The Liontrust Strategic Bond Fund returned 3.9%* in sterling terms in November. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was 3.0%.

The focus of the commentary this month is on the US inflationary dynamic and the US Federal reserve’s hiking cycle. November got off to a flying start with the release of US inflationary data on the 10th. Headline CPI, shown as the solid black line on the chart below, was 7.7% for October (consensus 7.9%, prior 8.2%); core CPI came in at 6.3% (consensus 6.5%, prior 6.6%) – this is depicted by the dashed line in the chart.

There is a danger in extrapolating too much from one data point, but the underlying constituent details of the CPI were also supportive of the trend turning downwards (from its far too high level).

Core goods prices were down month-on-month at 0.4% (still positive year-over-year as shown in blue above), driven by a fall in used car prices and inventory overhang pressures elsewhere, e.g. apparel. Services inflation (shown in gold) remains too high, but the pace decelerated in October from 0.8% to 0.5%. Owners’ equivalent rents (OERs) saw inflation decelerate from 0.8% month-on-month in September to 0.6% in October, while actual rents were up 0.7% on the month. Shelter accommodation remains a crucial and sticky part of CPI; seeing the monthly pace decrease is encouraging although we will not see a dramatic fall in the annual figures until Q2 or Q3 2023 due to natural lags in the way the BLS reports the figures. The US housing market is rapidly slowing with prices falling, the impact of this will feed through into CPI later on in 2023. Also within the services component was a big monthly fall in medical insurance (a reversal of the post Covid jump higher) of 4%. Due to the calculation methodology, this impact will persist until September 2023, replacing a 0.03% monthly uplift to CPI for the last 12 months into a forward looking 0.05% downwards drag (a good thing). Inflation will almost certainly still be above the Fed’s target at the end of 2023. I estimate core CPI to be in the 3-4% range by then but the trajectory will be firmly downwards.

The US Federal Reserve’s minutes from their 1-2 November FOMC meeting were released a fortnight after the CPI data. I had expected these minutes to be a damp squib given that so many FOMC members had been publicly speaking since the meeting. However, there were three interesting snippets; I will give the quotes (the bold emphasis is mine) and my interpretation:

1. “A number of participants observed that, as monetary policy approached a stance that was sufficiently restrictive to achieve the Committee’s goals, it would become appropriate to slow the pace of increase in the target range for the federal funds rate. In addition, a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.”

This is about the size of upcoming hikes; Powell’s trade-off has been that the pace will slow but there will probably be a higher terminal (peak) rate. The “substantial majority” language coupled with the word “soon” is a very clear indication that the Fed will raise rates by 50bps at its 13-14 December meeting. We have one more US employment report and CPI figure before then, and they would have to be very shocking to alter the Fed’s course.

2. “Many participants commented that there was significant uncertainty about the ultimate level of the federal funds rate needed to achieve the Committee’s goals and that their assessment of that level would depend, in part, on incoming data. Even so, various participants noted that, with inflation showing little sign thus far of abating, and with supply and demand imbalances in the economy persisting, their assessment of the ultimate level of the federal funds rate that would be necessary to achieve the Committee’s goals was somewhat higher than they had previously expected.”

This was, in my opinion, the most dovish part of the minutes. The key word is “various”, suggesting there is no majority consensus for a large increase to where terminal rates are going to be. This makes sense given the mix of hawks and doves on the FOMC, and the uncertainty that is always involved in economic forecasts but particularly when there are lagged effects of large cumulative tightening to feed through.

The “somewhat higher” points towards a revision upwards to the median forecast of terminal rates, but not a large one. The December meeting has an accompanying quarterly summary of economic projections. I expect the dot plot (showing FOMC members’ views of where rates will be) to have a cluster in the 4.75-5% and 5-5.25% buckets for peak rates with outliers in each direction.

3. “The staff, therefore, continued to judge that the risks to the baseline projection for real activity were skewed to the downside and viewed the possibility that the economy would enter a recession sometime over the next year as almost as likely as the baseline.”

This just shows that the Fed is now close to forecasting a 50/50 probability of recession in 2023. A continued move away from the narrative of achieving a soft landing.

Finally, the month finished with Powell, Chairman of the Federal Reserve, giving a speech. This was his last chance to publicly voice his opinion before entering the blackout period ahead of the next FOMC meeting on 13-14 December. In my opinion, there was nothing new when comparing what he said with the minutes from the November Fed meeting discussed above. The reiteration of the messages was, however, taken positively by bond markets.

Firstly, there is the extremely high likelihood that rate hike increments will be changed to be 50bps at the December meeting: “…the time for moderating the pace of rate increases may come as soon as the December meeting.” Then Powell repeats that the terminal (peak) rate will be higher than the prior dot plot and rates are currently forecast by the Fed to stay restrictive for an extended period: “…the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.” At the time of writing the bond market is pricing in 52bps of hikes for the December meeting and a peak rate of around 5% in May/June of 2023.

Fund positioning and activity

Rates

The Fund remains long duration at 5.25 years (reminder: range 0-9 years, neutral 4.5 years) but used the rally during November to take profits on the addition that had been made during October when US 10-year yields touched 4.25%. We sold 0.25 years from the US, leaving the Fund with 2.5 years still stateside, a little over 0.3 years in New Zealand, just under 1 year in the UK, and 1.5 years in the eurozone.

Allocation

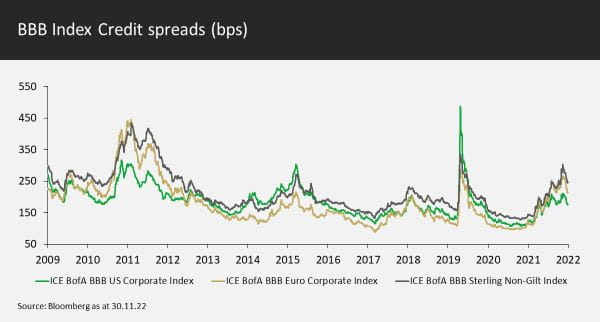

From late October onwards credit had a strong rally. For example, US credit spreads have rallied ~30bps and European credit indices are 40bps tighter. Spreads are at average levels in the US and about 40bps wider than the post-financial crisis norm in Europe. The chart below illustrates how BBB rated credits have seen their spreads compress.

Strategically, we believe credit offers long-term value both examining spreads and, particularly, the all-in yield. However, the upcoming recession in 2023 and reduction of central bank liquidity mean that we need to see more of a premium to justify a large overweight position. Given the less obviously attractive valuations, the spectre of recession and the potential for ongoing volatility, we have reduced our long position from 20% to 5%, taking investment grade exposure down to our neutral level of 50% (from 60%) and high yield to 25% (from 30%). This gives the Fund the risk budget to be able to buy more credit should valuations improve again during any period of volatility. As a reminder, we have a quality bias within credit, limited exposure to the most cyclical parts of the credit market, and the Fund owns no CCC rated bonds.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns

|

|

Sep-22 |

Sep-21 |

Sep-20 |

Sep-19 |

|

Liontrust Strategic Bond B Acc |

-15.5% |

3.0% |

4.0% |

5.9% |

|

IA Sterling Strategic Bond |

-14.5% |

4.6% |

3.6% |

7.1% |

*Source: Financial Express, as at 30.11.2022, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 30.09.2022, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12-month periods due to the launch date of the portfolio (08.02.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.