. Conferring proof of concept of the technology de-risks the company’s vaccine pipeline, particularly in its respiratory portfolio where we will see phase 3 readouts (for both Flu and RSV) in the next quarter.

These late-stage pipeline catalysts will be critical in establishing a reputation as a platform capable of driving multiple RNA drugs and are why we still see valuation upside to the shares.

Illumina

Another company we have managed to build a new position is Illumina. As you will recall, we define innovators as companies that create value for customers through lowering prices or enhancing the quality of their offerings. Well, no company has done more to drive down the costs of genetic sequencing over the past two decades than Illumina, on whose machines 80% of the world's sequencing takes place. Genetic sequencing can best be thought of as decoding our DNA; genes are the DNA sequences that quite simply determine the traits of you and me, and what Illumina’s sequencing machines let us do is read these sequences. Why is this important? Because gene mutations result in a variety of diseases, and so the ability to attain a comprehensive understanding of our genetic make-up has significant implications for improving the pathway to diagnosis, treatment and monitoring of patients across a wide and expanding range of settings from oncology to reproductive health, genetic diseases and infectious diseases.

For much of the past two decades, the costs of owning and operating sequencing machines have been prohibitively high - when the first human genome was sequenced in 2003 off the back of the Human Genome Project, the cost was a staggering $2.7trillion (and took 13 years). Fast forward to 2021, and the cost has collapsed to around $600. Early next year when Illumina’s newest machines are commercialized, the cost will fall further still to $200 per genome. What this does is open up the market to research labs and clinics who could simply not afford this technology before: in 2004, the total addressable market for genetic sequencing stood at $5bn; by 2014 it had increased to $20bn, and by 2027 it will reach $120bn. This is one of the purest forms of innovation driving down costs for customers and creating new markets in the process.

Our conversation with the company proved that innovation is certainly steaming ahead, with new products around the corner set to drive the company’s next leg of growth. Illumina’s new sequencing machines, coming to market in 2023 (the Novaseq X series), increase throughput three-fold and do so in half the time and for half the cost of running today’s technology. Reception by customers has exceeded expectations, with a backlog of 50 orders and further pipeline of 170 customers making management’s target for 300 shipments next year look conservative.

But what makes this new product range truly special is that for the first time, these machines will have inbuilt secondary analysis (think of having a supercomputer onboard), allowing customers to analyse the data and create insights almost instantaneously. No one else is doing this, which will further cement the company’s moat as the go-to platform for sequencers. It also opens up additional revenue streams associated with the storage and management of this data. Learning about how this innovation came about – from customer requests – brought to life the virtuous feedback loop of customer engagement driving R&D led innovation, a key reason why we hold the stock.

So what is the stock price telling us? Shares are down 45% year-to-date reflecting three main overhangs. Firstly, we are seeing tighter capital and inventory discipline from customer research labs against a tough economic backdrop (which should be transient). Secondly, customers are delaying purchasing decisions ahead of the new machine launches (which bodes well for growth looking into next year and beyond). And finally, there is uncertainty as to whether Illumina will dispose of GRAIL, the early-cancer detection company acquired in 2021 (which we should receive clarity on soon).

Does this alter the investment case? In a word, no. The company’s considerable competitive advantages in the form of IP and scale (it has the largest sequencing base in the world, with over 91,000 customers) are strengthened by its new product innovations, which crucially deliver more value to customers. As long-term investors, we see the pullback as an opportunity to invest in an innovator who enjoys a near monopoly in a growing and underpenetrated market.

Planet Fitness

After posting strong earnings for the third quarter, Planet Fitness - which we often refer to as the Aldi of US gyms - held its first ever capital markets day in November. This presents us with a good occasion to summarise why we believe this is such a good business.

Lastly, Planet Fitness is a disrupter in the purest sense of word: it has dramatically driven down the price of gym membership for many Americans (over 15 million and counting plus a small but growing number in Canada, Mexico and Australia) and has a business model that is almost impossible for the old guard to defend against. The average monthly gym membership subscription in the US is $50 and a high-end Equinox membership or the like will set you back $200-$250, while by stripping out everything but the basics from the cost structure, Planet Fitness’s is just $10.

The beauty of driving down prices by as much as 80% is that it expands the overall market size and generates a lot of growth. Over three-quarters of Americans have never had a gym membership before and this section of the population is a big opportunity for Planet Fitness. Of the 12.8 million aggregate new gym members in the US over the decade prior to the pandemic, 11.1 million of them – a staggering 87% – were new Planet Fitness members. Moreover, the pandemic afforded Planet Fitness to strengthen its market share against the competition with 25% of the industry closing down permanently while no PF locations permanently closed.

An important aspect of this growth is Planet Fitness’s “no judgement” non-intimidating, inclusive ethos, which, now that it is operating at far superior scale to competitors, it can propel through advertising and strong brand building. Its 2,353 locations is double the next ten low-price gym concepts combined, enabling it to spend the same on media as its 15 largest peers, including flagship national ads.

As an over 90% franchised business, Planet Fitness runs a capital-light model with high and growing returns on capital as it scales. With strong demand and low cost bases franchisees can achieve payback on their capital outlay in as little two years, which enables good economics upstream for the company. Other scale advantages include being the largest single buyer of gym equipment in the industry, typically achieving a c.25% discount (and requiring franchisees to upgrade equipment, purchasing from Planet Fitness, every 5-7 years.)

We see lots of growth potential ahead both in the US and perhaps more excitingly internationally given the simplicity of the concept which should transfer well in many other countries.

Discrete years' performance (%)**, to previous quarter-end:

|

|

Sep-22 |

Sep-21 |

Sep-20 |

Sep-19 |

Sep-18 |

|

Liontrust Global Innovation |

-24.3% |

19.5% |

29.9% |

2.0% |

16.5% |

|

MSCI AC World |

-4.2% |

22.2% |

5.3% |

7.3% |

12.9% |

|

IA Global |

-8.9% |

23.2% |

7.2% |

6.0% |

11.6% |

|

Quartile |

4 |

3 |

1 |

4 |

1 |

**Source: FE Analytics as at 30.09.22. Quartile generated on 07.10.22

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The Fund may invest in emerging markets/soft currencies or in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.