The Liontrust Global Technology Fund continues to invest in global leaders and disruptors within the technology sector that are well positioned to benefit from the new AI-driven technology cycle.

- In times of market uncertainty, fundamentals are almost the only thing that matter – because these are the only things we can be certain of.

- We remain highly confident in the fund’s prospects for 2025 and this earnings season so far is bolstering that confidence.

- Top contributors included Broadcom, CrowdStrike and Palantir, while Micron, Meituan and Nvidia were among the detractors.

Performance overview

The Liontrust Global Technology Fund returned 1.0% in April, placing it in the 1st quartile of peers ahead of the IA Technology & Telecommunications sector average return of -0.8% and the MSCI World IT Index return of -1.4% (both comparator benchmarks).

Longer term performance remains strong, the Fund having returned 44.3% since manager inception (08.02.2023), in the 1st quartile of peers ahead the IA Technology & Telecommunications sector average return of 30.9% but marginally behind the MSCI World IT Index return of 44.8%.

Fund commentary

In times of market uncertainty, fundamentals are almost the only thing that matter – because these are the only things we can be certain of.

The volatility provoked by Donald Trump's 'Liberation Day’ was unprecedented – the first week of April was the fifth worst selloff we have witnessed in 75 years and saw the VIX (volatility index) climb to levels not seen since Covid, when the economy was shut down, and the Global Financial Crisis. July to August 2024 saw a similar bout of volatility injected into markets, driven by a growth scare. Then, as we have seen in recent weeks, indiscriminate selling ensues and the companies that have done best get sold off hardest. We believe this dynamic will soon reverse – indeed, last week saw the start of this trend – because in a potentially slower macro environment, companies delivering decent earnings growth become scarce. Secular growth fuelled by innovation is where we want to be invested amid macro-uncertainty – in companies whose earnings growth momentum can be sustained.

Uncertainty remains around trade policy, but tariffs are likely to cause some upwards pressure on inflation. Here, we want to be invested in companies that have pricing power and high gross margins – this is the hallmark of our innovators and the direct impact of tariffs for the majority of our companies is minimal, since they can pass on incremental costs. We are already hearing this from our early reporters this earnings season, which are maintaining or raising guidance despite tariff uncertainty

Arguably more important are the second-order implications of tariffs (i.e. demand erosion), so companies facing inelastic demand owing to demand/supply imbalances are in a strong position. This is really where our innovators excel, since they are offering the lowest cost or highest quality innovation on the market. A couple of notable comments from CEOs in the past week on earnings calls include those from TSMC, which is sold out well into this year and seeing no change in consumer behaviour, GE Vernova, whose order book stretches into 2029, and Amphenol, which would ship more to customers if it could. We expect this phenomenon to play out more broadly across the funds as earnings season progresses, since many of our companies are supply constrained not demand constrained.

Finally and most importantly, the disconnect between our holdings’ fundamentals vs. their share price action is acute. This is why we remain highly confident in the funds’ prospects for 2025 and this earnings season so far is bolstering that confidence. Earnings power for our companies has changed little, or even strengthened, since the start of the year, yet share prices for many have moved in the opposite direction.

Strong fundamentals

The beginning of a new earnings season is underway, and against a backdrop of heightened uncertainty and macro volatility we continue to see evidence of strong business momentum and healthy fundamentals across the global leading innovators in our portfolio.

For example Amphenol was the top contributor to Fund performance in the month, shares climbing after the company delivered a monster 20% earnings beat matched by a 20% guidance raise. Earnings grew by 58% yoy, and orders by the same magnitude – underpinning durable and visible revenue streams well into next year. Amphenol has been one of our key top-ups across all three funds amid the past two months’ volatility.

As the leading supplier of high-tech interconnects globally, Amphenol is an essential component of the electric backbone of the economy, enabling electrification across every industry from defence to industrials to autos to data centres. Growth was broad-based, but the latter is where we have seen continued outsized growth for five quarters, with no slowdown in sight.

There has been much speculation and commentary around a looming digestion in data centre spend – Amphenol's results prove otherwise. Datacom growth for the company accelerated to 133% yoy in Q1 (up from 76% yoy growth in Q4), but the most astonishing number was sequential quarter-on-quarter growth of 34%. As the company’s CEO explained, its customers would buy more interconnect if Amphenol could ship more. It is supply constrained, not demand constrained. This is not digestion, this is acceleration – we believe the market has overly fixated and misinterpreted reports of Microsoft cancelling data centre leases, which we view as idiosyncratic (Azure is ceding competitive ground to Oracle as the cloud of choice for AI workloads).

Amphenol is like the Constellation Software of electronics – margins are software-esque but this is a hardware company; de-centralisation is at the core of the business model, whilst accretive M&A reflects the Amphenol’s status as the preferred consolidator in this space. As such, the impact of tariffs is expected to be negligible: Amphenol has pricing power, faces a demand/supply imbalance, and has a devolved and high localised business structure purpose-built to adjust supply chains and manufacturing.

With an earnings growth track record underpinned by strong fundamentals, the company appears well positioned for sustained top- and bottom-line growth in the years ahead.

Broadcom was another beneficiary of renewed optimism around the momentum of the AI infrastructure build-out, emerging as a top contributor to performance in April – a reversal of March fortunes, shares rallied to finish up nearly 15% for the month, a gain of over 30% from their recent low.

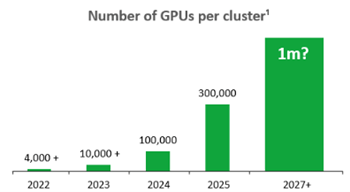

As the global leader in networking and custom ASIC semiconductor design, the company remains at the forefront of the AI revolution as customers embark on multi-year journeys to scale to clusters of 1 million XPUs to support next-generation models and AI propagation across the economy. This was evidenced in yet another strong update in March with AI revenues growing to $4.1 billion – up 77% year-on-year fuelled by demand for custom XPUs and AI networking solutions. Broadcom is scaling XPU cluster deployments at an aggressive pace to support the growing demands of hyperscaler AI infrastructure, with three existing hyperscaler clients (Alphabet, Meta, and ByteDance) projected to create a $60–$90 billion serviceable market for XPUs and networks by 2027. This momentum looks set to accelerate as the company capitalises on its first mover advantage in shifting to next-generation XPUs – the company unveiling the industry’s first 2-nanometer AI XPU featuring 3.5D packaging, a 15% performance improvement over leading 3 nanometre chips with a 25-35% reduction in power consumption.

This leadership is supporting continued new business wins, the company is now developing custom ASICS for four additional hyperscaler customers, with first tape-outs (the final stage of the design process) for two of these customers due later this year. The company also continues to enhance its networking solutions to support high-bandwidth AI workloads which require high-density, low-latency connectivity, ramping capacity for its existing Tomahawk 6 products while their next-gen Tomahawk 7 and Tomahawk 8 solutions are already in development. The company is also benefiting from operating leverage as it scales, with operating margins expanding and free cash generation ramping, positioning the company well for continued strong growth and returns in the years ahead.

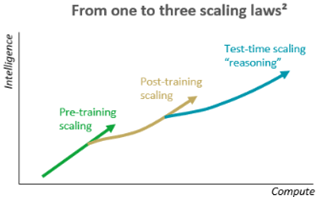

Computer clusters continue to get larger, driven by scaling laws

Sources: 1) Broadcom AI Infrastructure day 2024, Liontrust; 2) Nvidia 2024

The Fund also benefited from positions in CrowdStrike and Palantir – the top two contributors to April performance despite not reporting during this period. Both businesses are emerging as winners of the new innovation cycle driven by AI – operating at the intersection of Software 2.0 and the enterprise AI buildout, underpinned by unique data architectures that position them as clear challengers to legacy incumbents. CrowdStrike, the global leader in endpoint security, has rapidly expanded into adjacent categories including cloud, identity, and next-gen Security Information & Event Management (SIEM), driven by growing demand for unified, AI-native protection. Its Falcon platform now averages more than nine modules per customer, while new offerings like Charlotte AI are accelerating threat detection and analyst productivity. The company added over $220 million in net new ARR last quarter, with 97% gross retention and 23% free cash flow margins – strong evidence of both relevance and durability in a tightening IT environment.

Palantir, meanwhile, is scaling rapidly as enterprises and governments adopt AI in production. Its Artificial Intelligence Platform (AIP) enables organisations to integrate and act on large, complex datasets – a capability built on over a decade of ontology development. While the company’s roots remain in government and defence (where revenue rose 45% YoY as of its February quarter update), its commercial business is now expanding even faster (US commercial revenue grew 64% in the same period). AIP is being used to automate underwriting, optimise supply chains, and orchestrate manufacturing at scale, helping customers compress workflows from weeks to hours. With $5 billion in cash and a growing base of long-term platform commitments, Palantir is cementing its position as the orchestration layer of enterprise AI, with a strong runway of growth ahead.

Meanwhile Meta’s late-April earnings update once again showcased that the company is emerging as an AI-powered advertising juggernaut thanks to its broad platform reach and strength in AI model development, which the company is using to drive material improvements in advertising performance, user experience, and operating efficiency.

On the advertising side, new AI models drove a 5% increase in reels ad conversion rates, the number of advertisers using Meta’s AI-based creative tools grew 30% year-on-year, and the average price per ad increased by 10% – a sign that advertisers are willing to pay more for higher-performing, better-targeted placements. AI is also boosting user engagement and retention: daily active users across apps reached 3.43 billion (+6% year-on-year), Meta AI is approaching 1 billion monthly active users, and time spent on Instagram and Facebook rose by 6% and 7% respectively. Threads also posted a 35% increase in time spent over the past six months, recently passing 350 million monthly active users. Monetisation is improving as a result, with ad revenue up 16% year-on-year and strong demand from small businesses reinforcing Meta’s role as a go-to platform even during macro uncertainty. The company’s Ray-Ban smart glasses have also proven a major success, sales tripling over the past year as consumers are drawn to the voice-oriented AI form factor. At the same time, the company is using AI internally to drive operating leverage as it scales – operating margins expanded to 41% in Q1, EPS grew 36%, and the company lowered expectations for its full-year expenses by $1 billion. Given the tangible benefits AI is already delivering across the business, management have raised its full-year capex guidance to $64-72bn, laying the infrastructure foundations for the next phase of AI-led growth.

Elsewhere, Netflix is evolving into a structurally stronger business, with accelerating revenue, expanding margins, and growing embedded optionality. In In Q1, Netflix’s revenue advanced 13% year-on-year to $10.5 billion, while operating income leapt 27% and the margin hit a record 31.7% – marks last seen only in mature software franchises, not Hollywood studios. Free cash flow of $2.7 billion (up 25%) comfortably covered a further $3.5 billion of share buybacks, underlining the company’s transition from cash burner to cash compounder. Management held full-year guidance for 29% margins and $43.5 - 44.5 billion of revenue, implying another step-change in profitability despite a stronger US dollar.

With more than 300 million paying households – representing an audience of ~700 million people – Netflix already commands the industry’s deepest installed base, but its “backlog” is increasing too. Advance advertising commitments have grown sharply since the in-house “Netflix Ads Suite” launched in the US on 1 April and will roll out to all ad markets by midsummer; management expects ad sales to double this year even though they remain a single-digit share of revenue today. At the same time, the content pipeline is bursting: Squid Game S3 lands in June, Taylor vs. Serrano 3 streams live in July and Netflix has secured exclusive rights to two NFL Christmas Day fixtures in each of the next two seasons – events that drew a combined 65 million US viewers last year.

Importantly, price hikes introduced last autumn across the US, UK and Argentina are sticking, with stable churn and increasing engagement per user. Because content costs are amortised over 12-24 months, rising average revenue per user is translating directly into earnings: roughly 30 cents of operating profit for every incremental $1 of revenue. With visibility high, cash generation surging and $13.6 billion still authorised for buy-backs, we view Netflix as a durable, margin-accretive compounder.

Dislocation presents opportunity

In periods of market volatility prompted by macroeconomic factors, we have been strategically increasing our holdings in the hardest‐hit investments across the fund. Accordingly, over the past couple of months we have raised our positions in companies where upside opportunity has best emerged, such as ServiceNow – a company in which we re-initiated a position in late March.

We first bought ServiceNow during the 2022 tech selloff, exited in late 2024 after the shares hit our price target, and rebuilt the stake following April’s “Liberation Day” volatility, which reset the five-year upside hurdle we require to invest – shares had fallen nearly 40% from their 52-week highs. Strong Q1 results, and the 25%+ rebound that followed, highlight how the market can misprice quality, demonstrating the value of active portfolio management. Subscription revenue rose 20% year-on-year to $3 billion, operating margin reached 31%, free cash flow margin hit a record 48%, and current remaining performance obligation increased 22% to $22 billion.

Despite this strength, management trimmed FY guidance by a token $5 million, resetting expectations while signalling execution remains solid. Three forces now underpin the company’s growth story. First, Now Assist Pro+ (ServiceNow’s AI agent) featured in 15 of the top 20 deals, with contract value per AI customer up one-third quarter-on-quarter. Early adopters are reporting 16x faster lead-to-sale conversion and 86% ticket deflection. Second, federal demand is accelerating: net-new US public-sector ACV grew 30%, defying fears of a slowdown against a backdrop of tariffs and DOGE-related austerity. Third, the company is expanding its addressable market across the front-office, with CRM and industry workflows now delivering a third of new contract value and growing over 50% in EMEA and Japan. ServiceNow is enabling clients to cut costs during today’s efficiency cycle while opening fresh revenue channels for the coming AI super-cycle. With valuation risk reduced, new AI tailwinds, and record cash generation, we see ServiceNow as a durable compounder hiding in plain sight

We have also been highly active in establishing new positions in companies that have long been on our watchlist, and where we have awaited a suitable market dislocation to initiate positions. After initiating several new positions in March, in April we also added a new position in Coreweave, taking advantage of a sharp pullback following its recent listing – shares had fallen over 30% from their post-IPO high on broader macro uncertainty. CoreWeave is a next-generation cloud provider purpose-built for generative AI, delivering high-performance, GPU-accelerated infrastructure that meets the growing demand for specialised compute. Unlike legacy cloud vendors, CoreWeave has architected its platform from the ground up for AI workloads – offering low-latency, elastic compute capacity at a lower cost. The company originally pivoted from crypto mining and moved early to secure access to cutting-edge GPUs, establishing a deep relationship with Nvidia and emerging as a preferred partner for emerging AI leaders including OpenAI and Mistral. This strategy is clearly working: revenue has grown from just $15 million in 2022 to $1.9 billion in 2024, with continued strong growth expected this year as demand for inference and fine-tuning workloads accelerates. CoreWeave’s differentiated architecture, first-mover advantage in AI-dedicated infrastructure, and highly flexible deployment model have allowed it to take share quickly from incumbents, and position it well to benefit from multiple AI scaling laws and broader propagation in the years ahead.

To finance our buying activity, we have reduced holdings which have performed well, and exited certain companies whose upside potential is no longer sufficient. In April this included trimming recent strong performers such as Amphenol and Tesla.

We have managed our Tesla position actively over the past year. We held a sizeable holding coming in to Q4 of last year, but halved our position in the wake of the stock’s significant post-election bounce, consistent with our valuation discipline. Coming in to the Q1 earnings print, we topped up again marginally as shares pulled back. Declining deliveries, partly induced by the Model Y refresh (and changing over production lines across all factories), had been pre-announced to the market, so operating de-leverage and a short-term profitability hit were not surprising. Importantly, there were three key bright spots to the update, with shares responding positively as a result.

Firstly, Tesla’s innovation roadmap remains loaded and intact: a low-cost vehicle is still coming this year; the launch of the robotaxi (FSD unsupervised) in Austin in June is on track; and Optimus production remains on track for the end of 2025. The robotaxi launch is expected to be the key catalyst, and a critical proof-of-concept moment for Tesla’s end-to-end neural networking and vision-only approach to autonomy. We believe this architecture gives Tesla a distinct competitive advantage: having pivoted from hardcoded deterministic software to neural networks two years ago, Tesla is now seeing 5-10x improvements in FSD capabilities every two months, compared to a 2-4x annual pace previously.

Secondly, momentum in the energy business continues to build ahead of expectations. Tesla deployed 4.1GW of storage in Q1 (+154% year-on-year), driving 56% growth in energy revenue. With grid-stabilising Megapacks increasingly viewed as essential infrastructure for managing peak power shifts and supplying consistent energy to data centres, this segment is emerging as a major long-term growth driver. We believe it is increasingly plausible that Tesla’s energy business could surpass autos in profitability over the next five years.

We also opted to exit positions in several holdings including after they achieved our price targets or simply because we saw better upside opportunity on our watchlist. In April this included Airbnb, Synopsys, Alchip, Camtek, Confluent, Delta Electronics, and Fabrinet. These companies move back to our watchlist where we will continue to monitor them for potential attractive entry points in the future.

Innovators remain well positioned for a new cycle

While macro volatility and tariff uncertainty ultimately weighed on shares of companies across a range of different sub-sectors – including the likes of Meituan, Micron, and Nvidia (key detractors for the month) – the evidence we have seen so far this earnings season has reinforced our confidence in the outlook for innovators across the industry spectrum. These companies remain well‐positioned to benefit from the significant opportunities ahead. As sentiment, rather than fundamentals, has primarily driven the recent sell‐off, it has created an attractive entry point for those seeking to establish or expand positions, underscoring the importance of active management and valuation discipline during periods of volatility.

During such protracted periods of uncertainty it is critical to remain focused on the business fundamentals which underpin longer-term growth potential. We look to the ongoing earnings season and further research trips month ahead where we expect to see further evidence of innovative companies proving their resilience and adaptability, strengthening their competitive positioning against a difficult market backdrop. As always we will continue to maintain our valuation discipline, taking advantage of further market dislocations to invest in innovative companies at attractive prices.

Discrete years' performance (%) to previous quarter-end:

|

|

Mar-25 |

Mar-24 |

Mar-23 |

Mar-22 | Mar-21 |

|

Liontrust Global Technology C Acc GBP |

-8.0% |

51.9% |

-11.4% |

18.0% |

40.5% |

|

MSCI World Information Technology |

2.0% |

39.1% |

-0.7% |

20.6% |

50.8% |

|

IA Technology & Telecommunications |

-1.3% |

33.1% |

-6.0% |

4.3% |

57.0% |

|

Quartile |

3 |

1 |

3 |

1 |

4 |

*Source: FE Analytics, as at 31.03.25, primary share class, total return, net of fees and income reinvested. Fund inception 15.12.15; current fund managers’ inception date is 08.02.23.

Key Risks

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

■ Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

■ This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments.

■ The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

■ Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties

(e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

■ Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Disclaimer

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.