As more of us adapt our behaviour with climate change in mind, most activity has understandably been around how we heat and power our homes and travel around the world. But it is becoming increasingly clear that we also need to take a hard look at how we communicate and consume media.

Connecting people is one of our 20 investment themes as we believe access to communication tools and information, increasing amounts of which are online, is a pre-requisite of a more sustainable economy. The exponential rise in data and the need for connection between network carriers, enterprises and end users is driving ever-evolving infrastructure and growth in this area.

But as the digital world comes to encompass every conceivable field of human endeavour, we also have to be conscious of the potential environmental impact.

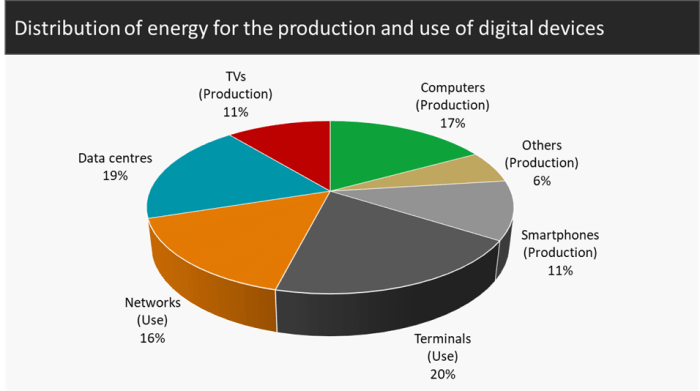

Source: The Shift Project 2018, as of Andrae & Edler 2015

New figures from think tank The Shift Project reveal that digital technologies now account for 4% of greenhouse gas (GHG) emissions, which is more than civil aviation, and this could double by 2025 as the energy required is increasing 9% a year. A few other figures highlight the scale of our global digital footprint:

- Online videos globally emit as much C02 as Spain (over 300 million tonnes per year)

- Online video services (like Netflix) account for 60% of global data flows and the GHG emissions of video-on-demand services like Netflix and Amazon Prime are equivalent to those of a country like Chile (more than 100 million tonnes per year)

According to The Shift Project, as people cannot see the pollution from selfies and videos streams, there is a perception these services are boundless; in reality, however, they suggest we need to move towards greater ‘data sobriety’ and the fear is that this means greater regulation.

New research shows the impact even a small change in online behavior can have, with data from OVO Energy claiming that sending just one less unnecessary email a day would save more than 16,000 tonnes of carbon a year, the equivalent of taking 3,300 diesel cars off the road. According to the report, excessive emailing contributes 23,475 tonnes of carbon a year to the UK's footprint.

This issue of rising data usage, and the amount of energy it requires, is one we have been tracking for several years. Traditionally, companies tended to have on-site server rooms, often in regular offices, and while these have evolved over time, they were not purpose built so cooling and ancillary power requirements make them highly inefficient.

Therefore, we see considerable resource benefits coming from the trend towards outsourced storage and processing, focusing on data centre operators that have low power usage effectiveness (PUE) and also use electricity from renewable sources.

We believe these co-location centres are vital for the digital economy and will increasingly underpin the infrastructure necessary for a more sustainable world. However, electricity used by data centres is expected to double approximately every five years and their emissions are already comparable to small countries. Energy now represents around two-thirds of the total data centre cost, greater than the hardware within them, mainly consumed by the ancillary systems such as cooling and Uninterrupted Power Supplies (UPS).

Investing in companies that are finding solutions to the world’s problems is central to our investment process and we believe those enabling significant energy and carbon dioxide savings for these centres should benefit from a sustained increase in demand. The technology industry in the US now emits more carbon than ever before, so more efficient data centres are vital: for the centres themselves, power is their biggest cost, giving further incentives to design and run their centres more efficiently.

We look at the world through the lens of 20 sustainable themes and companies in the data centre space represent a rare confluence of two of these, namely Connecting people and Improving the efficiency of energy use.

Held in our funds since 2011, US company Equinix runs co-location data centres, providing a gateway into important digital infrastructure such as public cloud computing networks. Equinix stands out as the only genuinely global player in this market and its centres have become an integral part of the plumbing for the digital economy. Its assets are almost impossible to copy, creating an important competitive advantage.

On top of this, the business is addressing critical environmental impacts of the technology industry. It discloses climate change impacts and mitigation efforts in a Carbon Disclosure Project (CDP) submission for example, and while no science-based targets are set so far the company anticipates doing this in the next two years.

Equinix has a long-term goal to reach 100% renewable energy, and in 2018 91% of purchased electricity came from renewable sources. The company also has a Global Energy Efficiency Program and completed 42 projects in 2018, upgrading and retrofitting chillers, control systems and a power supply.

We also hold InterXion across our European funds, a provider of carrier and cloud neutral co-location data centre services in Europe, supporting 1,800 customers through 50 data centres in 11 countries. While the company lags global peers on social and environmental reporting, it has good programmes in place operationally and runs all its centres on renewable energy. We continue to engage with the business on how its energy efficiency programmes work and encourage the company to report to the CDP.

Digital technologies and the internet have fundamentally changed the way many of us conduct our lives and Moore’s law on the rate of technical advance suggests far greater transitions to come. Providing broader access to this trend must be part of any sustainable world but it is vitally important, to paraphrase the UN’s 1987 Brundtland Report, that we are not compromising the future by meeting the needs of the present.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.