Our Sustainable Investment process at Liontrust focuses on companies contributing towards a cleaner, healthier and safer future and the second pillar includes themes such as Enabling innovation within healthcare and Enabling healthier lifestyles, which relate to physical wellbeing through breakthrough medicines, better diets and fitness. For us, mental health is equally important if we are to enjoy this improving world and we believe the leisure industry has a key role to play in a more sustainable economy – helping people relax and enjoy a more fulfilling life.

Economic growth and subsequent poverty alleviation over recent decades have enabled more people to enjoy leisure time. As ecological economist Tim Jackson (who sits on our Advisory Committee) puts it in his book Prosperity without growth: ‘In the advanced economies…material needs are broadly met and disposable incomes are increasingly dedicated to different ends: leisure, social interaction, experience… what really matters to us: family, friendship, sense of belonging, community, identity, social status, meaning and purpose in life.’

Leisure can facilitate these social interactions and help people find that meaning and purpose, with activities as diverse as going to a concert, to the cinema, having dinner at a restaurant or playing a video game with an online community. These all have negative externalities but the social experience is an important factor in a more sustainable and pleasurable economy.

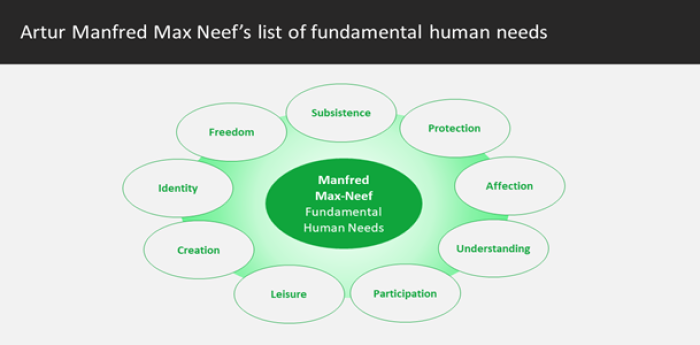

Many investors would still classify leisure stocks as ‘nice to haves’ rather than necessities, the classic definition of discretionary rather than staple in consumer land. Sustainable investors may also struggle with these companies as they are not providing a solution to one of our pressing issues such as the climate crisis or inequality. It is worth considering the work of Chilean economist Artur Manfred Max Neef, however, whose list of fundamental human needs, as depicted above, includes a leisure category.

Introducing our newest theme: Encouraging sustainable leisure

Up to now, leisure has been a quiet part of Enabling healthier lifestyles, but we see a strong case to introduce a distinct Encouraging sustainable leisure theme to clarify our thinking. We are not claiming music companies such as Spotify or CTS Eventim (our focus in this article) make people ‘healthier’ but, as stated, leisure is playing an increasingly important part in the economy and has a beneficial impact on mental well-being, particularly in the search for work-life balance.

Within the United Nation’s Sustainable Development Goals (SDGs), leisure fits into number 12, Responsible consumption and production, offering economic services that improve quality of life but can be delivered with lower resource intensity than sectors producing physical goods. Something else to consider is that leisure industries often involve people serving others and creativity, and labour intensity therefore tends to be higher and less substitutable by capital than in other industries. This is a positive for creating meaningful employment at a time when sectors such as manufacturing are undergoing an automation revolution, so the theme is also linked to SDG 8, Decent work and economic growth.

From an investment perspective, leisure is difficult to analyse due to its broad scope, encompassing everything from traveling around the world to listening to music or reading at home – and, as the cost of these activities varies, so too does their sustainability profile. What is clear, however, is that in the UK alone, the leisure market is worth around £117 billion (accounting for 7% of GDP according to a Deloitte report from 2016) and the sector is attracting 50% more discretionary spend than retail and growing twice as fast.

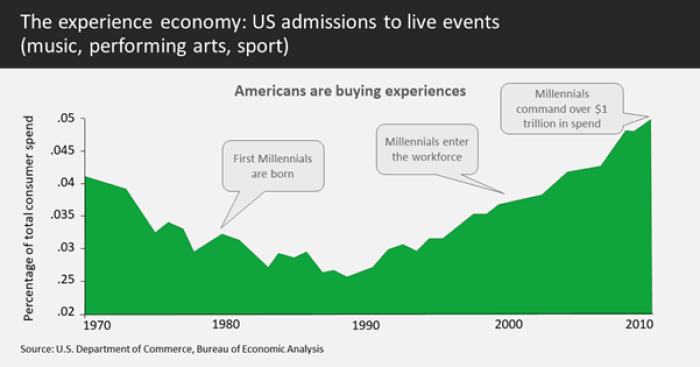

Spending priorities are a good indicator of structural growth potential, particularly among younger generations, and millennials have a clear preference for experiences over buying things. We believe this trend may be amplified amid a general Covid-inspired reassessment of priorities, creating a growing experience-based economy and a shift away from traditional material consumption.

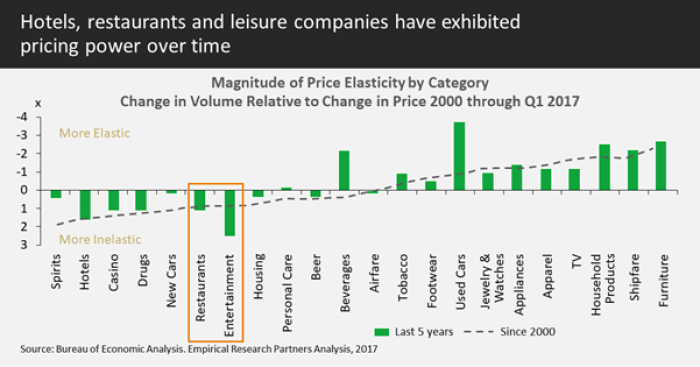

An important measure of success in any industry is the ability to increase pricing without impacting demand; in economics, this is called price elasticity. Empirical Research Partners has studied a range of consumer industries and found areas such as restaurants and entertainment typically exhibit strong pricing power, benefiting from robust demand and capacity to increase prices, whereas goods such as furniture, clothing, major appliances and jewellery experience heightened sensitivity to price.

With millennials overtaking boomers when it comes to aggregate income, consumer behaviour is at a crossroads and experiences are increasingly seen as more valuable than collecting assets. According to Empirical Research, hotels, restaurants and leisure stocks are trading at their most attractive levels in several decades, particularly compared to expensive consumer staples, and should benefit from demographic forces and pricing power – although the company suggests a focus on stocks providing live, immersive experiences rather than traditional media conglomerates.

We want to tap into this structural growth and pricing power, identifying the businesses that can grow consistently for the long term and generate high returns on capital at the same time. Companies that combine growth with high returns are the holy grail for long-term sustainable investors and Spotify and CTS Eventim are two we think fit the bill, exemplifying more positive consumption with lower environmental impacts.

Companies exposed to Encouraging Sustainable Leisure: investing in the music revolution

Music has been an important component of leisure and culture for millennia; whatever successive generations think about their children’s tastes, listening to music is a positive pastime and key to the human experience.

Taking Spotify first, we added the audio platform to our portfolios in July but before expanding on our thesis, it is important to address controversies surrounding this business. With streaming now the main form of music distribution, many artists are directing their displeasure at their share of industry revenues towards these global platforms, when they previously took issue with record labels. While criticism about Spotify is understandable given its size and ubiquity, we believe the truth is more complex and this company, and the trends behind it, has actually done a lot of good on balance.

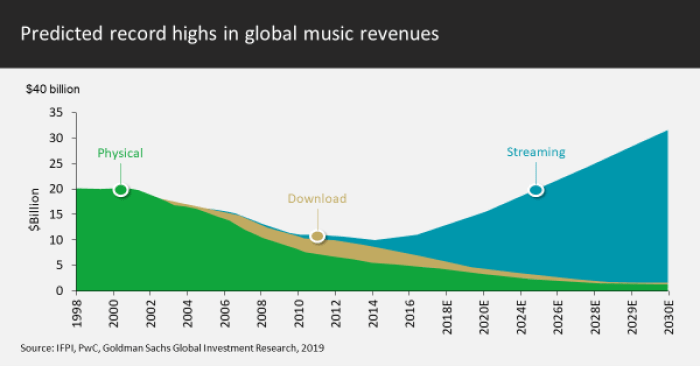

From a broad perspective, music’s move to digital steaming, doing away with the millions of tonnes of plastic used in CDs and vinyl and the devices used to play these, is an obvious positive. The environmental impacts are also much lower as streaming services are powered by renewable data servers operated by Amazon and Google. The social impacts of the streaming revolution are also significant: Spotify founder Daniel Ek recognised the unsustainable situation pirating and file sharing was creating, with the music industry declining 40% in revenue terms between 2001 and 2015. Simply put, very few people were willing to pay £10 or more for a CD when they could download it for free. This inspired Ek to build a convenient streaming service that offered instant access to music while providing income to artists and labels. Interestingly, Spotify was backed early on by Sean Parker, founder of piracy pioneer Napster. After several legal challenges and site shutdowns, Parker realised stealing content was not sustainable and decided to invest in Spotify and join the Board.

We would suggest Spotify’s business model is widely misunderstood: there are paid-for without ads and free ad-supported options, with the latter serving as an advertising funnel for paying users. In terms of revenues, around 95% comes from subscriptions, with an average €4.71 monthly fee. Over half of users listen for free and are ad-supported, and Spotify pays out around 99% of this directly to the labels.

Spotify retains around 27% of the subscription fee revenue, which is reinvested into improving and growing the platform and creating original podcast content; the rest is paid to the labels who own the music rights (82% of Spotify's library is owned by Universal, Warner and Sony). These have the relationships with artists and agree royalty terms independent of Spotify; the 73% of revenue comes with listener data (called Stream share) that labels use to divide up the money.

Spotify is taking the heat for the fact artists receive around 10% of the earnings their art generates but, as stated, this is down to prior agreements with labels. We believe Spotify's streaming technology has helped revive the industry and legally democratise music, and if you compare that 10% with effectively zero revenues under pirating, the situation is clearly better. Labels have growing revenues to pay for more music to be made and the number of recording artists is growing again, with Spotify also providing musicians with tools to engage with fans, including links to concert tickets where artists now generate 95% of their income.

Music economics remain skewed to the owners of rights rather than the creators but this has been the situation for decades, and the question is whether Spotify is entirely responsible for pushing labels to pay artists more. We would argue one company is not accountable for solving the ills of an industry but Spotify will no doubt face criticism as it becomes more dominant, and needs to play a role in making sure artists are fairly compensated.

Coming back to our thesis, Spotify is the world’s dominant audio platform with close to 300 million monthly active users in more than 70 countries, adding users at a faster pace than closest rivals Apple and Amazon and keeping them more engaged. While launched as a music streaming service, the company is moving into podcasts and its own content and we are excited to watch the business expand into audiobooks, live gigs and other areas as it takes advantage of its leading position.

Spotify collects comprehensive data from users and with so much for people to consume, the company is working hard to develop the ‘Spotify experience’ via curated and personalised content offerings. This creates an increasingly committed customer base, as users build playlists and get embedded in the product. With an improving experience, it will continue to take market share in what is clearly a structural growth area, improving pricing power and expanding margins. Evidence of a superior user experience can be seen by the fact Spotify listeners are twice as engaged as those using Apple Music – which means the company collects more data and continually builds its advantage: the average Spotify user spends 25 hours a month listening to music and podcasts on the platform versus 19 hours for Facebook.

We believe Spotify can comfortably scale up to 300 million paying users over the next decade and with a small monthly cost and a rough estimate of 700 million people globally willing to pay up to $1,000 for a smartphone, the addressable market for a device-agnostic platform is huge.

Sticking with music but moving to the live variety, we also started a position in CTS Eventim, Europe’s largest ticketing company for music and sports, earlier in 2020. Again, this company enables the shift towards a more experience-based economy and has far lower environmental impacts, piloting a number of tools to help music fans find lower carbon travel to and from events. While the stock sold off during the initial stages of the Covid crisis, we believe the market fundamentally misunderstood the ultimate impact on the business as the majority of events were postponed, not cancelled, and CTS experienced no significant cash outflows.

We are aware growth will be muted until there is a proven solution to the virus, but the company has a net cash balance sheet, low capital requirements, and the valuation when we bought reflected the very worst-case scenario. There are early signs the market is recognising this long-term story, with CTS shares recovering recently despite reporting a 71.5% year-on-year revenue decline over the first half of 2020 and a 96.6% fall over the second quarter. The company implemented measures to reduce costs and boost efficiency and these have already saved double-digit millions. Live music has experienced strong growth over the last few decades as people want to see their favourite artists in the flesh and musicians tour more as this has become their main source of income. Over the next five to 10 years, we believe the increase in demand and supply for live events will recover, seeing growth in absolute terms through the global financial crisis, for example, despite a dramatic fall in disposable income.

Work-life balance has become an increasingly debated topic and younger generations will have a very different working life than their parents. In this context, the words of Methodist minister Charles Spurgeon ring true and signal both how spending patterns look set to continue changing and the structural growth this creates in many leisure companies: ‘It’s not how much we have, but how much we enjoy that makes happiness.’

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.