The Liontrust Global Dividend Fund continues to invest in innovative global leaders, buying companies on the right side of AI at cyclically depressed prices ahead of a new innovation cycle.

- March rounded a quarter characterised by a renewed bout of volatility, spurred by uncertainty over tariffs and their impact on business activity. This market dislocation presented an opportunity to strategically increase our holdings in the hardest‐hit investments across our portfolios.

- Fundamentals remain strong; an exceptional Q1 earnings season for global innovators was possibly the best experienced in over two years.

- Our quarterly research trip – with 40 management team meeting and over 100 transcripts reviewed – has increased our confidence in the outlook for innovators across various sectors, with the ability to strengthen their competitive positioning against a difficult market backdrop.

The Liontrust Global Dividend Fund returned -7.9% in March, placing it in the 4th quartile of peers behind the IA Global Equity Income sector average of -3.7% and the MSCI World Index which returned -6.8% (both comparator benchmarks).

This rounded out the first quarter of 2025 where the fund returned -6.3%, placing it in the 4th quartile of peers, behind the IA Global Equity Income sector average return of 0.3% and the MSCI World Index return of -4.7% (both comparator benchmarks).

Longer term performance remains strong, with the Fund having returned 109% since manager inception (31.08.17), the number five fund in the sector, ahead of the IA Global Equity Income sector return of 68.3% and in-line with the MSCI World Index return of 109%.

Fund commentary

In the short term, market sentiment often drives share prices; however, over the longer term it is underlying fundamentals that determine investor returns. March rounded a quarter characterised by a renewed bout of volatility, spurred by uncertainty over tariffs and their impact on business activity. This new market cycle is now nearly two years old, characterised by both high returns and pronounced volatility. We believe now presents an opportunity for investors who have thus far remained on the sidelines, for three key reasons:

1. Strong fundamentals

We recently concluded an exceptional Q1 earnings season for global innovators – quite possibly the best we have experienced in over two years. These companies are generating strong momentum in the new market cycle as they capture market share or enter new markets. Just as in every prior cycle, the new winners this time around will differ from the past cycle. As in July 2024, when we experienced the last major severe market downturn, we are fortunate that this has occurred during a time when we are inundated with information from our companies and can underwrite our conviction in our holdings.

During sharp market sell‐offs or resets, the best‐performing stocks from the preceding period often suffer the steepest declines. This has indeed been the case: holdings across the fund — including Novo Nordisk, Nvidia, Broadcom, and Constellation Energy — have experienced pronounced drawdowns. Nevertheless, these companies' outperformance was because their fundamentals continued to run ahead of their share prices; that is now the case to an even wider degree. As such, they are likely to be among the first to see their share prices recover.

Novo Nordisk – the global leader in revolutionary GLP-1 weight-loss drugs alongside Eli Lilly (also held) – was the biggest detractor from Fund performance in both March and the quarter, driven by broader market volatility and a slightly disappointing trial read-out for its next-generation weight-loss drug, CagriSema, in patients with type 2 diabetes. Although the 16% weight-loss result fell short of market expectations compared to Eli Lilly's competing treatments, it significantly outperformed placebo (3%) and existing drugs such as Wegovy, highlighting the company's continued advancement in the GLP-1 space.

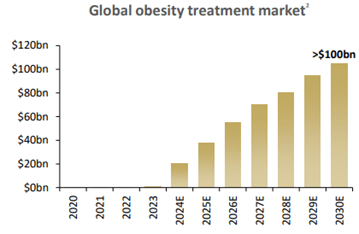

We view this latest trial result as merely a short-term hiccup, the company maintaining a healthy pipeline with multiple additional trial readings to come in the quarters ahead for different indications and with different dosing regimens. Importantly, the GLP-1 market remains vastly underpenetrated, with fewer than 1% of the estimated two-thirds of U.S. adults who are overweight or obese currently receiving treatment, yet market forecasts suggest the category could reach $100 billion by 2030.

Novo's last update showed it continues to seize this opportunity – revenue and earnings both growing c.30% year-on-year, dividend up 21%, guidance raised, and capex increased 38% year-on-year to 65 billion krone in the year ahead to support manufacturing growth. This ramping manufacturing investment, alongside its burgeoning pipeline of tailored GLP-1 medicines, provides a significant competitive moat that should underpin strong earnings growth as the company continues to scale – alongside Eli Lily – into a structurally growing market that is set to revolutionise health outcomes.

GLP-1s: revolutionary treatments driving down the cost of healthcare

Source: 1 ) Alzheimer’s Association, American Diabetes Association, American Heart Association, Centers for Disease Control and Prevention, Journal of Cardiac Failure, National Council on Aging, National Institute of Diabetes & Digestive & Kidney Diseases, World Obesity Federation, JP Morgan Asset Management; as of January 2024. 2) JP Morgan (2024); Company reports

Broadcom similarly continues to demonstrate strong progress despite recent share price weakness, the stock a key detractor in both March and the quarter as it sold off amid broader market uncertainty and concerns about AI infrastructure spending following the release of Deepseek’s more efficient AI model. As we have written previously, we believe these concerns are both overstated and misdirected: the collapsing cost of intelligence is by no means a new phenomenon and is crucial in facilitating the widespread adoption of AI across the economy. Moreover, breakthroughs in reasoning and the emergence of new scaling laws - post-training scaling and inference-time scaling - continue to support a strong long-term demand outlook for AI infrastructure, as reflected in the significant multi-year data centre roadmaps from hyperscalers and sovereigns alike. In this context, Broadcom – alongside Nvidia – has been a key beneficiary, and remains exceptionally well positioned. The company delivered extraordinary AI-driven growth throughout 2024, with AI-related revenues surging 220% year-on-year to $12.2 billion. Key AI connectivity products such as Tomahawk and Jericho quadrupled their revenues, and AI XPU shipments to key hyperscaler customers Alphabet, Meta, and ByteDance doubled. Looking ahead, management expects this momentum to accelerate further, capitalising on their first-mover advantage in transitioning to next-generation XPUs built on 3-nanometre nodes. In its last update, CEO Hock Tan emphasised the exponential increase in networking requirements as hyperscalers expand to clusters approaching 1 million XPUs - a substantial growth driver uniquely suited to Broadcom's expertise. With a serviceable addressable market projected at $60-90 billion by 2027 for just its major ASIC customers alone, Broadcom remains well positioned to capture value from this surging AI infrastructure demand. Recent share price weakness thus presented as an attractive top-up opportunity, underpinned by the company’s ongoing innovation, earnings growth prospects, and a strong track record of shareholder returns.

Constellation Energy was also a key detractor in March, despite having posted robust earnings earlier in the quarter that beat expectations with earnings per share up 38% thanks to strong operational performance and effective cost management across its leading nuclear fleet. As the most reliable form of energy, nuclear will be essential to meeting the surge in electricity demand from AI data centres, which is forecast to rise fifteen-fold by the end of the decade. With the largest nuclear fleet in the US and best-in-class capacity factors underpinned by continued innovation and operational rigour, Constellation is well positioned at the forefront of this emerging structural trend. Further, its recent acquisition of Calpine meaningfully expands its strategy and long-term growth profile, increasing total generation capacity to 60GW and making it the leading provider of carbon-free power in the US. The deal highlights strong vision from the management team, diversifying the portfolio beyond nuclear by adding substantial natural gas, geothermal and renewable assets, and enhancing Constellation’s ability to serve large commercial customers across a broader geographic footprint – including increased exposure to the high-growth Texas market. Crucially, the gas assets complement the intermittency of renewables, providing the reliable, dispatchable energy supply valued by hyperscalers and data centres. Financially, the acquisition appears well executed - immediately accretive to both earnings and free cash flow – while a recent regulatory shift in favour of data-centre co-location further supports Constellation’s strong long-term outlook.

2. Dislocation presents opportunity

We recently returned from our quarterly US research trip, having met with 40 management teams and reviewed over 100 transcripts. The message is clear: our portfolio companies remain well‐positioned to capitalise on multiple innovation cycles across a range of sectors.

In periods of market volatility prompted by macroeconomic factors, we strategically increase our holdings in the hardest‐hit investments across our portfolios. Accordingly, in March we raised our positions in companies across different sectors including Moody’s, Blackrock, and Meta.

Moody’s is effectively leveraging AI to enhance its core offerings in risk assessment and analytics, significantly improving client retention and expanding its addressable market. The company posted a strong beat-and-raise for Q4, with adjusted earnings per share up 20% and mid-term earnings guidance upgraded to reflect improved efficiency and new growth opportunities across private credit, transition finance, and data centre infrastructure financing.

Blackrock similarly benefits from its scale and leadership in asset management, enabling sustained investment in AI-powered analytics and portfolio tools. In its latest update, Blackrock reported a record $11.8 trillion in assets under management, supported by $641 billion in net inflows for 2024, while revenue surpassed $20 billion for the first time. Operating income rose 21% year-on-year, with an industry-leading margin of 44.5%, highlighting the company’s operational strength and improving profitability as it scales.

Meanwhile, Meta continues to ramp its AI capabilities across platforms, boosting advertising efficiency, engagement, and monetisation. Ad revenue grew 22% year-on-year in Q4, supported by growing user engagement and a 16% increase in average revenue per user. Operating income rose 35%, while free cash flow reached $14 billion, driven in part by more than 4 million advertisers now using Meta’s AI-powered ad tools – up from just 1 million six months prior.

Although these stocks had fallen between 15% and 25% from their earlier Q1 peaks, their fundamentals are in fact accelerating. Notably, we have just experienced a highly positive earnings season, highlighting that recent market capitulation – both at the overall market level and within the technology sector – has been driven by sentiment rather than fundamentals.

We have also been establishing new positions across the Fund in companies that have long been on our watchlist, and where we have awaited a suitable market dislocation to initiate positions.

For example, in March we initiated a new position in Apollo Global Management – a leading alternative asset manager and private credit platform – which remains exceptionally positioned to capitalise on secular trends, including the massive infrastructure buildout required by the growth of AI and digital services. With over $750 billion in assets under management and $60 billion in dry powder available, Apollo is strategically leveraging its scale and private credit capabilities to finance long-duration infrastructure assets such as AI datacentres. The company has delivered a five-year compound annual growth in earnings per share of 22% and targets an annualised dividend growth rate of 10%, reflecting a strengthening capacity for both reinvestment opportunities and shareholder returns. More importantly, the fundamentals underpinning Apollo’s growth – rising demand for alternative financing, favourable secular tailwinds, and robust transaction pipelines – reinforce our conviction in the company’s long-term outlook.

We also initiated a position in Walmart, the stock having fallen nearly 20% from recent highs on weakening consumer sentiment. This proved a well-timed entry, ending March as a top contributor to Fund performance. In spite of this backdrop the company continues to make significant strides in e-commerce, supported by a growing marketplace, robust fulfilment capabilities, and strategic use of AI. US e-commerce sales rose 20% year-on-year in Q4, while marketplace revenue surged 37% with nearly half of orders now fulfilled through Walmart Fulfilment Services.

Meanwhile, AI tools have saved over four million developer hours in 2024 alone, while predictive analytics and in-store automation enhanced inventory planning, reduced delivery costs by 20%, and expanded same-day delivery to 93% of U.S. households. These innovations are helping Walmart serve a broader customer base – including higher-income households – and support double-digit growth in premium services like Walmart+. With digital and operational capabilities continuing to scale, Walmart is increasingly viewed as a leader in retail innovation, uniquely positioned to drive margin expansion while catering to both value-conscious and premium shoppers.

Similarly, we reinitiated a small position in Apple late in the month, the company also down nearly 20% from stock highs. While the company will have to digest the impacts of tariffs on its supply chain, we continue to view Apple as particularly well positioned to benefit from an upcoming upgrade super-cycle at the Edge – seven billion smartphones worldwide need to be upgraded to hardware that can support on-device AI capabilities over the next few years, of which only around 10% have been replaced thus far. Despite near-term noise, we remain confident in the company’s ability to continue to leverage its scale, brand power, and strong IP to remain at the forefront of the smartphone market during this period of strong structural growth, with emerging opportunities in on-device AI software and services via its app store positioning it well for continued earnings and dividend growth in the years ahead.

To finance these purchases, we have reduced a number holdings of which have performed well, such as Chinese stocks, and exited certain companies whose upside potential is no longer sufficient. In March this included trimming recent strong performers such as L’Oreal, Halma, Antofagasta, and Tencent. In line with our strict valuation discipline, we also opted to exit our positions in Anta Sports Products, Atlas Copco, Deere, and Kone after they achieved our price targets, while also concluding our exit of Impax Asset Management which has seen a deterioration in fundamentals. These companies move back to our watchlist where we will continue to monitor them for potential attractive entry points in the future.

3. Innovators remain well positioned for a new cycle

Following our research trip, we have increased confidence in the outlook for innovators across various sectors. These companies remain well‐positioned to benefit from the significant opportunities ahead. As sentiment, rather than fundamentals, has primarily driven this recent sell‐off, it has created an attractive entry point for those seeking to establish or expand positions.

April has started with further volatility following the US government’s ‘Liberation Day’ event, with markets digesting the impact of new wide-spread tariffs from the Trump administration. While the breadth and scale of these tariffs appear significant, at this stage we are still waiting on further information from both the Trump team and other governing bodies around the globe.

During such protracted periods of uncertainty it is critical to remain focused on the business fundamentals which underpin longer-term growth potential. We look to the upcoming earnings season and further research trips in the quarter ahead where we expect to see further evidence of innovative companies proving their resilience and adaptability, strengthening their competitive positioning against a difficult market backdrop. As always, we will continue to maintain our valuation discipline, taking advantage of further market dislocations to invest in innovative companies at attractive prices.

Discrete years' performance (%) to previous quarter-end:

|

|

Mar-25 |

Mar-24 |

Mar-23 |

Mar-22 |

Mar-21 |

|

Liontrust Global Dividend C Acc GBP |

-2.7% |

23.4% |

-0.8% |

8.3% |

38.1% |

|

MSCI World |

4.8% |

22.5% |

-1.0% |

15.4% |

38.4% |

|

IA Global Equity Income |

4.8% |

13.3% |

2.3% |

11.8% |

32.0% |

|

Quartile |

4 |

1 |

3 |

4 |

2 |

*Source: FE Analytics, as at 31.03.25, C accumulation share class, total return, net of fees and income reinvested. Fund inception date is 31.12.01; the current fund managers’ inception date is 31.07.17.

Key Risks

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

■ Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

■ This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments.

■ The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

■ Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

■ Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

■ The level of income is not guaranteed.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Disclaimer

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.