- A strong month for the fund (+662bps; +187bps vs. FTSE ASX)

- Positive stock performance from Kitwave, Spirent, Midwich and Convatec

- Sainsbury's profiled – the changes in UK grocery are real

The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. Performance in March was strong, with the fund +662bps, outperforming the FTSE ASX by 187bps. Markets were perky, with UK inflation showing signs of moderation and Bank of England governor Andrew Bailey suggesting rate cuts were 'in play'. Performance was boosted by a handful of idiosyncratic single stock movements, with reporting season generally having seen positive updates from our holdings. Over one year the fund is in the 1st quartile of IA UK Equity Income comparator group, a position replicated over three years.

The top contributor to performance in March was Kitwave (+89bps, profiled in our January newsletter), which continued to find buyers post strong results and having announced an accretive bolt-on acquisition at the end of the month. Spirent (+73bps), the provider of test and assurance products to the telecommunications market, moved sharply higher after being acquired by a U.S competitor at a c.85% price premium. Midwich (+54bps), the global distribution of pro-AV equipment, also contributed strongly after reporting solid results, having drifted lower through last year. Convatec (+44bps), the manufacturer of medical devices, reached seven-year highs after reporting good FY23a results and guiding to further progress.

The only meaningful detractor in the month was consultancy Alpha Financial Markets (-13bps) which moved lower. There was no company specific news flow, although industry bellwether Accenture guided below market expectations for the year ahead. We are not expecting a particularly strong year for AFM but believe consensus estimates are broadly in the right place at this time.

Dividend paying companies with Competitive Power: Sainsbury's

'Never' is too definitive a word to apply in the field of investing. The world and financial markets are constantly evolving, surprising, humbling the dogmatic, shattering the ossified. Never, say never. That said, earlier in his career Dan spent several years as a sell-side equity research analyst covering the European food retail sector. At the point he moved to the asset management industry five years ago, he felt clear the UK grocery industry was a poor place to deploy long-term capital – over-spaced, undifferentiated, competitive, and low margin. And so this is a newsletter we would not have anticipated, profiling Sainsbury's as a new holding in our fund which preaches the virtues of quality dividend investing. Yet here we are, having built a position of c.3.3% of NAV at cost…so what has changed? The UK grocery industry looks quite different today and more attractive than at any point in the past decade. In this note we'll walk through the changes we observe, covering several key areas: space; market structure; online economics; loyalty; media revenue and the impact of discounters.

For anyone unfamiliar with the business, Sainsbury's is the second biggest UK grocery business with market share of c.15%. It operates from c.1,400 supermarkets and convenience store locations. It also owns the Argos general merchandise business, which is the UK's biggest click-and-collect retailer and the Nectar360 loyalty card scheme, which is also the UK's leading scheme with >16 million members.

The UK grocery industry experienced a collective loss of capital discipline over the early part of the 2010s. Supermarket space grew by c.3.5-4.0% compound over the 2010-14 period. This was the equivalent of a new ASDA being created, into a mature market offering limited volume growth. A multi-year price war was the inevitable, indeed rational, outcome of supply outpacing demand for a sustained period. But such is the capital cycle, this drove a sustained period of austerity. Recent data from UBS shows UK store formation has now slowed to c.0.5% per annum. This more balanced backdrop has allowed industry sales densities to be rebuilt and meant less obvious incentives exist to cut price to drive footfall to underutilised supermarkets.

Market structure has also evolved significantly, driven by the private equity backed takeovers of ASDA and Morrisons in 2021. These companies were the #3 and #4 players with respective market shares of c.14% and c.10%. Their new owners injected significant additional financial leverage into the businesses, both now operating with EBITDAR leverage of >6x (source: Fitch Ratings; earnings before interest, tax, depreciation, and lease payments). This change in ownership and financial structure came at a moment when global interest rates started to inflect higher, driving increased financial charges. Reduced financial headroom has seen these companies competing less aggressively on price over the past couple of years, alongside anecdotal reports of deteriorating store standards. Both have been losing market share and, we believe, have limited flexibility to compete as effectively as they have in the past. We would also note Lidl (c.8% market share) and Iceland (c.2%) also operate with relatively high levels of financial leverage.

Another concern we harbored was around online grocery, namely that the industry’s fastest growing channel was also its least profitable, cannibalising the profit pool of an already thin-margin industry. During the pandemic, demand for online grocery was artificially boosted, but a decent proportion of shoppers have opted to stick with the convenience of online –for instance, Sainsbury's Groceries Online sales remain c.81% higher and Tesco's c.60% ahead of pre-pandemic levels. This is fundamentally helpful as a key driver of online unit economics is so-called 'drop density', or the number of deliveries per van per day. A bigger pool of customers enables the retailer to optimise routes and achieve better fixed cost efficiencies. While the major UK grocers do not disclose online profitability specifically, our discussions have confirmed they are now enjoying a distinctly better economic model than prior to Covid-19, such that they are no longer seeing significant dilution from online sales relative to in-store.

We recently met with industry consultant Kantar, which shared some fascinating data on changes in customer loyalty over the past couple of years. We learned the multi-year trend in basket splitting (where consumers shop around at multiple supermarkets) has started to noticeably reverse, with basket sizes increasing meaningfully at both Tesco and Sainsbury's, in particular. Their hypothesis is that the combination of price match schemes with Aldi on key value items alongside new loyalty card linked pricing structures (e.g. Clubcard and Nectar pricing) has driven a change in shopper behaviours. Sainsbury's has seen Nectar card participation increase from 61% (Mar' 21) to >80% (Jan' 24), driven by its new mobile app. We think loyalty is a key metric. It reliably measures whether superior value has been delivered to customers to keep them coming back for more. It also kicks-off a series of positive second-order economic effects (higher retention rates, lower price sensitivity, lower cost to serve, plus inclination to proactively refer new customers). Various academic studies have proven small changes in customer retention rates can result in disproportionately high improvements in profits. In short, loyal customers are your best customers.

Using loyalty card data can underpin more scientific approaches to price, merchandising and marketing. And because Tesco and Sainsbury's have the biggest loyalty schemes in the industry, they collect the most data. Revamped and digitally led loyalty schemes are opening up new adjacent profit opportunities for these players, who are using their data to generate advertising revenue from major consumer packaged goods companies, working with them on promotional activities, new product launches and cohort targeting, for instance. Sainsbury's is targeting an incremental £100 million in profit from Retail Media over three years and Tesco has similar ambitions. This income stream comes at high margin and return on capital and cannot be replicated by discounters (who don’t have loyalty schemes) or other mainstream supermarkets (who have much less comprehensive datasets). It's an attractive incremental string to the bow, in an industry where profit growth has otherwise been hard to come by.

The combination of the above factors, alongside a fundamentally streamlined and better value for money proposition, has seen the mainstream supermarkets significantly diminish the impact of discounters Aldi and Lidl. For several years Aldi and Lidl were routinely taking a combined 150-250bps of market share, primarily from the so-called Big-4 (Tesco, Sainsbury, Aldi and Morrisons). Data from UBS shows that Aldi and Lidl new store openings are now at the lowest level in a decade, with Lidl having recently scaled back its opening plans. Most recent data from Kantar shows their combined market share gains curtailed to c.20bps YoY, the lowest in more than a decade. Industry data also suggests limited appetite or ability for the discounters to engage in aggressive price competition, for instance Aldi was the first grocer to move pricing higher during last year's inflationary cycle on key value items such as milk (source: Goldman Sachs). Overall, the pressure from these formerly highly disruptive players is more manageable than it has been in many years. And Sainsbury's has been winning share from every competitor in the UK, including both Aldi and Lidl.

So from several angles we observe a more attractive industry backcloth. And operators are in agreement. We listened to Tesco’s results call last week (where we also have a small position in the fund, on a similar thesis to Sainsbury’s) where CEO Ken Murphy stated ‘there’s a little bit of oxygen back in the industry.’ That’s not something a Tesco CEO has uttered in many moons.

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to try and understand and identify quality. In our view Sainsbury's operates in a low growth, but increasingly stable market and is demonstrating improvements in the five building blocks of quality we look for across our portfolio holdings.

1. The supermarket industry is never going to be an industry that generates supernormal returns on capital employed (ROCE), given its fixed asset intensity and margin structure. Sainsbury's generated an unacceptably low c.8% in FY23a. However, its three-year strategic plan sees this being restored to around c.10%. This suggests the incremental returns over the medium term should be quite attractive, with the direction of returns, rather than absolute level, the most important share price driver, in our experience.

2. As dividend-focused investors we want clean, cash generative financial models. Sainsbury's accounts are messier than we would like, with chunky P&L adjustments having been booked over recent years driven by restructuring costs related to the integration of Sainsbury's and Argos, headcount reduction to achieve cost efficiencies and some impairments (higher discount rates). A large proportion of this has been non-cash in nature and we expect lower adjustments going forward. Sainsbury's free cash flow (FCF) conversion has been good, averaging >100% of net income over the past three years, supported by good working capital management.

3. Sainsbury's balance sheet is in the best shape it's been in a decade or more. Excluding leases it reported a small net cash position (FY23a). Including leases its leverage ratio (net debt/EBITDA) is now towards the bottom of its 2.4-3.0x target range and it has recently announced a share buyback plan. Its pension schemes are now in surplus on both IAS19 and actuarial bases, although it is continuing to make small top-up payments.

4. The UK grocery market might not screen as an ostensibly attractive underlying market – though the cycle volume growth is relatively low (c.0.5%), it is competitive and the marginal shopper is motivated by price. However, as discussed, we think it is an improving market, and one in which well-managed winners should be able to deliver consistent defensive cashflows, relatively uncorrelated to the broader economic cycle.

5. We look for skilled, motivated management and have been impressed in our interactions with Sainsbury's current leadership team Simon Roberts (CEO) and Bláthnaid Bergin (CFO). They have been laser-focused on targeted cost reductions and improving Sainsbury's food offer which has driven market leading performance. We see the recent strategic plan as pragmatic, investing in highly selective growth opportunities, while remaining focused on cash generation and shareholder returns.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to assess whether Sainsbury's improving financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes - benefits to the company, manifest through pricing power or lower costs; and, barriers to competitors (for further discussion see here). We believe Sainsbury's has one of the seven Competitive Powers - Scale Economies, which we think will allow it to continue delivering solid performance.

- Scale Economies: Sainsbury's is the #2 player in UK grocery with >15% market share. Crucially, it also delivering sector-leading volume growth. This matters because when volume per SKU (stock keeping unit) is high and growing, a retailer is generally able to obtain better terms of trade from its suppliers. This is allowing Sainsbury to price match Aldi on c.600 core products. Another point of scale driven differentiation is the Nectar card loyalty scheme – this is the biggest scheme in the UK with >16 million members, which creates unique media profit opportunities, as discussed above.

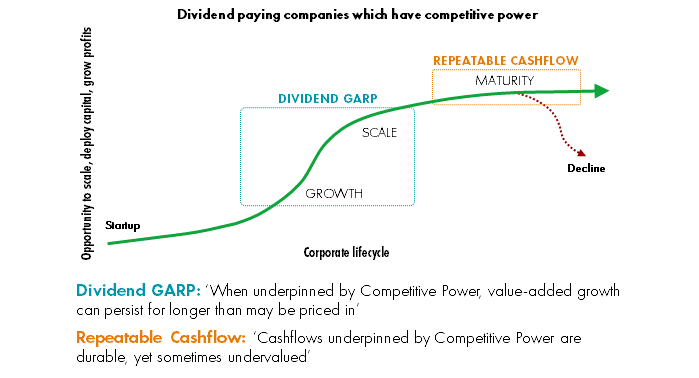

Sainsbury's sits within the Repeatable Cashflow portion of our portfolio. With this silo we focus on more mature companies, directing a greater proportion of their cashflows to dividends. Our investment hypothesis with this group of stocks is that 'cashflows underpinned by Competitive Power are durable, yet sometimes undervalued.' A high yield (or ‘cheap’ valuation) is an implicit expression by ‘the market’ of scepticism around the sustainability and/or growth potential of that cashflow stream. Often this scepticism is appropriate; sometimes it is not. Our job is to find companies, such as Sainsbury's, trading on attractive dividend yields, with better prospects than are currently ‘priced-in'.

The stock trades on blended forward P/E of c.11.5x (FY1e) vs. its own 5 and 10-yr average of c.11.6x and is on a prospective FCF yield of c.9.5%. We don’t wish to overstate the potential for a company such as Sainsbury's – this is not the sort of stock we expect to 'break-out' or feature regularly at the top of our attribution scorecards. But we do think it can play a role in a balanced income portfolio, delivering defensive profit growth of mid-to-high single digit percent over the medium term as margins are rebuilt towards historical levels. The dividend yield is >5% and this payout should grow in line with earnings, suggesting solid double-digit total shareholder return potential.

Fund performance year-to-date has been pleasing. We are, though, focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.