The Liontrust GF Absolute Return Bond Fund (C5 share class) returned 1.5%* in sterling terms in Q3 2023 and the IA Targeted Absolute Return, the Fund’s reference sector, returned 1.3%. The Fund’s primary US dollar share class (B5) also returned 1.5%.

The biggest driver of the total return during the third quarter was yield ‘carry’. A small rise in shorter-dated government bond yields and a little generic credit spread tightening roughly offset each other. Incremental returns were generated by curve positioning in Rates, as well as stock selection in both Selection and Carry.

Market Backdrop

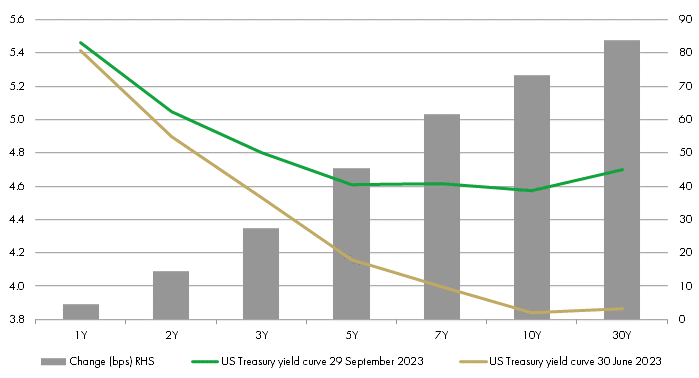

The third quarter of 2023 witnessed a large ‘bear steepening’ in developed economy sovereign bond markets. The bear part of this jargon refers to the fact that yields rose, the steepening means that longer dated bonds saw their yields rise by more than those with shorter maturity tenors. The chart below examines the change in the US Treasury yield curve during the quarter.

US Treasury yield curve change — Q3 2023

Source: Bloomberg, Liontrust.

The gold line shows yields of treasuries with various maturities at the end of June, with the green line representing the end of September; please do note that the horizontal axis scale is not linear. The grey bars show the difference between the two lines; 30-year yields rise by over 80 basis points, whereas the increase in 1-year yields was under 10 basis points. The yield curve steepened over the quarter; the shape is still inverted with shorted dated bonds yielding more than longer tenors, but the size of the inversion reduced during the period. In my opinion there were three main inter-related factors that caused this movement in bond yields.

Firstly, although economic data were mixed there were enough signs of economic robustness for the market to continue to delay, and sometimes cancel, forecasts of recession. The US economy has remained stronger than one would normally expect after so much tightening in monetary policy. We believe that the same factors that are delaying the recession will conspire to make it a relatively mild one. However, we continue to assign a very low probability of the Federal Reserve successfully engineering a soft landing. Having had so much difficulty in hiring, many companies will hoard labour through the downturn; but a significant increase of the current 3.8% unemployment rate will happen once the recession starts. The aforementioned labour hoarding might mean the unemployment rate doesn’t peak above 6% as we saw in the early 2000s, and definitely not at the 10% rate seen post the Global Financial Crisis. Instead, somewhere around 5% makes intuitive sense. We would not classify forthcoming anaemic consumption growth and roughly 5% unemployment, assuming this figure is in the right ballpark, as a soft landing.

Secondly, the continued large fiscal deficits, combined with shrinking central bank balance sheets, have led the market to demand more ‘term premium’ to lend to governments over longer time horizons. The news that Fitch had cut its sovereign rating on the US from AAA to AA+ caused a bit of a stir at the start of August. After the last debt ceiling prolonged debacle in 2011, S&P’s cut made much more of a splash. Fitch is less followed, and most investors had already adjusted mandates for the US losing the purity of its AAA. The US Treasury has been revising upwards its bond issuance forecast to meet its funding needs, so the rating cut did help to remind markets about the current fiscal largesse. The Fitch downgrade effect has already faded, but the ongoing fiscal deficit and associated glut of supply will remain at the forefront of bond investors’ minds.

Finally, the over-riding message from developed economy central banks has been that rates will be “higher for longer”. Although interest rates may be at or near their peak, central bankers are stressing that policy will stay at these restrictive levels for a prolonged period.

In September the FOMC (Federal Open Market Committee) left Fed funds rates unchanged at the 5.25%-5.50% range in line with expectations. The statement retained its tightening bias referring to the “…extent of additional policy firming that may be appropriate to return inflation to 2 percent over time.” However, the real hawkish elements were all to be found in the Summary of Economic Projections (SEP).

The SEP saw real GDP forecasts revised upwards relative to June’s assessment, 2023 is now 2.1% (prior 1.0%) and 2024 is 1.5% (prior 1.1%); 2025 remains unchanged at 1.8%. Unemployment was revised down for 2023 to 3.8% (prior 4.1%) which could be a little optimistic given that is where it presently resides; both 2024 and 2025 are now forecast at 4.1% against the prior 4.5% prediction. The forecast for core PCE (the Fed’s preferred inflation measure) in 2023 was revised down to 3.7% (prior 3.9%), 2024 was left unchanged at 2.6%, and 2025 tweaked upwards to 2.3% (prior 2.2%).

The revisions to the dot plot were more hawkish than expected. The dots continue to show one more rate hike being desired in 2023, while the market is pricing in approximately a 50% chance of this. The FOMC is divided about whether it has already reached a policy stance that is “sufficiently restrictive”. The bigger revision was in 2024, the median there is now 50bps higher at the 5.00% to 5.25% range; commentators had only been expecting an incremental 25bps upward move. The rate hike in 2023 is conditional on the forecasts of unemployment at 3.8% and core PCE of 3.7% being reached in Q4, the Fed remains data dependent. Taking some of the hawkish edge off in the press conference, Fed chairman Jerome Powell repeatedly stated that it would “proceed carefully.”

The over-riding message is higher for longer, but I suspect part of this is compensating for the farce of calling inflation transitory in the first place. It is worth remembering that these dot plots are not a plan, they merely represent the collective thoughts of 19 Fed officials. In my opinion, if rates are held at such restrictive levels for a few quarters the economy will weaken rapidly enough for core inflation to approach the 2% target much sooner, and that’s before one accounts for the lagged effect of the cumulative tightening we have already witnessed and the ongoing quantitative tightening (QT). A mild recession remains our central forecast, it has been delayed along with Fed rate cuts, but as the economic data weakens the Fed officials’ rates assessments will evolve.

The Bank of England’s Monetary Policy Committee (MPC) kept rates on hold at 5.25%; this was a surprise relative to economists’ forecasts, and a smaller surprise to markets which had moved to price in just over a 50% chance of a hike after the inflation data. It was a close vote with the split being 5-4, the dissenters all preferring a 25bps hike; those voting against were Greene, Haskel, Mann, and Cunliffe, for the latter it was his final meeting so the hawk count on the MPC will probably reduce.

As with the Fed above, the emphasis is shifting to the length of time rates are held at restrictive levels; the statement retained the mantra “…sufficiently restrictive for sufficiently long”, regarding returning inflation to the 2% target. At a conference in Cape Town in August, Huw Pill described this as the Table Mountain approach, as opposed to the Matterhorn. The hawkish bias for interest rates has been maintained, “…further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.”

The European Central Bank (ECB) was the outlier during September as it hiked rates by 25bps, taking the deposit rate to 4%. Forecasts for the meeting predicted that it was a very close call whether they hiked or held, economists were split about 48/52% respectively and the market had priced in a 65% chance of an increase. I would characterise the move as a dovish hike, the ECB has almost certainly reached its terminal (peak) interest rates for this cycle, but it has left some wiggle room to hike again in the unlikely circumstance that economic conditions materially improve. During the press conference Lagarde did reveal that some members of the Governing Council would have preferred a pause, but the “solid majority” was for a hike.

The key sentence in the ECB press release is “…Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.” Regarding the outlook for monetary policy, the focus is now more on the length of time rates are held at restrictive levels rather than the level itself. Although there is no clarity yet on the duration which the ECB thinks will be long enough to hold deposit rates at 4%, it is clear that the data dependency will be tested against future economic projections. Lagarde joked that the word “cut” is a word that the ECB has “not pronounced” if the next quarterly set of economic forecasts see further downward revisions to growth, core inflation forecasts will surely follow and Lagarde will be pronouncing cut sooner than the ECB currently envisages.

Performance commentary

Carry component

We split the Fund into the Carry Component and three Alpha Sources for clarity in reporting, but it is worth emphasising we manage the Fund’s positioning and risk in its entirety. As a reminder the Carry Component invests in investment grade bonds with <5 years to maturity, within this there is a strong preference for investing in the more defensive sectors of the economy.

The biggest driver of the total return during the third quarter was yield ‘carry,’ a small rise in shorter-dated government bond yields and a little generic credit spread tightening roughly offset each other. Incremental returns were generated by curve positioning in Rates, as well as stock selection in both Selection and Carry.

Alpha Sources

Rates

The Fund spent most of the quarter with a duration of 2years, above the neutral level of 1.5 years (as a reminder the permitted range is 0-3 years). At the end of the quarter the Fund had duration exposure of 2 years split between 1.05 years in the US, 0.70 years in Europe and 0.25 years in the UK.

By design the Fund invests predominately in the short-dated part of the yield curve, thus the bear steepening described in the market commentary above had a more benign impact on returns than it would have done for bond funds investing significantly across the maturity spectrum. Furthermore, the Fund had an alpha position on to take advantage of the yield curve move, a 2s10s steepener (long 2-year futures and short the duration equivalent amount of 10-year futures) in the US. This position was closed out during the quarter having generated 14 basis points of performance.

Allocation

The weighting in the Carry Component has been in the high 80s to low 90s percentage area throughout the quarter, due to the compelling yield on short dated defensive investment grade. With the weighting in the Carry Component being so high, we have reduced exposure to other credit in Selection.

Selection

The credits owned within Selection had a small positive impact in the third quarter, the total of these summed to 4 basis points. Stock picking within the Carry Component was also additive, with senior debt from Heimstaden Bostad and Aroundtown both continuing to recover from oversold levels.

To replace other maturing bonds in the Carry Component the Fund participated in a new bond deal from Nestle, the 3-year sterling denominated bonds which were a little cheap relative to existing bonds but very much at the high-quality end of the range. Additionally, euro-denominated bonds were purchased in Leasys; the company is 50/50 owned by Credit Agricole and Stellantis, providing a strong backstop to this single A rated 3-year bond.

Finally, the Fund undertook a relative value trade in American Tower’s bonds; by switching the 2025 into 2027 bonds a credit spread pickup of 66bps was generated, attractive terms for a 2-year maturity extension.

Key Features of the Liontrust GF Absolute Return Bond Fund

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The fund manager considers environmental, social and governance (""ESG"") characteristics of issuers when selecting investments for the Fund. Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. The Fund can invest in derivatives. Derivatives are used to protect against currency, credit or interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The Fund uses derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. The Fund invests in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of the fund over the short term. The Fund may encounter liquidity constraints from time to time. Participation rates on advertised volumes could fall reflecting the less liquid nature of the current market conditions. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. There is no guarantee that an absolute return will be generated over a rolling 12 month period or any other time period.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.