Rising urbanisation, in broad terms, has been a demographic talking point for years but data from the United Nations show just how quickly this is actually happening. Today, around half of us (55%) around the world live in cities but by 2050 this proportion is expected to reach as high as 68%.

With some 6.5 billion people living in such environments within 30 years and our current cities emitting 50-60% of global greenhouse gases (GHG), a sustainable future is impossible without significantly transforming how we build and manage urban spaces. Building better cities is therefore one of our 20 sustainable investment themes and serves as something of a nexus point, with the developments required stretching across many other themes and encompassing all three of our mega trends: Better resource efficiency (cleaner), Improved health (healthier) and Greater safety and resilience (safer).

Before exploring this in more detail, it is worth outlining the context: as with many of our themes, the basis is in some fairly alarming figures but therein lies the opportunity. The UN’s 2018 Revision of World Urbanisation Prospects document predicts over two-thirds of people living in cities by 2050 and this ongoing shift from rural to urban areas, combined with overall population growth, could mean an additional 2.5 billion city dwellers by that point.

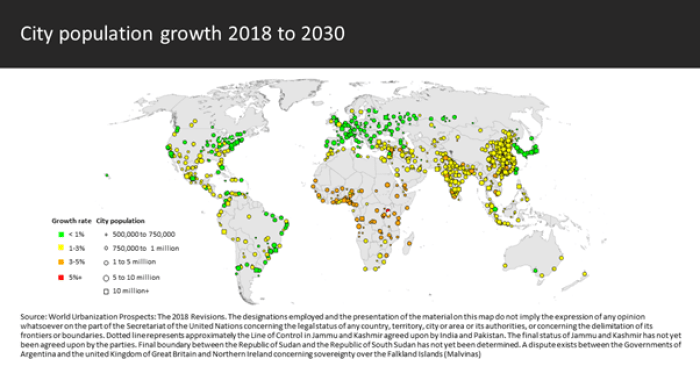

This would mean a doubling of the urban environment and equivalent to 70 million people moving to cities every year for the next three decades, with close to 90% of this increase taking place in Asia and Africa. Rapid growth up to now, as a result of rising populations and increasing migration, has already led to a boom in mega-cities (defined as having more than 10 million inhabitants) in the developing world. In such an environment, slums are becoming a significant feature of urban life, with more than 800 million people worldwide currently in such conditions and this number likely to mushroom if we move forward without change.

Today’s cities only take up around 3% of the planet’s land surface but have a disproportionate impact on the environment, linked to as much as 60% of GHG emissions as stated but also consuming three-quarters of primary energy – and these figures can only increase. As a counterpoint, cities are also where people can often be at their best and are responsible for 75% of global GDP; when done well, they can encourage tighter community cohesion and be inherently low impact in environmental terms.

This ‘done well’ is obviously the key point and the driver behind our Building better cities theme, which focuses both on developing current infrastructure to make it more efficient and improving what has gone before when building new urban areas. Many developed world cities will have to invest in some retrofitting to limit environmental impacts but, from a broader perspective, sustainable development will increasingly depend on successfully managing global urbanisation. As evidence of that, cities are considered one of four global systems that can accelerate climate action in terms of both mitigation and adaptation; as the IPCC laid out in its Special Report for Cities back in 2018, ‘climate science must be accessible to urban policymakers, because without them, there will be no limiting global warming to 1.5°C’.

Climate change is seen as a major issue for cities, particularly as so many are situated on coasts or rivers. By 2050, we expect to see a 50cm rise in sea levels and changes to precipitation patterns. Cities also create ‘heat islands’, increasing the ambient temperature for inhabitants by several degrees and retaining that heat long after the sun has set. Urban areas are therefore particularly vulnerable to changing conditions and will have to adapt to additional heat, flood and fire risks in the years ahead.

Positive news on this front is that city administrators and mayors tend to be more progressive than governments and are already forming coalitions such as the C40 Cities Climate Leadership Group, a collection of 96 cities (including Boston, Copenhagen, Durban, Hong Kong, Jakarta, London, Los Angeles, Mexico City, Milan, Paris, Seoul, and Tokyo) representing 25% of global GDP and one in 12 people worldwide. Founded in 2005, C40 is focused on tackling climate change and driving action that reduces GHG emissions, while also increasing the health, well-being and economic opportunities of urban citizens. This was designed to create an environment of collective action and responsibility, so a solution that works for London can rapidly be taken up by San Francisco for example and vice versa.

Characteristics of a sustainable city

- Compact, mixed use communities (including residences, shops, restaurants, schools and offices)

- Main amenities and workplaces within walking or bike distance from residences

- Effective mass transport systems, geared to walking or cycling

- Minimal reliance on cars (autonomous or otherwise)

- Low or negative energy use buildings

- Clean air, water and sophisticated waste recovery and treatment

- Self-generation or electricity and, where imported, renewable

- Buildings constructed efficiently with design for re-use

- Public spaces and leisure facilities

- Resilience to changing climate and sea levels

Various case studies have modelled the impact of a shift to more sustainable cities, with the Vision California project led by architect Peter Calthorpe examining four different scenarios for development towards 2050, from so-called business as usual through to a green future. There was a 100% difference in carbon emissions between the two, with land use, vehicle miles, water and energy saving the main determinants, but every household would also be better off (to the tune of around $10,000 due to lower fuel and energy bills) and enjoy better air and less congestion. No new inventions are required to achieve this, just better planning leading to more compact urban development.

Comparing a couple of cities in the C40 illuminates the huge differences in place even now: if a citizen of Los Angeles, which is built on the concept of urban sprawl and the hegemony of the car, moved to Copenhagen, where around half of travel is by bike, they would cut their carbon emissions by 75%. It is also worth noting that most of the great tourist cities are those you can explore by foot: Paris, for example, has its compact urban cells (arrondissements) where you can largely get around in 20 minutes and the contrast to a city like Los Angeles, where the layout locks in a high energy system, is stark.

As reflected in the dual aim of C40, better cities are not just about adapting to climate change and should also be designed to ensure the benefits of urbanisation are fully shared and inclusive. Policies to manage urban growth need to support access to infrastructure and social services for all, focusing on the needs of everyone for housing, education, healthcare, decent work and a safe environment.

As stated, many holdings in the Building better cities theme are linked to others in our list of 20, encompassing areas from construction (to create affordable homes, workplaces and schools within communities), through transportation and communication, to energy efficiency and waste and water management.

A favoured position is social housing provider Optivo, which we hold in our SF Corporate Bond Fund. Optivo has around 45,000 houses in inner London at low rental rates, which means limited void rates. We like the company’s business model where it uses profits from rental revenue to reinvest in its housing stock, improving both the energy efficiency and the community base.

Given the investment scope of Building better cities, we see this theme as a prime example of how employing capital today with progressive, sustainable companies can define and shape the world people inherit and inhabit in the future.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.