Although a long-term favourite in our Sustainable Future bond funds, it is fair to say insurance is hardly the first sector that comes to mind when thinking about sustainability or positive environmental, social and governance (ESG) characteristics.

Yet in focusing on three pillars when analysing companies for inclusion in our funds – sustainable credentials, fundamentals and valuations – insurance companies score well across all of these. Insurance is a hedge against financial loss and such a simple concept can have many positive impacts for society, business and the broader economy.

Sustainability

From an individual perspective, general insurance protects our homes and possessions and provides an economic safety net; it affords people the confidence to invest, which in turn contributes to broader economic growth and development. Life insurance and income protection, meanwhile, give families financial security should the worst happen. As for businesses, their assets are protected against catastrophe, and credit and cashflows can be underwritten and secured, while also hedging out potential future liabilities. Again, this gives them confidence to invest and grow, which can lead to further employment and economic development.

Insurance companies also allow people to provide for their future and improve their financial security through pensions, savings and investment products; combining the premiums earned on policies with consumer assets, the Bank of England calculates the sector in the UK alone manages roughly £2 trillion. The second order impact of this is that capital is invested in, or lent to, corporations, which provides funding for these to grow. In cases such as Legal & General, for example, capital is injected into real assets such as infrastructure, helping communities to prosper.

Looking beyond such a broadly net positive impact, we believe the leading insurance companies contribute in a more sustainable way by devoting capital to researching ESG aspects. The best companies in the sector research specific sustainability, environmental and social risks, for example, and are therefore able to better understand and price these and help clients protect against them. Not only does this make them better underwriters, greater understanding of such issues also turns these companies into more prudent investors through the inclusion and adoption of responsible practices. This will ultimately create more stable and sustainable companies and, from our perspective, more stable and sustainable investments opportunities.

Fundamentals

European insurance companies are generally highly rated institutions with a parent credit rating of single A and above, and this is evidence of underlying quality and strength of balance sheet. A recent note by Moody’s highlighted that, on average, leverage within the insurance sector is at or below levels commensurate with current ratings, implying these companies have capacity to issue further bonds to retain capital strength without impacting their balance sheet strength.

Combine this with highly cash-generative business models, strong levels of capitalisation and a creditor-friendly regulator that prioritises capital and cash retention over dividend distribution, and we have a sector that is fundamentally stable and robust.

Valuations

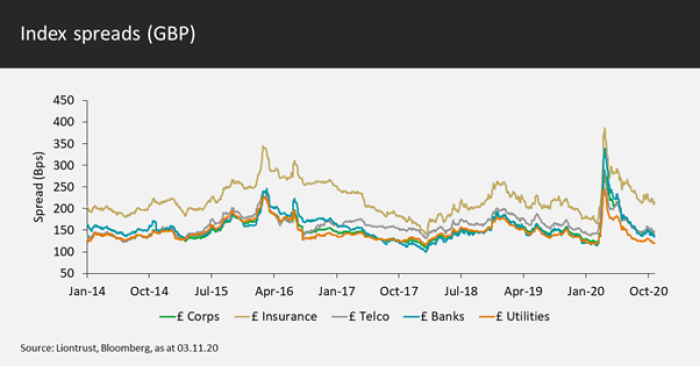

We can see from the chart below that the sector, despite these positives, still trades at a discount to the broader market. Some of this is explained by the subordinate nature of many of these bonds, which carry a higher level of volatility; fair value for the insurance sector overall should therefore naturally be wider than the benchmark average. When we factor in the underlying credit quality, however, this spread differential should be much less than the market is currently pricing. We are therefore happy to maintain an overweight position on the basis that we believe investors are more than compensated for the risks.

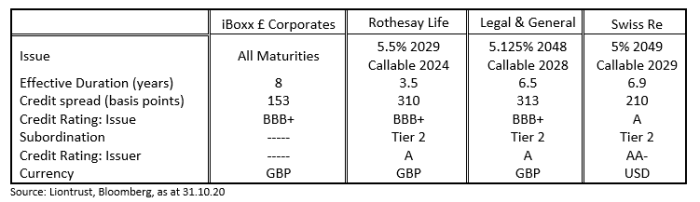

Looking more closely at individual names we hold, the following table shows three bonds from insurers versus the iBoxx Sterling Corporate Index.

The companies above operate in different sub-sectors: Rothesay specialises in pensions, Legal & General is the UK’s largest provider of life insurance while Swiss Re is one of the world’s leading providers of reinsurance (insuring the insurers). But while sitting in slightly different areas, there is clear commonality: all three bring security and resilience to clients, they are high-quality companies with parent credit ratings of single A and higher, and they offer a significant spread pick-up when compared to the benchmark average.

As outlined above, all the bonds mentioned are subordinated Tier 2 so a notch below senior but we are happy to move down the capital structure in such high-quality organisations and believe there is significant compensation for doing so.

Insurance provides a number of benefits to society, giving an economic safety net to millions, facilitating economic development and growth, and also researching and furthering our knowledge of sustainability and key environmental and social issues. It is a sector that has robust fundamentals and strong solvency on average and, most importantly, continues to offer long-term value to bond investors, demanding its core position across our SF Corporate Bond and Monthly Income Bond Funds.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.